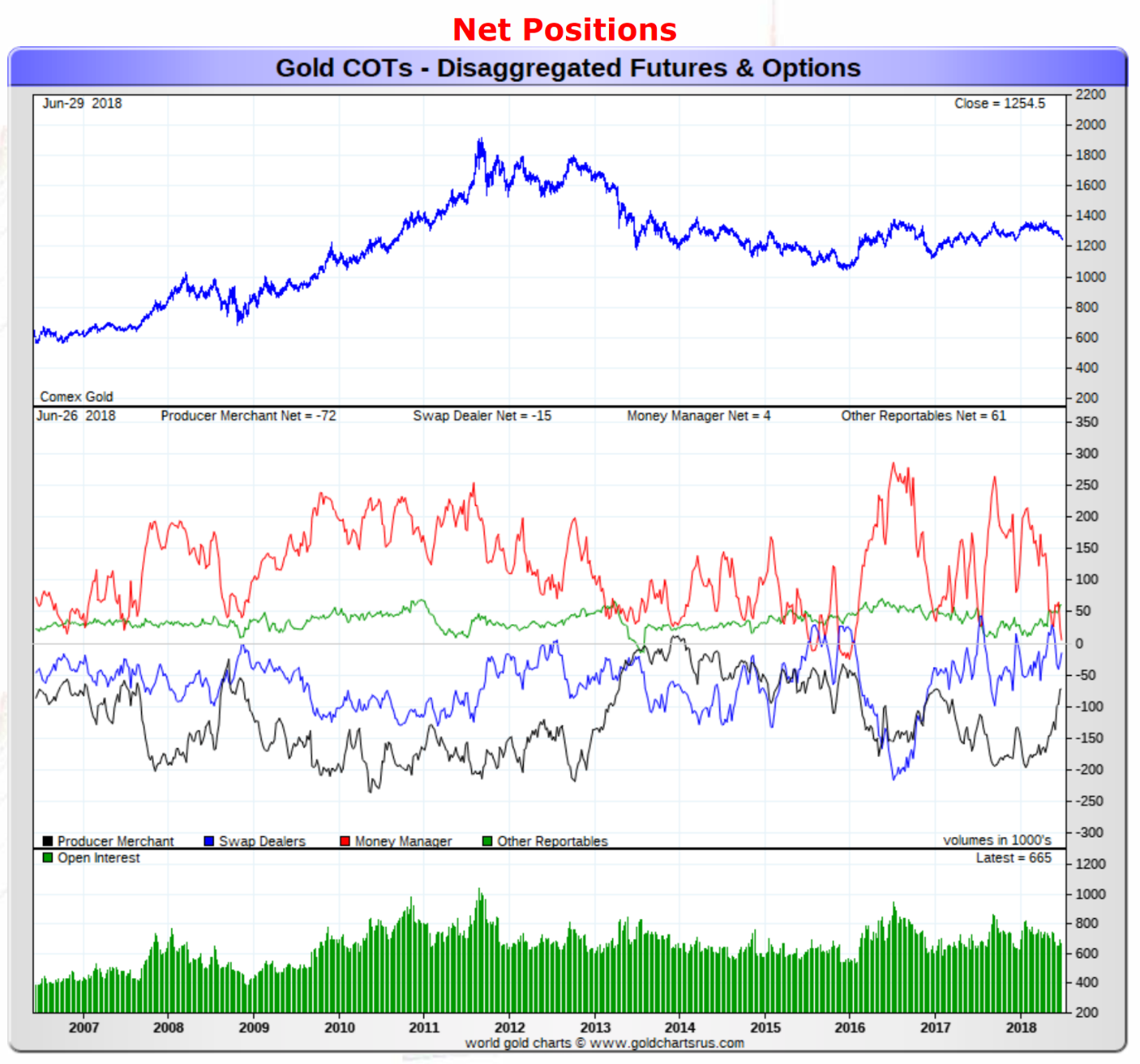

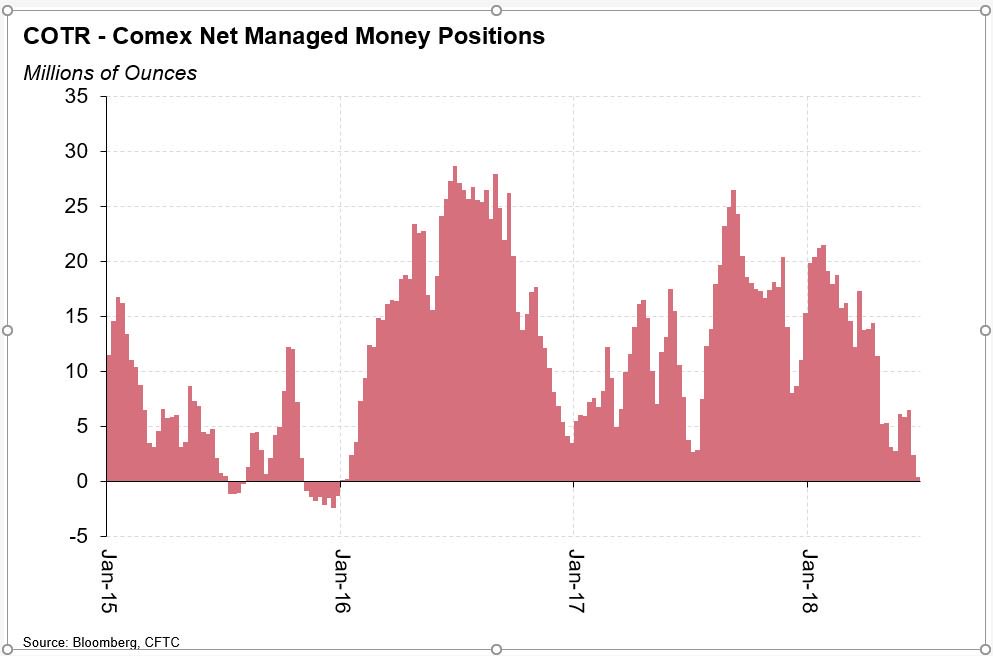

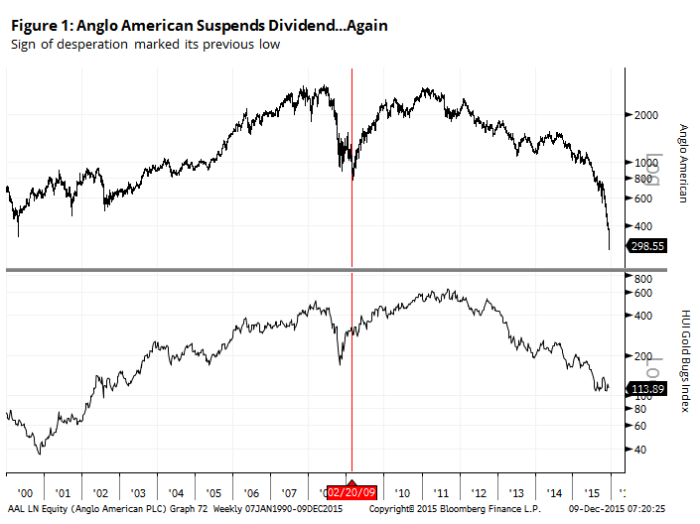

I am on my knees buying gold/silver/uranium miners with both hand this prior week (ouch!). Since the chart of the futures positions (COTS) is now more extreme–money managers are probably short now like back at end 2015/beginning 2016. I use the blog as a diary/bulletin board on occasion. I hate miners as a business but love the values. Note the vast underperformance of hard (read: miners) vs. financial assets (SPY). Not a recommendation, just a “diary” post.

- The Economics of Gold Mining_Myrmikan_Research_2017_03_14

- Gold mining equities Myth and Reality by Paulson

- Why Gold Mining is a Tough Business_Pollitt

- In-Gold-we-Trust-2018-Extended-version-english

Common sense from a grizzled veteran

Bob Moriarty Archives Jul 3, 2018

Entire article: http://www.321gold.com/editorials/moriarty/moriarty070318.html

Buying resource stocks has nearly nothing to do with the commodity. And near zero to do with management or country risk or interest rates or the dollar or what the DOW is doing. Those who are always wrong about markets spend a lot of time mumbling about all those things and they are just wasting ink.

Unbeknownst to GATA or the other PermaBulls who believe some munchkin at the Federal Reserve pulls the levers all of the time, markets go up and markets go down. They all do and they do it constantly. So if someone is telling you silver is the rarest mineral known to mankind and it should go up everyday of the week, forever, he’s lying to you in order to get you to pay for a subscription to his service. In short he’s like a bible thumping preacher or politician, he wants your support, and he specializes in telling you the lies you want to hear.

During the bull phase of the metals markets even the biggest piece of crap stocks go up. During the eventual bear phase of the metals markets even the best run with the most desired commodity in the safest jurisdiction goes down.

So investors in junior resource stocks need to keep two things in mind. You have to trade markets and take a profit when you can or the only alternative is to take a loss. I have had hundreds of investors tell me their biggest mistake was not taking a profit when they could. And given that something like 95% of investors in junior lottery tickets lose money, sell when you can, not when you have to.

You need to align yourself with the phase of the market you are in and let the wind be on your back. We had major lows in 2001 in gold and silver, again in 2008 and late in 2015. Don’t try to second-guess the market. If you were a buyer of anything from 2001 until 2008 you had a wonderful opportunity to profit. If you bought in 2009 or 2016, it was like shooting fish in a barrel. If you didn’t sell in March of 2008 or September of 2011, you got creamed regardless of the merits of the project or company. The phase of the market will either put money in your pocket or extract it regardless of what anyone says about a company.