From 1975-2001: ROI for T-Bills was 6.6%, S&P 500 14.1% with a 15% std. dev., Bulk Shipping 7.2 with a 40% std. dev., and Tanker Shipping 4.9% with a 70.4% std. dev! (Source: Maritime Economics, 3rd Edition)

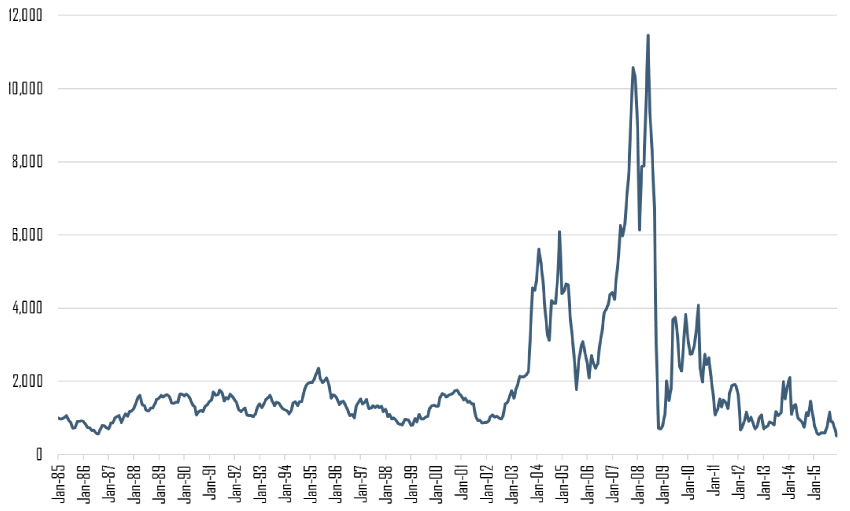

Who in their right mind would invest in the shipping business? Well, if you can buy low, then fortunes can be made. Recently, the Baltic Dry Index (BDI) hit a thirty-year low of 291, BDI Index and note the long-term chart below. Always look at MANY years of past data. The boom of 2007/08 will probably not be seen again for many years.

See a deep contrarian investor discuss the dry bulk shippers (March 2016):Deep Value Inv./Operator Discusses Dry Bulk Mkt.

“Dry bulk is a screaming buy; one of the best entry points in the cycle in the last thirty years. But be prepared to sustain a prolonged period of poor freight market conditions and have plenty of cash reserves and low leverage. In other words, you have to have a longer-term perspective than most investors–three to five years at least.

Isaac sowed seeds into the land during a drought. –Leon Patitasas

“That’s the funny thing about ships. They are actually more attractive to buy at 20xs EBITDA, or even negative cash flow, than they are at 4xs EBITDA,” Coco said.

“So you are telling me that investors should seek out money losing shipping deals?” she asked incredulously.

“Correct. And sell the ones that are making lots of money. Itis like that little Napoleon said….”Buy on the sound of cannons and sell on the soundsof trumpets.” (Source: The Shipping Man by Matthew McCleery).

—

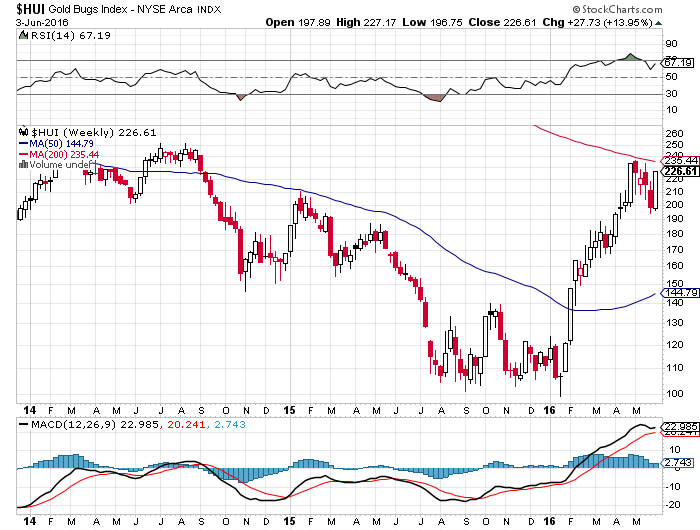

John Chew: Here is where I wonder if this post helps readers’ understanding of investing because is this investing or speculating? Note as much as what Warren Buffett does NOT do. He doesn’t invest in mining or shipping stocks. He has already had poor results with the airline industry. So why even mention an industry in massive distress with historically sub par returns and huge volatility? I would prefer businesses with great reinvestment opportunities or great capital allocators at the helm like Markel (MKL), but a horrific business going from a distress price to a bad price may give much better returns depending upon the price paid. Also, the worst bear market in freight rates in the past 30 years for dry bulkers means unusual opportunity just as the worst bear market in gold miners in the past 100 years offered bargains galore.

Readers know that I ventured into the miners in mid-to-late 2013, subsequently suffering back-to-back declines of about 25% before seeing the portfolio rally about 100%. So I still do not have a great return (12% after three years), but I bought miners with a five-year-to-seven year outlook and I am only three years into the investment. With Junior miners you can expect to see a 50% decline before they rally five to 10 times (assuming you chose the ones that survive! –Rick Rule). In a land of negative-to-low interest rates, I have to look further for bargains.

Readers can pipe in what they would like to learn in future posts–let me know.

Five years of declines in gold mining stocks and then…..

Are you investing or speculating by dry-bulk shipping stocks? These are stub stocks where the equity is a small fraction of the enterprise values due to the shrunken market cap and the large debt taken on to finance ship purchases. But if you buy a few well-managed and relatively well-financed shipping companies that can survive the trough of the cycle–two to four more years?– you can tolerate a few going to zero if the ones remaining multiply many-fold. Not for the weak-kneed. Scorpio Bulkers (SALT) has ALREADY diluted shareholders and has taken drastic action to survive. Note management buying shares at $3.00 Scorpio Bulkers Inc. Announces Financial Results for the First Quarter of 2016. An ugly past, but we invest for the future in terms of mean reversion. I have not yet invested in any shipping stocks!

Here is what I love about the shipping business. 10 ships and 11 cargoes, then a BOOM. 11 ships and 10 cargoes, then a BUST. You are also on the SAME footing as the most experienced ship owners in the world. NO ONE knows when the cycle will turn. This is like a poker game where the investor that has the ships when others have thrown in the towel takes a lot of the marbles. The worse the freight rates and the outlook, the better IF you can carry the costs until the cycle turns, and it WILL turn due to the laws of supply and demand.

I view this as intelligent speculation. I allocate five tranches of investment into five shipping companies. Say $5 units each. One unit goes to zero (ouch!), the next to $2 (Boo!), the next to $1 (Damn!), the next to $3 and the next to $50 (Homerun!) and it takes three years. There is a 31% compouned return. Though I have no idea if this is realistic because I must study the shipping industry thoroughly. I am just formulating a possible strategy IF I find the right companies at the right prices. But I am drawn to the shipping companies because some companies are trading below depressed net asset values. As Mr. Templeton suggests, look where the outlook is most dire.

The best source to learn about shipping is Maritime Economics. And a must read:

Meanwhile keep reading………………..

- A Wealth of Common Sense

- Base Hit Investing

- Beyond Proxy

- Brooklyn Investor

- CS Investing

- Fundoo Professor

- Gannon and Hoang on Investing

- Glenn Chan’s Random Notes on Investing

- Long Term Value Blog

- Microcap Club

- Musings on Market

- Net Net Hunter

- Odd Ball Stocks

- OTC Adventures

- Punchcard Investing

- Safal Niveshak

- Shadow Stock

RISK Management Video – Be prepared for the unexpected.