Someone sent me a postcard picture of the earth.

On the back it said, “Wish you were here.” — Steven Wright

Investment Checklists

We left-off here Last Lesson on Gross Profitability and Magic Formula and in that post, the next focus would be on investment checklists. We have been reading Chapter 2: A Blueprint to a Better Quantitative Value Strategy in Quantitative Value (I will email the Book to new students if they are in the Deep-Value Group at GOOGLE. Go here: https://groups.google.com/forum/#!overview then type: DEEP-VALUE and ask to join.).

On pages 56 to 59 of this chapter the author discusses the case for a checklist. Atul Gawande in his book The Checklist Manifesto: How to Get Things Right argues for a broader implementation of checklists. The author believes that in many fields, the problem is not a lack of knowledge but in making sure we apply our knowledge consistently and correctly.

The Quantitative Value Checklist

- Avoid Stocks that can cause a permanent loss of capital or avoid frauds and financial distress/bankruptcy.

- Find stocks with the cheapest quality.

- Find stocks with the cheapest prices.

- Find stocks with corroborative signals like insider buying, buyback announcements, etc.

Below are several books on checklists.

As students may know, I throw A LOT of information at you to force a choice on your part. You have to focus on what material can be adapted to your needs. In the three books above, you will find many interesting ideas that may be helpful in learning how to build your own list.

The more experienced you are, then the shorter the checklist. The point of a checklist is to be disciplined and not overlook the obvious while freeing up your mind for the big picture. Yes, you check off if there is insider buying, but if insiders are absent, but the company has a strong franchise and the price is attractive, then those factors may be overwhelmingly positive. You may ask, “Do I understand this business?” Then it may take weeks of industry reading to say yes or no.

Checklists are helpful, but only if you adapt them to your method.

Next, we will be reading Chapter 3, Eliminating Frauds in Quantitative Value. We are trying to improve our ability to build a margin of safety.

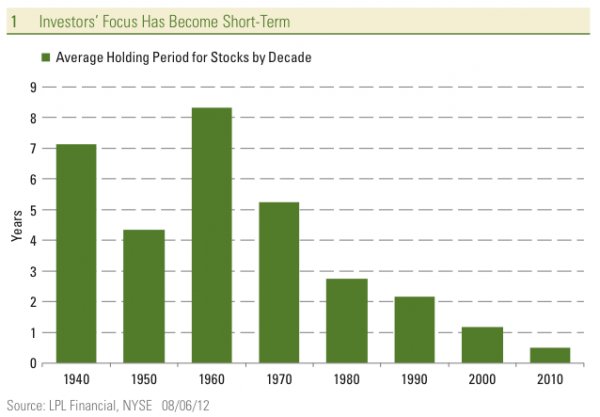

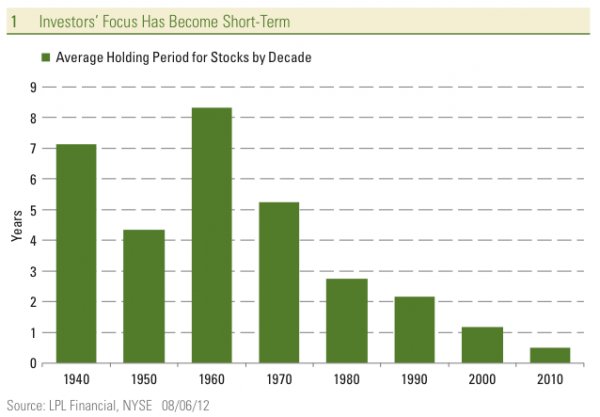

The Problem with Investor Time-frames

Note the dark line in the chart above representing the returns of the Goodhaven Fund. Two analysts/PMs split off from Fairholme and started in mid-2011. They had a big inflow in early 2014 and then some of their investors panicked as they vastly “underperformed the market.” I don’t know if these managers are good or bad but making a decision on twelve to twenty-four months of data is absurd unless the managers completely changed their stripes (method of investing). Therein lies opportunity for those with longer holding periods like five years or more.

Shareholder_Message_1114 (Some investors run for the door)

2014_AR

2013_AR

HAVE A GREAT EASTER and WEEKEND!