One day the Nouns were clustered in the street.

An Adjective walked by, with her dark beauty.

The Nouns were struck, moved, changed.

The next day a Verb drove up, and created the Sentence.

–Kenneth Koch, “Permanently”

Shelby Davis: An Unknown, Great Value Investor

February 23, 2011

http://intelligentinvestors.org/blog.php (good blog with interesting reading links)

We can’t be Shelby Davis, but we can be inspired to push ourselves to become the best we can be as investors. Note his late start as an investor, those of you who are a few years out of school. Another lesson: anyone can learn accounting but few realize the value of studying history like Davis.

In the pantheon of investing greats one of the least talked about, but most successful investors, is Shelby Davis. Starting at age 38, he took $50,000, provided by his wife Kathyrn, and amassed it into a $900 million fortune in 47 years (or 23.18% CAGR over 47 years!) This amounts to an annual compounded rate of return of over 23% during that time span. While his investing process can be summed up as growth-at-a-reasonable-price, he hardly wrote anything down as to not waste money on paper (he often wrote on the back of envelopes and scraps of paper which were tossed away). His extreme frugality helped him to save every penny he could to invest in “compounding machines,” as he called them. When he died he left his money in a charitable trust and left little to nothing for his two children; he was the epitome of a penny-pincher.

Shelby Davis received his bachelor’s in Russian history at Princeton (1930), his master’s degree at Columbia (1931), and his doctorate in political science at the University of Geneva (1934). Before starting his investment firm, Shelby Cullom Davis & Company in 1947, he worked odd jobs as a European correspondent with CBS in Geneva, as a “statistician” (before “stock analyst” was invented) for his brother-in-law’s Delaware fund, as a speechwriter and economic advisor for Thomas E. Dewey (then Governor of New York), a freelance writer, and author. He also worked for the War Production Board in Washington in 1942. A year prior to this he bought a seat on the New York Stock Exchange merely because it was cheap, having no use for it himself. He paid $33,000 for the seat which had fetched $625,000 in 1929. By the time Davis died in May of 1994 his seat was worth $830,000. His last job before he started his working on his investment portfolio was as First Deputy Superintendent of Insurance where he worked from 1944 to 1947.

Davis’ work analyzing insurance gave him an upper hand by the time he started his portfolio. He saw clear advantages in the insurance industry. Most insurers, he noticed, were selling well below book value. Dividends were large in this industry and if you bought an insurance company at market price you were basically getting the dividend stream for free. He also noticed that while life insurance policies were selling like hotcakes, policyholders weren’t dying. Insurance companies, he realized, were growth companies in disguise. Having studied Ben Graham’s writings Shelby knew of the power of buying these equities. Shelby bought out Frank Brokaw & Co., a street away from Wall Street, and turned it into Shelby Cullom Davis & Co. This is when his seat on the New York Stock Exchange started to show its use and he began to capitalize on that investment using it for his business.

Although he bought insurance stocks his portfolio acted like a modern-day tech portfolio, rising from $100,000 to $234,790 in one year (he always bought on margin). His biggest holding that year was Crum & Forster. By the early 1950’s Davis became a millionaire by sticking with insurance stocks. Insurance companies that had once traded at stodgy multiples (P/E’s of 3-4) and low earnings now traded at P/E’s of 15-20 with high earnings. Shelby called this the “Davis Double Play,” an initial boost from earnings and another from investors bidding up the multiple. He largely focused on fundamentals before choosing his investments, looking for a solid balance sheet and making sure the insurer did not hold risky assets like junk bonds. He then focused on the management quality and made trips to meet with management and drill them. Diversification was also one of his strategies as he believed you needed to own enough stocks so that the ones you were wrong on were compensated by the ones you were right on. Although he never gave a “magic number,” in the mid-1950’s he held up to 32 insurance companies.

After a trip to Japan in the mid 1960’s Davis was convinced that investing in Japanese insurance stocks was a winning bet. There were substantially far less insurers in Japan and many of these were selling at well below book value, sometimes even half of book value. He quickly snatched up American Insurance Underwriters (later acquired by AIG) and American Family (now AFLAC), both which had big dealings in Japan. He also added Tokio Marine & Fire, Sumitomo Marine & Fire, Taisho Marine & Fire, and Yasuda Marine & Fire to his holdings. Davis, after successfully investing in Japanese stocks, began buying stocks in Africa, Europe, the Far East, and Russia.

Like Buffett, Davis snapped up shares of GEICO when it was on the verge of failure. Davis even snapped up a large enough share to be placed on the board. Davis, enraged by a proposed stock sale plan by Buffett and David Byrne, eventually sold off all his shares and left the board, a decision he would live to regret. Shortly after, he increased his position in AIG but soon began straying from insurance holdings. Davis got ahold of Value Line during this time and used the analysis to his benefit. At this point his normal portfolio, usually 30-35 stocks, consisted of hundreds of holdings, often highly rated by Value Line, which he day-traded for small gains and actually profited in a flat market.

Although he deviated somewhat from insurance companies over his lifetime 11/12 most successful investments were still in that industry. These included AIG, the four Japanese companies above, Berkshire Hathaway, AON, Torchmark, Chubb, Capital Holdings, and Progressive. The odd man out was Fannie Mae. He had some other minor successes but the bulk of his portfolio was due to these 12. If anything can be learned from his investing it’s that holding a few big winners for a long time can go a long way.

Note: His son, also Shelby Davis, also went on to be a successful investor as well as his grandsons Chris and Andrew.

If you’d like to learn more about Shelby C. Davis’ life and investing style I urge you to read The Davis Dynasty by John Rothchild.

http://www.insuranceobserver.com/PDF/1994/060194.pdf Grandfather Knows Best.

Family affair

01 Sep 2001 –

In the 1990s journalist John Rothchild co-authored three bestsellers with investing legend Peter Lynch.

By Rich Blake September 2001 Institutional Investor Magazine

In his new book, The Davis Dynasty: 50 Years of Successful Investing on Wall Street, he takes on a less celebrated but no less successful subject, chronicling three generations of savvy stock pickers. It’s an intriguing tale that weaves in nearly a century of Wall Street history.

The well-researched, solidly written book focuses on the Davis clan: Shelby Cullom Davis, who died in 1994 at 85; his son, Shelby Davis, who in 1969 founded what would become the $40 billion mutual fund powerhouse Davis Selected Advisers; and his grandsons, Christopher and Andrew, who manage several of those funds today.

Patriarch Shelby Cullom Davis, who all but cornered the market in insurance stocks in the 1950s, began seriously investing at age 40 with a bankroll supplied by his wife. Over the course of four decades, his initial $50,000 stake grew into a $900 million fortune – a compound growth rate comparable to the one delivered by Warren Buffett, who also has an appetite for insurance stocks.

Born in 1909, Davis grew up in Peoria, Illinois, where his parents ran a corner store. His mother, Julia Cullom, traced her roots to the Mayflower. His father, George Davis, made a small fortune selling horse feed to Alaskan gold prospectors. After attending Princeton University, Davis in 1932 married Kathryn Wasserman, the daughter of a wealthy Philadelphia carpet mogul. He worked as a speechwriter and economic adviser for New York State governor Thomas Dewey, who appointed him to the post of deputy superintendent in the New York State Insurance Department. In 1947, with no MBA and no formal investment training, he quit his job to play the market full-time.

In those days most investors shunned insurance companies because of their heavy stakes in low-yielding bonds and mortgages. But Davis shrewdly recognized value in those assets. Between 1947 and 1949 the Dow Jones industrial average fell 24 percent, while Davis’s portfolio of seven insurance stocks more than quadrupled in value. By 1954 he had become a millionaire.

Davis frequently interrogated company managements. One of his favorite questions: “If you had one silver bullet to shoot a competitor, which competitor would you shoot?” A feared company must be doing something right, he reasoned. Rothchild writes of Davis, “He was a walking Rolodex of industry notables, an encyclopedia of actuarial trivia.”

Shelby Davis, born in 1937, “grew up on dinner-table stock talk and annual reports strewn around the house.” The elder Davis’s advice to his son: “You can always learn accounting on the side, but you’ve got to study history. History teaches that exceptional people make a difference.”

By age 25 Shelby was off to a quick start in his own investment career. In 1966 he left Bank of New York, where he worked as a stock analyst, to go into business with Guy Palmer, a fellow bank vice president. Jeremy Biggs, a portfolio manager for the U.S. Steel pension fund, joined them in 1968. (Biggs, the younger brother of Morgan Stanley strategist Barton Biggs, is now the chief investment officer at Fiduciary Trust Co.)

The group bought big stakes in technology names of the go-go ’60s. Most portfolios lost money in 1969; the partners’ New York Venture Fund, a large-cap value fund, gained 25.3 percent. The fund beat the market in all but six of the next 28 years. An original investment of $10,000 would have grown to $379,000.

Shelby’s self-made success pleased his father, who by the late 1950s had made it clear that his children would not be the beneficiaries of a large inheritance. In 1961 Davis squabbled with his daughter Diana over his plan to donate $3.8 million in her name to Princeton. Feeling cheated, she refused to sign the necessary papers and waged a public battle reported in the society pages of The New York Times.

Shelby, like his father, was determined not to spoil his children. “The most important thing I taught them about the investing business,” he recalls, “is how I loved being in it.”

It wasn’t long before the third generation got in the game. By the end of 1999, Christopher Davis’s New York Venture Fund had beaten the Standard & Poor’s 500 index for the sixth year in a row, and ranked near the top of Morningstar’s large-cap value category for five straight years. Venture gained 10 percent in 2000, while the S&P 500 lost 9 percent.

“We try not to be too positive about short-term success or too negative about short-term setbacks,” says Christopher Davis. It’s a sensible approach that has served the clan well.

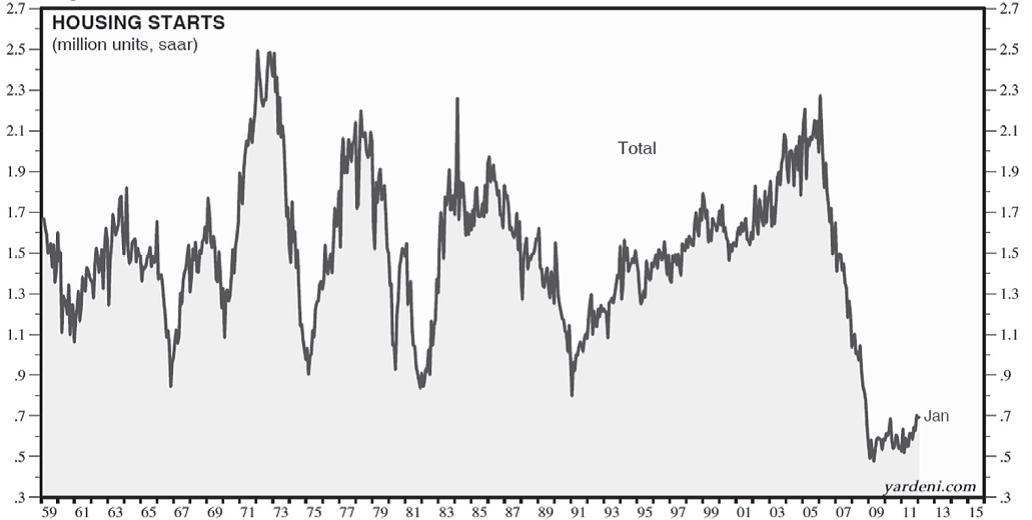

Booms do not merely precede busts. In some important sense, they cause them. This idea, on which so much of the analysis of these pages rests, is borrowed from the Austrian School of economics. It was the Austrians who observed that people in markets periodically miscalculate together. One important source of misjudgment is the interest rates that the central banks impose. A too-low rate provides high spirits and speculation; a too-high rate induces morbidity and contraction. Thus, the ultra-low money-market rates of 1993 not only strengthened balance sheets and reduced mortgage-interest costs, as policymaker intended. They also cause an outpouring of capital investment, as policymakers might or might not have intended. If precedent holds, these projects will be carried to extreme lengths. Like the Manhattan skyscrapers of the 1920s and the Texas oil rigs of the 1980s, the white elephants of the 1990s (coffee bars and semiconductor fabricating plants are the top candidates at this moment) will bring grief to their sponsors and drama to the next recession. Overbuilding and underbuilding constitute opposite sides of the same cyclical coin. James Grant in The Trouble with Prosperity (1997)

Booms do not merely precede busts. In some important sense, they cause them. This idea, on which so much of the analysis of these pages rests, is borrowed from the Austrian School of economics. It was the Austrians who observed that people in markets periodically miscalculate together. One important source of misjudgment is the interest rates that the central banks impose. A too-low rate provides high spirits and speculation; a too-high rate induces morbidity and contraction. Thus, the ultra-low money-market rates of 1993 not only strengthened balance sheets and reduced mortgage-interest costs, as policymaker intended. They also cause an outpouring of capital investment, as policymakers might or might not have intended. If precedent holds, these projects will be carried to extreme lengths. Like the Manhattan skyscrapers of the 1920s and the Texas oil rigs of the 1980s, the white elephants of the 1990s (coffee bars and semiconductor fabricating plants are the top candidates at this moment) will bring grief to their sponsors and drama to the next recession. Overbuilding and underbuilding constitute opposite sides of the same cyclical coin. James Grant in The Trouble with Prosperity (1997)