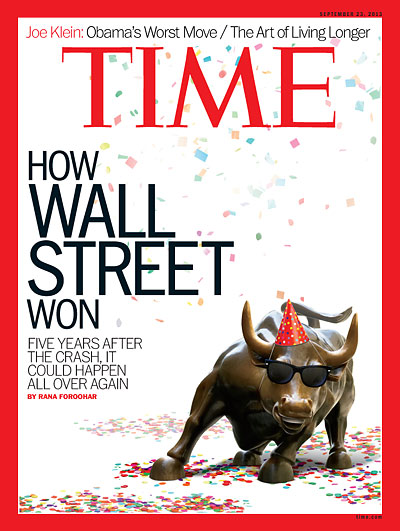

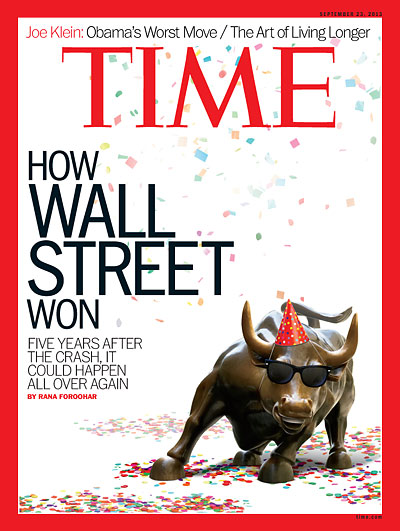

Oh, no my Red Flags are flying when I see a national magazine opine on the market. I feel like this: http://youtu.be/2bCwyzT0Z6E

“The Money They Can’t Print”

Jim Grant shared an email with (Fleckenstein) that he sent to an investment committee he is on. The committee was considering selling its gold position, and what follows are Jim’s reasons as to why that would be a bad idea:

“I just read the HSBC piece. It asserts, among other things, that gold’s bull run is over, that the future is ‘foreseeable’ and that ‘our average price forecasts for this year’ will rise.

“It seems that the analyst is just as confused as the rest of us. The future is not ‘foreseeable,’ neither by the central bankers nor anybody else. We may handicap the odds on future events, but that is a very different thing from foreseeing those events unfold.

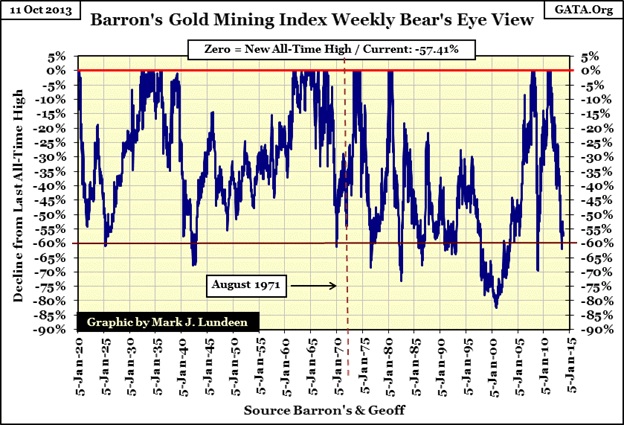

“Naturally, in the gold market, price action is mesmerizing. The metal earns nothing and pays no dividend. Impossible to value by CFA-approved techniques, gold becomes its price chart. These days, the chart looks bad.

The One Time You Can Divide By Zero“But there is, ultimately, a kind of fundamental value. The gold price is finally the reciprocal of the world’s faith in the thoughts and methods of Ben S. Bernanke and of his successor at the Federal Reserve. The greater the confidence, the lower the price, and vice versa. If we, as a committee, trust the Federal Reserve to remove the trillions of dollars it has materialized out of nowhere, exactly when the time is ripe, we should be out of the metal and out of the mining shares. If, however, we continue to entertain well-founded doubts, I suggest that we stick. On further weakness, I suggest that we add.

“Gold’s latest sinking spell perversely coincides with the dwindling of America’s geopolitical status in the world. Gold is selling off as uncertainty grows about the identity and thinking of the next Fed chairman, about the efficacy of QE and about the world’s tolerance to endure even the slightest tightening in the Fed’s unprecedentedly easy monetary policy.

All In, Whether We Like It or Not“For the first time in history, the world is on a universal fiat-money standard. And for the first time in history, central banks are pressing interest rates to zero and doubling down on zero percent through quantitative easing.

“If I were about 30 years younger, I would assure you that these policies will certainly, absolutely and indubitably fail. Forty years ago, I could have given you the date. But I have learned enough to understand that, in markets, nothing is out of the question. Gold — especially now, when it is out of favor — is a hedge against what we can’t know but which, based on centuries of monetary history, we are well advised to suspect. Pure and simple, gold is the money they can’t print. It’s good to have a little.”

Value Investors on ABX (Amer. Barrick, Senior Gold Producer)

CSInvesting: The lesson here is to do YOUR OWN thinking. I am as bullish on some (certain, not all) mid-tier and junior gold companies as anybody, but note the last sentence: Plus, a big chunk of our recent purchases occurred at price levels where the stock was trading a dozen years ago when gold was $300+/ounce. Such a deal? What matters is not the absolute price of gold but the spread between the gold price and input costs like labor, oil, rubber, etc. Think through the implications. I don’t see how they think ABX has a great balance sheet as compared to other competitors………..

Pitkowsky: Wally, over the last few months, we have significantly increased our holding in Barrick Gold (ABX), which had been a small position up until that point.

Gold over the last few months has experienced tremendous volatility in the price of the metal. And the mining stocks have experienced even more volatility in their share prices. Barrick has suffered over the last couple of years from a host of different mistakes: too much leverage; lack of focus on returns; political mistakes related to new developments they’ve been working on.

But there’s been a management change there. And the new CEO clearly has a different focus and a different set of marching-orders from the board, which is to reduce the leverage, to continue to be the low-cost operator, to resolve the political issues they have, and to focus more on returns — not just getting bigger. And we’ve taken note.

We added significantly to our holdings in Barrick Gold this spring as the price of gold and the gold miner stocks collapsed. Barrick is a low cost producer and is worth much more if gold prices are stable or higher but there is risk if gold plummets. The new CEO has a different focus than the prior CEO. He is focused on returns not size and less leverage is better. They have low-cost and world-class properties, and ABX is a business capable of generating attractive levels of free cash flow. We also like that ABX is a cheap and leveraged hedge against worldwide currency debasement policies being pursued by central banks. We don’t spend a lot of time worrying about macroeconomics, but we have been concerned by the scale of central bank interventions. Plus, a big chunk of our recent purchases occurred at price levels where the stock was trading a dozen years ago when gold was $300+/ounce. Read the whole interview:

Interview with Larry Pitkowsky and Keith Trauner of Goodhaven

(MSFT, HPQ, ABX)

—

Housekeeping:

A busy week, but I hope to have my introduction to CSInvesting Handbook posting by week’s end……………fingers crossed.