https://www.zerohedge.com/news/2019-07-23/what-risk-lessons-poker-can-teach-you-about-investing

The dealer is incredulous. “You’re raising tens on a lousy three flush?” she says to Robinson. Robinson never should have made that bet since he had only the slim makings of a straight flush and he was staring at McQueen’s pair of tens. You don’t often beat two pair, and certainly not a full house.

Lesson for an investor?

Hint: The market is no place for “making the wrong move at the right time.” Stick to your plan. Don’t personalize losses or success–especially success.

As students of investing we want to improve our skills though studying great investors, understanding and applying the proper principles and learning from case studies to make our education less costly, more profitable.

Only you can do the hard work of introspection of what your strengths and weaknesses. One fun way to improve is to play bridge or poker. Buffett plays bridge as described here:

http://www.hussman.net/wmc/wmc061127.htm

Aside from an affection for cheeseburgers and Cherry Coke, one of the personal facts commonly known about Warren Buffett is his love of bridge, which he periodically plays online with Bill Gates.

Why bridge? Though Graham wasn’t talking about Buffett at the time, he

offers a clue:

“I recall to those of you who are bridge players the emphasis that bridge experts place on playing a hand right rather than on playing it successfully. Because, as you know, if you play it right you are going to make money and if you play it wrong you lose money – in the long run.

There is a beautiful little story about the man who was the weaker bridge player of the husband-and-wife team. It seems he bid a grand slam, and at the end he said very triumphantly to his wife ‘I saw you making faces at me all the time, but you notice I not only bid this grand slam but I made it. What can you say about that?’ And his wife replied very dourly, ‘If you had played it right you would have lost it.’”

It takes an enormous amount of restraint to focus on playing every investment hand “right,” according to an established discipline, allowing the law of averages to work in your favor, rather than trying to win every hand. I would guess that this is exactly what appeals to Warren Buffett’s temperament. Over the long-term, good investing requires it.

Those quotes are excerpted from Hussman Funds. I recommend you bookmark this website: http://www.hussmanfunds.com/

My plug is to suggest a few hands of poker.

There are few things that are so unpardonably neglected in our country as poker. It is enough to make me ashamed of one´s species. Mark Twain.

If you look around the table and you can´t tell who the sucker is, it´s you. Paul Scofield, playing the role of Mark Van Doren in Quiz Show.

Poker, the game exemplifies the worst aspects of capitalism that have made our country so great. Walter Matthau.

A guy walks into a bar and notices three men and a dog playing poker. The dog is playing beautifully. ¨That´s a very smart dog,¨ the man says. ¨Not really¨ says one of the players. ¨Every time he gets a good hand he wags his tail.¨

Depend on the rabbit´s foot if you will but remember, it didn´t work for the rabbit. Anonymous.

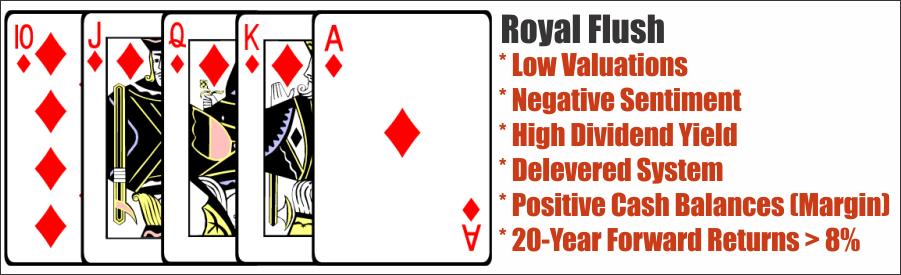

Poker will teach you about odds, money management, human psychology and your own temperament. An important lesson for investors is to maximize your winning investments. Joel Greenblatt, George Soros, Warren Buffett and Charlie Munger all were experts at heavily weighting their best investments because they could distinguish good opportunities. They knew the importance of being paid well for finding the rare opportunity. A few weeks ago in early October we had (and may still have) cheap valuations on some quality companies (AMAT, CSCO, MSFT, MDT, NVS, SYK–in my opinion and easy now to say in retrospect) because we had low expectations for growth, high anxiety, and hyper easy monetary conditions. Opportunities like that don´t appear often. Make the most of your chance. Now pundits are saying we are not going into a recession; where were they last month?

Poker strategy will drive home that lesson in spades (sorry). Poker is beautifully

simple, wildly complicated, and in its essence, pure Machiavelli and Sun Tzu,

if one plays better than the other, if he out-thinks and out-strategies, then

he will win the most money. Poker isn´t about the number of pots you take down, or how fantastic you look winning them. Claiming a pot when you have the best cards isn´t enough to make you a winning player. Remember, there is no grand pay scale for holding the best hand. No one gives you a pile of money for drawing a royal straight flush. Some sucker has to pay you off. You have to

maximize profits through guile and savvy, eke out every last dollar that your

competition is willing to lose to you–and, when you don´t have the winning

cards, flee as fast as possible. (Poker Nation by Andy Bellin).

—

Good luck and rub that rabbit´s foot.

Posted in Investor Psychology, Uncategorized

Tagged Bridge, Buffett, Money Management, Poker