Chapter 19: America on the Bargain Counter (The Forgotten Depression, 2014) (pages: 197 to 200)

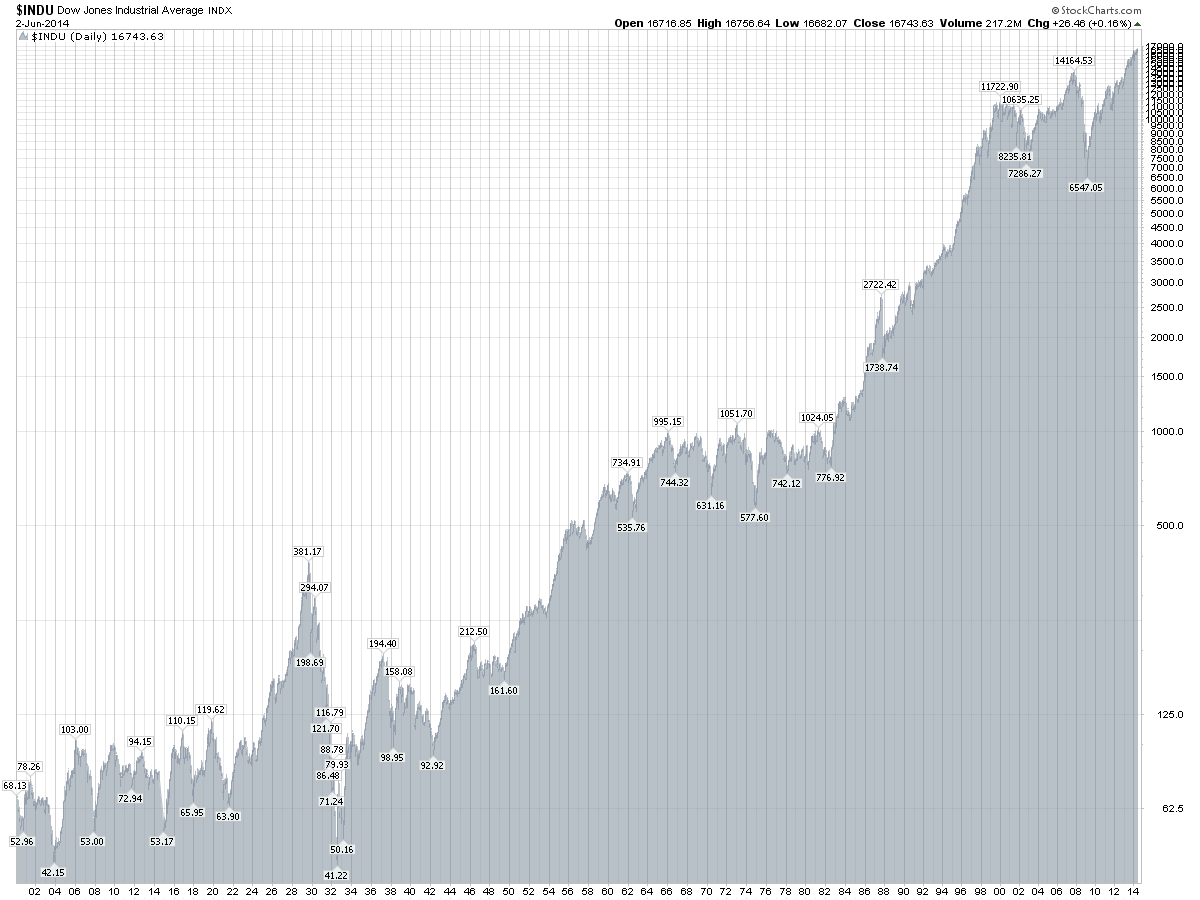

On August 24, 1921, the low point of the Dow, many stock prices translated into multiples on 1923 earnings of less than five times. That held true of the steel companies but also of the kind of consumer-products companies that had enjoyed a relatively prosperous depression. Thus, Coca-Cola, at $19 a share—500,000 shares were outstanding, providing a stock market capitalization of all of $9.5 million—was valued at what would prove 1.7 times 1922 earnings and 2.5 times 1923 earnings; the shares provided a dividend yield of 5.26%. Gillette Safety Razor Company, which was selling as many razors and blades in 1921 as it had in 1920, was quoted at a little more than five times forward earnings and yielded 9.23 percent. Radio Corporation of America, not yet revealed as one of the great growth stocks of the 1920s, could be purchased in the market for about as much as the company earned in 1923: $1.50 a share.

As a matter of course on Wall Street, bargains hold no appeal at the bottom of the market. In August 1921, stock prices had been sliding for almost two years. At such junctures, the memory of losing money is usually more vivid than the imagined prospect of making it.

It didn’t take much imagination to recognize the value of F.W. Woolworth Company, the five-and-dime chain merchandiser that was finishing its tenth year as a fused corporate unit. Frank W. Woolworth himself, founder and builder of the gothic corporate headquarters tower at 233 Broadway in lower Manhattan, had died in 1919, but his successors had distinguished themselves in the depression. They had stopped buying any but essential merchandise after the break in whole sale price in June 1920, while customers, happily, had kept right on buying. Now 1921 sales were on track to surpass the total for 1920. While other chain stores had raised prices, Woolworth hewed to the letter of its five-and dime appellation (15; cents was the top ticket west of the Mississippi). And how was this exemplar of deflation-era merchandising—about to close its year without bank debt and with no mis-priced inventory—valued in the stock market on August 24, 1921? At a price of $105 a share, or 3.7 times imminent 1922 earnings and 3.3 times what would turn out to be 1923 earnings. The stock yielded 7.62 percent.

James Grant Explains The Forgotten Depression