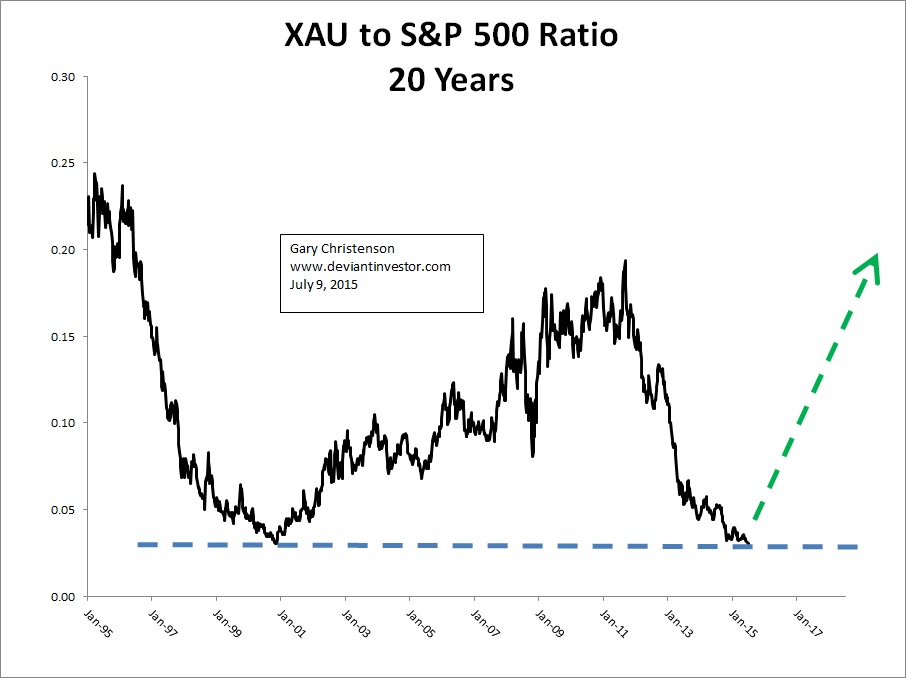

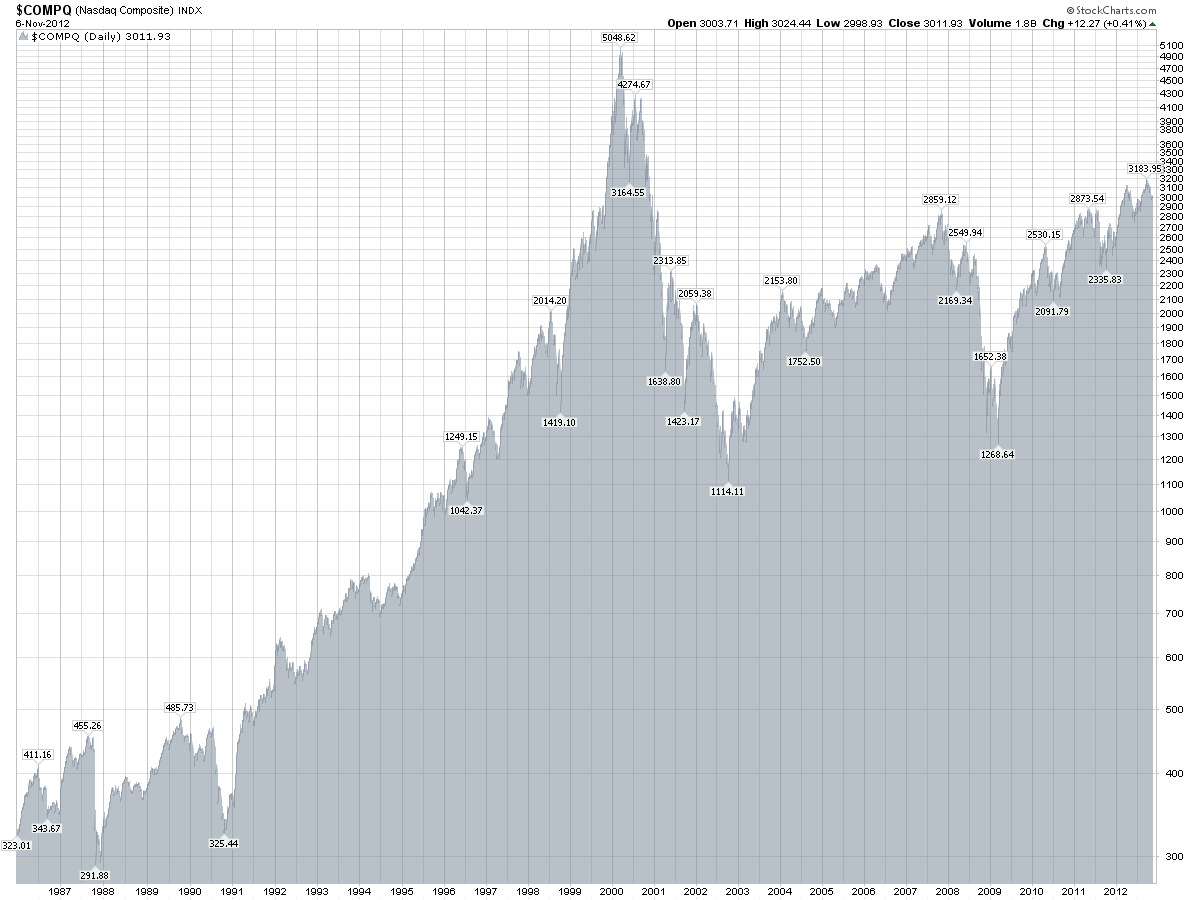

The chart above shows an index of gold and silver miners relative to the S&P 500, breaking now to a new extreme. Will the world need to produce and find more minerals and metals or will the world just need health care and bio-tech?

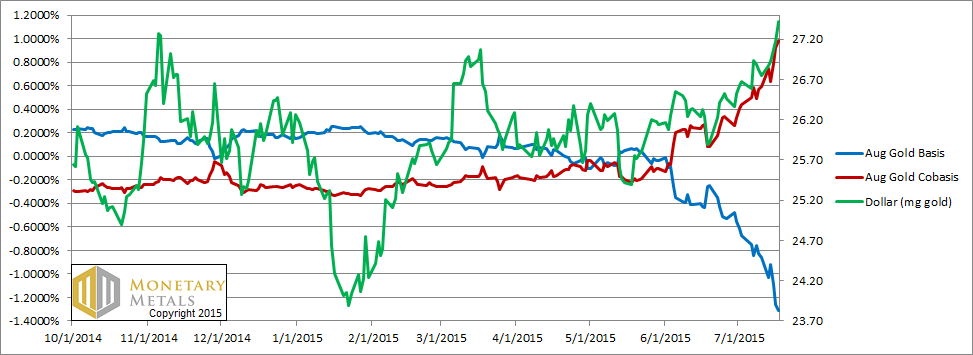

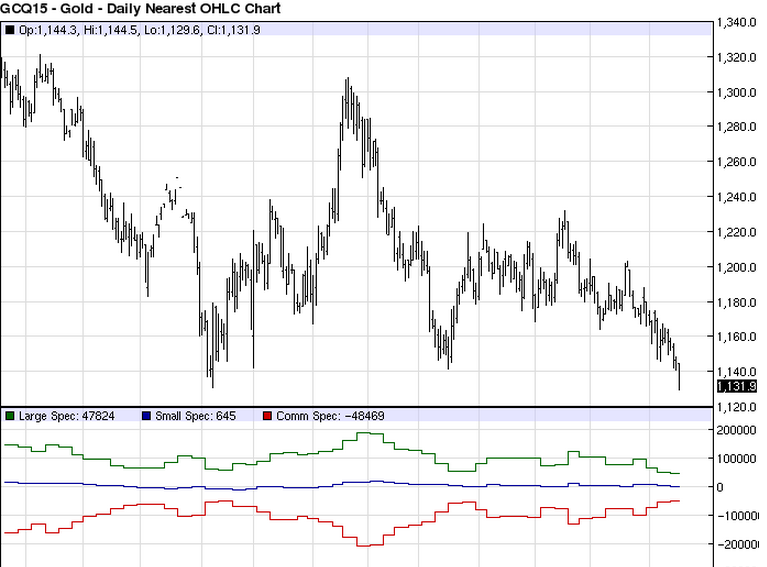

The read line is the co-basis that is rising as the dollar rises relative to gold. This indicates rising demand for physical and more futures selling. Bullish.

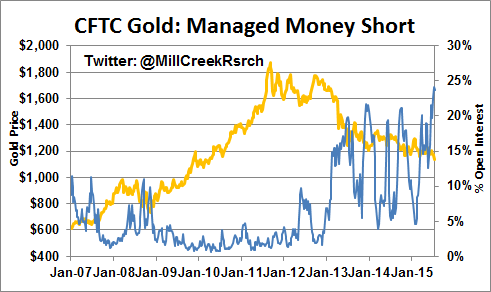

So who is selling?

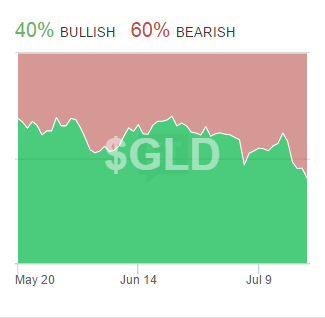

The Fed’s decision to restock the rate toolkit has got the gold market very nervous,” George Zivic, a New York-based portfolio manager at OppenheimerFunds Inc., which oversees $235 billion, said by phone. “We have already seen that gold did not perform as a safe-haven investment. There is not a single motivating reason to own gold.”

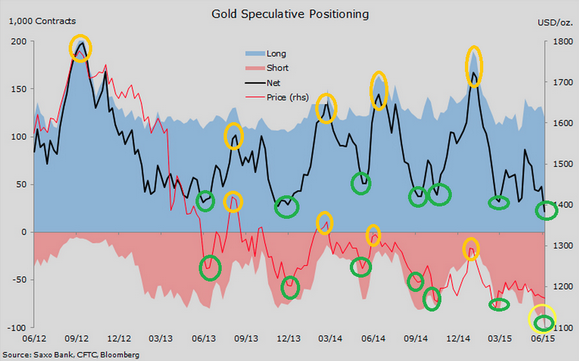

Who knows, perhaps money managers are funding their long equity positions with short gold positions.

“It looks like the end of an era for gold,” said Howie Lee, analyst at Phillip Securities in Singapore, adding that China had been grappling with oversupply after importing a record volume in 2013.

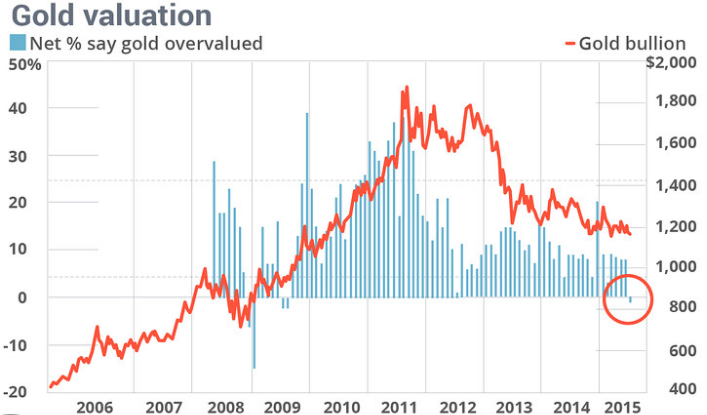

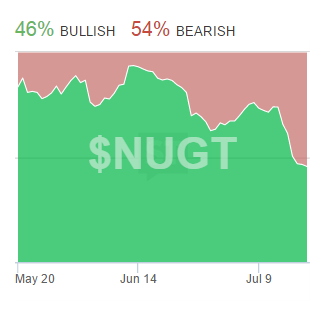

Money managers (a few of them) finally see gold as undervalued.

I am posting this so as to have a record of certain market events. I seek out where the most marginal or urgent seller is operating AFTER a long decline (four years).