A reader kindly shared:

Also, to see cash flow analysis of different industries to START your analysis go to: http://scheller.gatech.edu/centers-initiatives/financial-analysis-lab/

Now on to Iridium (IRDM)

You just got hired as a junior analyst for a hedge fund. Your boss calls you in and asks for your opinion on whether he should buy IRDM. He heard about it from a hedgie friend in New York who heard about it from another hedgie friend in New York who heard about it from…….you get the picture–a daisy chain of independent-thinkers.

Your boss slaps this on your desk:

IRDM_VL Dec 2014 Check this first.

You remember something about Buffett saying that the tooth fairy doesn’t pay for capex? What will you tell your boss this afternoon?

If you want more clues (after trying hard) go to the search box on this blog and type in IRDM–follow the links.

Good luck!

PS: I will resend the book folder to new students and I will send value vault folders to the folks who have been asking for the past three weeks. I try only to check email once a day and I group the various email requests over time.

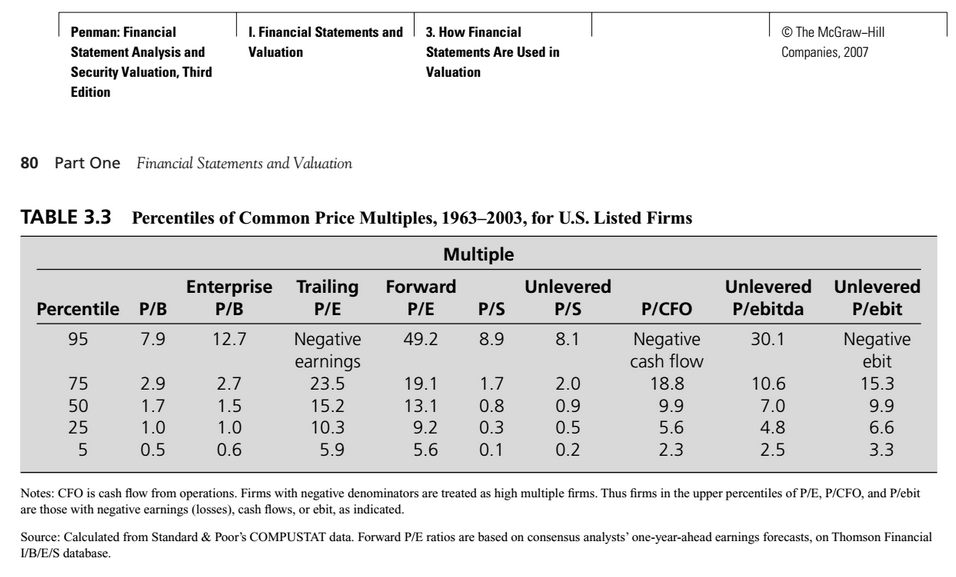

I will be next focusing on ROIC for Chapter Four in Deep Value because we already covered EBITDA and its use and ABUSE. And EV/EBITDA multiples. Remember that multiples are simply a short-hand for cost of capital. I remember when Blockbuster (US Video Chain) looked cheap in an EV/EBITDA analysis (from a broker report) but Blockbuster was being dis-intermediated by Netflix and planned to reinvest in its stores to sell popcorn and toys along with DVDs. How do you think that turned out? Rear-view looking at past multiples may mean being entombed in a value trap. When I heard of Blockbuster’s plan, I thought of entering a mule in a horse race–what are my chances?

Have faith but don’t be overconfident! Have a great weekend from sub-zero New England.