You have the choice between the natural stability of gold and the honesty and intelligence of the members of government. And with al due respect to those gentlemen, advise you, as long as the capitalist system lasts, vote for gold.” —George Bernard Shaw

Your Editor Interviewed Here: http://classicvalueinvestors.com/i/ (Do I have a career in radio?)

What is a dollar? (Thanks to Larry Parks of www.fame.org)

Virtually everyone believes that the pieces of paper that we carry around with the inscription “Federal Reserve Note” along with the image of George Washington or another president, the word “dollar,” and a whole bunch of signatures and seals are in fact real dollars. In fact, none of these pieces of paper are dollars.

Consider, the word dollar is used in the Constitution in two places but it is not defined in the Constitution. It used in connection with the slave tax, which is no more, but much more importantly, it’s used in the Seventh Amendment. That’s the amendment that guarantees you a right to a trial by jury for any dispute $20 or more.

In order for the Seventh Amendment to have objective meaning, the word dollar has to have objective meaning. And so the question arises: What is a “dollar” as used in the Constitution, which, as everyone should know, is the overriding law of the land. Every law has to be in conformity with the Constitution or else it is not a law.

If one looks at the history of money in the Colonies prior to the Revolution, one will find that the Spanish Milled Dollar was ubiquitous. Spaniards had built mints in many places and the Spanish Milled Dollar, the silver coin sometimes referred to as a Real and other times as a Piece of Eight, was the unit of account for most commercial transactions. Here is an image:

At the time of the Revolution, when the Colonies organized under the Articles of Confederation, the Articles gave the general government the power to issue paper money, at the time called emitting bills of credit, which were denominated in Spanish Milled Dollars. Here is an example:

One can see from the inscription they are to be redeemable into Spanish Milled Dollars or an equal sum in gold or silver.

After the Revolution and after the Constitution was ratified, the United States wanted to have its own coinage and did not want to rely on the Spanish mints. In other words the United States wanted to mint its own dollars.

In 1792, Alexander Hamilton, then Secretary of the Treasury, wrote the Coinage Act of 1792. Here we see the first definition of a dollar: 371.25 grains of fine silver. Question: Where did Hamilton get that crazy number? If he was arbitrarily defining a dollar, why not choose 350 grains or 400 grains of silver?

The answer is that the government could not define an entirely new coinage because all of the pre-existing contracts were already denominated in dollars. A small complication was that Spanish Milled Dollars did not have a consistent weight, depending upon which of the Spanish mints produced them. That is, there were slight variations in the amount of silver in each coin.

The solution was to weigh, say, a thousand of the Spanish Milled Dollars and take the average weight. That’s where the 371.25 grains of silver came from. Another way of looking at this is that all Hamilton did was to put into law what was already a fact. The definition of a dollar has never been changed. It cannot be changed.

Here’s an example of the United States dollar that is in conformity with the Constitution pursuant to the Coinage Act of 1792:

This is silver money. It is in fact and in law a one dollar coin as provided for by the Coinage Act of 1792. It is the dollar referred to in the 7th Amendment to the Constitution.

As one might imagine, it’s more than inconvenient to carry around any quantity of United States silver dollars. They are heavy, bulky, and just a bother. The solution was to deposit these dollars in a safe place, usually a bank, because a bank would have a big and secure vault, and take in exchange promissory notes from the bank or from some other depository. One would then carry around and transact using the promissory notes that promised to pay silver dollars instead of the actual silver dollars.

Here is an example of what one of these promissory notes looked like:

This is not a dollar. It is a promise to pay a dollar. (The words under Washington’s image read: “Will Pay To The Bearer On Demand ONE DOLLAR”)

In time, people did not redeem their promissory notes for silver dollars. They left the silver dollars at the depository. Because they trusted the depository, they circulated the promissory notes. Why would they redeem? What would they do with the silver dollars once they had them? The same state of affairs applied to promissory notes whereby gold was the promised coin.

Eventually, the issuer of the promissory notes realized that people were not redeeming. The issuers in most cases were banks. And so when people applied at a bank for a loan, the bank would issue them promissory notes redeemable on demand for gold or silver for which the bank did not have gold or silver. The jargon for this is called fractional reserve lending. It is enormously profitable for a bank to loan someone a piece of paper and charge 8% interest on the nominal amount.

Leaving out a great deal of history, eventually there came a time when the issuing authorities were asked to redeem their promissory notes. Because they had over issued, they didn’t have enough specie. In fact, they were bankrupt. What to do? (Bank run by depositors of gold and silver unveiled the inherent bankruptcy of fractional reserve banks).

With the connivance of politicians who some suggest were bribed with what are euphemistically called campaign contributions, banks defaulted on the promissory notes. They then issued pieces of paper, still called notes even though they were not notes, but left off the promise to pay dollars. Incredibly, they got away with misrepresenting these defaulted promises to pay dollars, as if they were dollars!

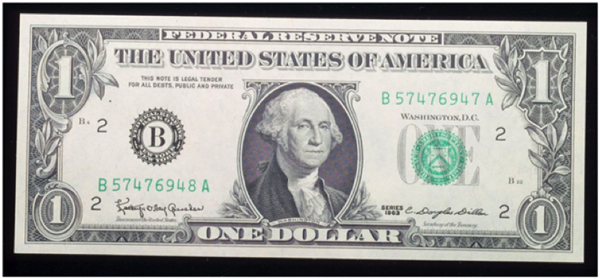

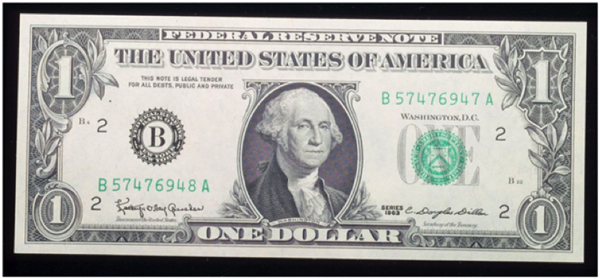

In other words, the broken promises to pay dollars became dollars. This is a gross misrepresentation. As a practical matter, people were precluded from objecting, because by law these pieces of paper were deemed to be legal tender. Here is what these broken promises look like:

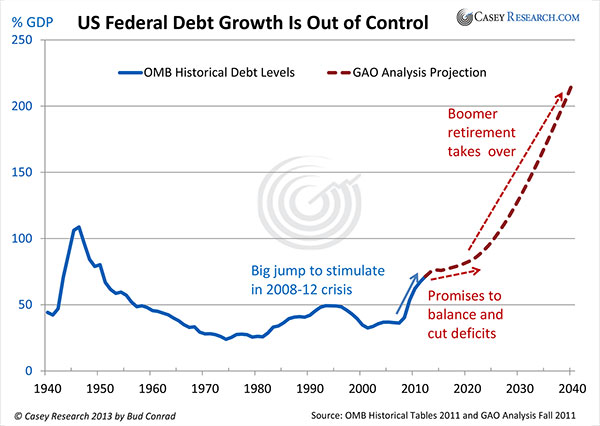

To learn more about monetary history and constitutional money and how we arrived at our current state of growing debt and fiat currency

A different perspective on Gold or How Not to Trade the Dollar

May 1, 2013 | Author Keith Weiner of www.acting-man.com

How Not to Trade the Dollar

I hope this essay provides some food for thought. It is not my intention to insult or belittle anyone, but using humor and cold logic, to help people understand an abstract topic with many counterintuitive principles. The ultimate goal is to protect what you have and make some more (in that order).

Gold is money. We have published a video to make the point that one should use gold to measure the economic value (i.e. price) of everything else including the dollar.

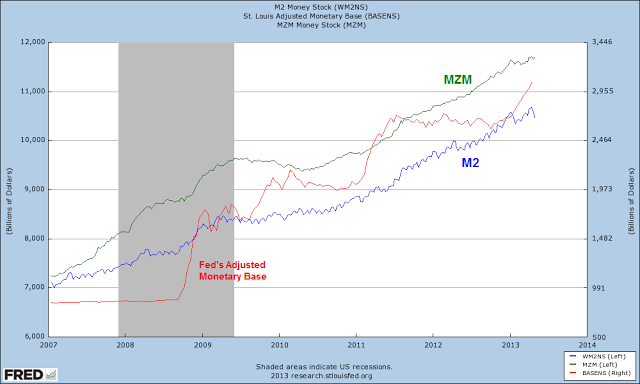

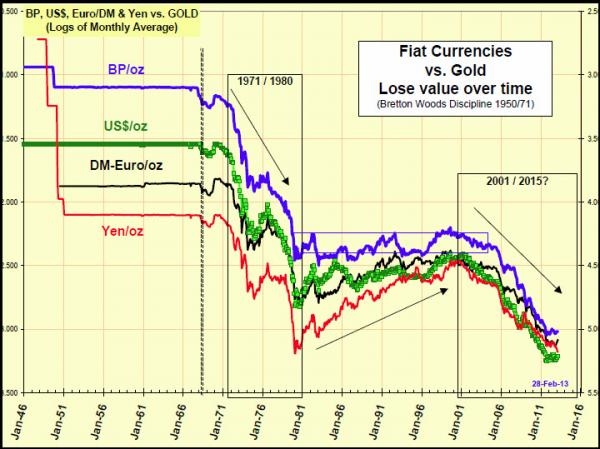

So what does that make the dollar? It is a form of credit, and its quality is constantly falling because the Fed is incessantly forcing more counterfeit credit into the market. The price of the dollar is in long-term decline, starting at around 1.6g of gold in 1913 to around 21.3mg (yes milligrams) today.

The price of the dollar sometimes rises for reasons that may not be obvious.The financial system today is highly leveraged. Small changes at the margin, such as intermittent pressure on debtors, can be amplified by this gearing. In the casino of FX markets, traders chase momentum. The occasional crisis somewhere in the world can put enormous (if short-term) buying pressure on the dollar. Fear, misinformation, and even delusion can make the crowd run the wrong way. How many people sold their gold on the rumor that Cyprus might sell 10 tons of gold on the market?

The dollar is not suitable to measure the value of gold. It is too volatile, not to mention that it is generally falling. This idea has profound implications on investing and trading. I address one of them in this article.

The central fact of gold today is both self-evident and non-obvious. Most people find it hard to get their heads around the fact that a rising gold price does not produce gains for gold owners. Our whole lives, we’re trained not only to think of the dollar as money, but to think that the dollar price of everything is its value. It is a deeply held belief that if you increase the number of dollars you own, then you have a gain. It is time for this illusion to be dispelled.

Consider a simple trade. First, you buy gold. Then the price of gold goes up. Then you sell the gold. You have a profit, right?

Wrong.

You have more dollars (and the government will tax you on the increase). Each of them is worth less, in precise proportion to the number of them that you gained. To underscore this, let’s look at it from outside the dollar bubble. A rise in the gold price from $1350 to $1500 is really a drop in the dollar from 23mg of gold to 20.7mg. If you bought an ounce of gold with 1350 dollars you still have one ounce worth of dollars when the dollar has fallen to 1/1500 ounce (or 1/5000).

This means that a strategy of buying and holding gold for the long-term does not produce wealth. It protects wealth, because gold does not fall. To get richer, you must either invest to receive a yield in gold, or speculate on an asset with a rising gold price. Producing a yield on gold is the reason why Monetary Metals was formed. Speculating on rising asset prices is challenging because as we head into this greater depression, demand is falling. I recommend checking out www.pricedingold.com, which has charts of many different things priced in gold. (The author of that blog, Sir Charles, has been an active investor in gold and silver since 1980, Charles slowly began to realize the importance of having a standard of value not tied to any country’s currency and monetary policy – that in fact, rising and falling ‘gold prices’ were really more accurately viewed as falling and rising ‘currency prices’, measured against the relative stability of gold. This insight led to the founding of Gold Monocle Group, Ltd, and the creation of the Priced in Gold website in 2007.)

It is possible to trade the short-term volatility in the dollar. To frame this objectively, it is buying the dollar when it is down and selling when it is up. I deliberately did not state this as people commonly think of it today: buying gold when it is down and selling gold when it is up. Gold is not going anywhere; it is the dollar that is volatile and falling.

Your first choice is whether to use leverage. Leverage would allow you to profit from the rising gold price because you will gain more dollars at a faster rate than the dollar is losing value. Let’s illustrate this with two examples.

The first example uses no leverage. You buy 100 ounces of gold for $1460 per ounce, a total of $146,000. The gold price eventually doubles to $2920. You have twice as many dollars, but unfortunately each of them is worth half as much. Your net worth in gold is still 100 ounces.

The second example uses 5:1 leverage. You buy 500 ounces of gold at $1460 per ounce, or $730,000 worth of gold, but you only need the same $146,000 as in the first example. The bulk of the capital, $584,000, is credit. Then, the gold price doubles to $2920. Now your 500 ounces is worth $1,460,000. You can sell 200 ounces to pay the debt, and you are left with 300 ounces free and clear. Your net worth tripled from 100 to 300 ounces.

However, there is a dark side to leverage. When the price falls, leveraged accounts are subject to margin calls. The trader must immediately put in more dollars or else the broker will sell everything, and the trader could lose everything. Just ask anyone who was leveraged a few weeks ago when gold was near $1600 what happened, and if he still has a gold position, or any capital left in his account at all.

This kind of event is exceedingly hard to predict. We did not predict it from our analysis of the basis (though we did make a bold and controversial prediction and trade recommendation that has performed quite well). Following April 15, the basis allowed us to see that large quantities of physical gold and silver were flushed out of someone’s hands and into the market. And as we go forward, it will allow us to see the changes in scarcity of gold and silver.

Not counting the Keynesians, or the perma-bears who have long thought that gold should collapse to $250,some technical analysts put out bearish calls on gold and a few called for a significant and rapid price drop.

Trading the downside in gold is very difficult because no matter how the technicals look, there is a risk that some central bank or big player could make an announcement that would drive the gold price up sharply. Indeed, we predict that volatility will rise as we go forward. For this reason, and of course the upward bias to the gold price, we never recommend a naked short position in gold or silver.

If you do not use leverage, it is difficult to produce a real gain. Remember that a generally rising gold price is just a generally falling dollar. You can’t make a profit from this. You rely on short-term volatility. You buy gold at a lower price and then sell it at a higher price. And you must hope that the gold price falls again. If not, then your strategy has failed.

There are other downsides to the unleveraged strategy. One is that you must hold falling dollars at times. You buy gold, hold it for an hour or a day or a week and then you sell it. You’re left holding dollars, hoping for a lower gold price. During that time, you are exposed not only to the falling dollar, but also to the credit of your bank or broker as well. We would prefer a strategy that allows one to sleep at night, especially Friday, Saturday, and Sunday night.

I corresponded with a gold dealer in Cyprus following their collapse. He recommended to people to buy gold. Not one person took his advice. Now, of course, they regret their decisions. This is not because consumer prices rose in Cyprus, but because what they thought of as “money” has turned out to be just bad credit, a defaulted piece of paper. Gold does not default.

At the end of the day, when the dollar collapse takes on a more vicious dynamic and rapid pace, the gold price will be rising sharply, perhaps exponentially. What will you do then? If the charts say that gold is overbought, will you take your profits? Will you sell at a record high price? Will you trade all of your gold for dollars immediately prior to the dollar becoming utterly worthless?

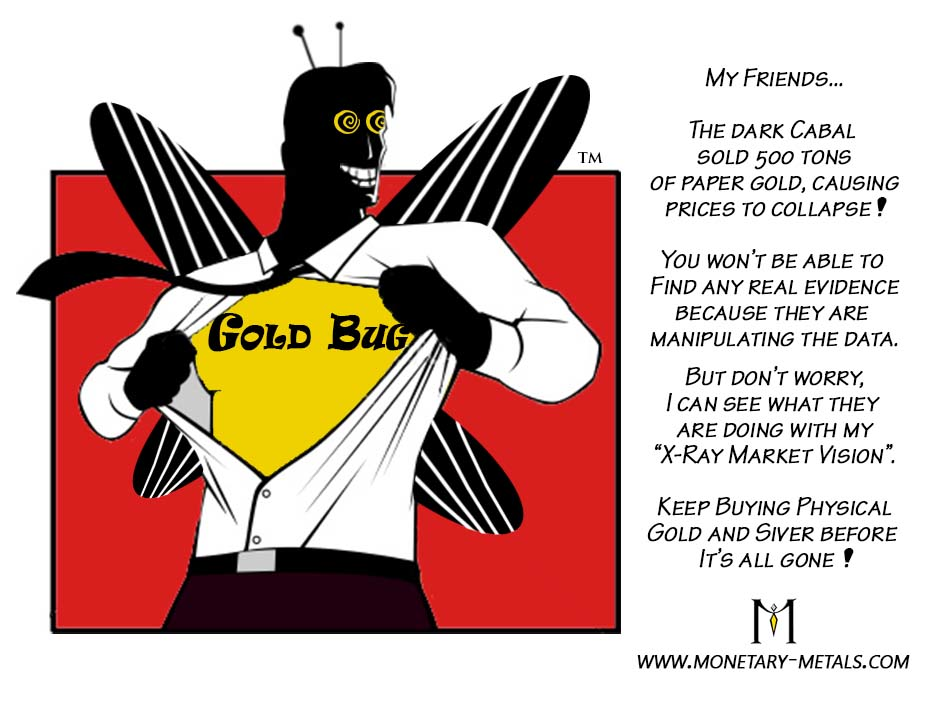

With or without leverage, trading any market without better information and/or a superior understanding than the other traders is a sucker’s game. Having faith in a $50,000 gold price and a conspiracy theory that a Dark Cabal manipulates it down to $1460 is not information or understanding. It is just hope plus words of comfort to use after each wounding.

The gold market has price moves that cannot be predicted in advance and in some cases do not have an obvious cause in contemporaneous news coverage. In my article on the gold price drop, I do not point the finger at the rumors of Cyprus being forced to sell its gold, Texas or Germany demanding their gold, etc.

Today, at $1460, the question is: are there dissatisfied traders who held on during the crash, and who are now waiting for a slightly higher price to sell? Will these people outweigh the hungry buyers who look at the current price as a sale, in the short-term? We would not care to make a prediction on this. The long-term is much easier to predict. The catch is that without leverage, you cannot profit from it and with leverage you can get squeezed out in a price drop before the price rises.

Technical analysts that we respect now say that massive damage has been done to the gold and silver charts, and there is a likely to be a further drop in the prices. Some technicians are calling for a price at or below $1100. Will it happen? Maybe, and if it does, it won’t be caused by the Dark Cabal.

It will be dollar-oriented traders, eager to sell low because gold is “falling”, and the destructive dynamics of stop orders, margin calls, momentum chasers (who do sometimes short gold naked), etc. As when gold’s price was rising, now that it’s falling traders are trying to outguess the others in the market, who are trying to outguess them. The picture of a Ouija Board is not too inaccurate.

It is possible to trade gold professionally, to make a profit measured in gold. If you want to trade, then you ought to know about the mechanics of the market (e.g. arbitrage, about the concept of relative gold scarcity (i.e. the gold basis), and about monetary science (e.g. pressures on markets related to changes in credit). Develop your trading strategy around them, rather than on whispers of big London or Chinese buyers, and curses at Dark Cabals.

Dr. Keith Weiner (keith at monetary dash metals dot com) is the president of the Gold Standard Institute USA, and CEO of Monetary Metals. Keith is a leading authority in the areas of gold, money, and credit and has made important contributions to the development of trading techniques founded upon the analysis of bid-ask spreads. Keith is a sought after speaker and regularly writes on economics. He is an Objectivist, and has his PhD from the New Austrian School of Economics. He lives with his wife near Phoenix, Arizona.