Search Strategy: Go where the outlook is bleakest (John Templeton). Keep his wisdom by your side: Sixteen Rules for Investment Success_Templeton

Search Strategy: Go where the outlook is bleakest (John Templeton). Keep his wisdom by your side: Sixteen Rules for Investment Success_Templeton

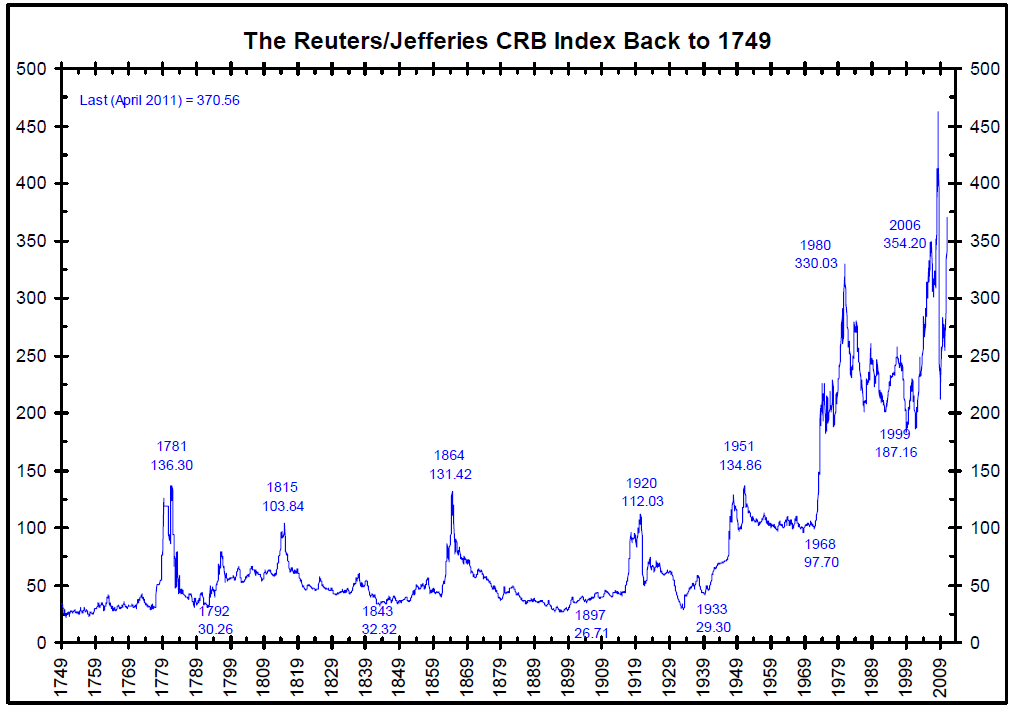

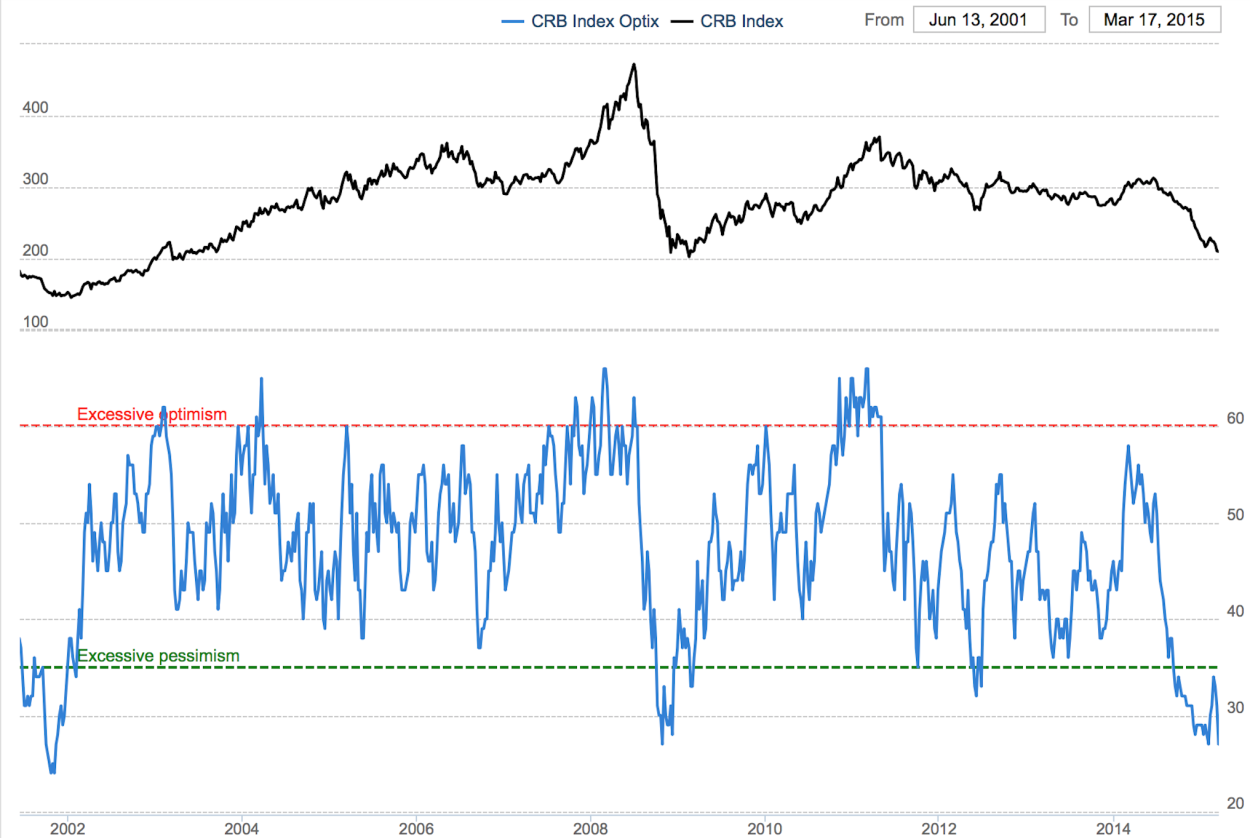

Commodities (CRB Index) fall back to a 40-year support zone ($185/$205)

As global commodities prices plummet, it’s incredibly convenient to pronounce the commodities super-cycle dead, isn’t it? Yet banks from Goldman Sachs to Citigroup to Deutsche Bank are on record as saying it’s over. http://www.wallstreetdaily.com/2014/12/08/jim-rogers-commodities-interview/

The point is not to follow the “experts” but search where there is carnage. I am looking at Templeton’s Russian and Eastern Europe Fund TRF Semi Annual Report because:

- Hated Countries (Russia, Ukraine)

- Currencies Down,

- Commodity Exporters and

- trading at a 10% discount so the 1.4% management fee is covered for six years.

- Poor performance for the past few years

Things can and will probably get worse. So please don’t follow the blind (me) off the cliff. This is meant as an example of a SEARCH STRATEGY.

—

More on Reversion to the Mean and the Growth Illusion

We are beating this subject to death but you can’t understand how investing in bargains works without grasping these concepts.

Contrarian Strategy Extrapolation and Risk Abstract: Value strategies yield higher returns because these strategies exploit the sub-optimal behavior of the typical investor and not because these strategies are fundamentally riskier. Yes, this is an academic paper, but worth reading to understand WHY and HOW value (buying stocks with low expectations/and low price to business metrics like earnings, cash flow, EBITDA, etc.) provide better returns.

Growth Illusion

The Two Percent Dilution It is widely believed that economic growth is good for stockholders. However, the cross-country correlation of real stock returns and per capita GDP growth over 1900–2002 is negative. Economic growth occurs from high personal savings rates and increased labor force participation, and from technological change. If increases in capital and labor inputs go into new corporations, these do not boost the present value of dividends on existing corporations. Technological change does not increase profits unless firms have lasting monopolies, a condition that rarely occurs. Countries with high growth potential do not offer good equity investment opportunities unless valuations are low.

value-vs-glamour-a-global-phenomenon (Brandes Institute)

Thick as a Bric by Efficient Frontier

Does the Stock Market Over React

Discussion of Does the Stock Market Over React

Criticism of the Over Reaction Theory

The above is meant to supplement your reading in Deep Value Chapter 5, A Clockwork Market

Ben Graham’s Net-Net Strategy Revisited