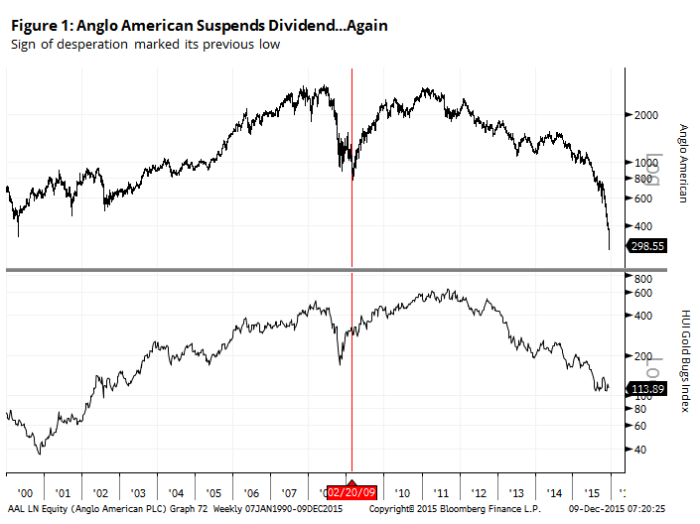

Anglo Suspends Dividend (Ringing a bell) We are watching collective capitulation by shareholders and management (a sign of the beginning of the end of the bear trend).

Remember the panic of bankers back in ’09?

A repeat for global miners in 2015/16?

At lows, commodity price narrative is pure supply and demand with LIMITLESS SUPPLY (oil) and anemic demand (China slowdown) while at highs the narrative for commodities is driven by financial speculation (China boom/Commodity Super Cycle). Buy low and sell high.

2 responses to “Ringing a bell for commodities producers”