Case-Study-So-What-is-It-Worth Prior Post where students discussed the case.

Turn up the VOLUME: Don’t believe the …..?

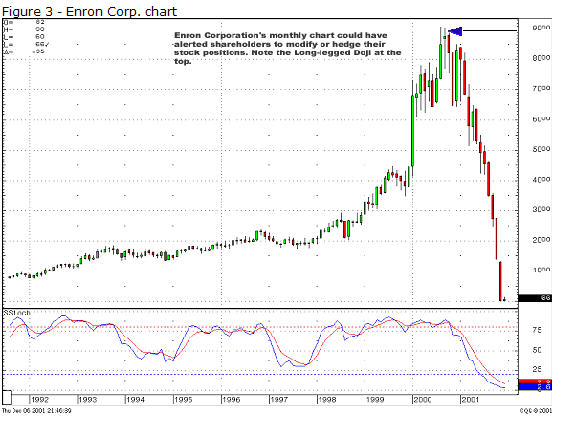

Enron-Case-Study-So-What-is-It-Worth My walk-through. I go straight to the balance sheet then calculate the returns on total capital in the business. These financial statements were easy to discard because of the size of the business and the poor returns. My estimate of $5 to $7 per share worth or 90% less than the current share price, was wrong. The company was worth $0. This is more a case of institutional imperative and incentive-based bias. Wall Street was feeding at the financial trough to keep raising money for Enron (to keep the bad businesses afloat) so guess what the financial analysts (CFAs and MBAs) suggested? Buy! I guess the market is not ALWAYS efficient.

Forget accounting scandals, this was a crappy business based on trading so no way to determine normalized earnings. When I was in Brazil and saw Enron’s newly-built generating plant sitting idle, I asked why. A project developer said he got paid by doing deals by their size not profitability, therefore, the bigger the white elephant, the better. When I called mutual funds who owned Enron as it was trading $77 per share to ask the analyst if he/she was aware of Enron’s declining businesses coupled with absurd price, I was told to shut up. As one analyst (Morgan Stanley?) told me, “I only believe what I want to believe and disregard the rest.”

Enron Annual Report 2000 Ha, ha! and Is Enron Overpriced?

The above august panel never answered why anyone would give capital to Enron? No one mentions the elephant in the room. Sad.

What does the above case have to do with net/nets and our course. Everything! Look at the numbers, think for thyself, ignore Wall Street, and be aware of incentives. Buying bad businesses at premium prices is a guarantee of financial death.

This is an aside, but based on the above Enron example, does value investing serve a SOCIAL purpose or benefit? Prof. Greenblatt doesn’t think so–you are just trading pieces of paper, but what do YOU think?

See these two venture capitalists explain the social purpose of their business:

11 responses to “Enron Case Study Analysis. Ask Why? Why?”