“Where ignorance is bliss, ’tis folly to be wise.” Thomas Gray.

A Reader laments

“My broker bought FaceBook for me, and now I am sucking gas and losing money! What should I do and whom should I sue? Please advise.

My reply: Well, we all make mistakes like the time I asked a psychic for a stock tip or when I bought Cramer’s recommendations the day after the stock price rallied. But I was 8 years old.

Perhaps this Death Therapy would help: http://www.youtube.com/watch?v=w_bxkVFK3Wc

Or–on a more serious note–you might have a psychological issue with a gambling addiction: http://www.youtube.com/watch?v=gZfemmJ7gx0&feature=related and a shrink explains further: http://www.youtube.com/watch?v=o0K5o9xIceU

BEFORE you invest you must be able to answer two questions:

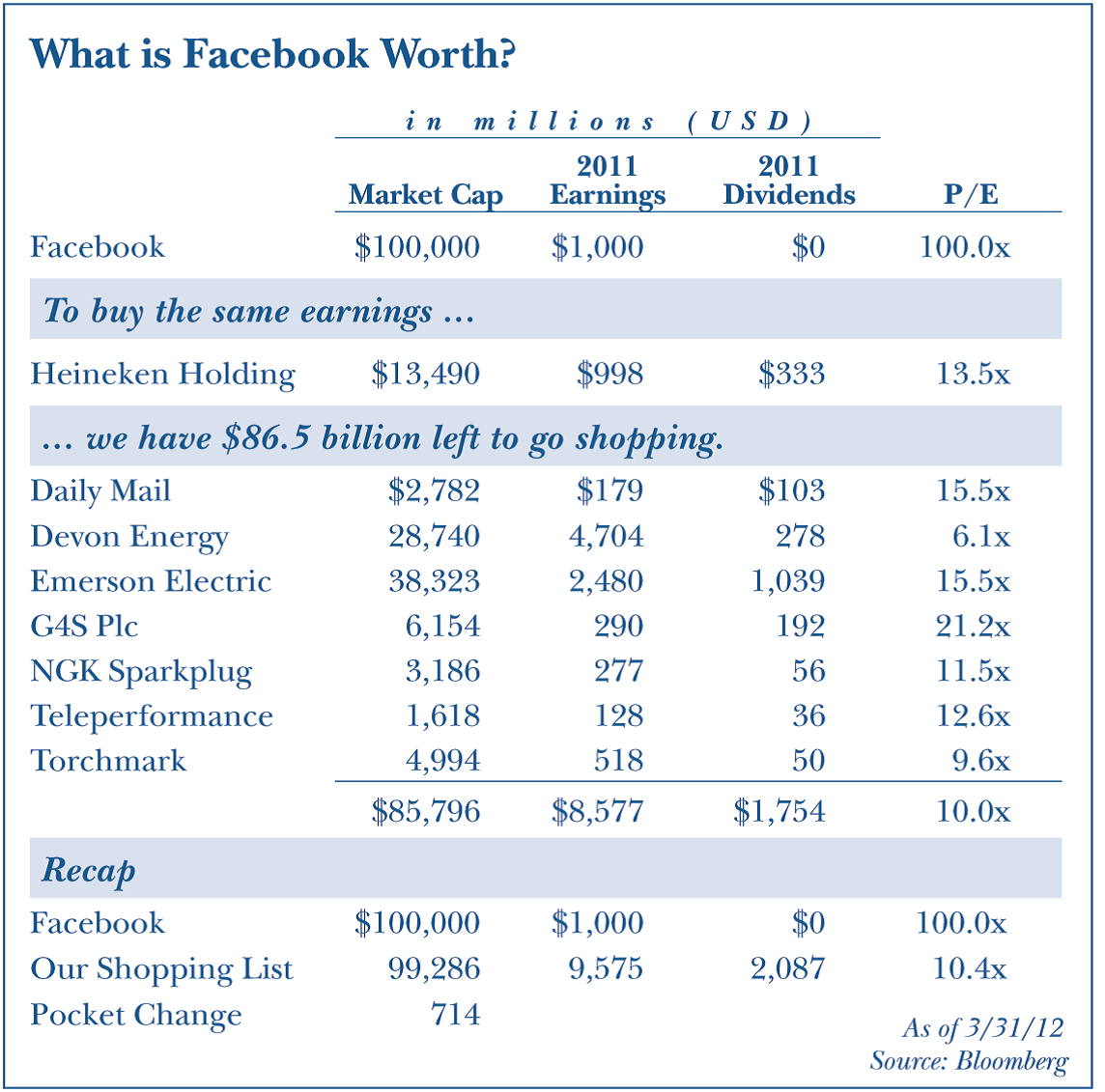

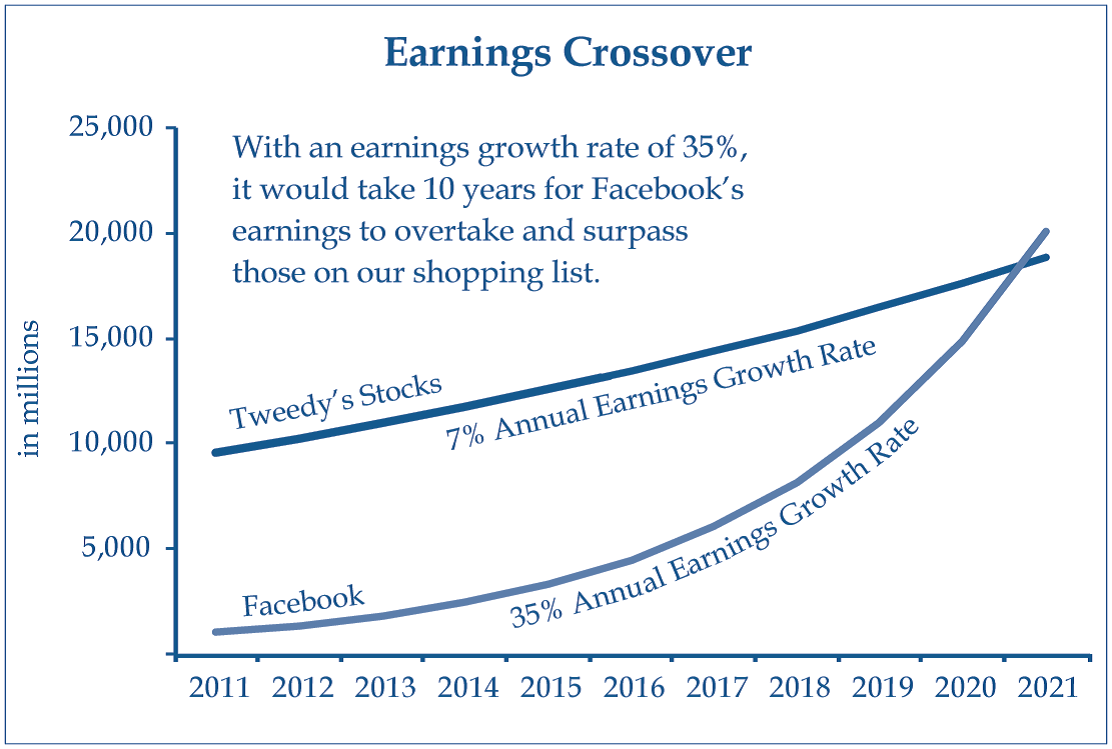

Is this a good business and a good price–a price with a margin of safety–to pay for the business? I don’t dismiss Facebook out of hand. I would read the comprehensive S-1:You can find Facebook’s S-1 here to understand Facebook and other media/advertising businesses. Certainly if I owned a newspaper or Google, I would wish to understand Facebook as a business. But the price of $105 billion compared to revenues and profits with all the surrounding publicity leaves me cold with several questions:

- What do I know about Facebook that no one else does? I don’t even use Facebook.

- How much speculative growth am I paying for? A lot.

- Who is on the other side from me on this investment? Mark Zuckerberg, an insider. No edge here.

Finally, looking at popular IPOs for ideas is usually a waste. Look at busted IPOs a few years later when investors, who have overpaid, sell their shares. The business may be perfectly fine with low debt due to the high-priced equity raise, but the main crime was investment bankers overpricing their merchandise (no surprise).

Whom to blame?

You want to sue your broker? The person to blame is staring back at you in the mirror. Did the broker torture you to buy Facebook shares like in the Spanish Inquisition http://www.youtube.com/watch?v=CSe38dzJYkY

The investors’ Creed

Instead of saying, “This is my rifle……Say, This is my investment. I will always be rational in trying to solve the two investment questions: good price and good business. I will write down my reasons for buying and what I will do in case I miscalculate or misjudge the business and/or price. http://www.youtube.com/watch?v=Hgd2F2QNfEE&feature=related

Facebook Articles

A value investor discusses Facebook both as a business and as an investment: http://www.gurufocus.com/news/177739/can-a-value-investor-buy-facebook-fb

Another analyst discusses what Facebook should trade for: http://www.marketwatch.com/story/facebooks-stock-should-trade-for-1380-2012-05-25?link=MW_story_popular

Well, then, what should be the price of Facebook’s stock?

Rather than endlessly rehashing the events that have taken place over the past week, it is this question that investors should be asking. Surprisingly, however, few are doing so.

And yet, courtesy of a just-released study, calculating a fair price for Facebook’s stock isn’t as difficult as it might otherwise seem.

The study is entitled “Post-IPO Employment and Revenue Growth for U.S. IPOs, June 1996–2010.” Its authors are Jay Ritter, a finance professor at the University of Florida, and two researchers at the University of California, Davis: Martin Kenney, a professor in the Department of Human and Community Development, and Donald Patton, a research associate in that same department. ( Click here to read a copy of their study. )

The researchers found that the revenue of the average company going public in the period analyzed in the study grew by 212% over the five years after its IPO (excluding spinoffs and buyouts). Assuming Facebook’s revenue grows just as fast, and given that the company’s latest-year revenue was $3.71 billion, its annual revenue in five years’ time will be $11.58 billion.

Since Facebook FB -3.39% is most often compared to Google GOOG -2.01% , let’s assume that its price-to-sales ratio in five years will be just as high as Google’s is currently: 5.51-to-1. You could argue that this is an overly generous assumption, of course. But it nevertheless means Facebook’s market cap in five years will be just $63.8 billion — 30% less than where it stands today.

Assuming that the total number of its shares stays constant, that works out to a price per share of just $23.26 — in contrast to its recent closing price of $33.03.

Ouch.

Actually, however, the news is even worse: No one is going to invest in Facebook shares today if its price will be 30% lower in five years. So, in order to entice someone to invest in it today, Facebook needs to offer a handsome return. Assuming that its five-year return is equal to the stock market’s long-term average return of 11% annualized, Facebook shares currently would need to be trading at just $13.80.

Double ouch.

Don’t like that answer? Try focusing on earnings rather than sales, and you get only a marginally different result. Assuming its profit margin stays constant (instead of falling as it could very well do as it grows), assuming its P/E ratio in five years will be just as high as Google’s is today, and assuming that its stock will produce a five-year return of 11% annualized, Facebook’s stock today should be just $16.66.

How can Facebook investors wriggle out from underneath the awful picture these calculations paint? By assuming that its revenue and profitability will grow faster than the average IPO between 1996 and 2010 — and not just by a little bit, either, but a whole lot faster.

Of course, it’s always possible that Facebook will be able to pull that off.

More Articles

http://www.minyanville.com/business-news/markets/articles/facebook-ipo-fb-aapl-zuckerberg-chan/5/21/2012/id/41129

The Blame Game

http://www.huffingtonpost.com/2012/05/24/facebook-ipo-high-frequency-trading_n_1544187.html?ref=business&icid=maing-grid7%7Cmain5%7Cdl1%7Csec1_lnk3%26pLid%3D164289

HAPPY MEMORIAL DAY