How-the-outsiders-became-one-of-the-most-important-business-books-in-america/

I recommend the above book!

When we read annual reports and shareholder letters we are searching for good businesses, cheap assets and excellent operators and capital allocators.

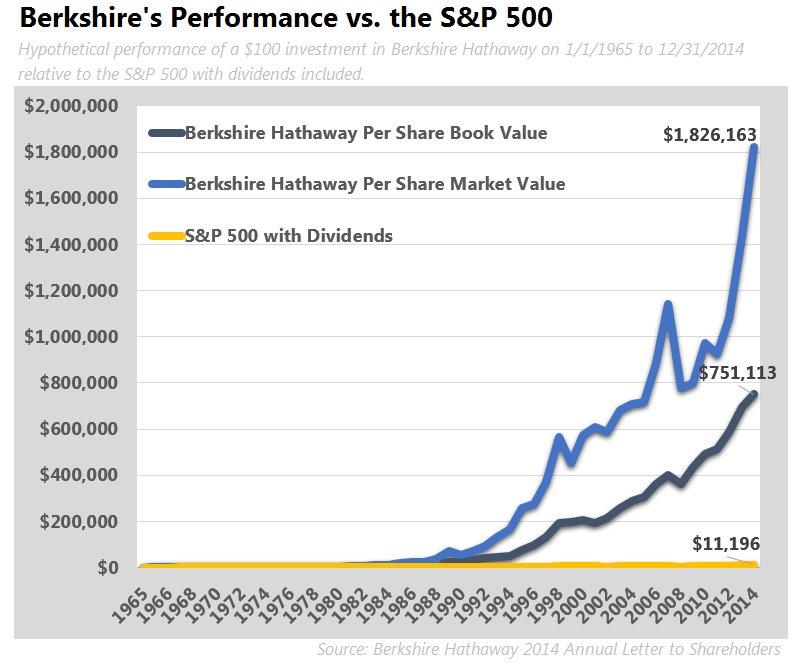

From the Preface of The Outsiders: In assessing performance, what matters isn’t the absolute rate of return but the return relative to peers and the market. You really only need to know three things to evaluate a CEO’s greatness: The compound annual return to shareholders during his or her tenure and the return over the same period for peer companies and for the broader market (S&P 500)

Context matters greatly–beginning and ending points can have an enormous impact, and Welch’s tenure coincided almost exacly with the epic bull market that began in late 1982 and contiued largely uninterrupped until early 2000. During this remarkable period, the S&P 500 averaged a 14 annual return, roughly double its long-term average. It is one thing to deliver a 20 percent return over a period like that and quite another to deliver it during a period that includes several severe bear markets.

A baseball analogy helps to make this point. In the steroid saturated era of the mid-to-late 1990s, twenty-nine nome runs was a pretty medicore level of offensive output (the leaders consistently hit over sixty). When Babe Ruth hidid it in 1919, however, he shattered the prior record set in 1884 and changed baseball forever, ushering in the mdoern power-oriented game. Again, context matters.

The other important element in evaluating a CEO’s track record is performance relative to peers, and the best way to assess this is by comparing a CEO with a broad universe of peers. As in the game of duplicate bridege, companies competing within a industry are usually dealt similar hands, and the long term difference between them, therefore, are more a factor of managerial ability than expernal forces.

When a CEO generages signifiantly better returns than both his peers and the market, he deserves to be called “great,” abnd by this definition, Welch, who outperformed the S&P 500 by 3.3 times over his tenure at GE, was an undeniably great CEO.

He wasn’t even in the same zip code as Henry Singleton:

- Emultate Henry Singleton

- Teledyne and Henry Singleton a CS of a Great Capital Allocator (MUST READ!)

- Singleton the Sultan of BuyBacks

From a Deep-Value Member: Hi guys and girls:

Seeing as though we have such a passionate investors in John’s group, and we’re in annual report season, I wondered if everyone could nominate their top 5-10 “must read” shareholder letters. I will collate the results and re-post the top 10 back to you all when done (hopefully by the coming weekend). I think the idea here is for us all to hear about a few undiscovered names, rather than the obvious ones… so there is nothing too small or obscure as long as you think it conveys something meaningful and insightful.

Please reply with “shareholder letter” in the title as it will make this a little easier for me. Also… we can all assume Berkshire is an annual must read, so lets leave this on one off the list. I’m curious to hear what people have to say. Let me start off seeing as though I have put forward the idea.

- Fairfax Financial Letter 20015

Markel Corporation Annual Report 2014 - Burgundy AM (Canada) Stoicism-and-the-Art-of-Portfolio-Intervention 2014-Confessions_of_a_Buffetteer (from Canada)

- http://www.leithner.com.au/links.php (Australian Grahamite-FABULOUS) http://www.chrisleithner.ca/newsletter/index.php#.VUzyCvlVhBc Great links to investing material/lessons.

Cut and past the above–excellent web-site with a trove of Graham an Dodd links, materials and letters!

JP Morgan

Amphenol

Overstock.Com

Serco Plc

Amerco

……………………………………………

After two weeks of sifting and sorting, I can reveal our top 10 favorite shareholder letters. It’s an eclectic mix.

Thank you to all you who contributed.

- Complete_Buffett_partnership_letters-1957-70

- Aristotle Capital Annual Letters Managers-and-Baseball-Aristotle-Borowski-7.22.13 Aristotle-The-Essence-2015Q1-ACML-15-197-Kosher-Meat Aristotle-Commentary-2015Q1-Value-Equity-ACML-15-220

- Ned Goodman Annual Letters Dundee 2013-Annual-Report and Dundee Annual-Report-2012

- Ennismore Asset Management Letters OEIC – Most Recent NL and Globo – Jan 2014 (Good to see the international managers mentioned)

- Oaktree Capital Management – Howard Marks Liquidity

- Packaging Corp of America Shareholder Letters PCA_2014AnnualReport (??)

- Skagen Fund 2015 04 01_Market-report (looks interesting!)

- Expeditors EXPD_2014_Full

- Seacor Holdings SEACOR 2014_Annual_Report (A brilliant man in a mundane group of businesses)

- Grantham Mayo van Otterloo – Quarterly Letters breaking-out-of-bondage-and-are-we-the-stranded-asset- and gmo-7-year-asset-class-forecast-(1q-2015)

Here are my (from another reader/contributor) favorite letters:

Skagen from Norway – Just finished reading it today – good stuff!

http://ipaper.skagenfondene.

Go straignt for the PDF (icon in the middle)

About Skagen: We search for companies that are priced significantly lower than our estimation of the value of the underlying operations. Our ideal investment is a company which is Undervalued, Under-researched and Unpopular, and that has potential triggers which could make hidden values visible and therefore create excess returns for our clients.

Troy Asset Management in the UK

http://www.taml.co.uk/archive-

Orbis Fund management in Bermuda

https://www.orbisfunds.com/

Ennismore Small European Value

http://www.ennismorefunds.com/

GMO

www.gmo.com (free registration required but worth it)

Their Quarterly letter is a real gem.

http://www.gmo.com/

RECM in South Africa

https://www.recm.co.za/

California based Aristotle Capital

http://www.aristotlecap.com/

—

John Chew: Fantastic to have the international contributions!

Great Value Investing Blogs as chosen by another blogger:

Catch-22

HAVE A GREAT WEEKEND!