subscription

Categories

Do you want the keys to the Value Vault?

Simply send an email to aldridge56@aol.comTag Cloud

AAPL ABCT Ackman Austrian Economics bitcoin Blogs books Bubbles Buffett business Case Study Competition Demystified Contrarian Cuba Deep Value Economies of Scale economy Federal Reserve Franchises Gold Gold Stocks Graham Greenwald History inflation James Grant Klarman Learning Lectures miners Mises money Munger Politics Risk ROIC Rothbard Strategic Logic Strategy The Fed valuation Value Investing Resources Value Vault Videos WMT-

Recent Posts

Changes in the Finance Industry; A Hatchet Job on Buffett

Structural Changes in the Finance Industry for Junior Miners

https://www.youtube.com/channel/UCyjyUPbLw38tG9iAw0p7nxg

Hatchet Job on Buffett

Special Investigation: The Dirty Secret Behind Warren Buffett’s Billions

America’s favorite investor loves monopoly, not free markets.

By David Dayen

Surprise! Buffett craves monopolies. Who wouldn’t want to invest in them? How about helping citizens by doing away with government controlled monopolies like the US Post Office or the Fed?

Posted in Uncategorized

Buffett Interviewed on the Financial Crisis–a Good Review of Buffett’s Thoughts on Investing

BUFFETT INTERVIEW on FINANCIAL CRISIS and MOODY’s Moody Analysis and Transcript-of-Warren-Buffett-Interview-With-FCIC

The Above Book is a good primer on investing. See course by the author.

http://www.advancedvalueinvestingworkshop.com/register.html

Understanding Interest Rates

https://monetary-metals.com/category/supply-demand-report-public/

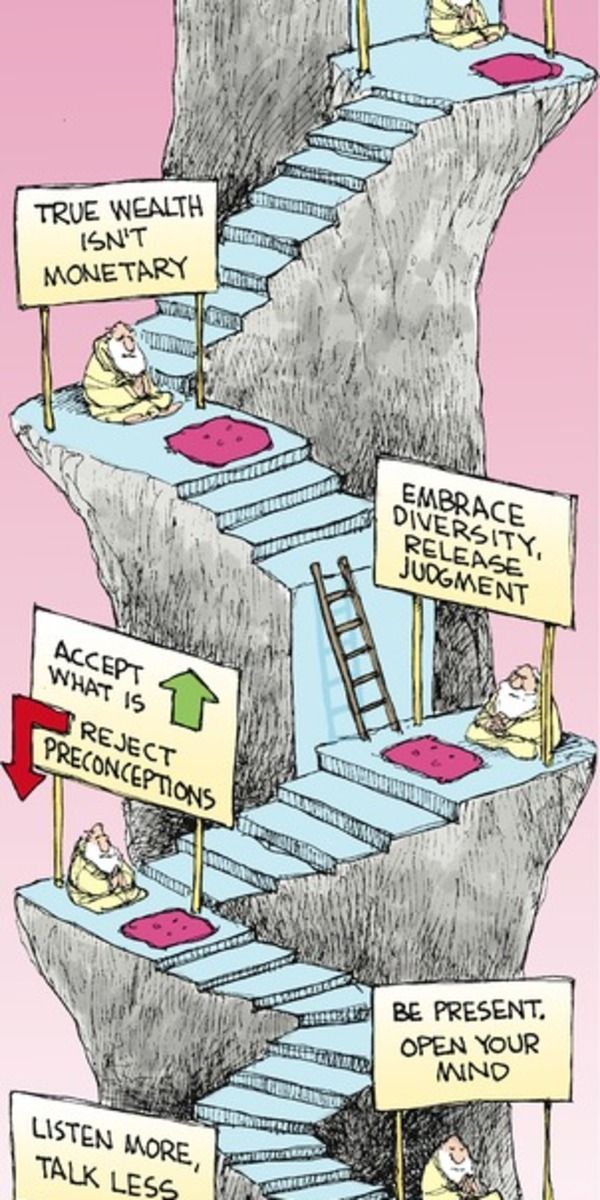

What could help you with Mr. Market

The first line of Epictetus’ manual of ethical advice, the Enchiridion—“Some things are in our control and others not”—made me feel that a weight was being lifted off my chest. For Epictetus, the only thing we can totally control, and therefore the only thing we should ever worry about, is our own judgment about what is good. If we desire money, health, sex, or reputation, we will inevitably be unhappy. If we genuinely wish to avoid poverty, sickness, loneliness, and obscurity, we will live in constant anxiety and frustration. Of course, fear and desire are unavoidable. Everyone feels those flashes of dread or anticipation. Being a Stoic means interrogating those flashes: asking whether they apply to things outside your control and, if they do, being “ready with the reaction ‘Then it’s none of my concern.’ ”

https://www.newyorker.com/magazine/2016/12/19/how-to-be-a-stoic

Barrons-interview-Bruce-Greenwald-13052017 (1)

Posted in Uncategorized

Lecture on Studying Financial History (Russell Napier)

Russell Napier’s Lecture

on Financial History (60 minutes)

A good lecture on integrating past lessons into today’s current conditions.

A CFA composite book on Financial History: Financial History CFA Institute

If you do study financial history like the period of the Internet Boom then collect books and articles from many perspectives AND look at supply as well as demand. Also, incentives rule.

For example,

read several books from different perspectives and the history of interest rates, the history of commodity prices, other equities, interest rate spreads, etc.

read several books from different perspectives and the history of interest rates, the history of commodity prices, other equities, interest rate spreads, etc.

Posted in Economics & Politics, History

Tagged CFA, History, Internet Boom, Russell Napier

Acq. Multiple, Yog Berra and Financial Satire, and Hedge Fund Quiz

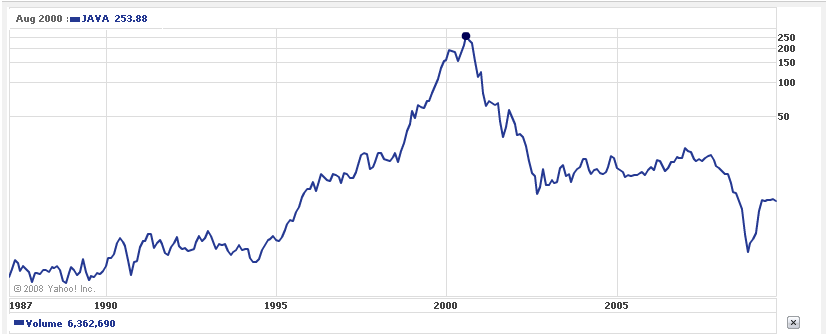

While at all times Wall Street analysts try to justify the valuations, here is a fun quote (via Bloomberg) from 2002 looking back from Scott McNeely, the CEO of Sun Microsystems, one of the darlings of the 2000 tech bubble:

“At 10 times revenues, to give you a 10-year payback, I have to pay you 100% of revenues for 10 straight years in dividends. That assumes I can get that by my shareholders. That assumes I have zero cost of goods sold, which is very hard for a computer company. That assumes zero expenses, which is really hard with 39,000 employees. That assumes I pay no taxes, which is very hard. And that assumes you pay no taxes on your dividends, which is kind of illegal. And that assumes with zero R&D for the next 10 years, I can maintain the current revenue run rate. Now having done that, would any of you like to buy my stock at $64? Do you realize how ridiculous those basic assumptions are? You don’t need any transparency. You don’t need any footnotes.

What were you thinking?”

An educational, savagely satirical view of our current market conditions and lessons on valuation. I read about 40 investment letters a quarter and this is about the best I have read in five years. Hilarious! Mark McKinney – Its Like Deja Vu All Over Again – Final and his prior letter: I Dont Get It – Mark McKinney – Final 8292017 New

—

An excellent interview by Tobias Carlisle. CHEAPNESS not quality wins! Yes, I was somewhat shocked. Why?

http://www.valuewalk.com/2018/01/tobias-carlisle-talks-acquirers-multiple-valuetalks/

ACKMAN INTERVIEW

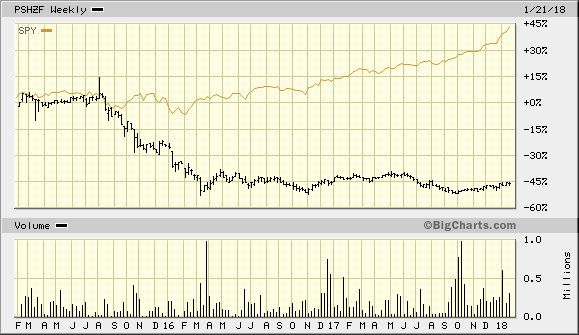

Ackman’s embattled Pershing Square hedge fund laid off 18 percent of its staff on Friday — a total of 10 pink slips that brought head count down to 46.

Investors have suffered in Pershing Square (PSHZF) vs. S&P 500:

He wants to hire an analyst who can THINK INDEPENDENTLY. You walk into his office and he asks you, “Can you think independently as an analyst?”

How do you reply. Be careful…………think for awhile before you reply. What proof can you give?

If you are struggling to answer, then https://www.newyorker.com/magazine/2015/11/23/conversion-via-twitter-westboro-baptist-church-megan-phelps-roper

will provide clues.

What determines the price of gold:

A Case study on Cognitive Dissonance

I only hear what I wanna hear and disregard the rest.

I have my righteous rage and pointless point of view–The Angry Young Man by Billy Joel

Often wrong but never in doubt–Chicago Slim

You will learn more about investing (or clear thinking) than weeks of hearing investment pundits, or I will send you a check. Without a point of view, just listen carefully to the above interview. If necessary stop the video and think after each question how you might respond in that situation. What techniques is the interviewer using? What is going on? There are many levels of psychology and level 1 and level 2 thinking exhibited here.

What did YOU learn? Even after multiple views, I need to review. Ignore politics and focus on the logic of the questions and answers. How does one’s psychological point of view and beliefs devastate a person’s ability to think critically?

Interviewer, Cathy Newman, “So what YOU are saying……………………….”

Jordan Peterson: “I DID NOT say THAT, because I am VERY, VERY, VERY CAREFUL with my words.”

If you only have two minutes to spare, then click on the 22 minute mark of the above video. Interviewer: “Why should YOUR right to FREEDOM of SPEECH trump a trans-person’s right not to be offended?” Remember that a “journalist” is asking this question in a Western liberal democracy.

Articles about the interview:Jordan Peterson Interview

Another analysis of the interview

Sandstorm Back of the Napkin Valuation

We last discussed Sandstorm (SAND) here: http://csinvesting.org/2017/11/01/sanstorm-gold-analysis-other-readings/

I did a back of the envelope valuation here: Sand Report

Buffett on Start-Up Investing

CS of Buffett Filter on Catastrophic Risk

The above is an example of how Buffett would approach a “start-up”. You can assume that he would almost 99.9999999999999999% pass on all opportunities.

Gold Allocation

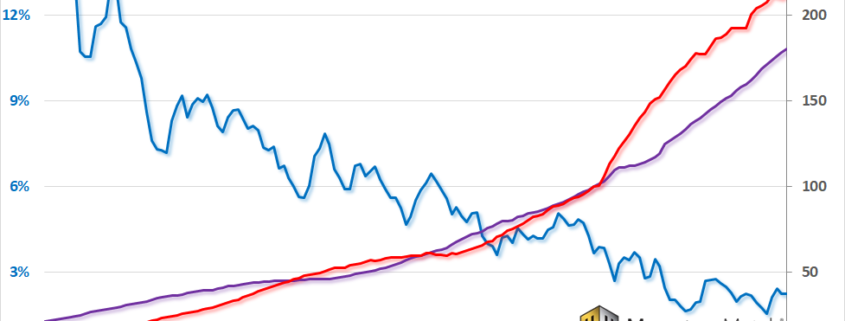

Today the Fed reports it holds 8133 tonnes of gold, worth $349.4 billion at $1,330 an ounce, which equals 7.9$ of the Fed’s reported $4.4 TRILLION in liabilities. The current model suggest a 56% weighting of gold to 44% holding of S&P 500.

CFA Seminar on Financial History; Bubble Studies; Advanced Study in Human Action

Seminar of Financial History

In an age when an algorithm is the main competitor for many fund managers, what can we know that they don’t? Algos understand the data trail of history, but this trail provides only limited insight into the key lessons of financial history for investors. In this talk, first provided at the 62nd Annual CFA Institute Financial Analysts Seminar, Russell Napier discusses those 21 most important lessons from financial history that allow human beings to profit at the expense of the machines. 1 Hour on-line seminar Feb. 1, 2018. Register (CSInvesting.org: I believe it is free: https://www.cfainstitute.org/learning/events/Pages/02012018_138012.aspx

Regardless of whether you can attend, read relentlessly about financial, economic, and common history. Note what Jim Grant of Grant’s Interest Rate Observer says:

But our main goal is to tell you the next important event in the markets. And sometimes we succeed.

– As with the tech bubble in 1999

– The 2008 mortgage crash

– The 2009 recovery in financials

– And the 2012-13 rise in house pricesHow have we been so prescient over the years?

We don’t have fancy, financial computer models or a team of MBAs and Ph.D.’s to help us make these predictions. And we don’t have access to any kind of special information.But we have been immersed in the markets for over 30 years. And we’ve studied the financial history of the past 200 years. None of which guarantees clairvoyance—nothing does. What we do claim is the capacity to see the present in the context of the helpful lessons of the past.

Like when we warned about the mortgage debt bubble in September 2006.

From the Sept. 8, 2006 Grant’s:

“Overvalued,” we, in fact, judge trillions of dollars of asset-backed securities and collateralized debt obligations to be, and we are bearish on them. Housing-related stocks may or may not be prospectively cheap; they at least look historically cheap. But housing-related debt is cheap by no standard of value. For institutional investors equipped to deal in credit default swaps, there’s an opportunity to lay down a low-cost bearish bet.

Bubble Studies

368353935-GMOMeltUp J. Grantham says that the current market does not YET show the characteristics of a bubble despite being highly valued.

Referenced study in the article: Bubbles for Fama 2017 and gmo-quarterly-letter

and more of interest: faang-schmaang-don-t-blame-the-over-valuation-of-the-s-p-solely-on-information-technology

Update (1/10/2018) Runaway Train – Dec 2018

—

Advanced Seminar in Human Action

12/06/2017 Mises Institute

Arguably one of the greatest thinkers of the twentieth century, Ludwig von Mises created a framework for all of economic science beginning with the simple axiom that individuals act. In his magnum opus, Human Action, he described economics as a branch of the theory of human action and stressed how broadly it spans, far beyond a discussion of mere money and prices. Mises said, “Economics must not be relegated to classrooms and statistical offices and must not be left to esoteric circles. It is the philosophy of human life and action and concerns everybody and everything. It is the pith of civilization and of man’s human existence.” For Mises, it was imperative that everyone learns economics, calling it “the main and proper study of every citizen.”

Human Action is a challenging read. With over 800 pages of dense material, study tools are very helpful. The course, Advanced Seminar in Human Action, is a useful addition to other materials like the Human Action Study Guide.

In this course, leading Austrian economists walk the student through Human Action a chapter at a time.

If you’ve ever wanted a push to help you get through the book or if you’ve wondered about your own reading of the material, here is your opportunity to study Human Action with David Gordon, Joe Salerno, Jeffery Herbener, Peter Klein, Guido Hülsmann, and Mark Thornton.

Human Action by Ludwig von Mises is available for free on Mises.org and for purchase as a paperback and hardcover in the Mises Bookstore.

Register: https://mises.org/library/advanced-seminar-human-action

The teachers are excellent and Human Action is the Magnum Opus of Ludwig von Mises. The book is a DIFFICULT read but there is a study guide, lecture videos, and lecture slides for all the chapters of the book. You will have a strong grounding in economics and improve your reading and critical thinking skills, but if you are a beginner, I would opt for https://www.mises.org/library/economics-one-lesson

Posted in Free Courses, History, Investing Gurus

Tagged Bubbles, Financial History, Free Course, Human Action

Kiril Sokoloff; Bitcoin Investing

An agnostic interpreter of what the markets are telling us.

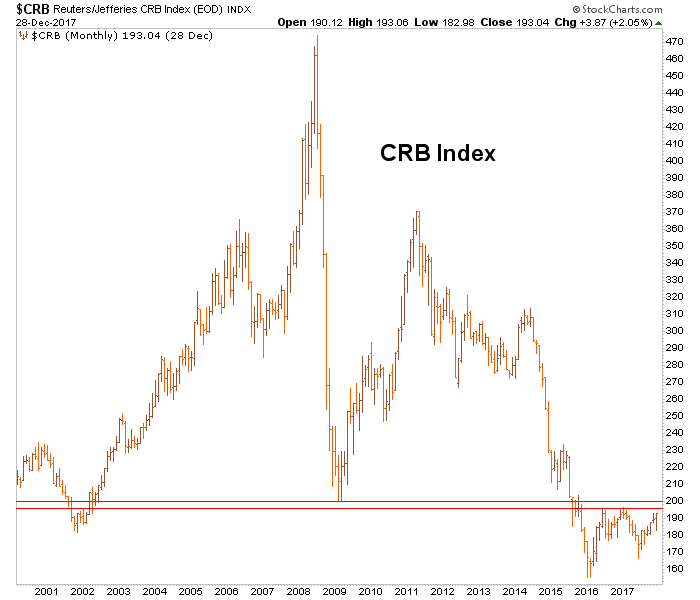

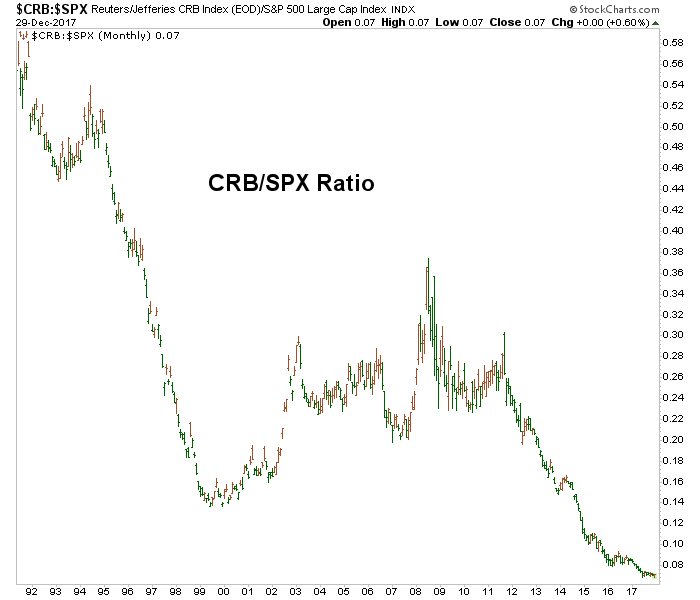

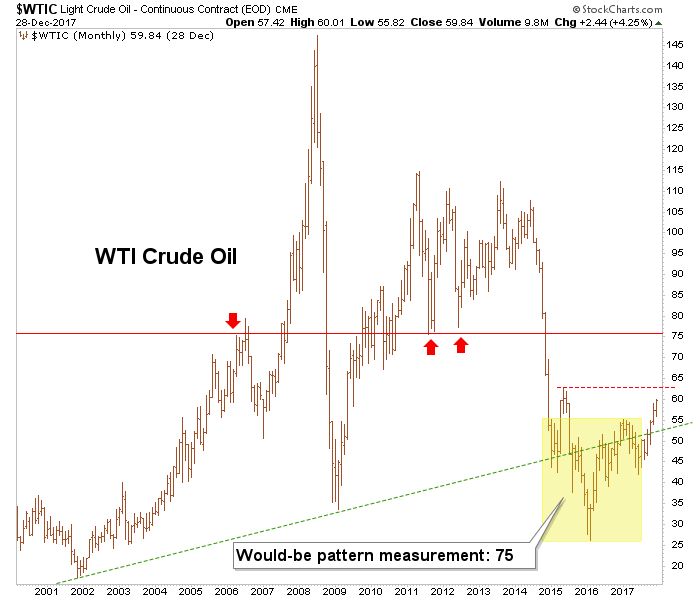

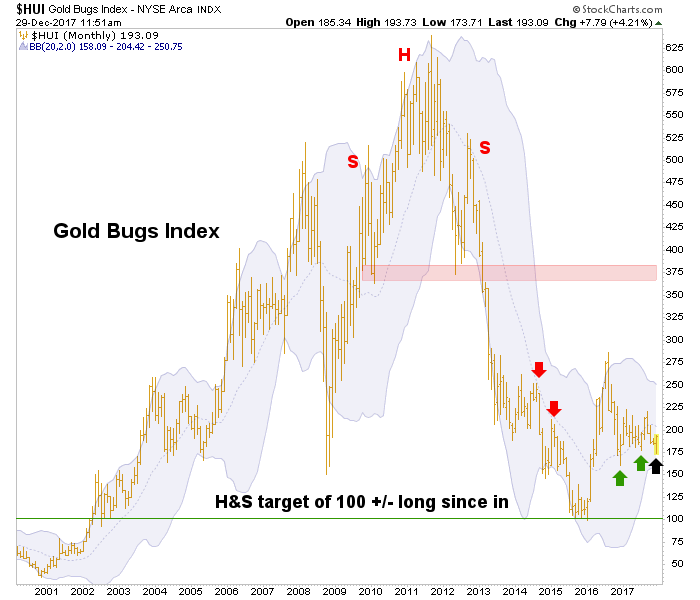

CSInvesting: Note how he understands the cycles in commodity prices (oil)

Explore extensively here: http://13d.com/news.html#kiril-interview

I recommend listening to the interviews several times over the next few days. Note how you can apply what he says. His understanding of European history (many centuries of horrific wars) will probably mean that many European states will want to remain in the European Union–thus, a weaker dollar than expected.

Funny!

Munger rips bitcoin

Note the date Dec 2016

Note the date Dec 2016