Free Book: Gold, the Monetary Polaris by Nathan Lewis

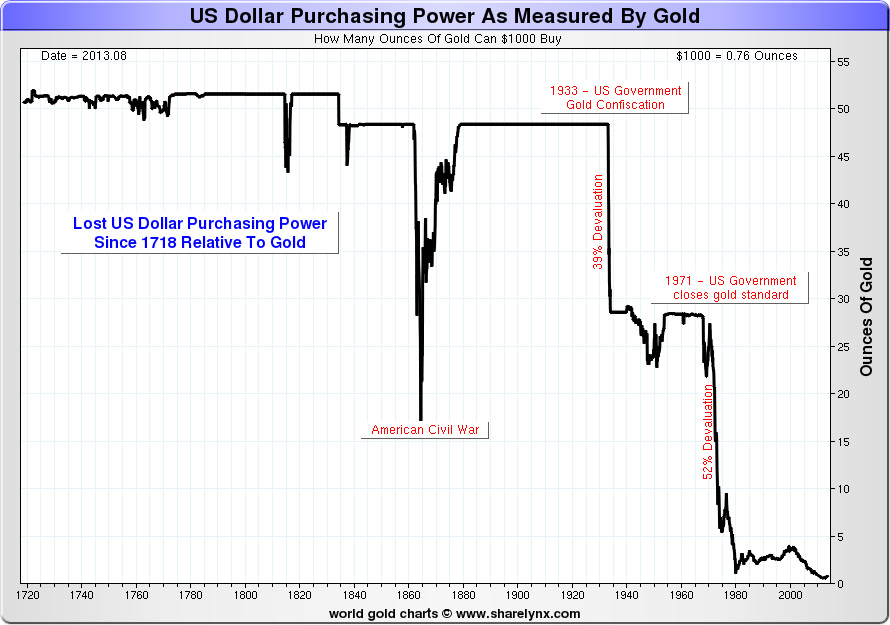

I highly recommend this book to understand our current mess and how we can go back to stable money and a prosperous world for all. Before dismissing the idea of a gold standard with thoughts of–there is not enough gold; we tried that before and why gold, we now have Bitcoin–learn first how a gold standard works and then financial and monetary history. Your study will pay huge dividends. Lewis debunks the myth that you need 100% gold-backing for paper money. (See Rothbard’s book, Case for a 100 Percent Gold Dollar)

For a great romp through financial history and the role that gold played: Gold as money Lewis Another great book.

Lewis writes on page 5, “A gold standard system has a specific purpose: to achieve, as closely as is possible in an imperfect world, the Classical ideal of a currency that is stable in value, neutral, free of government manipulation, precise in its definition, and which can serve as a universal standard of value, in much the manner in which kilograms or meters serve as standards of weights and measures.”

The author shows how and why the Classical principle of stable, gold-based money once made Americans wealthy. Why not now?

Stable money along with clear property rights/rule of law and low taxation/regulatory burdens have provided the means for the greatest human prosperity.

View Nathan Lewis’ articles here: www.newworldeconomics.com

Video Lecture published on Feb 18, 2014: Http://Www.Cato.Org/Events/Gold-Monet…

In this sequel to Gold: the Once and Future Money, Nathan Lewis describes the theoretical basis of gold-standard monetary systems. Lewis argues that the pre-1913 world gold standard system was perhaps the most successful monetary system the world has ever seen, enabling high levels of economic growth. Descriptions of both Britain’s economic rise under the gold standard and the United States’ rise to economic prominence under gold are also discussed.