My reply: I agree that analysts can provide great overviews of companies and industries in their initiation reports. I will read them as a supplement to my own reading of original source documents. I would not read them for valuation or investment recommendations. The idea that analysts can predict next quarter’s earnings is absurd. Finding a reasonable range of normalized earnings three years to five years out is what matters, not the next six months of earnings.

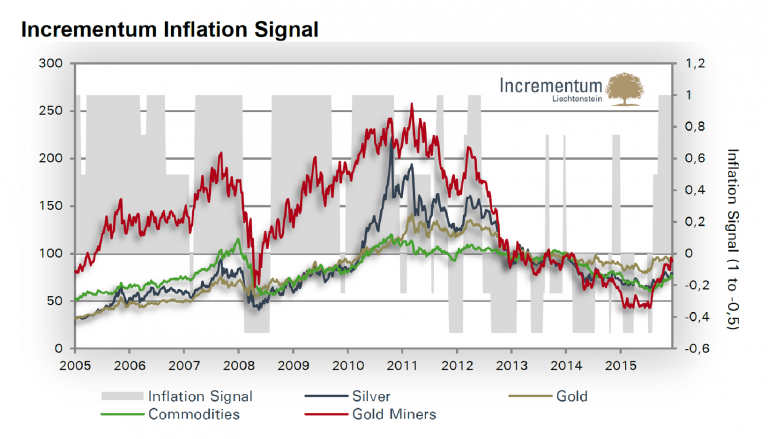

Another reason I might try to read analysts reports is not for new ideas, but to see the extent to which the market is already discounting my own views. Note the universal calls from analysts at Goldman and UBS for gold to trade to $900 or $800 See www.acting-man.com:

“Goldman Sachs lowers gold price target to $1,050” (Bloomberg, Reuters, etc. sometime in January and repeated ad nauseam ever since)

“Moody’s lowers gold price target to $900” (January)

“Morgan Stanley: Gold price won’t see $1,300 again” (April)

Also, analysts may overlook key values in a company because they fixate on the next six months. For example, the most common way of valuing an exploration and production company is an appraisal of net asset value, based on sum-of-the parts approach. But most appraisals tend to ignore exploration assets which are not going to be drilled within some arbitrary time period, say the next 6 to 12 months. For some companies, much of the value is in assets which are not going to be drilled in the next year.

I think most of an investor’s edge is behavioral. (See http://www.amazon.com/Inefficient-Markets-Introduction-Behavioral-Clarendon/)

Take Coach’s (COH) recent plunge.

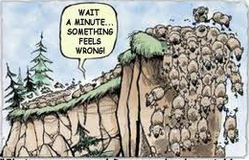

Coh Comments June 2014 and June 23 VL 2014 The company has to increase its investment to rebuild its brand. Wall Street analysts then act like this:

Therein lies opportunity or maybe not. But if the markets didn’t act that way, then markets would not overreact. Markets tend to over-discount a known risk or uncertainty and under-discount an unknown uncertainty.