Hopefully–and thanks to all the good wishes–I am in recovery or….a moment of silence.

Money and Inflation

Video: Money and Inflation with Greg Rehmke http://youtu.be/efDGIMpE3OE

Perpetual Fed Intervention and Manipulation

| James Grant Blasts Fed AgainThu 20 Sep 12 http://video.cnbc.com/gallery/?video=3000117340We are in a market without the yield. We shouldn’t have this. There is a great stampede in the corporate debt, in speculative grade debt by people that are not getting paid for the risk.They’re looking for yield. The credit markets when they are left un-manipulated convey information.A struggling issue will pay more than a sound issue. You read the financials, and that is priced in the marketplace. When there’s a stampede for yield bond, the credit markets convey no information except for the one and only important piece of information — this is what they want to have it be priced at.Maria at CNBC: “Let me ask you about the implications or –you’re talking about long-term implications.”

James Grant: “The implications for the saver — there are some very short term implications as well. yeah, I mean — if you are and you are confronting zero percent. Your options are all together unpalatable. And they are the options the government presents you. I heard somebody — I heard a former fed guy the other day castigate Mitt Romney for daring to challenge the independents of the fed. Who said the fed was the fourth branch of government? These guys are answerable to Gongress, right? Congress, under the constitution has the power to coin money and regulate the value thereof. Where do these guys get off?

Maria of CNBC: “And yet the Congress is not doing anything, in terms of their own fiscal policy.”

James Grant: “They’re on vacation. Exactly. What is the best way to invest around these realities that we face?

We recognize that the Fed keeps bailing everybody out, we recognize this is going to be the case until 2015. How do I make money on this story? We have written favorably, recently about General Motors. GM was trading 6.5 times or so, the 2013 estimate. It’s got all manner of hair on it, beneath the hair, there’s a sound post balance sheet — post bankruptcy balance sheet, we think even adjusted for immediate pension difficulties.

There is the fact that the American odometer is at near record highs. People are driving old cars. We think GM is in a pretty good place with respect to its product, And the stock is cheap on the numbers. So what we think one ought to do is to look for a margin of safety in equity like investments that will stand to benefit from these monetary exertions. We are all living in a world of speculation and manipulation. It’s not so easy. But there are things to do.

Your latest cartoon, “Darling, you’re so quantitative.” “Yes, not everyone hates this policy. This is a policy for Greenwich, Connecticut (Home of Hedge Funds). It’s great if you can fund zero%. if you are on the inside and know when they are going to do what they’re going to do, it’s great. Your asset prices levitate. It’s good for commercial real estate probably; good for a lot of things, but we don’t know all together what it’s bad for. We have a general sense, but we’ll find out more in about three years.

“When do you think the Fed should start raising interest rates?”

James Grant: “Two years ago. I think that rates are prices, and price control is a demonstrated failure as a public policy. Chairman Bernanke himself castigated the Nixon administration for imposing price controls 1971. He was right, price control fails. What he’s doing is controlling prices. He’s suppressing interest rates, and this phrase, the investment portfolio balance channel or some such. He’s attempting to press — to lift equity markets, because that will, he says, induce economic growth. Shouldn’t equity markets respond or discount wholesome growth rather than be muscled higher? The answer to that question is yes.”

Maria, “You’re a free markets guy, I agree, you want the markets to work the way the markets ought to work. Is there any reason to believe that you don’t want — you want to get in front of this train, that is the stock market?”

James Grant: “I think it’s where security analysis comes in, I think it’s where an investment in gold and silver comes in. Central Banks around the world are bound and determined — either through actions or words to debase their currency. They’re telling us. How high can gold go in this scenario? The nice thing about gold, it has no PE multiple. There’s no telling. Gold is a speculative assets — it earns in yields, gold is a speculation on an anticipated macro economic outcome. That macro economic outcome being the systematic debasement of currencies by the central banks. They’ve done qe 3, right? The economy appears not to be in the best of health.

Why wouldn’t they do Quantitative Easing 4? What intellectual argument do they have against doing it again and again and again? That’s one of the risks, right? Well, it’s open ended already. Maybe they didn’t need it, because we know it’s open ended. They can save the paper in the press release.

Maria: You mentioned real estate. One of the unintended consequences in Hong Kong because of the dollar relationship. There is an argument to be made that you want to be buying hard assets like a gold, like real estate.

James Grant: I think it depends how it’s valued. in some markets in this country, you can finance them at all time — certainly generational low interest rates in the mortgage market. That’s not a bad way to hedge against the currency.

Maria: “I know Bernanke knows you have been so critical. What is his answer to you, when you raise these points?”

James Grant: “We don’t talk any more.”

Maria: ” Thank you so much. Jim Grant for joining us, founder of Grant’s Interest Rate Observer.

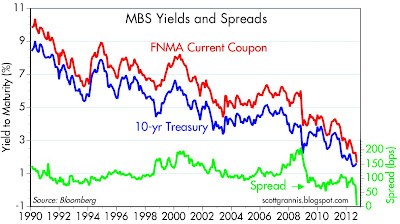

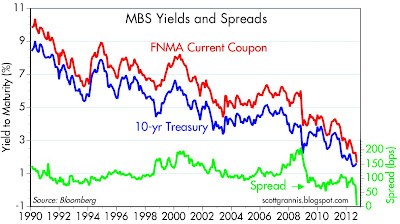

Look at the distortion of MBS compared to US Treasuries

|

—

Mason Hawkins of Longleaf Partners Interview with GuruFocus

Sep 17, 2012 | About: DIS -0.06%DTV +1.05%LVLT +0.04%TRV +0.12%L +0.51%BRK.A -0.63%BRK.B -0.34%

Mason Hawkins is chairman and chief executive officer of Longleaf Partners, an investment advisory firm with $34 billion in assets under management. He recently took investing questions from GuruFocus readers. Here are his responses:

Investment Philosophy

Question: You manage more than $30 billion, but most of the assets are in the top 10 names. Why do you run such a concentrated portfolio?

We believe that holding a limited number of financially strong, competitively entrenched businesses at a significant discount to intrinsic value has lower risk of capital loss and better return opportunity than owning a large number of inferior businesses at higher prices. Statistical analysis shows that security-specific risk is adequately diversified after 14 names in different industries, and the incremental benefit of each additional holding is negligible. We own 18-22 companies to allow us to be amply diversified but have the flexibility to overweight a name or own more than one business within an industry. Finding investments that meet our disciplines at any given time is normally difficult. When one qualifies, we want it to have an impact when value is recognized. Limiting the portfolios to our 20 most qualified investments allows us to know the companies we own and their managements extremely well while providing ample security-specific diversification. As Longleaf’s largest investor group, we want our capital in competitively advantaged companies run by competent managements that sell at materially discounted prices.

Question: We know that you assign every investment an appraised value. How does quality play a role here? Question: In your opinion, what kind of companies are high-quality companies?

We view quality through the lens of a business owner. We want to own companies with the following qualitative characteristics. 1) Unique assets having distinct and sustainable competitive advantages that enable pricing power, long-term earnings growth, and stable or increasing profit margins. 2) High returns on capital and on equity as measured by free cash flow rather than earnings. 3) Capable management teams with operating skills, capital allocation prowess, and properly aligned, ownership-based incentives. While most agree that growing businesses that generate high returns meet the quality definition, many also want earnings stability. Our long-term horizon gives us the opportunity to own quality businesses at deep discounts at points when their earnings may be temporarily depressed. By focusing on a company’s competitive advantages and what the value will be in 3-5 years, we can buy companies such as Disney (DIS) after September 11, 2001, or Philips today that are dominant leaders in their industries and will grow with high returns, but have short-term earnings challenges.

Question: A fan of yours from nearby, in Jonesboro, Ark. – I’m curious what initial measures/qualitative factors catch your attention? Is it a depressed stock price? Secular shifts in an industry? Great business or management? Price/FCF?

We are attracted by all of the above and more. We run numerous screens to source new ideas including price to cash flow, insider purchases and ownership, corporate buy backs, industries/sectors out of favor, and the new low lists for example. We also keep a master list of appraisals for 600+ good businesses that we would like to own at the right price. Because of the short investment time horizons in the markets today, we often get the chance to buy businesses that we have previously owned. Generally, companies and managements that we have lived with successfully in the past come with fewer unknowns and therefore less appraisal risk.

Value Investing Environment

Question: Your investment performance target is 10% plus inflation. You historically achieved this goal over ten year periods through mid- 2007. What factors have been preventing you from achieving this goal in the 10 year periods since then? Do you think the value investing landscape has changed?

The value investing landscape is certainly out of favor today with investors clamoring for what they perceive to be safety – whether in bonds, high dividend stocks, or stocks that are viewed as “higher quality” meaning more stable. Most companies with a degree of economic cyclicality or some financial leverage have been ignored for much of the past year. We have faced previous periods when intrinsic value investing was out of favor, and we know that the key to delivering outsized long-term returns is owning good businesses at large margins of safety of value over price and remaining patient. Any time a performance period includes a negative return, an absolute return goal becomes challenged. Fortunately, in our almost 40 years as a firm and 25 years managing Longleaf Partners Fund, we have had few down years. The worst of those, however, was in 2008 with the economic crisis. Strong absolute returns are required to make up for that year, but we do not believe the world has changed in a way that will make achieving inflation plus 10% difficult. Over Southeastern’s history, including the post 2008 period, we have achieved our absolute return goal 78% of the time over quarterly rolling 10 year periods. The current end point for reviewing performance incorporates an environment that the U.S. had not encountered since the Great Depression. That was the only other period when bonds outperformed equities over 10 years, and the S&P dividend yield was higher than the 10 year Treasury yield. We think that the view that broad equity returns are limited to around 3% going forward based on an expected low GDP growth plus dividend yield misses the importance of retained earnings and its significant capital compounding benefit. As an active manager who is selecting good businesses and capable management teams that are undervalued out of the broader universe of equities, we expect to deliver better than the broad market returns over time as we have over Southeastern’s history.

Stocks

Question: You have been a long-term investor of Level 3. The company has been doing poorly and in a lot of financial stress. What is your thesis in investing in Level 3 (LVLT)? Isn’t it a value trap?

Level 3 is among the world’s largest internet backbone service companies offering a unique combination of long-haul and metropolitan fiber routes spanning 45 countries on 3 continents. No other single provider offers the same range of global coverage. Demand is rapidly growing aided by the increase in mobile and cloud computing as well as growth from voice, data and video traffic across the internet. Over the last ten years, rising demand combined with industry consolidation have enabled pricing strength as excess capacity from overbuilding in the dot.com era has declined. Because of the high contribution margins in this largely fixed cost business, revenue increases will drive large free cash flow and value growth. The current top line value growth makes Level 3 one of our most compelling investments.

The company sells far below our appraisal for several reasons including the perception of “financial stress” echoed in your question. While Level 3 has a history of being highly levered, the company has successfully managed its capital structure even through the challenge of the financial crisis. Last year’s acquisition of Global Crossing essentially removed the company’s debt strain as EBITDA to Net Debt greatly improved. The acquisition also added three board members from Temasek, the Singaporean fund, who will bring additional focus on successful sales execution. While some would argue that the company sells near industry EBITDA multiples, those views do not account for Level 3’s lower required capex and a substantial tax advantage relative to competitors.

Question: What is your view on Travelers (TRV)’s competitive advantage? How troubling is the huge fixed-income portion of their investment portfolio (in relation to future inflation)? How much do you like Jay Fishman? I really like the fact they are aggressively repurchasing shares and the fact that it is trading at book value, which I estimate to earn around 13% (ROE).

Travelers’ main competitive advantages are its depth of product offerings as well as its leading edge technology platforms that make the company a preferred provider for insurance agents. In regards to their fixed income portfolio and future inflation, longer-term we prefer higher interest rates since interest income is normally a major source of earnings. While book value could get marked down some with inflation, earnings from interest income would increase. In the meantime, the company is reducing capital invested in the business and wisely buying shares at a discount to book and to our appraisal value. Jay Fishman is both a capable operator and an astute capital allocator as evidenced by the company’s strong ROE and growing value, even during the past soft pricing period in the insurance industry. He’s led the industry’s improved pricing environment.

Question: Considering the margin of safety with which Longleaf invests, how much of the loss in ACS is permanent impairment of capital and how much is paper loss? If there is permanent impairment of capital, what were the mistakes made in the investments? If the thesis hasn’t changed why haven’t you added heavily to this investment due to the bargain that it would theoretically represent at this price?

We believe that ACS represents an unrealized paper loss, not a permanent impairment of capital, based on our conservative appraisal for the company today combined with the substantial dividends we have received during our investment. However, we consider ACS a mistake from our initial purchase in November 2007, as appraisal value has declined over the holding period primarily due to the company’s ill-timed, leveraged purchase of 20% of Iberdrola. ACS’s price over the last year has been primarily impacted by concerns over its stake in Iberdrola and to a lesser extent, its 50% stake in Hochtief. The appraisal decline was driven largely by the company selling approximately half of its Iberdrola stake at around €3.50 a share vs. our appraisal of over €5 a share. Since ACS purchased Iberdrola shares using leverage, the appraisal decline was amplified. In our appraisal of ACS, we carry the remaining Iberdrola stake at market, which is down over 30% from its December price. Broader concerns over the Spanish and European economy have further pressured ACS’s price. Spain’s main index, the IBEX 35 where ACS is listed, contains 35 companies, many with low free float. As a result, ACS has become a proxy for betting against Spain with over 30% of the stock’s free float being shorted. We added to our position in late April 2012 as price fell below €14 and today maintain a slightly overweight position in Longleaf Partners International Fund. While our average cost for ACS is higher, we have received €9.90 per share in dividends over the course of our investment.

Question: How do you think about DIRECTV (DTV) in terms of competitive advantage and valuation?

DIRECTV is the largest satellite broadcaster in the U.S. and has rapidly growing, dominant market share in Latin America. Domestically, the company offers better quality and programming to attract high-end customers that pay premium rates with little churn. Pricing power has driven rising ARPU (average revenue per user). Because viewers will “unplug” for some of their viewing over time, we place a lower multiple on the U.S. than in the past. But live sports where DTV has unique offerings are much less vulnerable to delayed viewing. In Latin and South America, DTV has almost no competition in most countries because cable has not been and will not be installed in less developed places with minimal infrastructure. Although the stock is multiples above our cost in DTV, the price remains below our appraisal as value has grown steadily from management’s reinvestment of the cash coupon into high-returning Latin America and discounted shares.

Question: Have you ever looked at Leucadia (L), particularly since it’s trading at 80% of book value?

We purchased Leucadia in the second quarter in Longleaf Partners Small-Cap Fund. Since it is a new position, we prefer not to comment on the company specifics at this time. We have high regard for our partners, Ian Cumming and Joe Steinberg.

Question: Have you ever looked at buying Berkshire Hathaway (BRK.A)(BRK.B)? If so, what do you think is the best way to value the company?

We recently purchased Berkshire Hathaway for the second time in our history when the stock fell near book value. The appraisal is based on a sum of the parts analysis which has become more relevant as the non-insurance businesses have become a larger part of the company. Berkshire’s capital strength, investment success, and underwriting knowledge provide an advantage in the insurance businesses, which comprise just over half of our appraisal. The competitively entrenched operating companies include the railroad, Burlington Northern, the utility and pipeline business, MidAmerican, and a number of smaller companies. We have superior partners not only in Warren Buffett, but also in the next level of management responsible for the different pieces. His recent share repurchase reflects his view that the stock is discounted. Additionally, the board is structured to insure a consistent approach and culture long past Buffett’s tenure.

As a result of the investment opportunity created by the fear and dislocation we have discussed in this interview, we have decided to launch the Longleaf Partners Global Fund in the 4th quarter of this year. While we have been managing global separate accounts for over 10 years, we believe the current market environment makes this a compelling time to make a global mutual fund available to our partners.