This won’t end well–Chicago Slim

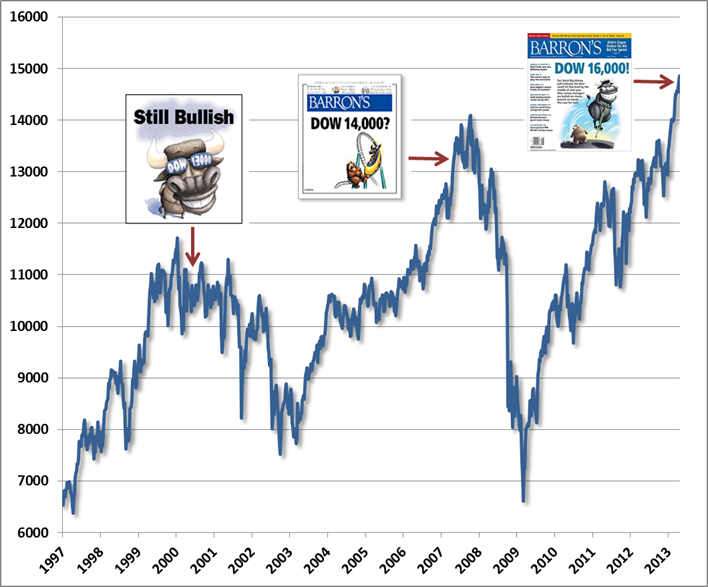

Only Barron’s semiannual Big Money poll of professional investors also is setting a record — for bullishness, that is. In our latest survey, 74% of money managers identify themselves as bullish or very bullish about the prospects for U.S. stocks — an all-time high for Big Money, going back more than 20 years. What’s more, about a third of managers expect the Dow Jones industrials to scale the 16,000 level by the middle of next year, notwithstanding a dismal week of selling that left the blue-chip index at 14,547.51 on Friday.

This spring’s survey is notable, as well, for the dearth of bears: A mere 7% of respondents are pessimists today, down from 27% last fall.

A contrasting view:

A few reminders…

“Still Bullish! (Dow 13000)” – Barron’s Magazine Big Money Poll, May 1, 2000

The May 2000 Big Money Poll was published with the Dow Jones Industrial Average at 10733.91. The Dow had already peaked nearly a thousand points higher in January of 2000, and would go on to lose about 40% of its value in the 2000-2002 bear market, with the S&P 500 and Nasdaq faring far worse.

“Dow 14000?” – Barron’s Magazine Big Money Poll, May 2, 2007

http://www.hussmanfunds.com/wmc/wmc130422.htm

http://www.hussmanfunds.com/wmc/wmc130415.htm