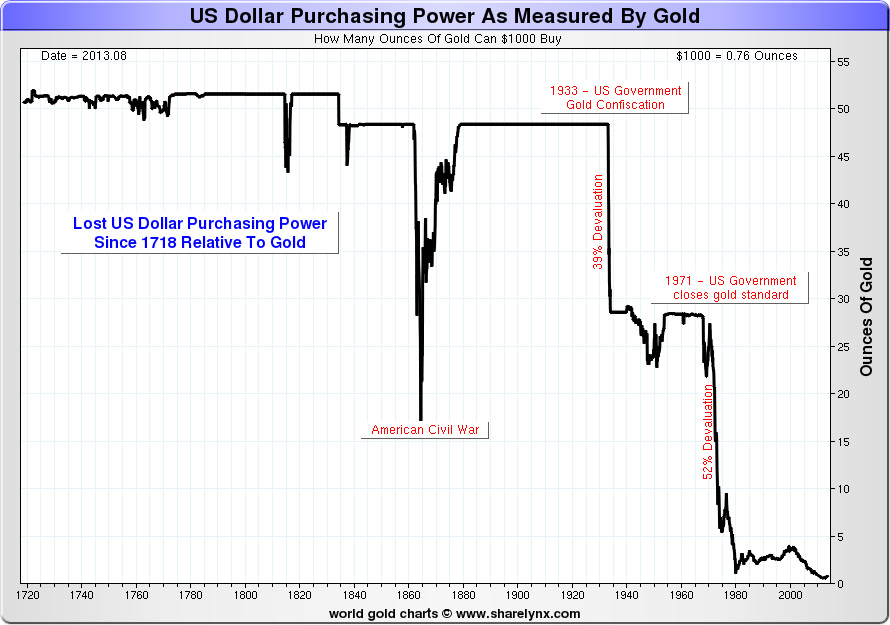

Does anyone sense a trend over the past three hundred years?

The severing of the dollar link to gold in 19171 and the movement to flexible exchange rates in 1973 removed constraints on monetary expansion. The dollar emerged as the only international money and, in the words of Robert Mundell:

The U.S. Federal Reserve could now pump out billions and billions of dollars that would be taken up and used as reserves by the rest of the world. Not only that, but US government Treasury bills and bonds became a new form of international money. Dollars became the reserves of new international banks producing money in the Eurodollar market and other offshore outlets for international money. The newly elastic international monetary supply was now made to order to accommodate the supply shock of the oil price spike at the end of 1973. The quadrupling of oil prices created deficits in Europe and Japan which were financed by Eurodollar credits, in turn fed by US monetary expansion. The Fed argued that its policy was not inflationary because the money supply in the United States did not rise unduly. The fact is that it had been exported to build the base for inflation abroad. As I showed in an article published in 1971 (IMS in the 21st Century Robert Mundell and mundell-lecture), it is the world, not the national dollar base that governs inflation. Prices rose 3.9 times in the quarter century after 1971, by far the most inflation than at any other time in the nation’s history.

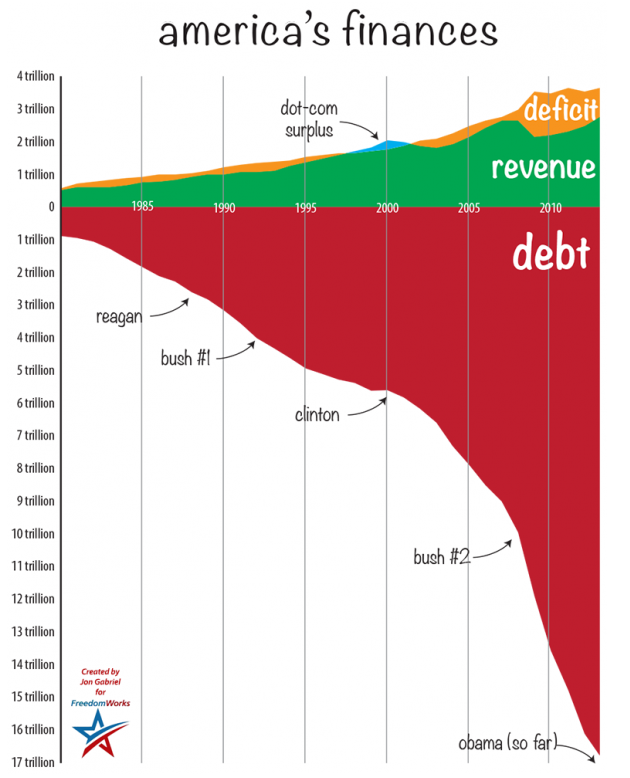

Our Current Situation

Our choices are to restructure the debt, grow our way to repayment and/or print. What choice will the Fed make?

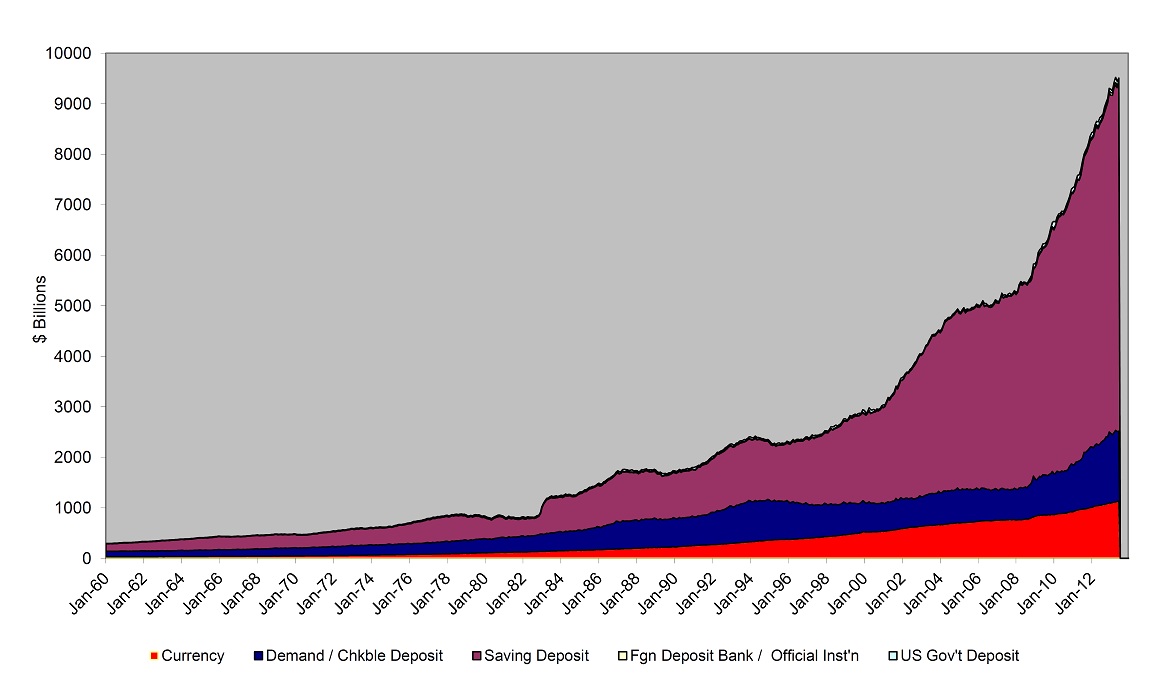

US money supply TMS-2 (components by legal categorization) since 1960 – by Michael Pollaro.

If there were a free market for money, unexpected sudden increases in the demand for money (due to exogenous events like e.g. the threat of war) would likely also see a reaction from the supply side. However, the increase in resources devoted to obtaining a larger supply of the money commodity (in a free market, money would be a commodity with a pre-existing use value) would be strictly guided by the wishes of consumers. Moreover, even if the money supply were completely fixed, a demand for higher cash balances would simply lead to adjustment by raising money’s purchasing power until the higher demand was satisfied (we are assuming that if a free market in money were to obtain, the entire economy would likely be unhampered; prices and wages would be free to adjust).

Given the enduring popularity of inflationary policies, we suspect that lessons that should have been learned long ago will have to be relearned – the hard way.

Read the article on why many hope for a return of inflation: http://www.acting-man.com/?p=26808t

—

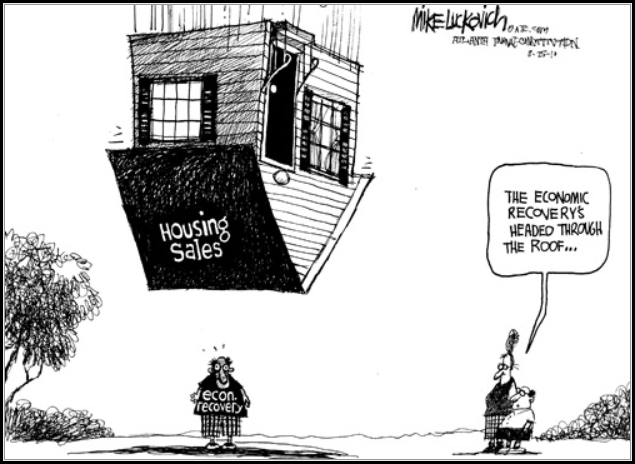

Meanwhile the market sets up with its Fed induced distortion: http://www.cnbc.com/id/101137648