What Worked in Investing-Tweedy Browne

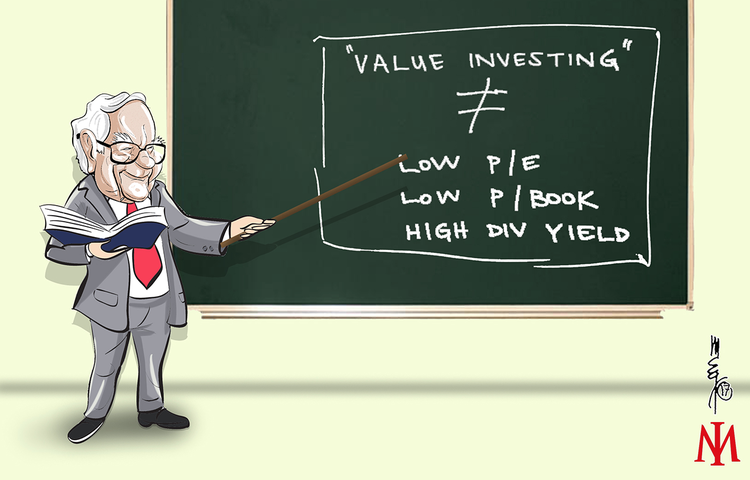

Low price to book value or high book value to price was an INDICATOR of value but no guarantee to coincide with intrinsic value as Buffett explains:

“In past reports I have noted that book value at most companies differs widely from intrinsic business value – the number that really counts for owners.” Berkshire 1986 Letter

“Book value’s virtue as a score-keeping measure is that it is easy to calculate and doesn’t involve the subjective (but important) judgments employed in calculation of intrinsic business value.

It is important to understand, however, that the two terms – book value and intrinsic business value – have very different meanings. Book value is an accounting concept, recording the accumulated financial input from both contributed capital and retained earnings. Intrinsic business value is an economic concept, estimating future cash output discounted to present value. Book value tells you what has been put in; intrinsic business value estimates what can be taken out.

An analogy will suggest the difference. Assume you spend identical amounts putting each of two children through college. The book value (measured by financial input) of each child’s education would be the same. But the present value of the future payoff (the intrinsic business value) might vary enormously – from zero to many times the cost of the education. So, also, do businesses having equal financial input end up with wide variations in value.” Berkshire 1983 Letter

“Some investors weight book value heavily in their stock-buying decisions (as I, in my early years, did myself). And some economists and academicians believe replacement values are of considerable importance in calculating an appropriate price level for the stock market as a whole.

Those of both persuasions would have received an education at the auction we held in early 1986 to dispose of our textile machinery. The equipment sold (including some disposed of in the few months prior to the auction) took up about 750,000 square feet of factory space in New Bedford and was eminently usable. It originally cost us about $13 million, including $2 million spent in 1980-84, and had a current book value of $866,000 (after accelerated depreciation). Though no sane management would have made the investment, the equipment could have been replaced new for perhaps $30-$50 million.

Gross proceeds from our sale of this equipment came to $163,122. Allowing for necessary pre- and post-sale costs, our net was less than zero. Relatively modern looms that we bought for $5,000 apiece in 1981 found no takers at $50. We finally sold them for scrap at $26 each, a sum less than removal costs.

Ponder this: the economic goodwill attributable to two paper routes in Buffalo – or a single See’s candy store – considerably exceeds the proceeds we received from this massive collection of tangible assets that not too many years ago, under different competitive conditions, was able to employ over 1,000 people.” Berkshire 1985 Letter

“Of course, it’s per-share intrinsic value, not book value, that counts. Book value is an accounting term that measures the capital, including retained earnings, that has been put into a business. Intrinsic value is a present-value estimate of the cash that can be taken out of a business during its remaining life. At most companies, the two values are unrelated.” Berkshire 1993 Letter

“We define intrinsic value as the discounted value of the cash that can be taken out of a business during its remaining life. Anyone calculating intrinsic value necessarily comes up with a highly subjective figure that will change both as estimates of future cash flows are revised and as interest rates move. Despite its fuzziness, however, intrinsic value is all- important and is the only logical way to evaluate the relative attractiveness of investments and businesses.

To see how historical input (book value) and future output (intrinsic value) can diverge, let’s look at another form of investment, a college education. Think of the education’s cost as its “book value.” If it is to be accurate, the cost should include the earnings that were foregone by the student because he chose college rather than a job.

For this exercise, we will ignore the important non-economic benefits of an education and focus strictly on its economic value. First, we must estimate the earnings that the graduate will receive over his lifetime and subtract from that figure an estimate of what he would have earned had he lacked his education. That gives us an excess earnings figure, which must then be discounted, at an appropriate interest rate, back to graduation day. The dollar result equals the intrinsic economic value of the education.

Some graduates will find that the book value of their education exceeds its intrinsic value, which means that whoever paid for the education didn’t get his money’s worth. In other cases, the intrinsic value of an education will far exceed its book value, a result that proves capital was wisely deployed. In all cases, what is clear is that book value is meaningless as an indicator of intrinsic value.” Berkshire 1994 Letter

—

Is Accounting as Useful as an Indicator as it Used to be?

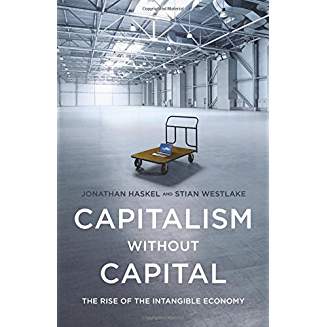

Recent years has seen the brisk rise in market value of businesses defined by their network effects and operational leverage to the new economy rather than those dependent on traditional accounting defined forms of capital. Also, we have seen rising domestic Gini coefficients despite global improvements in aggregate output. Capitalism without Capital investigates the increased investment in intangible assets and their place in the modern economy.

The book is about the change in the type of investment observed in more or less all developed countries over the past forty years. The authors argue:

- There has been a long-term shift from tangible to intangible investment.

- Much of that shirt does not appear in company balance sheets and national accounts because accountants and statisticians tend not to count intangible spending as an investment, but rather as day-to-day expenses.

- The tangible, knowledge-based assets that intangible investment builds have different properties relative to tangible assets: they are more likely to be scalable and have sunk costs; and their benefits are likely to spill over and exhibit synergies with other intangibles.

Is Book Value Irrelevant?

http://thereformedbroker.com/2018/04/30/is-book-value-irrelevant/

To be continued………..