An excellent Wealth Track interview of Joel Greenblatt on his portfolio management process (25 minutes): http://zortrades.com/how-to-manage-money-like-joel-greenblatt/

At the ten minute mark Joel makes an amazing statement: 97% of the top quartile money managers from the decade of 2000-2010 (encompassing two big sell-offs) were in the bottom half of performance three years out of ten; 79% were in the bottom quartile and a whopping 47% were in the bottom decile (in tenth place!) in three of the ten years. Talk about fortitude and sticking to your strategy!

Joel Greenblatt’s Magic Formula for those unfamiliar with his approach.

Joel Greenblatt is the founder and a managing partner of Gotham Capital, a hedge fund (also called a private investment partnership). He is also an adjunct professor at the Columbia University Graduate School of Business, and holds a B.S. and an MBA from the Wharton School. According to Greenblatt’s “The Little Book that Beats the Market” (Wiley, 2005) learning to successfully invest in the stock market is simple. Greenblatt said that he wanted to write a book his children could read and learn from. The main point Greenblatt makes is that investors should buy good companies at bargain prices-businesses with high return on investment that are trading for less than they are worth. This is a classic value investing methodology that Benjamin Graham would have espoused.

Finding Undervalued Stocks

To those familiar with Benjamin Graham, Greenblatt’s approach is obvious: buy stocks at a lower price than their actual value. This assumes you are able to somewhat accurately estimate a company’s actual value based on future earnings potential. Greenblatt alleged that stock prices of a company can experience wild swings even as the value of the company does not change, or changes very little. He views these price fluctuations as opportunities to buy low and sell high.He follows Graham’s “margin of safety” philosophy to allow some room for estimation errors. Graham said that if you think a company is worth $70 and it is selling for $40, buy it. If you are wrong and the fair value is closer to $60 or even $50, you will still be purchasing the stock at a discount.

Finding Well Run Companies

Greenblatt believes that a company with the ability to invest in its business and receive a good return on that investment is usually a “well run” company. He uses the example of a company that can spend $400,000 on a new store and earn $200,000 in the next year. The return on investment will be 50%. He compares this to another company that also spends $400,000 on a new store, but makes only $10,000 in the next year. Its return on the investment is only 2.5%. He would expect you to pick the company with the higher expected return on investment.Companies that can earn a high return on capital (the return a company makes after investing in the business) over time generally have a special advantage that keeps competition from destroying it. This could be name recognition, a new product that is hard to duplicate or even a unique business model.

Magic Formula

EBIT to Enterprise Value

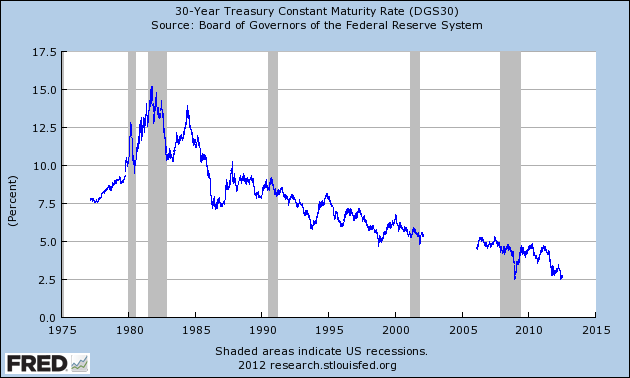

Greenblatt compares a company’s ratio of EBIT (earnings before interest and taxes) to enterprise value against the risk-free rate. Enterprise value is a measure of company value that takes into consideration the company’s capital structure (debt versus equity). You could do a simple earnings yield calculation by dividing net earnings by the market value of the company’s stock, but Greenblatt has a different take. He divides earnings before interest and taxes by a stock’s enterprise value. A company’s enterprise value represents its economic value, which is the minimum value that would be paid to purchase the company outright. In keeping with value investment strategies, this is similar to book value.Enterprise value is equal to the market value of equity (including preferred stock) plus interest-bearing debt minus excess cash. Greenblatt uses enterprise value instead of just the market value of equity because it takes into account both the market price of equity and the debt used to generate earnings.Companies with debt must pay interest on the debt and eventually pay off the debt. This makes the debt’s true acquisition cost higher. Adding debt to market capitalization lowers the EBIT to enterprise value, making a company less attractive. Excess cash is subtracted from enterprise value because the un-needed cash reduces the overall cost of acquiring a business. If a company is holding $25 million in cash, the effective acquisition cost is reduced by that amount. Excess cash raises EBIT to enterprise value, making the company more attractively priced.EBIT to enterprise value helps to measure the earnings potential of a stock versus its value. If the EBIT-to-enterprise value is greater than the risk-free rate (typically the 10-year U.S. government bond rate is used as a benchmark), Greenblatt believes you may have a good investment opportunity-and the higher the ratio, the better.

Return on Invested CapitalReturn on capital, or return on invested capital (ROIC) is similar to return on equity (the ratio of earnings to outstanding shares) and return on assets (the ratio of earnings to a company’s assets), but Greenblatt makes a few changes. He calculates return on capital by dividing earnings before interest and taxes (EBIT) by tangible capital. Instead of using net income, return on invested capital emphasizes EBIT, also known as pretax operating earnings. Greenblatt uses this number because the focus is on profitability from operations as it relates to the cost of the assets used to produce those profits.Another difference is Greenblatt’s use of tangible capital in place of equity or assets. Debt levels and tax rates vary from company to company, which can cause distortions to both earnings and cash flows. Greenblatt believes tangible capital better captures the actual operating capital used.The equity value Greenblatt uses to calculate return on equity ignores assets financed via debt, and the total assets value used in the return on assets calculation includes intangible assets that may not be tied to the company’s primary operation. According to Greenblatt, the higher the return on capital, the better the investment.

Greenblatt’s Implementation of the Magic Formula

Greenblatt started his Magic Formula screen with a universe of the 3,500 largest exchange-traded stocks, based on market capitalization (shares outstanding multiplied by share price). He then ranked the stocks from one to 3,500 based on return on capital (the highest return on capital got a ranking of one; the lowest received a rating of 3,500). Next, he ranked the stocks based on their ratio of EBIT to enterprise value, with the highest ratio assigned a rank of one and the lowest assigned a rank of 3,500. Finally, he combined the rankings (if a company ranked 20 for return on capital and 10 for EBIT to enterprise value, the combined ranking was 30).For practical purposes, Greenblatt recommends investing in 20 to 30 stocks by purchasing five to seven every few months. The holding period he advises for each stock is one year. He believes this strategy will allow you to make changes on only a few stocks at a time as opposed to liquidating and repurchasing the entire portfolio at once.

Performance

Greenblatt tested his investing strategy over a 17-year period and earned an average annual return of 30.8%. He held 30 stocks at a time and held each stock for one year.In the book, Greenblatt devotes an entire chapter to explaining that the strategy is not a “magic bullet” that always works. During his test period, he found that, on average, five of every 12 months underperformed the market. Looking at full-year periods, once every four years the approach failed to beat the market.Sticking to a strategy that is not working in the short run even if it has a good long-term record can be difficult, Greenblatt says, but he believes you will be better off doing just that. Greenspan supposed that following the latest fad or short-term investment ideas will not yield market-beating results.

Narrowing the Stock Universe

The first step is to remove all over-the-counter stocks (OTC) and ADRs (shares of foreign companies trading on U.S. exchanges). Greenblatt’s initial database of stocks included only exchange-traded stocks. Next, all stocks in the financial and utility sectors are excluded due to their unique financial structures.

Market Capitalization

While Greenblatt’s original study included stocks with market capitalizations of $50 million or greater, he subsequently modified the minimum value for market capitalization between $50 million and $5 billion, depending upon on liquidity needs and risk aversion.

Return on Invested Capital

Return on capital measures the return a company achieves after investing in the business; the higher the return on capital, the better the investment.Tangible capital is defined as accounts receivable plus inventory plus cash minus accounts payable. This figure is based on the fact that a company needs to fund its receivables and inventory but does not have a cash outlay for accounts payable. For our screen, we require a return on invested capital greater than 25%, as specified in Greenblatt’s alternative screening suggestions.

EBIT to Enterprise Value

The ratio of EBIT to enterprise value helps to measure the earnings potential of a stock versus its value. To calculate, Greenblatt divides EBIT by enterprise value. For this screen, we use the EBIT-to-enterprise-value ratio to narrow the field to 30 stocks by choosing those with the highest ratio.

Conclusion

Like any stock screening strategy, blindly buying and selling stocks is never a good idea. Developing and implementing disciplined buy, sell and hold strategies is a better option. Greenblatt’s Magic Formula is not revolutionary, but does provide a new twist on the old value investing ideas. While his past record is impressive, it will be interesting to see how the screen holds up during this period of market turmoil and its aftermath.

Joel Greenblatt’s Magic Formula Criteria

- Companies in the financial and utilities sectors are excluded

- Over the counter stocks are eliminated

- Non-US companies are excluded

- Market capitalization is greater than $50 million

- Return on capital is greater than 25%

- Return on capital is found by dividing earnings before interest and taxes (EBIT) by tangible capital

- EBIT = Pretax income + interest expense

- Tangible capital = accounts receivable + inventory + cash – accounts payable + net fixed assets

- Pick the 30 stocks with the highest earnings yield

- Earnings yield = EBIT/ Enterprise value

- Enterprise value = market value of equity (including preferred stock) + interest-bearing debt – excess cash