I was walking down the street wearing glasses when the prescription ran out. —Steven Wright

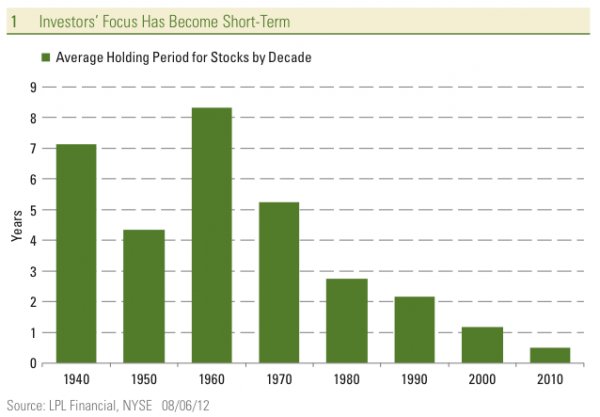

Time Preference

People value present goods over future goods. Would you pay 50 cents for a glass of beer today or a year from now?

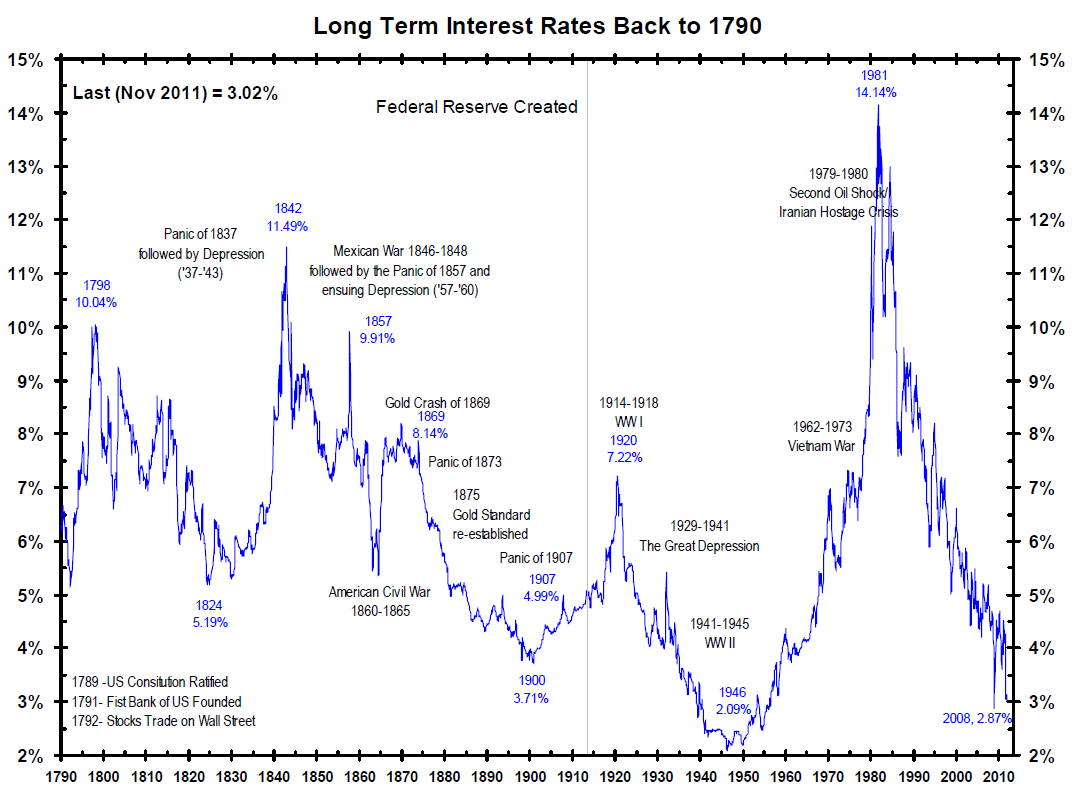

An increase in time preference implies that a higher ratio of income is devoted to consumption vs. savings and investment for the future. Central banks with their policy of financial repression (Zero Interest Rates Policy or “ZIRP”) want to “correct” underconsumption. Please take me to meet an “underconsumer.”

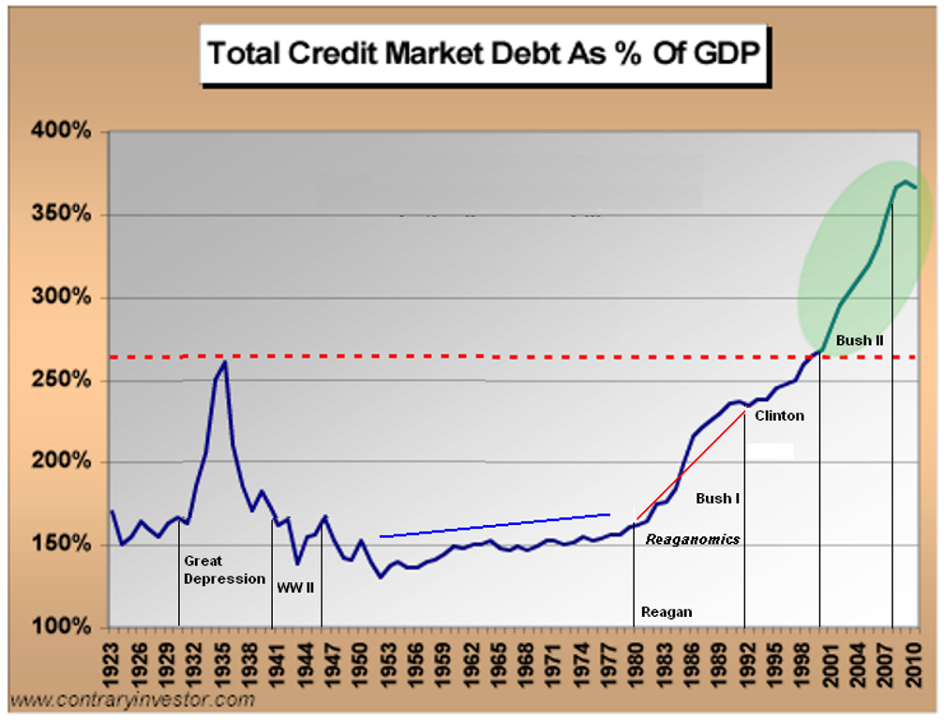

While aggressively seeking to increase time preferences with all its negative implications, on the one hand, central banks are trying to give the impression that time preference is lower than it really is by making current levels of consumption seem more sustainable by forcing down interest rates and replacing savings with cheap credit. This artificially extends time horizons and increases confidence. However, a rising time preference is indicative of a weakening economy, not a strong one and one which is more vulnerable than it appears…..

If central banks induce businesses to make incorrect capital investment decisions, the end result will be that production is out of line with consumption preferences. This will distort the ratio of capital and consumer goods. In such circumstances some of the increased capital goods will turn out to be mal-investment. Capital will decrease both in terms of physical wastage and loss of value, and decisions on new investment will be cancelled. Look at the cyclical iron ore and coal markets today! Note KOL (Coal ETF)

If you invest in any business that is cyclical then read this:

Selling-Time What is happening today due to central bank distortion of time preferences. Must Read!

The Pure Time-Preference Theory of Interest_2 The following essays parse through the uniquely Austrian insight of the pure time-preference theory of interest, but more importantly go to the core of why modern central bank monetary engineering leaves the economy further from recovery while at the same time providing a Petri-dish for speculation and mal-investment–Douglas French

For those who want to go even further:

- latham_interesttheory A critique of the theory.

- Multiple Interest Rates and ABCT another critique

- https://mises.org/Time Preference Theory of Interest

- Man, Man, Economy and State See Ch 6.pdf (a solid foundation)

The Gold Market

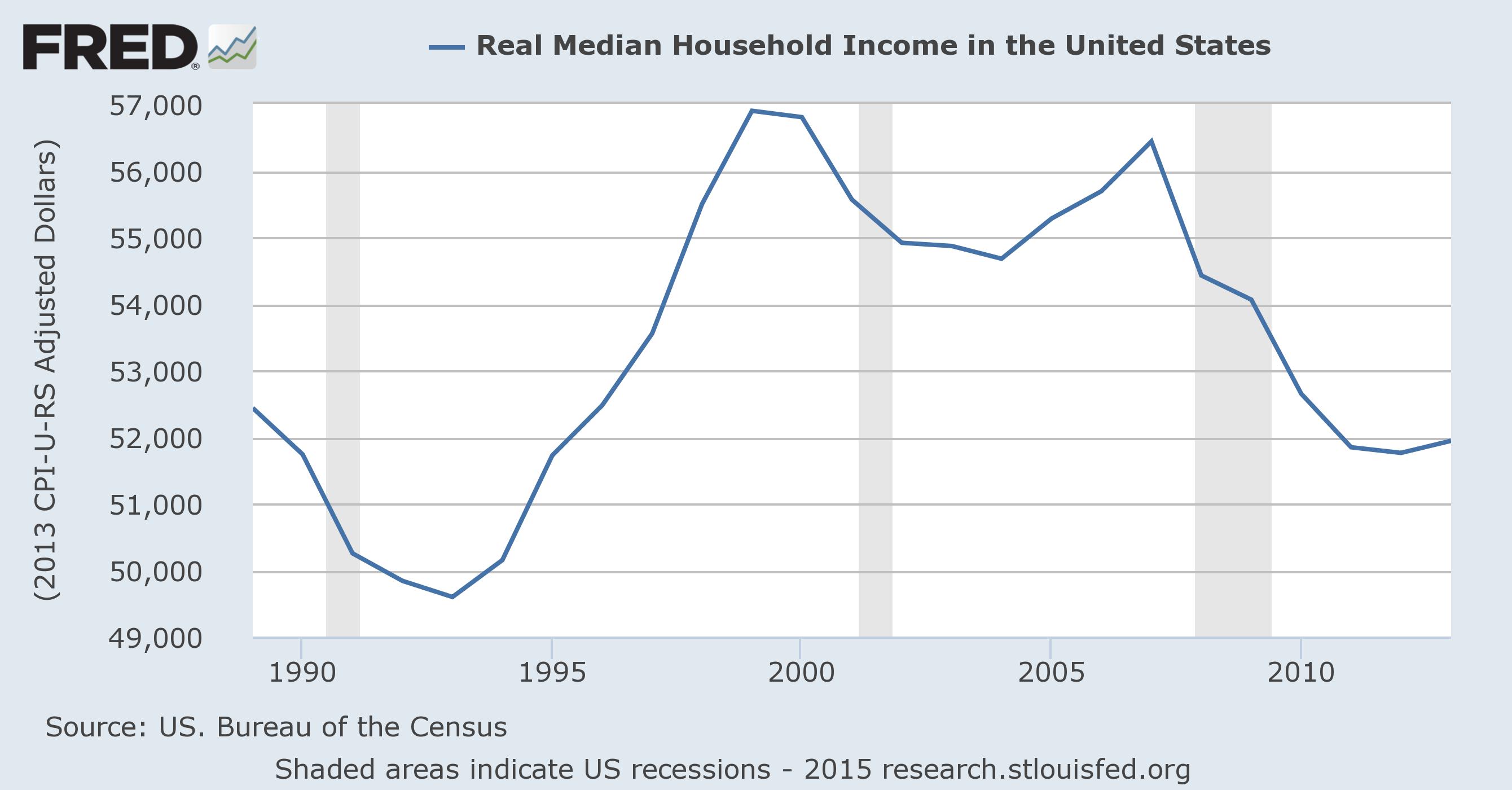

The twilight zone in gold (from Monetary-Metals): Spot Gold trades at a premium to distant contracts. Financial historians will look back in fifty years and ask what were they thinking? We live in the biggest global credit bubble in history.

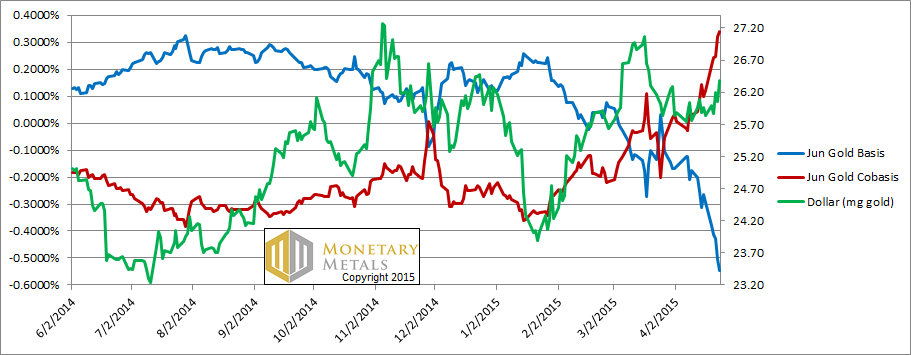

For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide brief commentary. The dollar will be represented in green, the basis in blue and cobasis in red.

Here is the gold graph: The Gold Basis and Cobasis and the Dollar Price

Along with the rising dollar (green line), we see rising scarcity in gold (i.e. cobasis, the red line or the bid for spot gold is rising relative to the offer for future delivery). One could now earn 0.34% annualized, to sell a bar of gold and buy a June contract. Where else can one get that kind of return on a two-month bill or note? This opportunity should never exist in the gold market, but it does. The August contract is not backwardated yet, but it’s close. (Source: www.monetary-metals.com).

A scramble to obtain physical gold is indicative of a rising time preference or time horizons are becoming shorter in the gold market. I want possession of my gold NOW rather than not risk obtaining it in the future. A sign of increasing risk awareness.

We live in interesting times.