As Gold Rises; Gold Miners Fall Down By Johanna Bennett

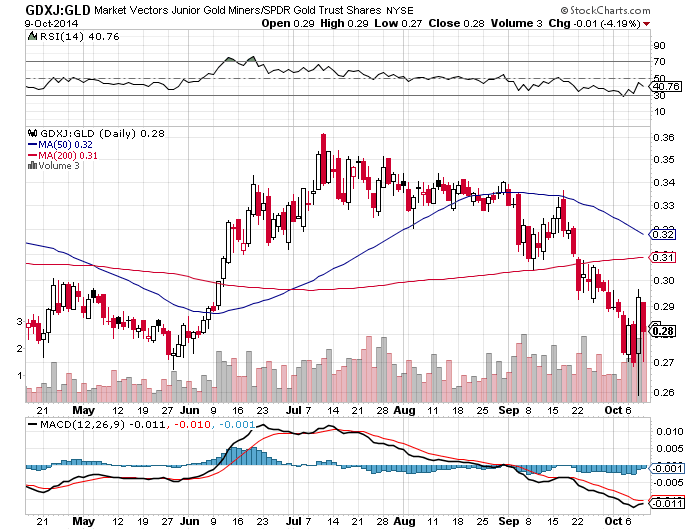

The price of gold may be rising, but gold mining stocks are getting hammered today. And do you know why?

They are still stocks. (What does THAT mean?)

On the heels of yesterday’s late-day price surge, the Market Vectors Gold Miners ETF (GDX), of fell more than 4.5% amid a broader market selloff that sent the Dow dropping more than 300 points and the S&P 500 declining almost 2%.

The dovish minutes from the Federal Reserve’s September policy meeting have gold bugs buzzing. The precious metal touched a two-week high today, amid easing concerns that the Fed is near to raising interest rates, reviving gold as an inflation hedge.

Gold prices rallied to $1,234 a troy ounce, their highest level since Sept. 23, a day after minutes from the Fed’s September policy meeting revealed officials were worried weaker growth in Asia and Europe could curtail U.S. exports. The central bank also highlighted a stronger dollar as a barrier to U.S. inflation climbing toward the Fed’s 2% target, stoking hopes for a sustained period of low interest rates.

The most actively traded contract, for December delivery, was ended the day at $1,225.10 a troy ounce on the Comex division of the New York Mercantile Exchange, up $19.10, or 1.59% after earlier today climbing as high as $1,380.

ETFs linked to the commodity prices saw little improvement today. The SPDR Gold Trust(GLD) rose 0.25% to $117.76, while the iShares Gold Trust (IAU) inched up 0.21%.

But while worries regarding a weak economy can lift gold prices they can squeeze gold mining companies. GDX has plunged more than 60% over the past two years with the likes of Barrick Gold (ABX) falling more than 65% during that same time span and Newmont Mining (NEM) falling 59%.

—

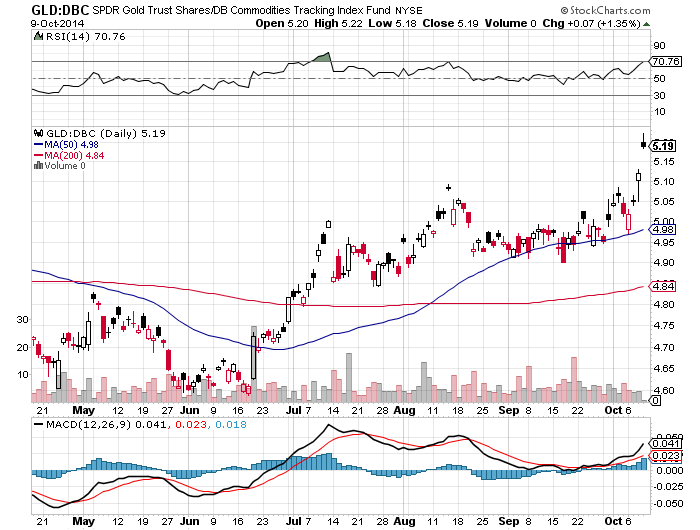

The above is an article from an “elite” financial publication (Barrons) where the theme is that miners are being hurt/squeezed because they are stocks. I ask my readers how are miners hurt LONG-TERM (the next decade) if the REAL price of gold is rising? Sure miners may have been sold today due to leveraged investors selling to go into cash, but how does that “squeeze” the mining business if gold is risng RELATIVE to input costs like crude oil and commodities? Mining is a spread business. You make money on the spread between input costs and output revenues. Never take what you read on face value.

Miners realtive to gold in the chart above.

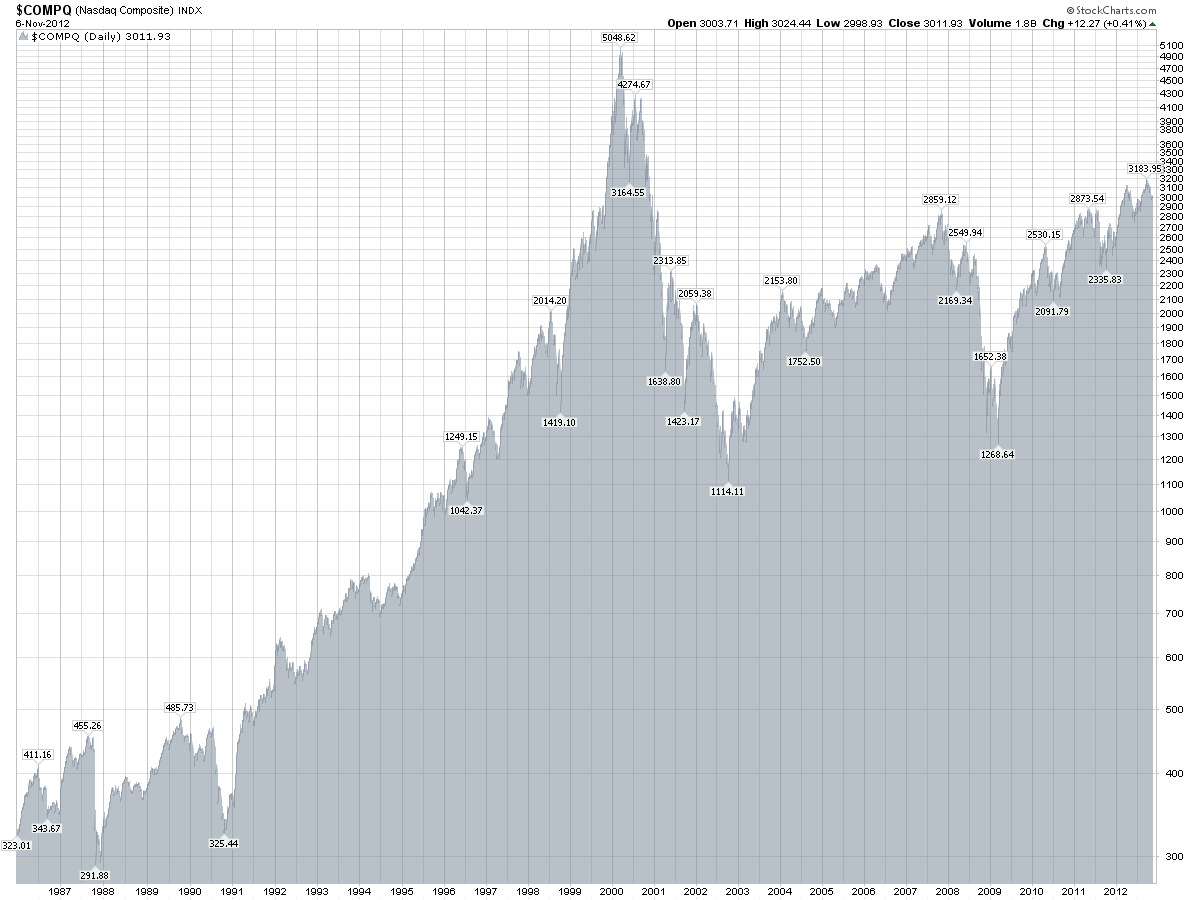

Four Boom and Bust Cycles and the Implications for today’s Cycle (Microdocumentary)

This microdocumentary video examines in detail 4 major booms in the last 100 years and explains how monetary policy and interest rate manipulation has led to the inevitable bust:

- The great depression of the 30ies

- The recession of the 90ies

- The dot com bubble

- The housing bubble

http://www.safehaven.com/article/35401/microdocumentary-the-truth-about-boom-and-bust-cycles A bit simplistic, but a good introduction to the dangers of excess credit growth.

Rap Video on the Boom Bust Cycle or Hayek vs. Keynes