Back to School!

The key is not to predict the future but to be prepared for it.–Pericles

Wal-Mart vs. Costco

| Data | WMT | Cost | Difference | |

| Supercenters | 3158 | 448 | ||

| Discount Stores | 561 | 0 | ||

| Sam’s Clubs | 620 | 0 | ||

| Neighborhood Mkts | 266 | 0 | ||

| Foreign Stores | 6,148 | 174 | ||

| 10,753 | 622 | 17.3 | times | |

| Employees | 2,200,000 | 147,000 | 14.97 | times |

| Stock Keeping Units (SKUs) | 70,000 | 3,600 | 19.4 | times |

| Revs. ($bil.) | 495 | 107 | 4.63 | times |

| Return on Tot. Cap (VL) | 15% | 13% | 2% | |

| Ret. On Equity (VL) | 22% | 14.50% | 7.50% | |

| Gross Profit Margin | 24% | 10% | 140% | |

| Oper. Income/Margin | 5.90% | 2.85% | 100% | |

| Sales per square foot | 437 | 976 | 110% | |

| Book Value | $25 | $25 | 0% | |

| Price Aug. 2 | $78.55 | $119.10 | ||

| P/BV | 3.1 | 4.8 | 55% | |

| Debt | 37000 | 4800 | ||

| Equity | 82,500 | 13,825 | ||

| Debt to Equity | 45% | 35% | ||

| Est. Growth | ||||

| Sales | 6.50% | 8.50% | ||

| Earnings | 9% | 11% | ||

Comparing

I think when you compare numbers, what strikes you is the difference in # of SKUs between retailers. WMT’s business model is much more labor intensive coupled with a lower-income customer. The squeeze on the middle class has crimped WMT. You would think with WMT’s higher ROC and ROE compared to COST’s that WMT would not be lagging CostCo’s in share price performance but remember that COST is growing faster above its cost of capital and has more room to grow than behemoth, Wal-Mart. In other words, CostCo can redeploy more of its capital at higher rates than WMT can (grow its profits faster).

That said, the market knows this and has handicapped Costco with a higher price to book and P/E ratio than WMT’s. As an individual investor, your time might be better spent looking at smaller, more unknown companies to find mis-valuation. Also, when a company gets as big as WMT (1/2 TRILLION $ in sales), the law of large numbers sets in and the company becomes a magnet for social engineering and protest. But if you had to have me choose what company to own over the next ten years, I would choose COST because its moat is stronger (greater customer captivity) shown by its huge inventory turns/high sales per square foot plus greater PROFITABLE growth opportunities. However, I do see WMT becoming more focused rather than expanding overseas where their local economies of scale are lessened.

My analysis is cursory, but for those that picked out the main differences, you have a better grasp of whether WMT can raise its employees’ wages to the level of Costco’s. It can not unless it reduces its SKUs and employees.

More analysis from others:

| Why Wal-Mart Will Never Pay Like CostcoBloomberg writer Megan McArdle hits the nail on the head with her analysis of the situation in Why Wal-Mart Will Never Pay Like Costco.Wal-Mart is trying to move into Washington, a move that said local housing blog has not enthusiastically supported. Hence, we’ve been treated to a lot of impassioned reheatings of that old standby: “Costco shows it’s possible” for Wal-Mart to pay much higher wages. The addition of Trader Joe’s and QuikTrip is moderately novel, but basically it’s the same argument: Costco/Trader Joe’s/QuikTrip pays higher wages than Wal-Mart; C/TJ/QT have not gone out of business; ergo, Wal-Mart could pay the same wages that they do, and still prosper.Obviously at some level, this is a true but trivial insight: Wal-Mart could pay a cent more an hour without going out of business. But is it true in the way that it’s meant — that Wal-Mart could increase its wages by 50 percent and still prosper?Upper-middle-class people who live in urban areas — which is to say, the sort of people who tend to write about the wage differential between the two stores — tend to think of them as close substitutes, because they’re both giant stores where you occasionally go to buy something more cheaply than you can in a neighborhood grocery or hardware store. However, for most of Wal-Mart’s customer base, that’s where the resemblance ends. Costco really is a store where affluent, high-socioeconomic status households occasionally buy huge quantities of goods on the cheap: That’s Costco’s business strategy (which is why its stores are pretty much found in affluent near-in suburbs). Wal-Mart, however, is mostly a store where low-income people do their everyday shopping.

As it happens, that matters a lot. Costco has a tiny number of SKUs in a huge store — and consequently, has half as many employees per square foot of store. Their model is less labor intensive, which is to say, it has higher labor productivity. Which makes it unsurprising that they pay their employees more. But what about QuikTrip and Trader Joe’s? I’m going to leave QuikTrip out of it, for two reasons: first, because they’re a private company without that much data, and second, because I’m not so sure about that statistic. QuikTrip’s website indicates a starting salary for a part-time clerk in Atlanta of $8.50 an hour, which is not all that different from what Wal-Mart pays its workforce. Trader Joe’s is also private, but we do know some stuff about it, like its revenue per-square foot (about $1,750, or 75 percent higher than Wal-Mart’s), the number of SKUs it carries (about 4,000, or the same as Costco, with 80 percent of its products being private label Trader Joe’s brand), and its demographics (college-educated, affluent, and older). “Within a 15–minute driving radius of a potential site,” one expert told a forlorn Savannah journalist, “there must be at least 36,000 people with four–year college degrees who have a median age of 44 and earn a combined household income of $64K a year.” Costco is similar, but with an even higher household income — the average Costco household makes more than $80,000 a year. In other words, Trader Joe’s and Costco are the specialty grocer and warehouse club for an affluent, educated college demographic. They woo this crowd with a stripped-down array of high quality stock-keeping units, and high-quality customer service. The high wages produce the high levels of customer service, and the small number of products are what allow them to pay the high wages. Fewer products to handle (and restock) lowers the labor intensity of your operation. In the case of Trader Joe’s, it also dramatically decreases the amount of space you need for your supermarket … which in turn is why their revenue per square foot is so high. (Costco solves this problem by leaving the stuff on pallets, so that you can be your own stockboy). Wal-Mart’s customers expect a very broad array of goods, because they’re a department store, not a specialty retailer; lots of people rely on Wal-Mart for their regular weekly shopping. The retailer has tried to cut the number of SKUs it carries, but ended up having to put them back, because it cost them in complaints, and sales. That means more labor, and lower profits per square foot. It also means that when you ask a clerk where something is, he’s likely to have no idea, because no person could master 108,000 SKUs. Even if Wal-Mart did pay a higher wage, you wouldn’t get the kind of easy, effortless service that you do at Trader Joe’s because the business models are just too different. If your business model inherently requires a lot of low-skill labor, efficiency wages don’t necessarily make financial sense. If you want Wal-Mart to have a labor force like Trader Joe’s and Costco, you probably want them to have a business model like Trader Joe’s and Costco — which is to say that you want them to have a customer demographic like Trader Joe’s and Costco. Obviously if you belong to that demographic — which is to say, if you’re a policy analyst, or a magazine writer — then this sounds like a splendid idea. To Wal-Mart’s actual customer base, however, it might sound like “take your business somewhere else.”

|

From www.Morningstar.com

Concentrating on fewer stock-keeping units generates buying power for Costco on par with, or perhaps even greater than, larger mass merchants. At first glance, excluding gasoline, at about $60 billion in U.S. sales Costco seems at a scale disadvantage against Wal-Mart’s WMT $265 billion domestic purchasing power. However, Costco concentrates its merchandise purchases on 3,300-3,800 active SKUs per warehouse, compared with the average 50,000-75,000 SKUs at a Wal-Mart superstore. As an illustration, if we assume a straight average, that calculates to more than $16 million in sales per SKU at Costco compared with just over $3.5 million-$5 million per SKU at Wal-Mart. Moreover, the company limits its buys to only specific, faster-selling items. Costco turns its inventories in less than 30 days. This variable cost parity with larger mass merchants, along with the little or zero mark-up requirement of its membership business model, produces price leadership for Costco on the products it chooses to sell.

Note sales per square foot: http://www.wikinvest.com/stock/Costco_Wholesale_(COST)/Data/Sales_per_sq._ft

Unlike its big-box peers, Costco’s international operations generate returns above its cost of capital. The company owns about 80% of its properties, operates its business at an EBIT margin below 3%, and is at the earlier stages of international expansion but still generates on average 12% returns on invested capital because of its low fixed asset base. In its fiscal 2012 year, just 439 domestic warehouses generated roughly $60 billion in revenue (excluding fuel). That calculates to $135 million in sales per unit, or $960 per square feet, which we estimate is about 2.3 times higher than Wal-Mart supercenters. That powerful unit model also works in international markets, where sales productivity levels remain high at $900 per square feet. As result, despite likely lacking logistical scale, returns on net assets for operations outside of North America are roughly 12%, above the company’s cost of capital. This is in contrast to the 6%-7% RONA range for Wal-Mart’s international operations over the past decade.

Economic Moat 05/09/13

We assign Costco a narrow economic moat. We base this on its business model’s loss-leader capabilities and ever-increasing buying power. Membership fees are the main driver of operating profits, so Costco has the ability to sell virtually any consumer product at wholesale rather than retail prices. This makes it very difficult for other retail concepts to compete with Costco on price. Moreover, its price leadership position is reinforced because the company concentrates its merchandise buys on much fewer and faster-turning SKUs, which generates disproportionate purchasing power for its size. Additionally, the company does not advertise and its austere warehouse format requires much lower maintenance capital expenditures. Therefore, the membership wholesale business model has a sustained cost advantage versus other retail operators that sell the same product categories.

Costco WalMart Case The document to read

COSTCO_Why Good Jobs Are Good for Retailers_ZTon

WMT Annual Report 2013 and Costco 2012 Annual Report (7)

For those who feel they DESERVE a prize simply email me at aldridge56@aol.com with PRIZE in the subject heading.

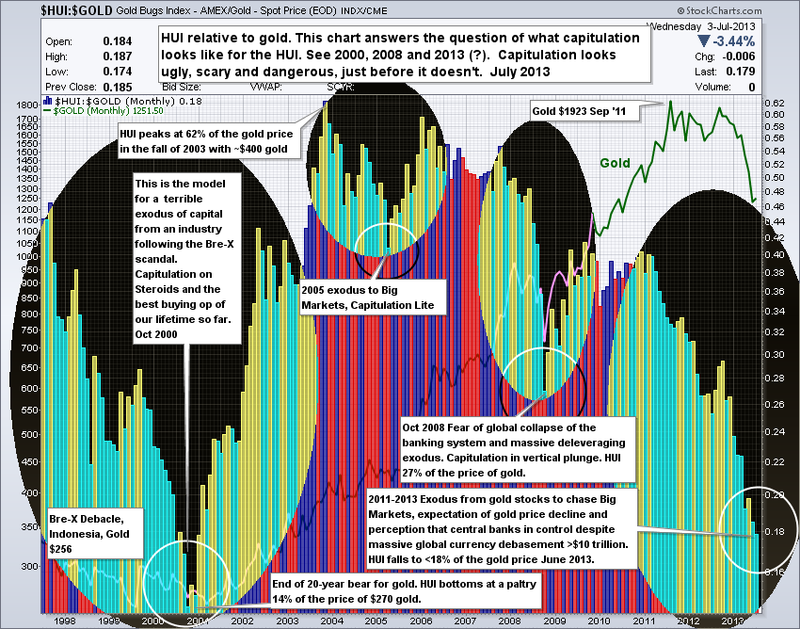

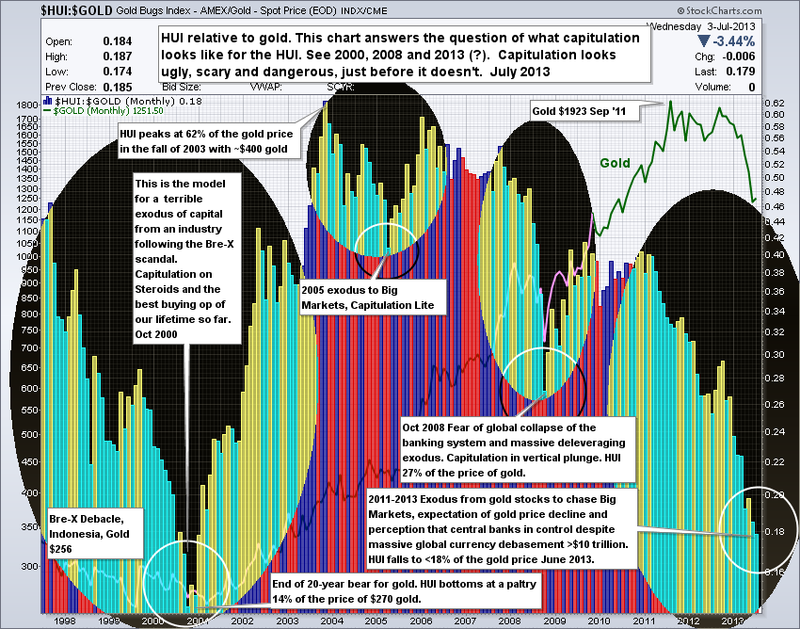

Gold, Debt and History

Gold-Bull-Debt-Bear-in-50-Charts-by-Incrementum-Liechtenstein

Note page 10, the Stock to flow ratio for gold is 65 years compared to about a year for both oil and copper. Gold is money.

Pages 60 to 61, how Austrian Economics is applied.

Notes: I hope to post my rough draft of the CSInvesting Analysis Handbook by the end of the week. I have a book recommendation coming…….