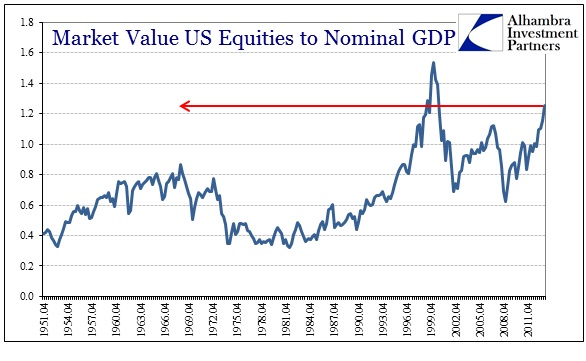

Bubble Watch

GMO_QtlyLetter_1Q14_FullVersion

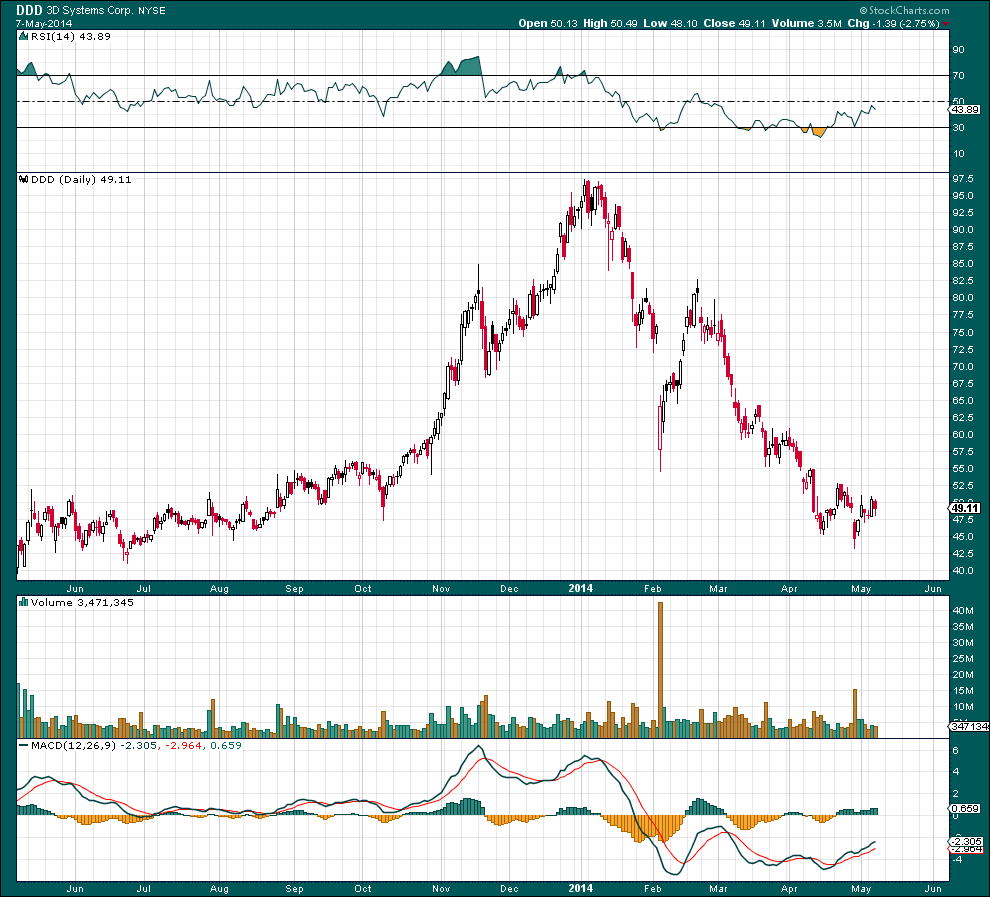

Momentum Stocks Crushed

http://www.acting-man.com/?p=30382#more-30382

Buffett Notes

http://covestreetcapital.com/Blog/?p=1173 Icahn slams Buffett on his cowardice.

Warren-Buffett-Katharine-Graham-Letter on Pensions 1975

Buffett1984Retail Stores and Clean Surplus

Berkshire_Hathaway_annual_meeting_notes_5-3-2014

20140424_CNBC_Transcript__Legendary_Investor_Warren_Buffett_Speaks_with_Becky_Quick

Have_Researchers_Uncovered_Buffetts_Secret

20140224_Preview_of_Buffett’s_annual_letter__Learn_from_my_real_estate_investments

And in case of Buffett overdose: Crony Capitalist

Resource Stocks: Rules of Thumb for Junior Mining Speculators and A Light at the End of the Tunnel

3 responses to “Reading for this weekend”