Here is the Perhsing Square website on Herbalife. Sign up and learn:

Pershing has their HLF deck up on the website: http://factsaboutherbalife.com/

Verdict: This will get ugly but my money would be on Ackman since there is no competitive advantage, so I would place the value no more than tangible book value at best with no more than a 90 second look at the financials.

The purpose of this post is also to study a Ponzi scheme. The response of the company to Ackman’s research leads me to say this company’s days are numbered.

BOOM and BUST

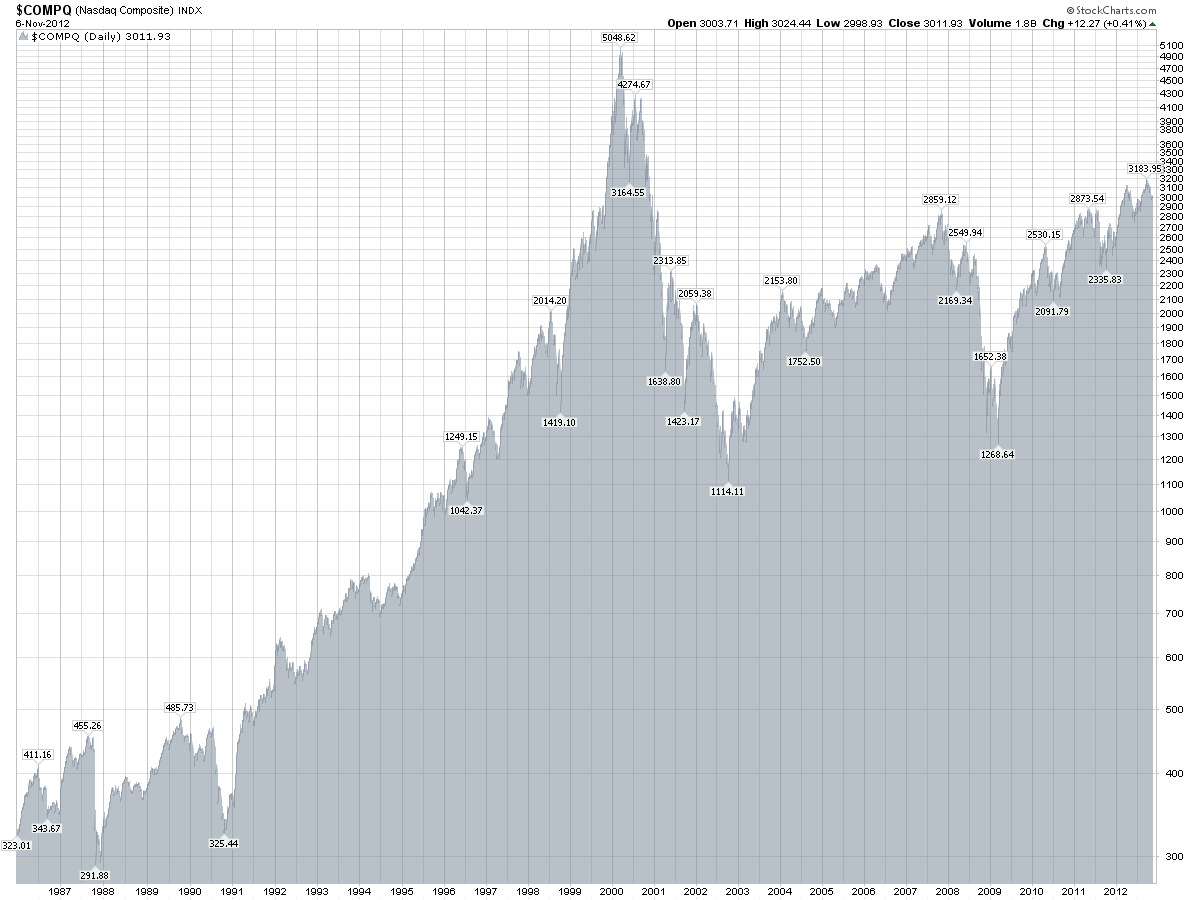

Could Austrian Business Cycle Theory Dotcom Boom and Bust have helped you as an investor? Buffett’s presentation on the Dotcom Bubble in early 1999 (See page 64) A Study of Market History through Graham Babson Buffett and Others. Note how the market went into a speculative frenzy, rising more than 50% AFTER Buffett’s speech. Human action can’t be predicted like a physics experiment.

An excellent book that predicted the bust was the The Internet Bubble: Inside the overvalue World of High Tech Stocks–and What you Need to Know To Avoid The Coming Shakeout by Anthony Perkins and Michael Perkins (1999 and 2001 editions).

Burning up (cash) http://www.fool.com/news/foth/2002/foth020830.htm

A student’s overview: David Carr – THE TECHNOLOGY STOCK BUBBLE

Ackan presents on Herbalife: http://www.reuters.com/article/2012/12/20/us-ackman-herbalife-idUSBRE8BI1MZ20121220. He says that he will be setting up a website with all his research on Herbalife. If anyone FINDS IT, please send me the link to post. This could become a good case study on multi-level marketing.

Dec. 21 2012 Update: Thanks to a reader: www.businessinsider.com/bill-ackmans-herbalife-presentation-2012-12

See presentation here:Who-wants-to-be-a-Millionaire

See this article:http://seekingalpha.com/article/918831-an-investor-s-guide-to-identifying-pyramid-schemes

Motivate thyself: Anthony Robbins http://www.youtube.com/watch?v=Cpc-t-Uwv1I&feature=share&list=PL70DEC2B0568B5469. Yes, he could be a huckster, but he is a great public speaker. Focus on HOW he presents.