Money Managers Are Price Chasers

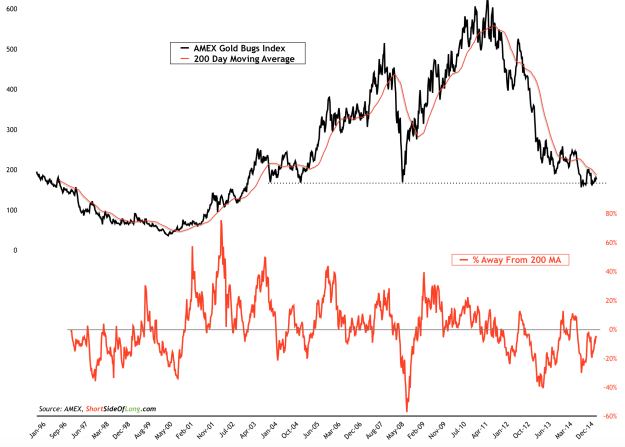

Markets can do ANYTHING in the short-term, so the following is not a prediction that miners will rise in price. However, what comes first–the price rising or the buying? 🙂 Miners chop around in a trading range as money managers flee the sector and now sit with record low allocations to this sector. * How good are money managers (on the whole) picking the right sector to invest in? I leave it to you to find that out.

Wedgewood Partners: Franchises in Cyclical Market and a Lesson on Diversification

wedgewood partners fourth quarter 2014 client letter Look at pages 12-20 where David Rolfe, the manager, discusses NOV, SLB and CLB–high-quality companies in the cyclical oil sector.

He points out diversification may mean the sources of profitability can be different among companies within a particular sector. (Refer to Competition Demystified by Bruce Greenwald for a course on this distinction). Note the high revenue conversion to free cash flow (page-14) for those companies compared to other companies in the oil services sector.

Now move on to wedgewood partners first quarter 2015 client letter crude realities. Note on page 13 how he looks at the oil services market–the structural attribute to focus on is drilling intensity. Interesting…. Look at pages 18 and 19 for a further discussion on NOV and CLB.

To learn, you might download those company’s recent annual reports and try to figure out their revenue to free cash flow conversion. Look at what the companies use for maintenance capex. Note how Core Labs is a free cash flow gusher (Charlie Munger would smile on this). Core Labs is a different business than SLB and NOV, but is grouped in the same industry/index. When sellers of ETF sell, they don’t distinguish among companies and therein lies opportunity for us. Yeah!

I do the opposite of this:

**Merrill Lynch Fund Managers Survey May 4, 2015

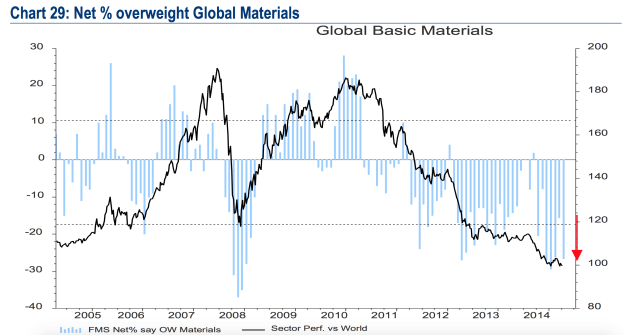

Today’s chart of the day focuses on sentiment in the basic materials sector. Regular readers of the blog already know that I have been closely following Merrill Lynch’s Fund Manager Survey for years now. This months survey was conducted in a period between 2nd to 9th April 2015 with a total of 177 panellists, with $494 billion of assets under management. The survey should be used as a very good contrarian indicator.

According to the recent survey, global fund manager allocation towards global materials declined sharply in the month of April to net 27% underweight from net 16% underweight the previous month. As we can clearly see from todays chart of the day, sentiment is very depressed right now. Merrill Lynch states that the current allocation is 1.8 standard deviation below its long term average.

Furthermore, the overall commodity and natural resources theme is very much disliked by global money managers. Commodity allocation is unchanged for the third straight month and remains at net 20% underweight. That is 1.2 standard deviations below its long term average and even more interestingly, fund managers remain underweight commodities for the 28th month in the row.

(Source: www.shortsideoflong.com)