And when the money failed in the land of Egypt, and in the land of Canaan, all the Egyptians came unto Joseph, and said, Give us bread: for why should we die in they presence? For the money faileth.” –Genesis 47:15 King James Version

We’re in the midst of an international currency war.” Guido Mantega, Finance Minister of Brazil, Sept. 27, 2010

I don’t like the expression….currency war.” Dominque Strauss-Kahn, Managing Director, IMF, November 18, 2010

Before you sell your stocks, buy gold, and huddle in the basement with your canned food and ammo cans, none of what you read below is inevitable. I post this to make you aware of what is going on and to encourage you to learn about money and credit. Turn off your TV and read. We may be entering the end of one monetary regime and the beginning of another, though the process may take several years.

The Theory of Money and Credit_Mises plus the STUDY GUIDE to_Money and Credit, Course Outline by Robert Murphy and Mises on Money_Vol_3 by Gary North and 2012 1Q Mises on Money and Banking Lecture 1 (If enough readers are interested I can put up a folder with audio lectures and notes of each chapter of Mises’ monumental work, The Theory of Money and Credit). Yes, the book will take careful, multiple readings to fully grasp, but you will have a greater understanding of money and credit than 99.99999% of anyone on Wall Street or Washington, then you can place the world around you in context.

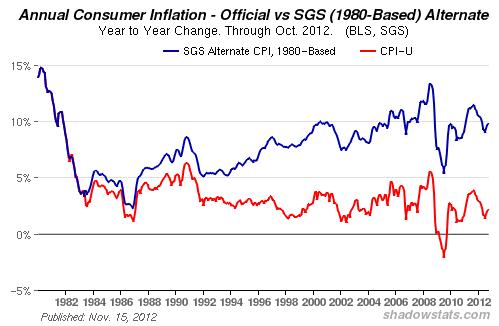

Note that the period from 1971, when President Nixon severed the last anchor to gold, to today is an unusual period in monetary history. Compare these 43 years to the thousands of years where money had some linkage to an object(s) of intrinsic value like gold, copper, or silver. Listen to Nixon’s excuses for his actions–blame the “international speculators” instead of his government’s wildly inflationary policies.

The Book, Currency Wars, The Making of the Next Global Crisis is one that I recommend. See more: http://www.currencywarsbook.com/

The cause of currency wars: http://www.peakprosperity.com/blog/james-rickards-paper-gold-or-chaos/71504

A simulated currency war

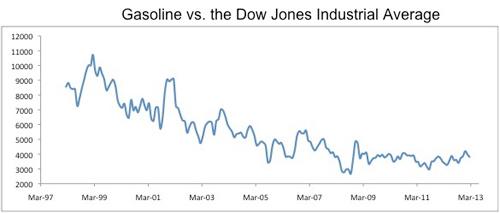

Not to give away the conclusion, but if we linked the dollar to gold then this might happen:

An explanation here: The Gold Money Index and gold

Our Current Situation (March 2013) James Rickards:

rickards-02242013 and more scenarios: http://youtu.be/4gx4osDMfGw

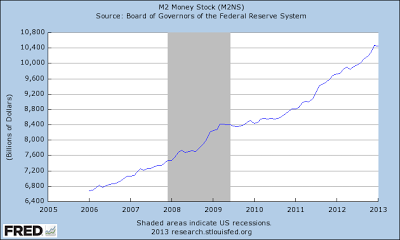

What does this have to do with today? Warning bells are ringing: Cypriot_Bailout_Sends_Shivers_Throughout_the_Euro_Zone. On the one hand, people should be aware of how banks are inherently bankrupt under today’s current fractional reserve banking system and loss of their savings would teach a lesson. However, to simply change the rules of the game with a sudden theft by bureaucrats devastates savers who may have had nothing to do with the crisis and are the ones whose savings are crucial for the economy. If you think U.S. is different from Cyprus, it’s not. $400B per year goes from depositors to banks via the Fed zero rate policy. See how the Fed devastates poor savers and those on fixed incomes (an important read): Senate-Testimony-Hearing-Rickards-03-28-12

Wake up! SYDNEY (MarketWatch) — Asia stocks reacted badly on Monday March 18th to details of a bailout of Cyprus over the weekend — with U.S. stock-index futures and the euro also sharply lower — as investors fretted about the potential implications of a decision to levy private bank deposits.

The Euro Has Brought Central Planning and Destruction

The Euro has succeeded in serving as a vehicle for centralization in Europe and for the French government’s goal of establishing a European Empire under its control—curbing the influence of the German state. Monetary policy was the political means toward political union. Proponents of a socialist Europe saw the Euro as their trump against the defense of a classical liberal Europe that had been expanding in power and influence ever since the Berlin Wall came down. The single currency was seen as a step toward political integration and centralization. The logic of interventions propelled the Euro system toward a political unification under a central state in Brussels. As national states are abolished, the market place of Europe becomes a new Soviet Union.

Read: The Tragedy of the Euro

A Way Out?

Murray Rothbard, the great American Austrian monetary historian and economist suggested: 100_percent Gold Back Dollar Rothbard

The problem of moving to a gold-backed dollar: http://mises.org/daily/5492

Ben Graham knew no country engaged in a currency war ever benefited. His solution, a dollar backed by a basket of commodities:

You have about six months of reading if you spend 40 minutes each day tackling the various subjects. Good luck!

—-

PS: The ext post I will answer readers’ questions and post a valuation study for beginners.