Are Booms and Busts Inherent in the Market Economy?

In this excerpt from a lecture at Liberty Classroom, Jeffrey Herbener says no.

Excellent lecture on the stock market’s booms and busts during the 1920s to 1960s. Worth viewing or downloading.

In this excerpt from a lecture at Liberty Classroom, Jeffrey Herbener says no.

Excellent lecture on the stock market’s booms and busts during the 1920s to 1960s. Worth viewing or downloading.

Posted in Economics & Politics

Tagged Booms and Busts, Great Depression, Herrbener, Libert Classroom, Tom Woods

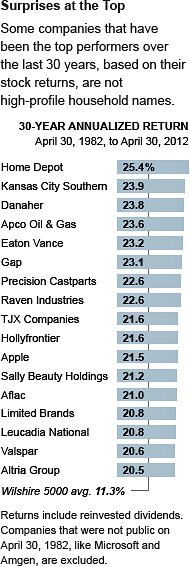

QUIZ: Can anyone tell us what are the common characteristics of these companies? Prize awarded for first, second and third place. No more than a few sentences. Please read the embedded links below.

QUIZ: Can anyone tell us what are the common characteristics of these companies? Prize awarded for first, second and third place. No more than a few sentences. Please read the embedded links below.

Retire rich? …Seems like a penny stock scam. No, it is possible.

Here is an article about how those companies were selected:Picking Stocks and 100 to 1

AFLAC Altria Group APCO Oil and Gas Apple DHR

Eaton Vance Hollyfrontier Home Depot Kansas City Southern

Leucadia National Limited Brands Precision Castparts

RAVEN INDUSTRIES Sally Beauty Holdings The Gap Store

TJX Companies VALSPAR Corporation

I will be away until Monday and upon return prizes will be awarded.

If you need a HINT then read a study in excellence:Teledyne and Henry Singleton a CS of a Great Capital Allocator

Posted in Search Strategies

Tagged Compounding Machines, excellent investments, Teledyne

Losing their shares: fretful investors at a US brokerage in the 1960s.

| Investor Sentiment for Jun 6, 2012 | |||

| Bullish | 27.5% down 0.6 | ||

| Neutral | 26.8% down 3.2 | ||

| Bearish | 45.8% up 3.7 | ||

|

Note: Numbers may not add up to 100% because of rounding. Change from last week: Bullish: -0.6 Long-Term Average: Bullish: 39% |

|||

Nikhil Srinivasan, the man who decides where one of the world’s biggest insurance funds places its assets, wants to know why he should invest in stocks. “We are delivering what policyholders want,” says Allianz Investment Management’s chief investment officer, speaking from his Munich base. “So there is no need to get aggressive about equities.”

Allianz, with a total of about €1.7tn under management, has only 6 per cent of its insurance portfolio in equities, while 90 per cent is in bonds. A decade ago, 20 per cent was in equities. It is far from alone: institutional investors, from pension funds to mutual funds sold directly to the public, have slashed holdings in the past decade. Stocks have not been so far out of favour for half a century. Many declare the “cult of the equity” dead.

The consequences are already being felt. Even the mighty Facebook is finding it hard to raise equity capital. With equity financing expensive, many companies are opting to raise debt instead, or to retire equity. As equity markets shrink, so does the sway of the owners of that equity, reducing shareholder control over companies – and challenging accepted concepts of corporate ownership.

Further, with equity returns virtually flat for more than a decade, the incentive for investors to take risks by funding smaller, more entrepreneurial companies has declined – eroding a process that has traditionally given managers the flexibility they need to grow. Capitalism with less equity finance would follow a much more conservative model.

“Ultimately what is going on is that fundamental tenets of capitalist society are being questioned,” says Andreas Utermann, chief investment officer of the Allianz division that manages €300bn in assets for external clients.

He forecasts that this will lead to a big transfer from savers to “the profligate and irresponsible” as the benefits of long-term saving are eroded. “The risk is that there will be a backlash by savers. The [impact will be felt] societally, politically, at a regional level and globally. We are still at the beginning of the whole process.”

Compared with bonds, stocks have not looked so cheap for half a century. During this period, the dividend yield – the amount paid out in dividends per share divided by the share price, a key measure of value – has been lower than the yield paid by bonds (which moves in the opposite direction to prices). In other words, investors were happy to take a lower interest rate from stocks than from bonds, despite their greater volatility, reflecting their confidence that returns from stocks would be higher in the long run.

But now investors want a higher yield from equities. According to Robert Shiller of Yale University, the dividend yield on US stocks is today 1.97 per cent – above the 1.72 per cent yield on 10-year US Treasury bonds.

Some hope that the cycle is about to turn and that the preconditions for a new cult of the equity will emerge even if it takes time. Few people doubt, however, that the old cult of the equity – which steered long-term savers into loading their portfolios with shares – has died.

This is stunning in light of overwhelming evidence that, in the long run, equities outperform. From 1900 to 2010, they beat inflation by 6.3 per cent a year in the US, according to a widely used benchmark maintained by London Business School, compared with only 1.8 per cent for bonds. In the US and the UK, public pension funds had allocations to equities as high as 70 per cent only 10 years ago. They are now down to 40 per cent in the UK, and 52 per cent in the US

At least two critical factors have combined. First came two stock market crashes since 2000, which shook faith in equities. Second, institutions have faced growing regulatory and business pressure to withdraw from stocks.

Indeed, equities have not been so cheap relative to bonds since 1956, which turned out to be one of the best moments in history to have bought stocks. George Ross Goobey, the British fund manager who ran Imperial Tobacco’s pension fund, had announced to great scepticism that he was shifting his entire portfolio into equities, sparking the cult of the equity because dividend yields exceeded bond yields.

Some see similar reasons for long-term optimism today – at least once heavily indebted households and governments complete the process of deleveraging. Amin Rajan of fund management consultancy Create Research says: “Equities are now undervalued by any measure. There’s a big wad of money sitting on the sideline waiting for a green light on the debt front. We may see the mother of all rallies at the first hint of a credible breakthrough.”

This year Goldman Sachs published a widely read report arguing that: “Given current valuations, we think it’s time to say a ‘long good bye’ to bonds, and embrace the ‘long good buy’ for equities as we expect them to embark on an upward trend over the next few years.”

However, this argument is more about bonds than stocks. With the recent crashes preceded by great bull markets, stock performance in the past 30 years has not been historically unusual. But yields on US Treasury bonds peaked in 1981 and global sovereign debt prices have risen steadily ever since. Buoyed initially by the US Federal Reserve’s success in bringing inflation (the enemy of bondholders) under control, and more recently by their “haven” status as investors sought to protect themselves against risks elsewhere, government bonds are now more expensive than at any time in history.

The trend cannot continue much longer without yields on bonds turning negative – meaning investors would pay for the privilege of lending to the government.

Ian Harnett of Absolute Strategy Research in London says money could start flowing back into equities once bond yields start to revert to historically normal levels, which will mean investors sell bonds and look for a new use for their cash. But like others, he is reluctant to say the moment has arrived, as central banks and governments are still heavily pushing investors towards bonds. “We are still in politicised markets. And that means you’re gambling, because you don’t know what politicians will do next.”

Meanwhile, fund managers emphasise the increasing regulatory incentives to buy bonds, a phenomenon now known as “financial repression”. “Governments are trying to deleverage by stealth and encourage banks to own as much as they can of sovereign debt,” says Mr Utermann of Allianz: “With all the regulators are throwing at them, it has become more difficult to own risk assets.”

Indeed, in the decades around the bursting of the technology bubble in 2000 that first punctured confidence in equities, governments have changed tax treatments on dividends; insisted companies and banks value assets as they are traded in the markets rather than on the basis of models and assumptions; altered accounting rules on how companies value pension promises to employees; and prodded pension managers to buy bonds by forcing them to match their assets to future liabilities.

These developments have “generated a regulatory regime for pension funds and insurers that is heavily pro-cyclical”, says Keith Skeoch, chief executive of Standard Life Investments, one of the UK’s biggest fund managers, which controls assets of about £200bn. “Even as bond yields fall and prices rise, and equity prices fall,” he says, “the regime is forcing institutions to hold risk-free assets”.

The pressure to cut equity exposures is being felt across the savings industry. Alasdair MacDonald of Towers Watson, one of the world’s biggest actuarial firms, points out that the UK’s savings and retirement funds that use the traditional “with-profits” model, where a bonus for savers is declared each year, are also withdrawing from equities. This is despite the fact they are more risk-tolerant than insurance funds, are not being forced to “de-risk” and have less onerous solvency requirements.

And if equities were to bounce and bonds fall, such funds would be more likely to sell more equities rather than stock up. Mr MacDonald forecasts that equity holdings could halve again in the next two decades.

Meanwhile, company and occupational pension funds are being pushed out of equities. Traditional defined-benefit or “final salary” pension funds in the developed world are relinquishing equities under pressure from actuaries as schemes near maturity. The steady shift to defined-contribution pensions, which do not guarantee a set income and where individual savers must make investment decisions, has also led to lower equity weightings, as private investors tend to be more conservative.

Retail investors’ conservatism has also driven money out of collective investment funds. In the US, inflows to bond funds have exceeded equity inflows every year since 2007, with outright net redemptions from equity funds in each of the past five years.

For Mr MacDonald, the issue is whether there are sufficient bonds to satisfy all the demand that has been created for them. “Does it all add up? There are not enough bonds in the world,” he says. If so, exceptionally low bond yields could continue. That would delay the hoped-for big switch back into equities.

“Overall, the past 10 years have been horrid. The question is why equity markets have not been down more,” says Mr Utermann.

The answer is that reduced demand for equity has been answered by reduced supply. Companies are buying back their own stock, which often makes sense if valuations are too cheap, while investors force them into paying higher dividends. With interest rates low, acquisitions tend to be financed by debt, not equity, leading to a fall in the overall pool of equity.

According to Rob Buckland of Citigroup, who christened this phenomenon “de-equitisation” back in 2005, net equity issuance in the US was negative last year, as it was in Europe between 2003 and 2007. Across the developed world, equity issuance is far lower than in the 1990s, and has made only a feeble recovery since the credit crisis.

For Mr Buckland, this is “the logical response to the collapse in investor appetite for equities evident in the past decade”. But it also implies that capitalism as currently conceived, where corporate managers are responsible to their owners through the stock market, is under threat.

With fund managers under pressure to buy bonds – and companies content to adapt to this rather than create the conditions where equities might look exciting again – it is easy to see why they believe the next cult of the equity is still up to a decade away. For Mr Utermann, there is “no natural flow into equities” for the next five to 10 years. “The rules of the game have changed”.

Note the proverbial, “This time is different.” “No it ain’t.” –Chicago Slim.

Everywhere is within walking distance if you have the time. –Steven Wright

Start your day with an interesting podcast: National Public Radio’s Planet Money:http://www.npr.org/templates/archives/archive.php?thingId=127413729. Today’s show, “Three Ways to Stop a Bank Run.”

Excellent posts here: www.greenbackd.com

http://greenbackd.com/2012/06/06/dont-be-deceived-by-outcomes/

http://greenbackd.com/2012/06/05/what-to-do-in-sideways-markets/

http://greenbackd.com/2012/06/04/how-to-value-the-stock-market-using-the-equity-q-ratio/

Have a good day.

Perhaps the law of supply and demand got in the way……….The Myth of Peak Oil (2005 Article) http://mises.org/daily/1717

But we need to remember a few things.

First, whatever ends up replacing petroleum will come in its own good time, later than we’d like but probably sooner than we expect. It will come because it stores energy and power better than gasoline does and more cheaply to boot. It will come with some tremendous benefits and some unfortunate drawbacks. Consider as you lament the evils of crude oil: the fairly accidental discovery of kerosene and expansion of the refining process in the second half of the 19th century saved whales from an early mass extinction while at same time making nighttime light and winter heat affordable to even the most impoverished parts of Asia, Africa and Latin America. Gasoline itself was originally a waste product, largely unused until the invention of the internal combustion engine, and automobiles made for cleaner streets (no more manure) and safer farm equipment, given that farmers no longer had to wrestle with motors that had minds of their own. Kerosene itself languished as an unloved byproduct of refining for several decades until the invention of the jet engine.

Second, that new fuel will probably not come as the result of government-sponsored research. Government efforts to target new development – whether hydrogen fuel cells, hybrid engines, coal gasification, ethanol subsidies – may contribute some, but the kind of thinking and investing needed to find or make that new fuel probably cannot be done by government bureaucrats, scientists or regulators, who can only think incrementally and usually only consider efficiency and conservation, rather than entirely new ways of doing things.

I don’t necessarily trust technology, but I do trust human ingenuity. Civilization as we know it will grind to a halt without the energy we derive today from crude oil, and that’s in and of itself is motivation enough to make sure that future energy is widely available at prices people can afford.

Warnings from the recent past:

http://www.oildecline.com/news.htm

“Peak oil is now.” German Energy Watch Group 2008

“By 2012, surplus oil production capacity could entirely disappear.” U.S. Department of Defense 2008 & 2010.

“A global peak is inevitable. The timing is uncertain, but the window is rapidly narrowing.” UK Energy Research Centre -2009

“The next five years will see us face the oil crunch.” UK Industry Taskforce on Peak Oil and Energy Security 2009

Natural gas is a diminishing resource as well and cannot satisfy the growing demand for energy. US Gas supplies were so low in 2003 after a harsh winter that to preserve life and property supplies were close to being cut off to manufacturers, electric plants and lastly homes.

http://mjperry.blogspot.com/2012/06/julian-simon-power-of-market-prices-and.html

As resource economist Julian Simon taught us years ago, we never have, and never will, run out of scarce resources like oil because as a resource becomes more scarce, its price will rise, which will set in motion a series of actions that will counteract the scarcity. For example, higher prices for oil will increase the incentives to: a) find more oil, b) conserve on the use of oil, and c) find more substitutes. And that’s exactly what’s happened recently in response to higher oil prices – domestic crude oil production reached a 14-year high in March, and the share of rigs drilling for oil (vs. natural gas) set a new record high of 70% last week.

Of all the idiotic things that people believe, the whole “peak oil” thing has to be right up there. It is literally impossible for us to run out of oil. We have never run out of anything, and we never will.

If we did start to use up the oil we have…(though, counting shale oil, we still haven’t used even 10% of the total KNOWN reserves on earth, and there are lots of places we haven’t looked)…but suppose we were on our way to using it up. Three things would happen.

1. Prices would rise, causing people to cut back on use. More fuel efficient cars, better insulation on houses, etc. Quantity demanded goes down.

2. Prices would rise, causing people to look for more. And they would find more oil, and more ways to get at it. Quantity supplied goes up.

3. Prices of oil would rise, making the search for substitutes more profitable. At that point (though not now!) alternative fuels and energy sources would be economical, and would not require gubmint subsidies, because they would pay for themselves. The supply curve for substitutes shifts downward and to the right.

This is econ 101. Even Paul (“I sold my soul to become a wanker”) Krugman would credit this scenario.

But we ignore econ 101. And so we get this debacle. Ethanol was bad enough when it was just inefficient to produce and wasting more energy than it created. But we actually went further and bought too much of the stuff.

Yikes.

….and today North Dakota is in an energy boom as energy supply grows: http://mjperry.blogspot.com/2012/06/dakota-model-booming-north-dakota-led.html

Whenever you hear “Peak” this or that just listen to this:http://www.youtube.com/watch?v=ix62PttEfhU

Job Search Strategy

Job Search StrategySome may find the links below helpful.

How do I get a job on Wall Street? http://www.economicpolicyjournal.com/2012/06/how-do-i-get-job-on-wall-street.html

Beware of the typical advice, “Conditions are bad now so go get an MBA and then come back in two years when things will be better.” First, “things” may be worse and how does an MBA equate to investing success?

Go where the money is: http://www.economicpolicyjournal.com/2012/06/hottest-area-in-finance.html

Yes, Wall Street is grim since it is over-bankered/brokered after decades of easy money and over leverage. But areas like manufacturing and energy will grow. You don’t have to be on Wall Street to use your skills. Be creative.

The budget should be balanced, the treasury should be refilled, public debt should be reduced, the arrogance of officialdom should be tempered and controlled, and the assistance to foreign lands should be curtailed lest Rome become bankrupt.

The budget should be balanced, the treasury should be refilled, public debt should be reduced, the arrogance of officialdom should be tempered and controlled, and the assistance to foreign lands should be curtailed lest Rome become bankrupt.

– Cicero, 55 B.C.

As expected, investors who either did not know what they were doing or refuse to acknowledge that they paid too much, seek to absolve themselves of responsibility and blame others: http://www.nypost.com/p/news/business/facebook_claims_

Facebook CEO knew about overpriced IPO and dumped shares, new lawsuit claims

Mark Zuckerberg is losing even more friends.

Another group of disgruntled Facebook investors has reportedly sued the the social media guru, saying he made out like a bandit over the site’s botched IPO.

This latest class-action lawsuit claims Zuckerberg knew Facebook was horribly overpriced at $38 per share when trading began last month, TMZ reported today. He used that inside information to quickly unload shares, in a dirty billion-dollar move, the lawsuit claimed. FB closed at $27.72 a share and was down 27 percent since going public this past Friday.

Editor: Surprise! Insiders were selling on an IPO. Of course, they believe the price is high enough to exchange shares for cash. Investors who do not shoulder their responsibility then lessons are lost and they can’t improve.

Tweedy Browne did a good job placing Facebook’s (FB) valuation in perspective. Go to i-7 of their annual report: TBFundsAnnualReportMarch2012 and an interview of Tweedy’s principals:VIIFundReprint_033112

As you can see in the above chart, you could buy roughly the same amount of earnings that Facebook produced in 2011 by simply buying Heineken Holdings for $13.5 billion, and you would then have $86.5 billion left over to go shopping for other companies in our Funds’ portfolios. For the remaining $86.5 billion, you could buy Emerson Electric, Devon Energy, G4S PLC, Torchmark, NGK Sparkplug, Daily Mail, and Teleperformance, and still have roughly $700 million in walking around money. When all is said and done, for Facebook’s IPO price, you could purchase the above group of leading companies in their respective fields at a price/earnings ratio of 10.4 times estimated earnings. As a group, these companies produced nearly ten times the earnings of Facebook in 2011, and paid dividends of over $2 billion. According to our calculations, Facebook would have to compound its current earnings at an annual rate of approximately 35% over the next ten years to catch up to the amount of earnings produced by the selected companies held in the Tweedy, Browne Funds, which are compounding their earnings at a more realistic 7% per year.

Now, it might very well turn out that Facebook performs as expected and compounds at even more attractive rates, producing superior returns when compared to the stocks selected above from the Tweedy, Browne Funds’ portfolios, but the stakes are high given the lofty IPO price. Very high expectations are built into stocks that trade at 100 times earnings. If it disappoints, the results for its investors could be disastrous.

Lest we forget, just six years ago, media and tech savvy News Corp., run by Rupert Murdoch, a rather shrewd investor, acquired MySpace, then the most popular social networking site in the US for $580 million, which valued the company at over 100 times earnings. Last summer, after a string of disappointments and corporate losses, News Corp. sold MySpace for $35 million to a company fronted by Justin Timberlake. At the time of the sale, MySpace had approximately 35 million users, which meant a purchase price of roughly $1 per user. Applying that metric to Facebook would give it a valuation of approximately $1 billion instead of the $100 billion, which is anticipated for the red hot IPO. News Corp. experienced a permanent loss of capital on its MySpace investment of 94%. From all indications, few expect Facebook to be such a flash in the pan. After all, it’s hard to question its efficacy at bringing people together, and in some instances it has even been a catalyst for political revolutions such as the Arab Spring. That said, expectations are extraordinary, and anything less than spectacular growth going forward could lead to disappointing stock market performance.

For us, Facebook serves as a convenient reminder that stock market prices can and do at times become significantly delinked from underlying value.

Roll a dog turd in sugar doesn’t make it a donut–Chicago Slim

Invert, always Invert

Carl Gustav Jacob Jacobi was a German mathematician who lived in the 1800s. Jacobi once said “man muss immer umkehren” which translates to “Invert, always invert.” Jacobi believed that the solution for many difficult problems in mathematics could be found if the problems were expressed in the inverse. —http://amarginofsafety.com/2011/01/09/456/ (recommended)

This is a lesson in reverse search or what to avoid, though I am seeking shares (GWBU) to short. We will study:

In the U.S., shares trading for less than one dollar are known as microcap or penny stocks. Their low valuation and low trading volumes make them susceptible to price manipulation schemes. Penny stocks also lack transparency in their underlying business and operations and often do not have a verifiable financial history, making them susceptible to securities fraud schemes.

Our first case study in early March 2012 on Pump and Dumps (Frauds) was SNPK, last mentioned here http://wp.me/p1PgpH-LC

I call these types of promotions, “Death Stocks” because their stock charts eventually look like this (Note the flat line, similar to the chart of vital signs of a dying/dead patient:

Current Stock Price as of June 5, 2012: $1.75. 360 million outstanding shares at $1.75 = $630 million market cap. Tangible Net Worth ($70,500). Price above value??? More than $600 million for negative net worth. No revenues. Mr. Daniele Brazzi is both the CEO and CFO. Located in Baloney, Italy. This company and all its affiliates exist for one purpose only–to sell pumped up stock to the unsuspecting, greedy and ignorant.

Now GWBU is in the early stages of a Pump. Ultimate Value—IMHO–within 22 months $0.00, where the stock will find excellent “technical” support.

A detailed (38 pages) tutorial on the GWBU Pump and Dump with current financial statements are here:Great Wall GWBU Pump and Dump The Horror! The document is almost comical, but this stock is a DEATH STOCK.

But where are the Feds? The SEC? Here they are: http://www.youtube.com/watch?v=jocRd-aajW0

Updates to follow………….

Then there was the time in 1978 when the bear market was taking its toll on Putnam’s holdings. Walt (The technical analyst of the firm) just couldn’t make the portfolio managers understand that bear markets trump even the best fundamentals.

So he circulated the following memorandum to Putnam’s investment department, which he considers the best thing he ever wrote:

Once upon a time, there was a big fishing boat in the North Atlantic. One day the crew members noticed that the barometer had fallen sharply, but since it was a warm, sunny and peaceful day, they decided to pay it no attention and went on with their fishing.

The next day dawned stormy and the barometer had fallen further, so the crew decided to have a meeting and discuss what to do.

“I think we should keep in mind that we are fishermen,” said the first to speak. “Our job is to catch as many fish as we can; that is what everyone on shore expects of us. Let us concentrate on this and leave the worrying about storms to the weathermen.”

“Not only that,” said the next, “but I understand that the weathermen are ALL predicting a storm. Using contrary opinion, we should expect a sunny day and, therefore, should not worry about the weather.”

“Yes,” said a third crew member. “And keep in mind that since this storm got so bad so quickly, it is likely to expand itself soon. It has already become overblown.”

The crew thus decided to continue with their business as usual.

The next morning saw frightful wind and rain following steadily deteriorating conditions all the previous day. The barometer continued to fall. The crew held another meeting.

“Things are about as bad as they can get,” said one. “The only time they were worse was in 1974, and we all know that was due to the unusual pressure systems that were centered over the Middle East that won’t be repeated. We should, therefore, expect things to get better.”

So the crew continued to cast their nets as usual. But a strange thing happened: the storm was carrying unusually large and fine fish into their nets, yet at the same time the violence was ripping the nets loose and washing them away. And the barometer continued to fall.

The crew gathered together once more.

“This storm is distracting us way too much from our regular tasks,” complained one person, struggling to keep his feet. “We are letting too many fish get away.”

“Yes,” agreed another as everything slid off the table. “And furthermore, we are wasting entirely too much time in meetings lately. We are missing too much valuable fishing time.”

“There’s only one thing to do,” said a crew member. “That’s right!”

“Aye!” they all shouted.

So they threw the barometer overboard.

(Editor’s Note: The above manuscript, now preserved in a museum, was originally discovered washed up on a desolate island above the north coast of Norway, about halfway to Spitsbergen. That island is called Bear Island and is located on the huge black and white world map on the wall in Putnam’s “Trustees Room” where weekly investment division meetings took place.)

What differentiates Walt’s book http://www.amazon.com/Walter-Deemer/e/B005Y5NBNE/ref=ntt_athr_dp_pel_1 and sage advice is that he was on the front line — he walked the walk in leading Putnam Management’s technical analysis effort when Putnam was one of the premier money management firms extant.

I want to close by repeating what I view as my buddy/friend/pal Walt Deemer’s most famous words of wisdom — these words are always relevant, perhaps even more so in today’s markets.

— Walt Deemer

Posted in Investing Careers, Investing Gurus, Investor Psychology, Risk Management

Tagged Fishing, Storms, Technical Analysis

My last mention of the Roman Empire, http://wp.me/p1PgpH-vM.

The fall of the Roman Empire ushered in the Dark Ages (Wow! Now THAT is a bear market–an age of fear, despair, fiefdoms, and darkness) http://en.wikipedia.org/wiki/Dark_Ages_(historiography)

By Daniel J. Sanchez at www.mises.org

Monday, June 4th, 2012

Thanks to Ed Smith for pointing out this passage in the Decline of the Rome Wikipedia article:

Historian Michael Rostovtzeff and economist Ludwig von Mises both argued that unsound economic policies played a key role in the impoverishment and decay of the Roman Empire. According to them, by the 2nd century AD, the Roman Empire had developed a complex market economy in which trade was relatively free. Tariffs were low and laws controlling the prices of foodstuffs and other commodities had little impact because they did not fix the prices significantly below their market levels. After the 3rd century, however, debasement of the currency (i.e., the minting of coins with diminishing content of gold, silver, and bronze) led to inflation. The price control laws then resulted in prices that were significantly below their free-market equilibrium levels. It should, however, be noted that Constantine initiated a successful reform of the currency which was completed before the barbarian invasions of the 4th century, and that thereafter the currency remained sound everywhere that remained within the empire until at least the 11th century – at any rate for gold coins. According to Rostovtzeff and Mises, artificially low prices led to the scarcity of foodstuffs, particularly in cities, whose inhabitants depended on trade to obtain them. Despite laws passed to prevent migration from the cities to the countryside, urban areas gradually became depopulated and many Roman citizens abandoned their specialized trades to practice subsistence agriculture. This, coupled with increasingly oppressive and arbitrary taxation, led to a severe net decrease in trade, technical innovation, and the overall wealth of the Empire.[8]

The passage of Human Action in which Mises discusses the decline and fall of Rome was recently featured as a Mises Daily.

http://www.tweedy.com/resources/library

_docs/reports/TBFundsAnnualReportMarch2012.pdf

Third Avenue Value Funds 2nd Qtr. Report: http://www.thirdave.com/ta/documents/reports/TAF%202Q%202012%20Shareholder%20Letters.pdf

Posted in Economics & Politics, Investing Gurus

Tagged business, economy, Fall of Roman Empire, government, Sanchez, TAVF, Tweedy Browne