When to start buying mining shares

See the lows put in Jan. 11th in both the HUI Goldbugs index and Freeport McM (FCX). Only six days after the publishing of this article.

Five years ago, the FTSE 350 Mining index reached a post-financial crisis peak at just over 28,000. It currently sits at 7,134, down 75% at an 11-year low, and share prices remain vulnerable.Global commodities markets remain massively oversupplied and Chinese demand is waning, but there will come a point at which mining shares are a ‘buy’ again. (You always want to buy commodities and/or commodity stocks at the point of MAXIMUM PESSIMISM or when supply is greatest and demand lowest!).

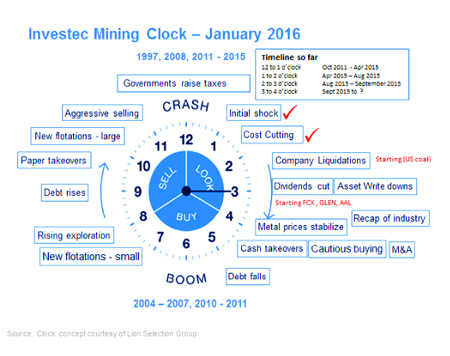

Investec Securities has built a “Mining Clock”, which brilliantly illustrates the mining cycle, including when to buy and when to sell. It’s a real “cut-out-and-keep” for every investor.

Investec writes:

“Please see the updated Mining Clock below where we indicate that it appears still too early to be buying the mining sector. This is despite five straight years of underperformance from mining equities globally, in every sector, save Australian listed gold equities which outperformed the ASX in 2014 and 2015.” (Where is the article that told you WHEN, exactly, to buy?). Rearview investing doesn’t work.

—

The above article proves once again that no one can time a sector–except when (like in this article) there is no hope for a rebound.

http://prostedywagacje.blogspot.co.uk/2016/08/how-to-play-this-bull-market-in-gold-in.html

Last time I sold a few of my miners back in July

http://csinvesting.org/2016/07/08/time-to-sell-some-miners-but-not-much/

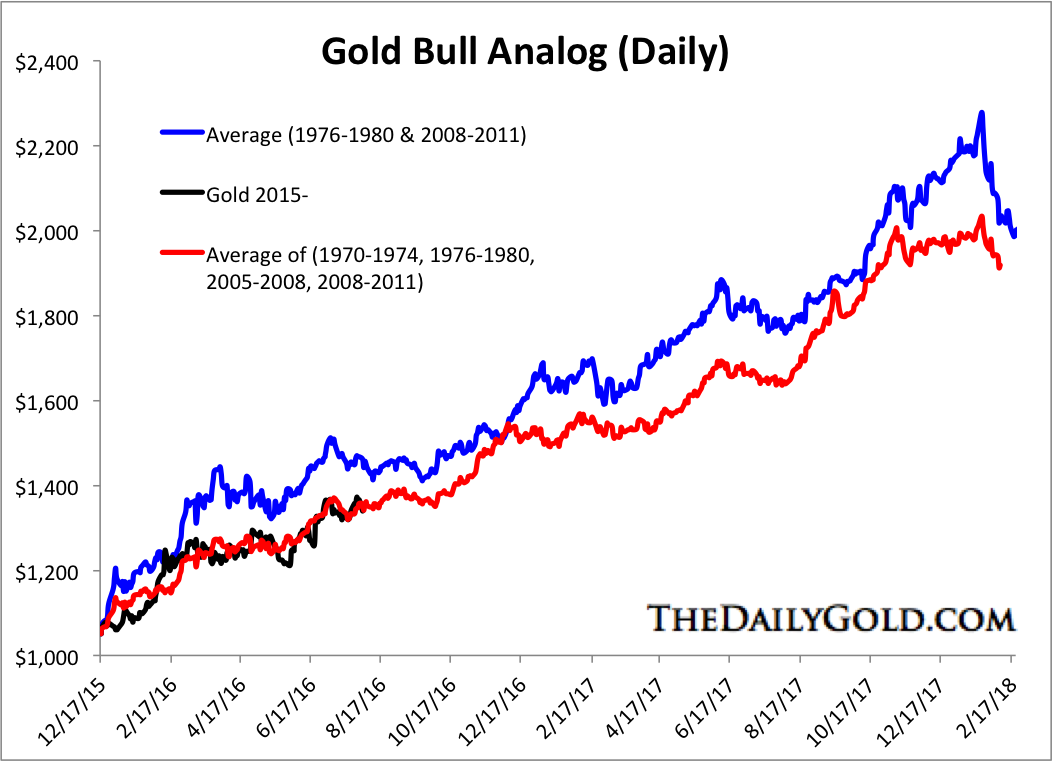

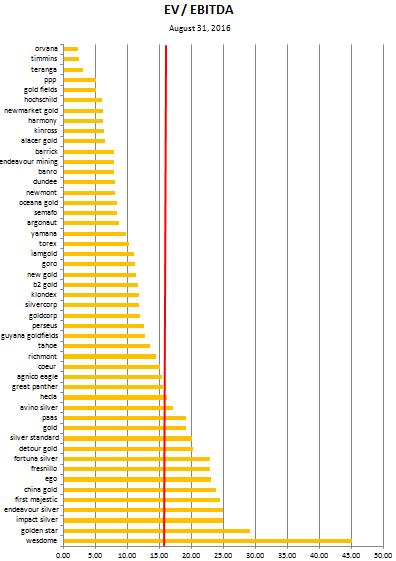

And now over the next few days and weeks, a time to rebuy at the margin. But if you are in a bull market Sentry__Com_BullishGold_MacLean___E then sitting tight is what you must do. At most, I think we are in six to seven on the mining clock. So far, the public is not yet participating except perhaps in the last month.

WHAT do YOU think?

HAVE A GOOD WEEKEND!

P.S.: http://donmillereducation.com/journal/ Work on yourself!