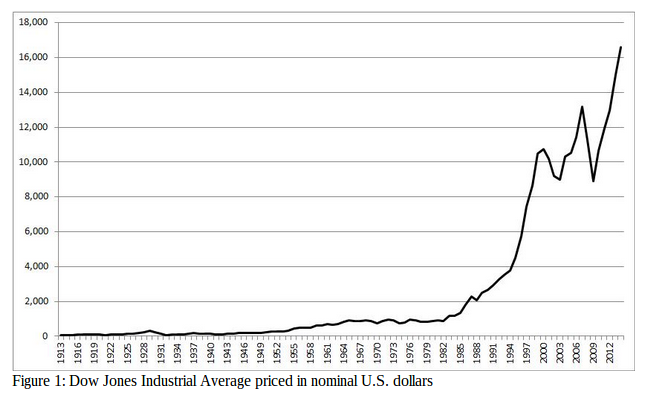

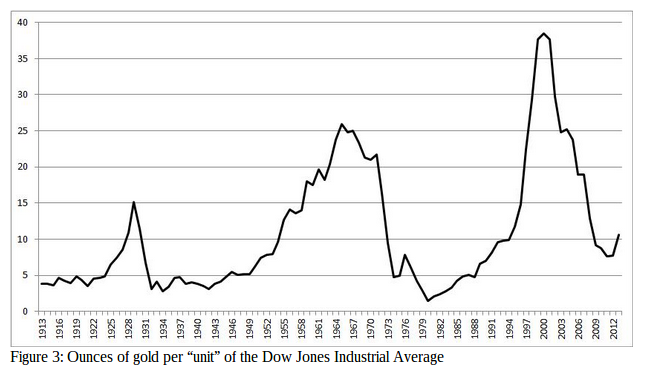

What is the Real Value of the Stock Market? This:

or this:

Four Ways to Value The Stock Market

http://mises.ca/posts/articles/four-ways-to-value-the-stock-market/

Case Study in Management Rape of Shareholders

from: Bob Moriarty Archives May 7, 2014

In 13 years running this website and visiting dozens of projects yearly I have run into every sort of charlatan, crack addict, drunk and all-round scam artists among the legions of fools who believe they can run a mining company successfully. In most cases, they have been lucky enough to collect absurd salaries long enough before the abused shareholders toss the bastards out.

Write these names down and keep them handy. If you ever see them associated with any company you are considering buying, prepare yourself to be raped. Ian Rozier, President of Newport Exploration, Barbara Dunfield, CFO of Newport and David Cohen, Director of Newport. What they pulled on Newport Exploration wasn’t just your typical screwing shareholders that we all expect on a regular basis, they raped Newport shareholders on a continuing basis.

I would describe Newport Exploration as pretty much a shell company. In November of 2010 they entered into a JV with another pretty much shell company named Reva Resources. This action can be considered one of the first examples of rape since two significant shareholders of Reva are directors of the Company. So in essence, directors of a shell company with enough cash in the bank to pay salaries to people for doing nearly nothing does a JV with another shell company that they just happen to own much of. If you are kind you can think of it as a sweetheart deal.

As a result of the unannounced press releases detailing the royalty payments, Newport shares were trading on the open market for $.04 a share while management knew that they had $.17 in cash at the end of October. In effect, company A paid themselves in company B shares worth four times as much in cash as in the open market because nobody reads quarterly reports from companies not doing anything. So the real issue is, was this a conflict of interest between the interests of management and the interests of shareholders and what exactly is a material disclosure? I think both questions are easy to answer.

Read more: http://www.321gold.com/editorials/moriarty/moriarty050714.html

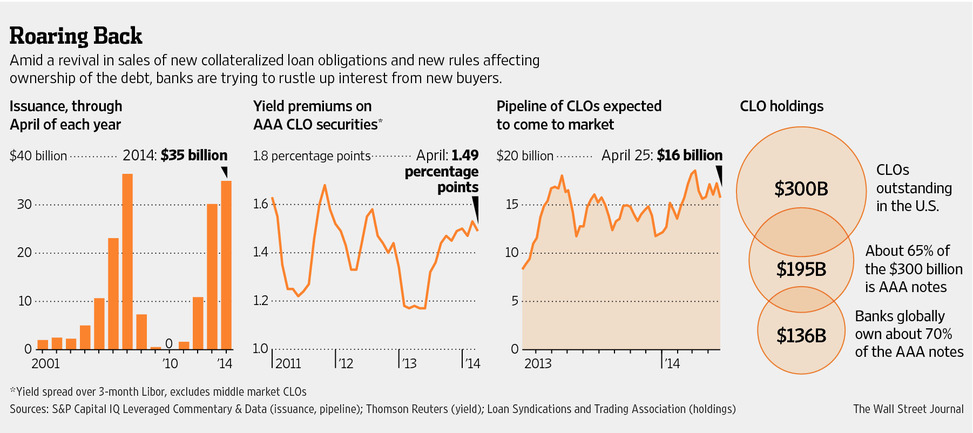

The Current State of Mania

Embracing Leverage Again http://www.acting-man.com/?p=30331

Mal-Investment Lunacy: http://www.acting-man.com/?p=30313

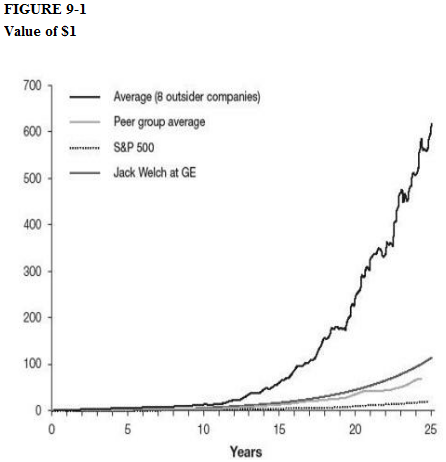

Outsider CEOs (Skilled Management vs. Shareholder Rape)

A Great blog: http://student of value.com/notes-on-the-outsider-ceos/