Peter Schiff on the Internet (2000/02) and Real Estate Bubbles (2008/09) VIDEO: http://archive.lewrockwell.com/schiff/schiff8.html

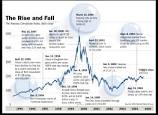

An at-the-time analysis of investing during the Internet bubble

The Internet and Value Investing

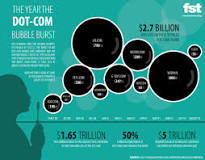

Leithner Letters 2000 and 2001 The Internet Bubble

Risks: risks_revised

Graham emphasized that the margin of safety rests upon simple and definite numerical reasoning from statistical data. Grahamite value investors are logical and analytical but like Austrian School economists they distrust arcane calculations, models, and the spurious precision they convey. To improve their investment results, they strive to increase the quality and quantity of their information. Second, they seek to improve their ability to interpret information. Finally, they attempt to identify and reduce the psychological and other biases that mar judgment. Probably, their chief edge comes from having a long-term, patient approach.

For there to be a true investment there must be a margin of safety. And a true margin of safety is one that can be demonstrated by figures, by persuasive reasoning, and by reference to a body of actual experience.”

Back to today: Buy 3M? Why/Why Not?: MMM

Government Spending and a Young Man (What are the odds that the school loan will be repaid? The future of America?)