Questions from a Reader:

Subject: Competition Demystified+Fusion Investing

QUESTION

I am currently reading Bruce Greenwald’s Competition Demystified, and I am not finished. However, I remember asking you before about emerging franchise, and you replied that Prof. Greenwald covered this topic in the book. I would appreciate if you can direct me to this chapter and where he exactly tackles the strategic issue of emerging franchise and company strategic actions.

Answer: Let me be sure we have the same definition for emerging franchise. This would be a franchise in its early to middle stage of (typically rapid)growth like Wal-Mart (WMT) in the early 1970s and 1980s as it grew through local economies of scale on the edges of its local territorial advantage. WMT could earn high returns while also redeploying its capital at the same high returns (high marginal returns to capital) thus funding its growth and compounding capital at high rates for a 20-year period. No wonder WMT created more millionaires than any other company in history. Now, of course, WMT can not grow by redeploying its capital at the same rates since it has saturated the US market, and the company does not have unique cost advantages in foreign markets. The first two cases on Wal-Mart and Coors will cover local economies of scale. See pages 77 to 112 of the book, Competition Demystified.

Then you have entrant strategies for a company trying to enter against established incumbents like Kiwi enters the airline industry–see pages 238 to 254. The entrant has to go into niches that are not of interest to the larger incumbents, then build from there. Note the Japanese Car companies entrant strategies into the US auto market–from small, fuel-efficient cars to Lexus! The Japanese took market share from the Americans.

Now if you are thinking of smaller, dominant companies in their niches, you might enjoy reading, Hidden Champions of the 21st Century: Success Strategies of Unknwn World Market Leaders by Hermann Simon (2009)

QUESTION

- What is your take on Fusion investing approach (blending Fundamental (value approach) +Technical + Quant+ behavioral + intermarket ). I noticed some successful money managers who are in the minority adopted this approach successfully over long periods of time. Names like : John Palicka, who this week published his book on fusion investing, John Bolton and Michael Burry).. http://www.amazon.com/Fusion-Analysis-Fundamental-Technical-Risk-Adjusted/dp/0071629386#_

Mr. Palicka is a CFA and CMT. The value of a CFA designation: http://www.businessweek.com/bschools/content/apr2011/bs20110426_844533.htm

Answer: I don’t know if John Bolton and Michael Burry use technical analysis, but any tool which helps you understand who is on the other side of the trade from you is helpful. If I saw Seth Klarman, Einhorn, and Buffett on the Buy-side against my short position, I would seriously recheck my work or at least find out their reasons for owning the company. You have to respect the other side or else you discover the fool is you.

I am not an expert on technical analysis but I do know that when I traded soybeans and T-Bonds on the trading floor in Chicago (1980s) finding out who the supra-marginal buyer or seller was and then doing the opposite was almost a guarantee of making money at least in the short-term (one hour to three days). The price would rally up for two or three days into long-term resistance and the chart breakout players would come into the market following the price, and I would sell responsively into their demand because the market orders were from small, weaker speculators whom were buying from commercial hedgers. I wanted to be with the strong against the weak.

If you see prices flat-lining for several years, it means that there is little new supply or demand, and people become used to this price level. If there is a breakout to the upside (especially if the marginal cost of production is above average costs), then I would buy on the higher price. There are economic reasons behind the price rise. However, what possible edge can you have (Barriers to Entry?) reading charts since everyone sees the same thing as you do? nGo where you have the biggest edge.

But I do not know in what exact proportions to “fuse” all the different methods. All I am trying to do is figure out what something is worth and then pay a whole lot less for it. For most companies and for much of the time, I can’t figure it out. But there are certain times when the world goes crazy and prices become extreme then even I can find opportunity.

I can guarantee that too much complexity will hurt your results. Also, I am extremely skeptical that Mr. Palicka with a CFA, CMT writing a book will provide anything new. Having a CFA, CMT may not hurt you, but I do believe those designations are neither necessary nor sufficient to help you as an investor. I know that comment may find much disagreement, but I am happy to post such rebuttals in the comments section. At the risk of alienating some readers, I will call it; like I see it–like the umpire says.

I have heard Joel G. explain that despite going to Wharton MBA school, he learned value investing through Graham and Buffett and then his application of those principles. There is no secret to investing–just relentless application over years with the right framework and independent thinking.

If you want a philosophical background to think for yourself then read, Atlas Shrugged or The Fountainhead by Ayn Rand.

QUESTION

I would also appreciate if you can share your reading list with us.

Do you mean a recommended list or what I am reading now? My current reading list is below. Since I live five blocks from a good research library, I can check out many interesting books on diverse subjects. Also, I often just skim books.

- The Rise and Fall of the Third Reich by William Shirer–with the passage of the expanded “Patriot” Act, the U.S. President can arbitrary detain, torture and execute American citizens without Habeas Corpus and Due Process provided that they are “Terrorists.” How convenient. I don’t like my neighbor because his dog uses my motorcycle like a fire-hydrant. He makes the perfect terrorist suspect don’t you think? …….So I want to study the lessons of Fascism and totalitarianism.

- The Great A&P and The Struggle for Small Business America by Marc Levinson. This books shows that corporate goliaths are not immune to the insistent forces of competition and change. Perhaps I can find a case study here.

- The Ikea Edge by Anders Dahlvig. Some people read Wall Street Research, but I find business histories on companies and CEO’s a great education for studying competitive advantage and how companies evolve–the inevitable ebb and flow of success and failure.

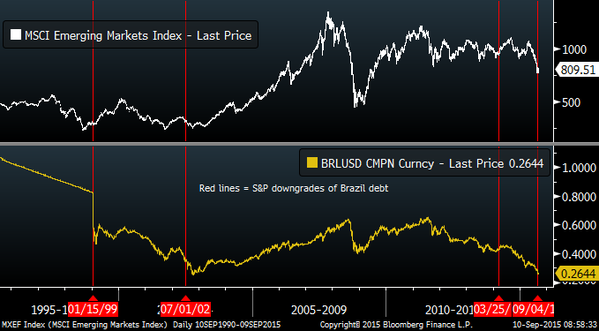

- Uprising by George Magnus. Will emerging markets shape or shake the world economy? I have traveled and worked in Brazil, Cuba and other countries. I am not so enthused as the public hype about emerging markets. Take China–how does a dictatorial regime that is directing the banking sector (similar to the Fed in the US) not go through a massive boom/bust? Brazil’s business regulations require 200,000 pages of fine print. Absurd! No wonder large segments of the economy operate on the black market. Using the best lawyers, we opened a business in Brazil after ten months–ten months of paperwork, delays and denial.

Thanks for the questions.