You must know yourself if you want to accomplish anything in life–Jim Rogers, A Gift to My Children

We need to do our best to break the dangerous cycle of investment returns impacting our mood. The best way to do this is by not focusing on outcomes, but on the process you used to make decisions. Most of us also have a tendency to anchor off our peak net worth or the high point of the portfolio in the current year. Ravee Mehta, The Emotionally Intelligent Investor

KILL BILL

CSInvestor: As I learned during “my best day ever” http://wp.me/p2OaYY-1Ez arrogance and overconfidence bring forth tragedy as in any Greek drama.

Have a Good Weekend!

Editor’s Note: There is as much ego as money behind Dan Loeb and Bill Ackman’s battle over the nutritional company Herbalife. The story of their cycling trip from Bridgehampton to Montauk, which has practically achieved urban-legend status in the hedge-fund eco-system, provides a vivid example of what is at stake for the two former friends. Vanity Fair contributing editor William D. Cohan gets Ackman’s response on the ride in a story on the rivals that will appear in the April issue. Read an excerpt here—the full story will be released next week.

The supremely confident billionaire hedge-fund manager Bill Ackman has never been afraid to bet the farm that he’s right.

In 1984, when he was a junior at Horace Greeley High School, in affluent Chappaqua, New York, he wagered his father $2,000 that he would score a perfect 800 on the verbal section of the S.A.T. The gamble was everything Ackman had saved up from his Bar Mitzvah gift money and his allowance for doing household chores. “I was a little bit of a cocky kid,” he admits, with uncharacteristic understatement.

Tall, athletic, handsome with cerulean eyes, he was the kind of hyper-ambitious kid other kids loved to hate and just the type to make a big wager with no margin for error. But on the night before the S.A.T., his father took pity on him and canceled the bet. “I would’ve lost it,” Ackman concedes. He got a 780 on the verbal and a 750 on the math. “One wrong on the verbal, three wrong on the math,” he muses. “I’m still convinced some of the questions were wrong.”

Not much has changed in the nearly 28 years since Ackman graduated from high school, except that his hair has gone prematurely silver. He still has an uncanny knack for making bold, brash pronouncements and for pissing people off. Nowhere is that more apparent than in the current, hugely public fight he and his $12 billion hedge fund, Pershing Square Capital, are waging over the Los Angeles–based company Herbalife Ltd., which sells weight-loss products and nutritional supplements using a network of independent distributors. Like Amway, Tupperware, and Avon, Herbalife is known as “a multi-level marketer,” or MLM, with no retail stores. Instead, it ships its products to outlets in 88 countries, and the centers recruit salespeople, who buy the product and then try to resell it for a profit to friends and acquaintances.

Ackman has called Herbalife a “fraud,” “a pyramid scheme,” and a “modern-day version of a Ponzi scheme” that should be put out of business by federal regulators. He says he is certain Herbalife’s stock, which in mid-February traded around $40 per share, will go to zero, and he has bet more than a billion dollars of his own and his investors’ money on just that outcome. (Ackman declines to discuss the specifics of his trade.) “This is the highest conviction I’ve ever had about any investment I’ve ever made,” he announced on Bloomberg TV. An interviewer on CNN reminded him that Herbalife had been around since 1980 and had withstood many previous challenges to its business plan. How long was he willing to “sit on this bet”? Ackman replied, “We’re not sitting. We’re shouting from the rooftops. They’ve never had someone like me prepared to say the truth about the company. I’m going to the end of the earth. If the government comes out and determines this is a completely legal business, then I will lobby Congress for them to change the law. I had a moral obligation. If you knew that Bernie Madoff was running a Ponzi scheme, and you didn’t tell anyone about it, and it went on for 33 years … ”

Ackman says he suspected, when he “shorted” (i.e., bet against) Herbalife, that other hedge-fund investors would likely see the move as an opportunity to make money by taking the other side of his bet. What he hadn’t counted on, though, was that there would be a personal tinge to it. It was as if his colleagues had finally found a way to express publicly how irritating they have found Ackman all these years. Here finally was a chance to get back at him and make some money at the same time. The perfect trade. These days the Schadenfreude in the rarefied hedge-fund world in Midtown Manhattan is so thick it’s intoxicating.

“Ackman seems to have this ‘Superman complex,’ ” says Chapman Capital’s Robert Chapman, who was one of the investors on the other side of Ackman’s bet. “If he jumped off a building in pursuit of super-human powered flight but then slammed to the ground, I’m pretty sure he’d blame the unanticipated and unfair force of gravity.”

Lined up against the 46-year-old Ackman on the long side of the Herbalife trade were at least two billionaires: Daniel Loeb, 51, of Third Point Partners, who used to be Ackman’s friend, and Carl Icahn, 77, of Icahn Enterprises. Along for the ride are some smaller, well-regarded hedge-fund investors—who would like to be billionaires—John Hempton, of Bronte Capital, and Sahm Adrangi, of Kerrisdale Capital.

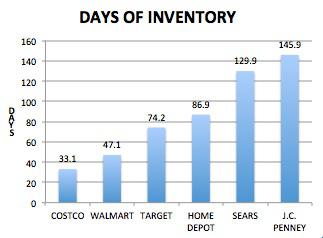

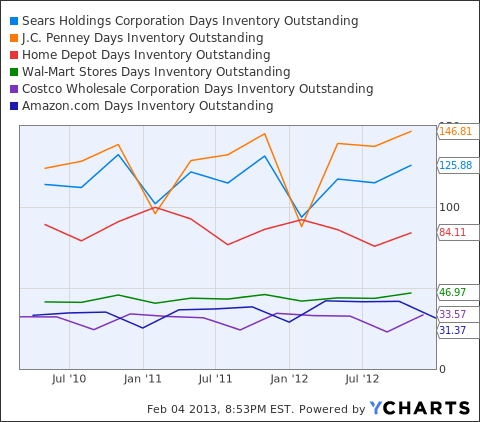

It’s Ackman’s perceived arrogance that gets to his critics. “The story I hear from everybody is that one can’t help but be intrigued by the guy, just because he’s somewhat larger than life, but then one realizes he’s just pompous and arrogant and seems to have been born without the gene that perceives and measures risk,” says Chapman. “He seems to look at other members of society, even legends such as Carl Icahn, as some kind of sub-species. The disgusted, annoyed look on his face when confronted by the masses beneath him is like one you’d expect to see [from someone] confronted by a homeless person who hadn’t showered in weeks. You can almost see him puckering his nostrils so he doesn’t have to smell these inferior creatures. It’s truly bizarre, given that his failures—Target, Borders, JCPenney, Gotham Golf, First Union Real Estate, and others—prove he’s as fallible as the next guy. Yet, from what I hear, he behaves that way with just about everybody.”

Another hedge-funder describes the problem he has with Ackman in more measured tones. “There is a saying in this business: ‘Often wrong, never in doubt.’ Ackman personifies it He is very smart—but he lets you know it. And he combines that with this sort of noblesse oblige that lots of people find offensive—me, generally not. On top of that he is pointlessly, needlessly competitive every time he opens his mouth. Do you know about the Ackman cycling trip with Dan Loeb?”

It’s Not About the Bike

The story of the Ackman-Loeb cycling trip is so widely known in the hedge-fund eco-system that it has practically achieved urban-legend status, and Loeb himself was eager to remind me of it.

It happened last summer when Ackman decided to join a group of a half-dozen dedicated cyclists, including Loeb, who take long bike rides together in the Hamptons. The plan was for Loeb, who is extremely serious about fitness and has done sprint triathlons, a half-Ironman, and a New York City Marathon, to pick up Ackman at Ackman’s $22 million mansion, in Bridgehampton. (Ackman also owns an estate in upstate New York and lives in the Beresford, a historic co-op on Manhattan’s Central Park West.) The two would cycle the 20 or so miles to Montauk, where they would meet up with the rest of the group and ride out the additional 6 miles to the lighthouse, at the tip of the island. “I had done no biking all summer,” Ackman now admits. Still, he went out at a very fast clip, his hypercompetitive instincts kicking in. As he and Loeb approached Montauk, Loeb texted his friends, who rode out to meet them from the opposite direction. The etiquette would have been for Ackman and Loeb to slow down and greet the other riders, but Ackman just blew by at top speed. The others fell in behind, at first struggling to keep up with the alpha leader. But soon enough Ackman faltered—at Mile 32, Ackman recalls—and fell way behind the others. He was clearly “bonking,” as they say in the cycling world, which is what happens when a rider is dehydrated and his energy stores are depleted.

While everyone else rode back to Loeb’s East Hampton mansion, one of Loeb’s friends, David “Tiger” Williams, a respected cyclist and trader, painstakingly guided Ackman, who by then could barely pedal and was letting out primal screams of pain from the cramps in his legs, back to Bridgehampton. “I was in unbelievable pain,” Ackman recalls. As the other riders noted, it was really rather ridiculous for him to have gone out so fast, trying to lead the pack, considering his lack of training. Why not acknowledge your limits and set a pace you could maintain? As one rider notes, “I’ve never had an experience where someone has gone from being so aggressive on a bike to being so hopelessly unable to even turn the pedals…. His mind wrote a check that his body couldn’t cash.”

Nor was Ackman particularly gracious about the incident afterward, not bothering to answer e-mails of concern and support from others in the group until months later.

In a recent interview on CNBC, the blunt-talking and cagey Icahn hinted there would be a concerted effort to take Ackman down a peg or two in the Herbalife battle, which “could be the mother of all the short squeezes,” he said, referring to a technique that can be used by a group of traders who band together to try to clobber a short-seller.

Chapman agrees. “This is like Wall Street’s version of the movie Kill Bill,” he says. “Bill Ackman has been so arrogant and disrespectful to so many people, presumably on the theory that he would never be in a position where these subjects of his disrespect could actually act on their deserved hatred for him But now, with JCPenney [which is down 20 percent from Ackman’s 2010 investment] and Herbalife going against Ackman, his ‘stock’ has moved down, allowing once again, a decade later, for those holding their Kill Bill puts [i.e., options they have been waiting to cash in] to exercise them against him.”

To read the rest of this story, subscribe to Vanity Fair and receive our April 2013 issue.