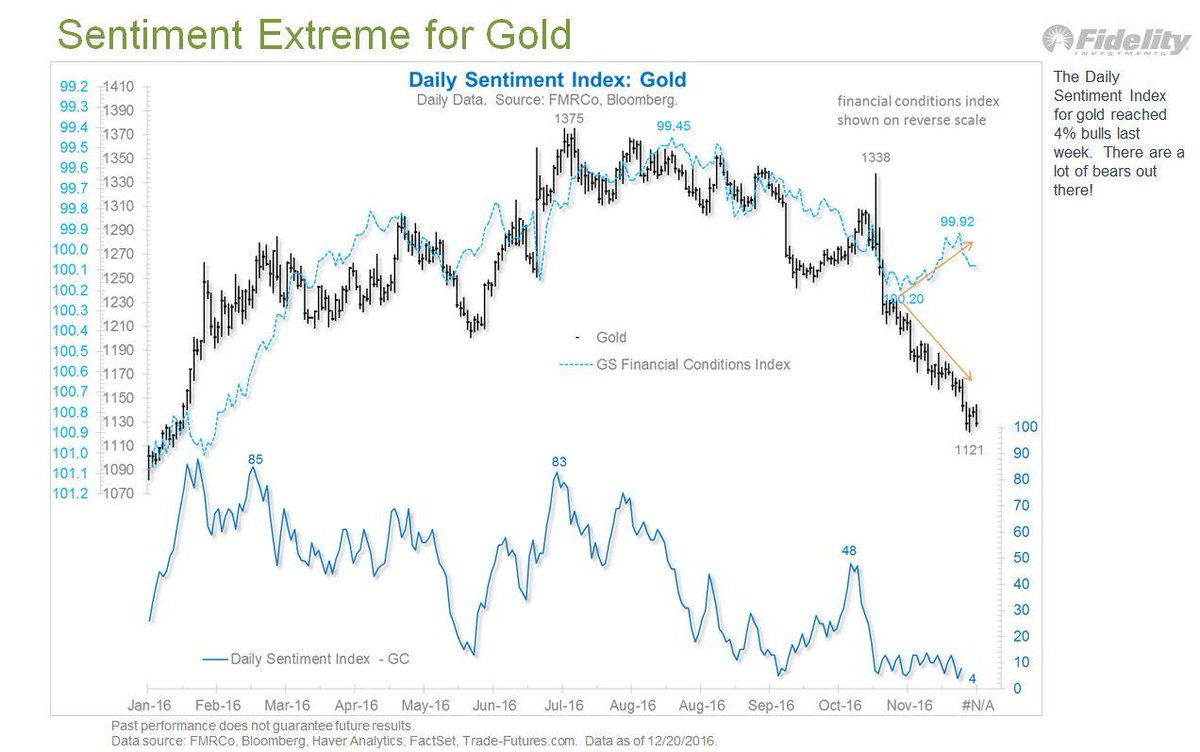

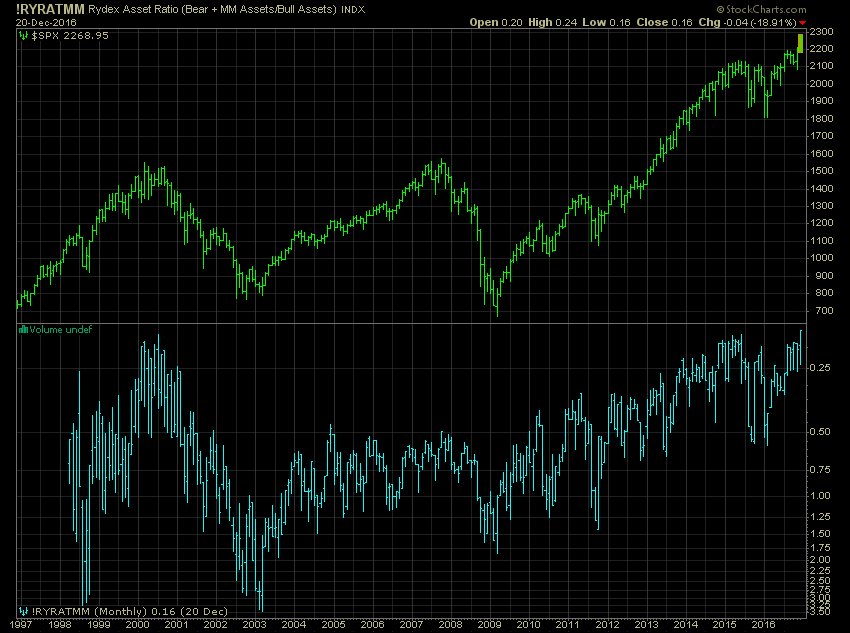

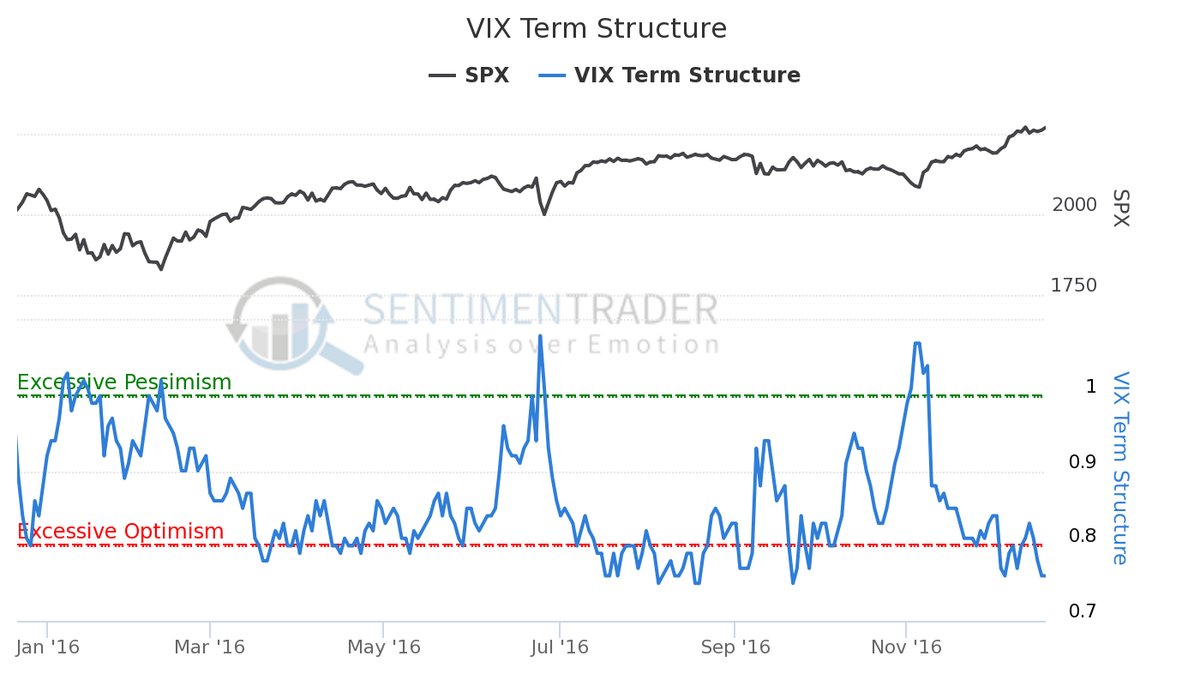

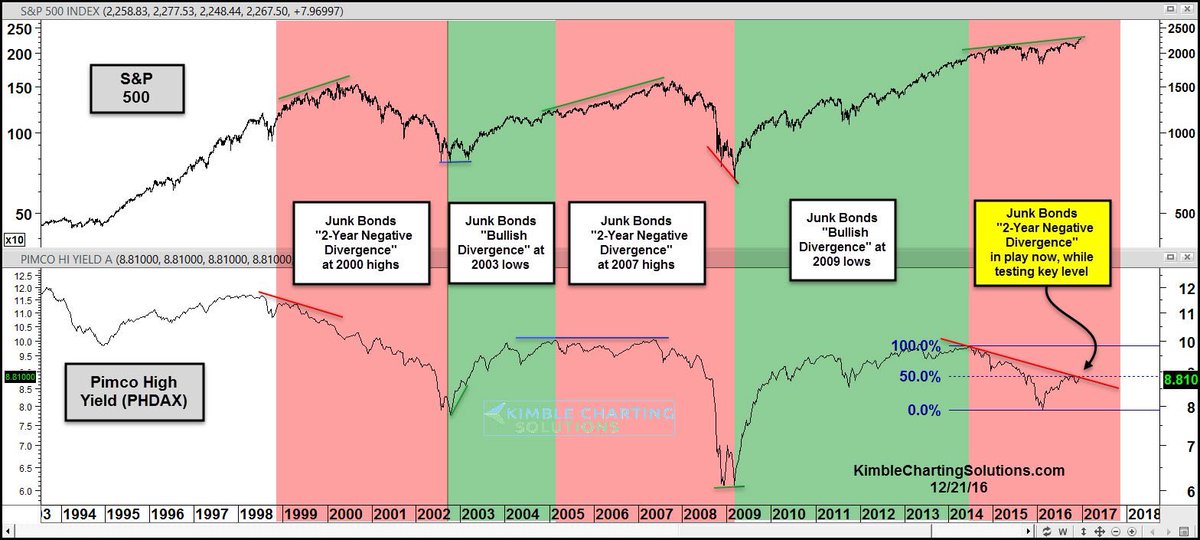

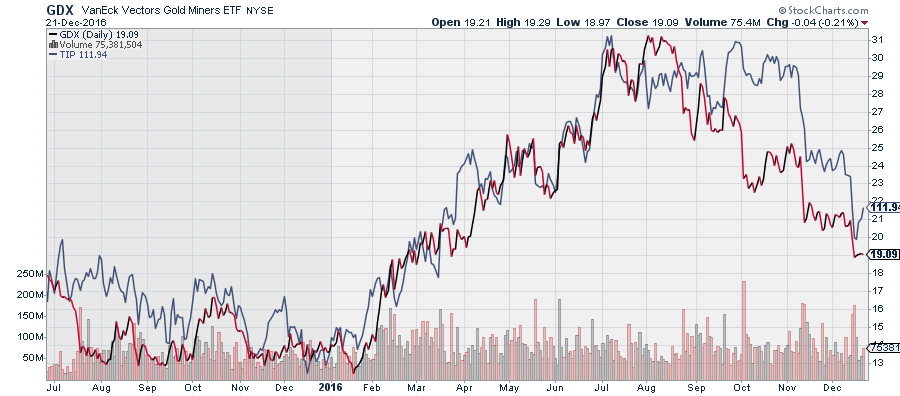

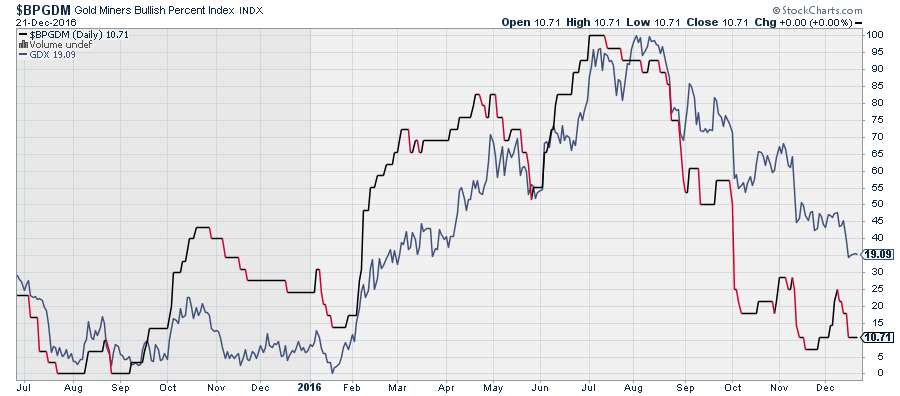

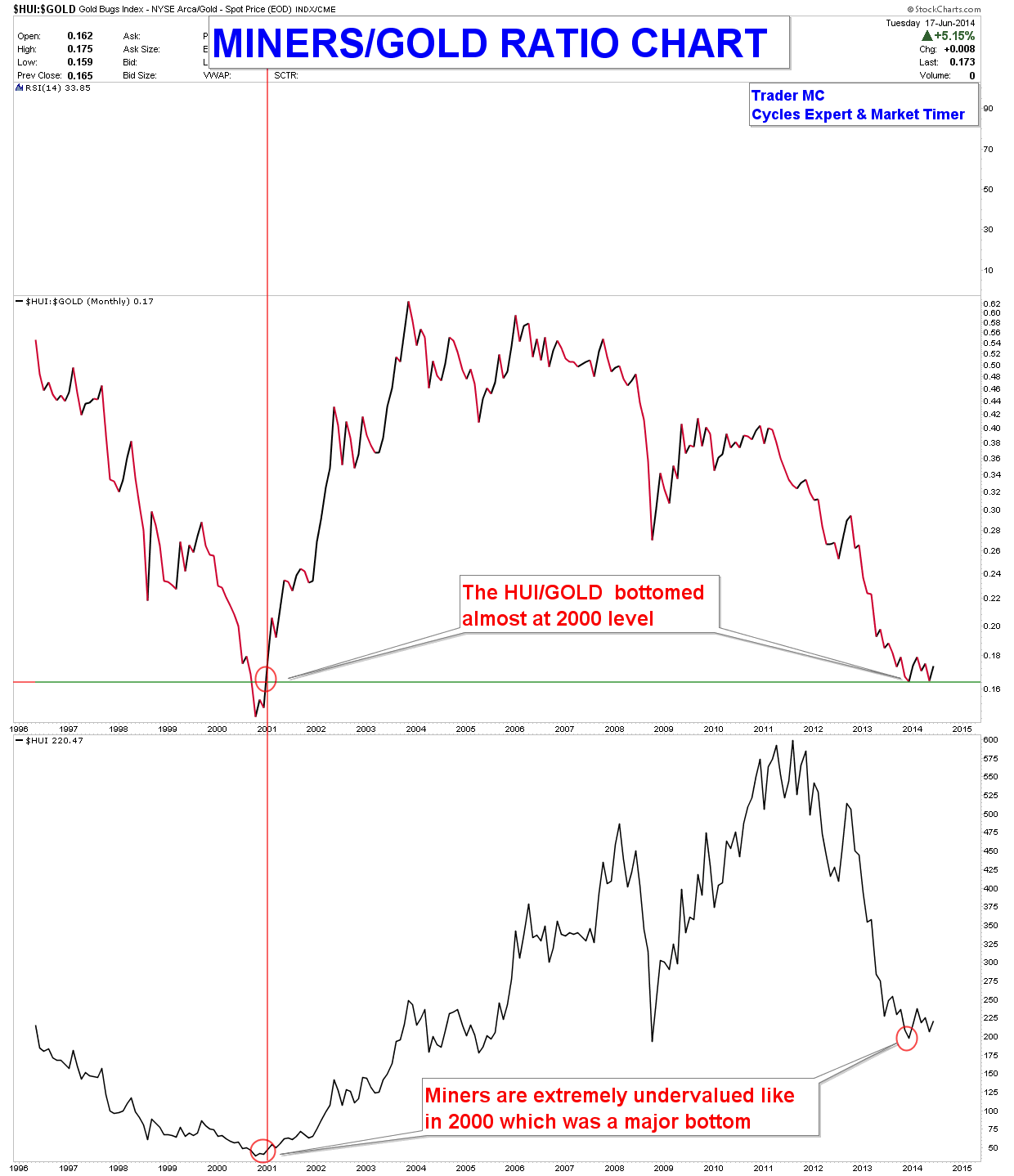

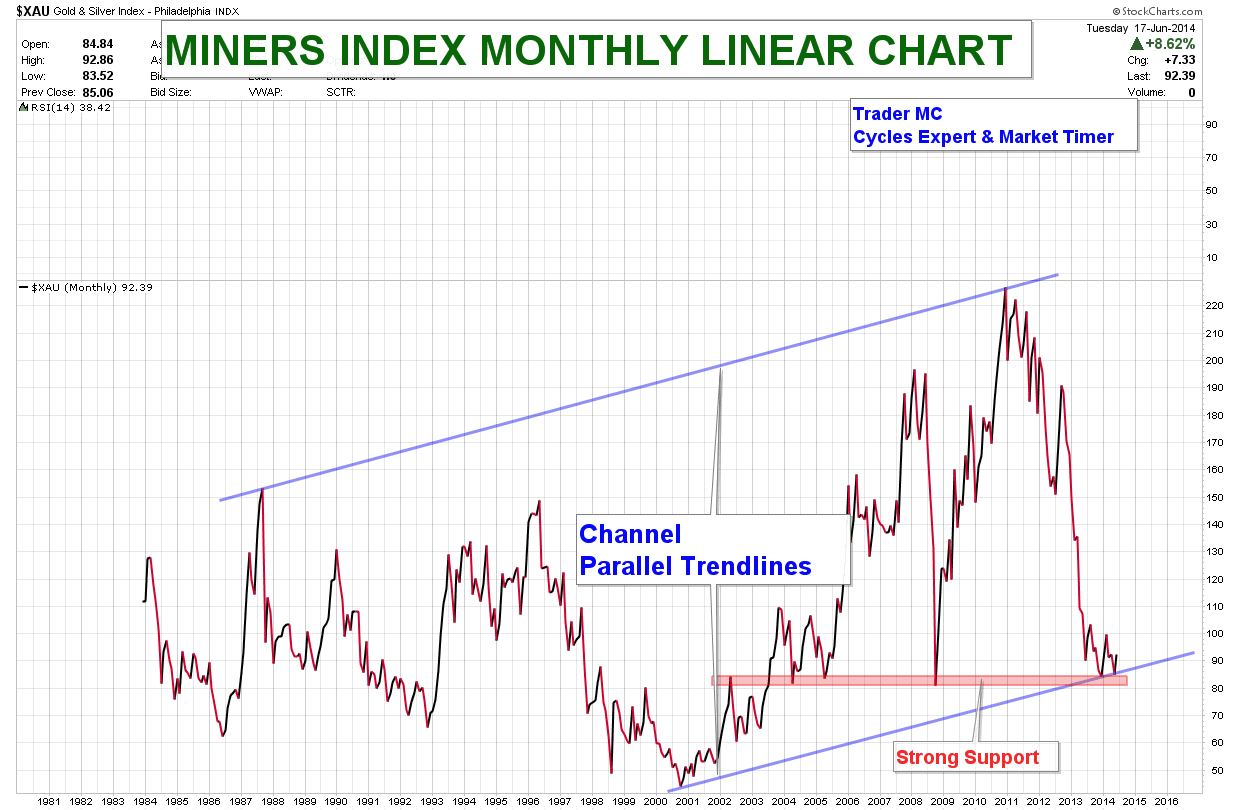

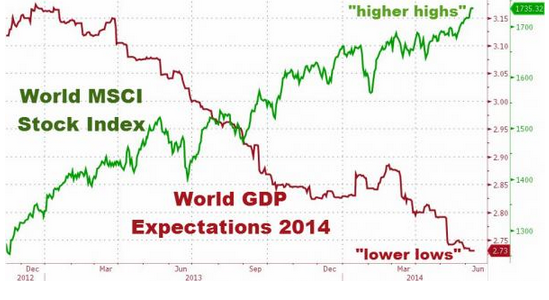

I like to have a reference to refer back to a year or five years from now capturing certain points in time. The market seems to be placing peak confidence in financial assets (stocks) vs. gold.

This post continues from a prior post: http://csinvesting.org/2016/11/17/when-no-one-wants-em-search-strategy/

The Bearish Gold Articles keep on coming: http://www.businessinsider.com/heres-why-you-should-never-buy-and-hold-gold-2016-12

http://seekingalpha.com/article/4032167-gold-miners-perfect-bear-case

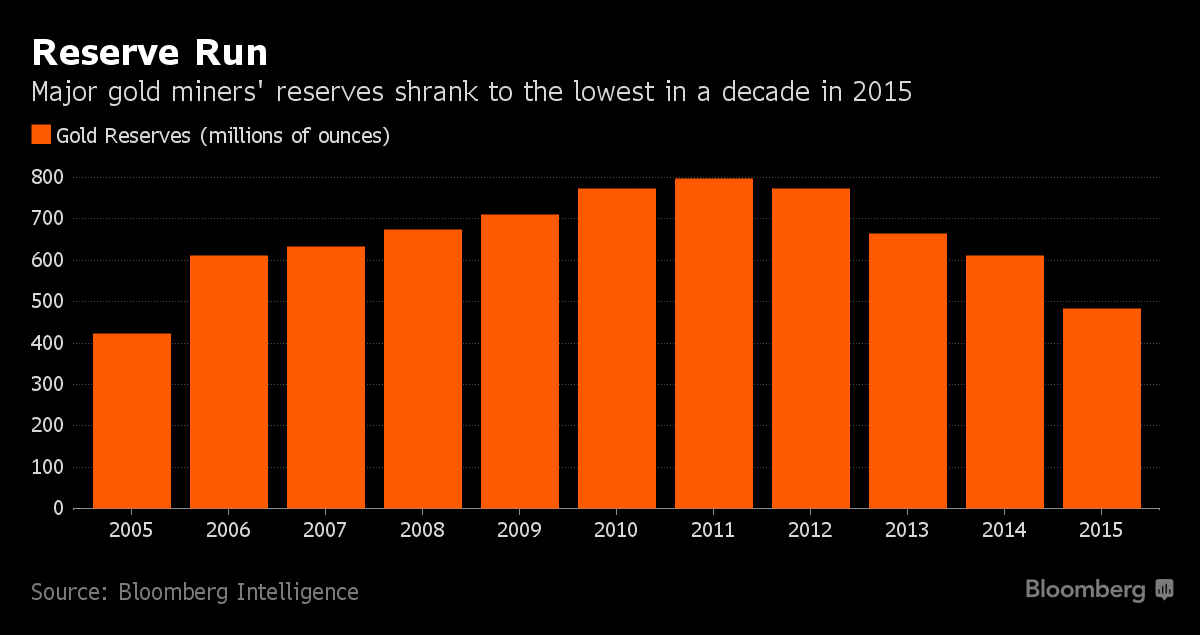

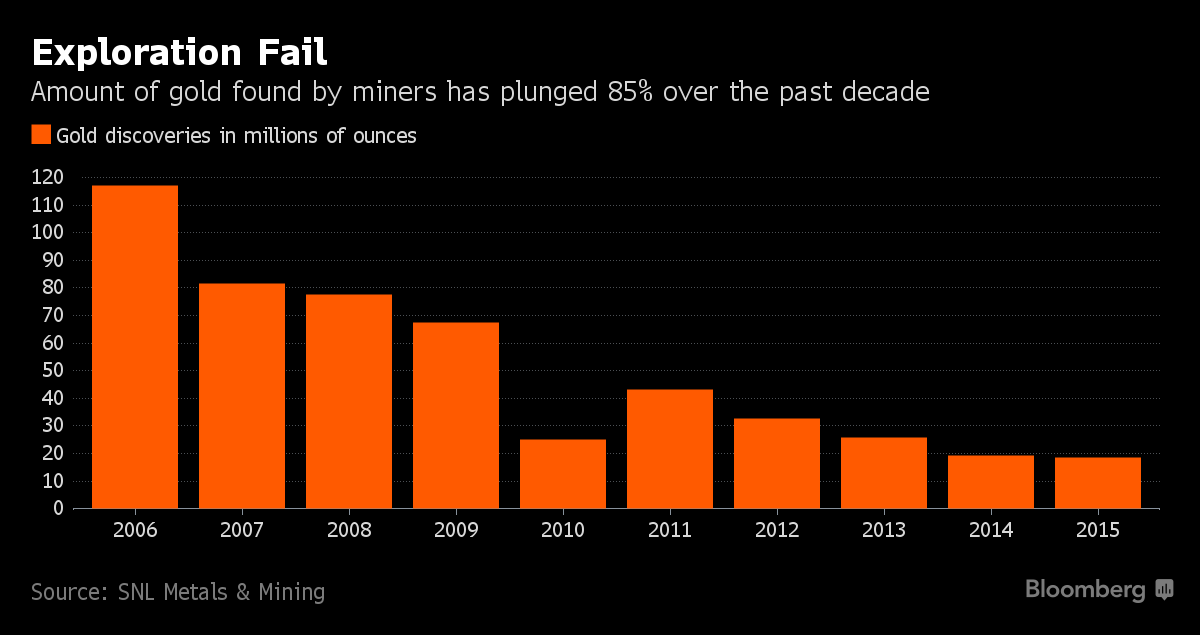

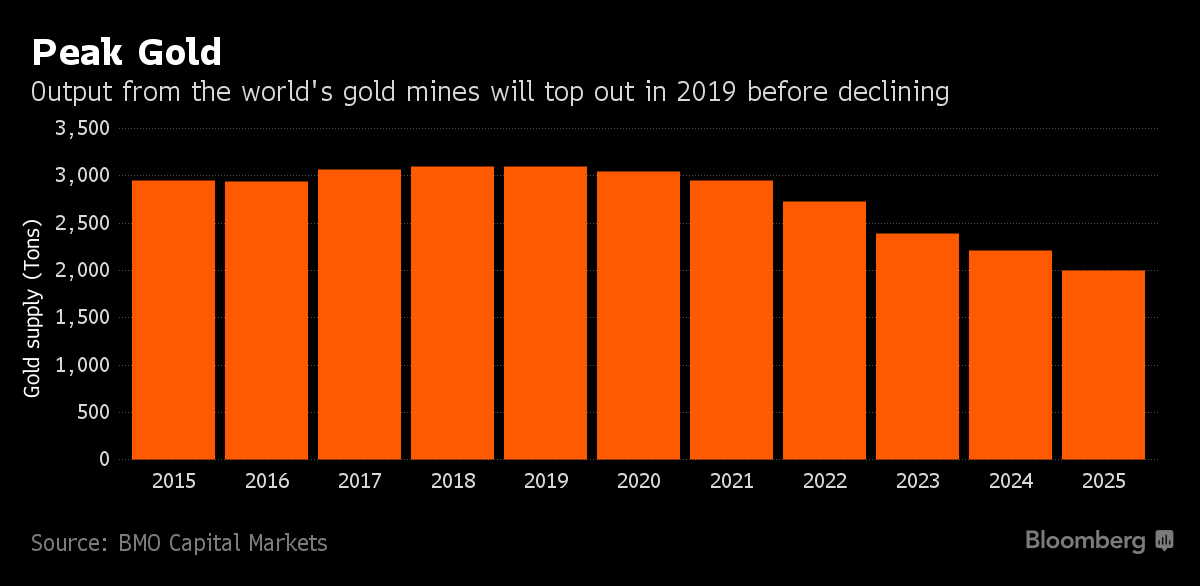

http://bloom.bg/2hWukKn Running out of metal.

Even bullish mining investors expect “waterfall declines” and gold going below $1,100. Momentum creates the news: http://www.kitco.com/news/video/show/Gold–Silver-Outlook-2017/1456/2016-12-22/Mining-Stocks-Could-See-Waterfall-Declines—David-Erfle To be fair, he is long-term bullish, but note the “certainty, inevitability” of gold falling in USD below $1,100 or even to $1,000. Since he is probably considered strong hands (better capitalized with more experience in precious metals miners) his view indicates VERY bearish near-term (1 day to two/three months sentiment). As I interprete this news.

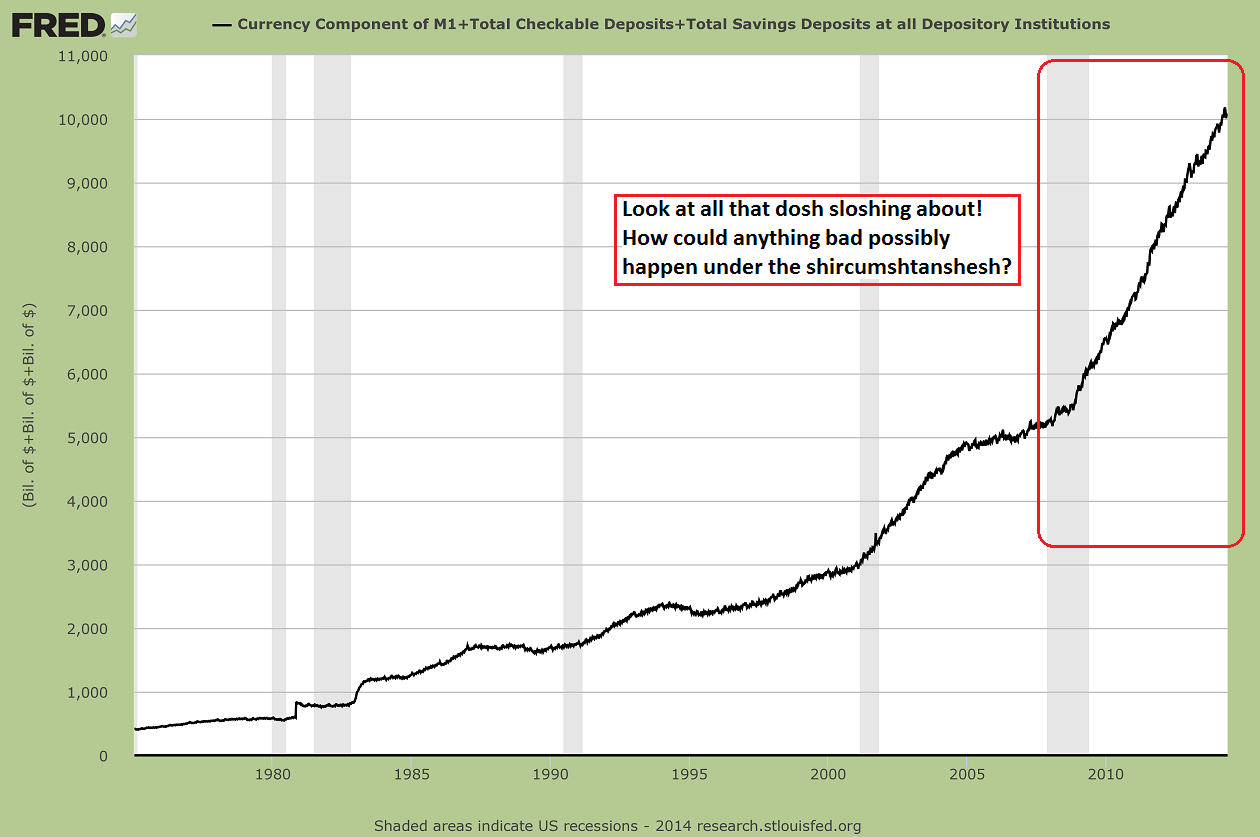

Financial risk is increasing on US company balance sheets, but then who cares while confidence is high?

-

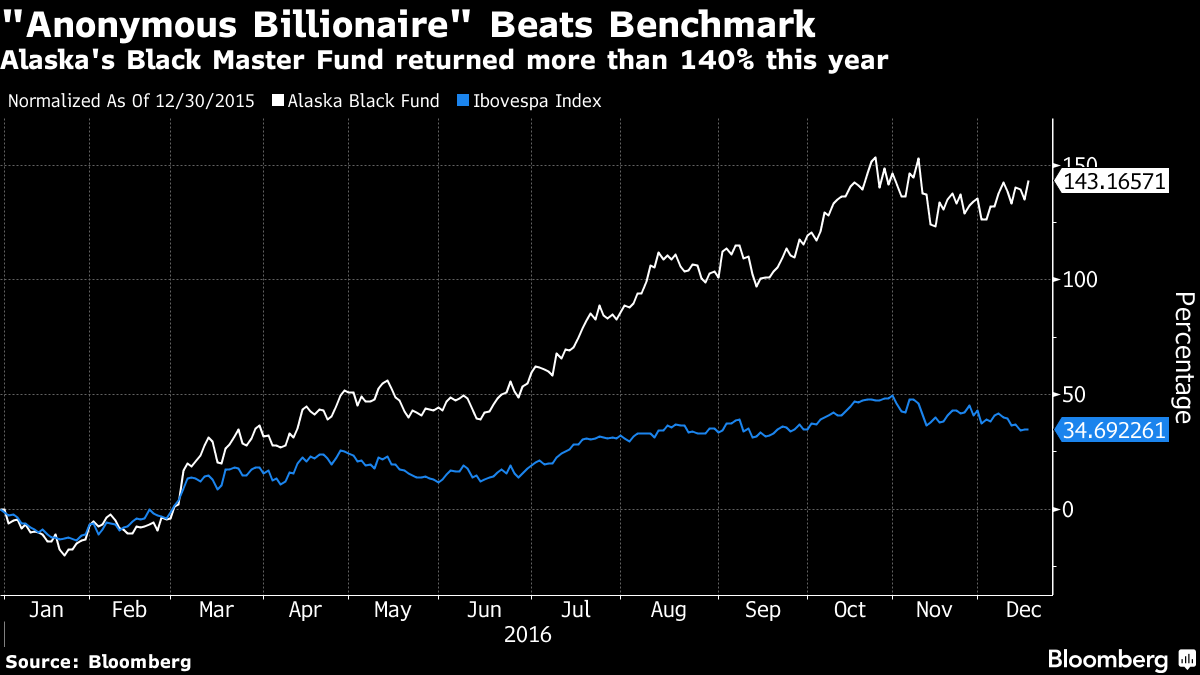

Alaska fund is No.2 fund focused on Brazilian equities

-

Barros’s fund is now buying up Fibria, Marcopolo, Vale

Luiz Alves Paes de Barros is something of an enigma in Sao Paulo’s financial circles. At 69, he’s known around town as the “anonymous billionaire” for quietly amassing a fortune by wagering on stocks almost no one else seemed to want.

In Magazine Luiza SA, Barros may have made one of his best bets yet.

Starting in late 2015, Barros’s Alaska Investimentos Ltda. made the battered retailer one of its biggest holdings, a brazen move in a nation stuck in the middle of its worst recession in a century. It paid off. Magazine Luiza has surged more than 1,000 percent since reaching a record low about a year ago, making it the top stock in one of the world’s top-performing markets. That turned Alaska’s Black Master, which Barros co-manages with Henrique Bredda and Ney Miyamoto, into the No. 2 fund among 569 peers focused on Brazilian equities, according to data compiled by Bloomberg.

Barros’s latest success only adds to the intrigue surrounding one of Brazil’s most storied, but media-shy, individual investors. Early in his career, he traded commodities and was a partner of star fund manager Luis Stuhlberger at what is now Credit Suisse Hedging-Griffo. Barros then spent the next half century investing only his own cash, almost exclusively in Brazilian stocks, and regulatory filings show he personally holds 1.2 billion reais in equities.

When it comes to managing other people’s money, Barros is a rookie, having co-founded Alaska in July 2015. But his investing method remains the same. He only holds a handful of stocks, favors companies with bottom-of-the-barrel valuations and usually jumps in as everyone else is bailing.

“Perfecting patience is all I’ve done over the past 50 years,” Barros says. “I love when things get bad. When it’s bad, I buy.”

During two interviews, first in Alaska’s shoebox office in the heart of Sao Paulo’s financial district and then at his personal office on the city’s oldest business thoroughfare, the silver-haired asset manager explained what drew him to Magazine Luiza and went over the stocks he likes now: Fibria Celulose SA, Braskem SA, Marcopolo SA and Vale SA.

“The market has forgotten these stocks,” he says.

Alaska started building a stake in petrochemicals maker Braskem about four months ago (the stock has surged 48 percent since mid-August after tumbling 20 percent this year before then) and pulpmaker Fibria a few months later. Barros likes both companies because they’re fundamentally sound — and valuations are low. Braskem’s price-to-earnings ratio is 8.3, less than half the level three years ago. Fibria’s valuation is less than half the average of the past two years.Marcopolo, a maker of trucks and buses, is a play on Brazil’s rebound from recession, while miner Vale will benefit as global investors start seeking value again over safety. There’s no economic expansion in Brazil without infrastructure investments, he says.

“Vale won’t be a disaster for anyone. When iron-ore prices rise again, Vale will fly,” he said.

If those stocks return just a fraction of what Magazine Luiza did, they’d count as stellar investments. In all, Alaska acquired almost 40 percent of Magazine Luiza’s free-floating shares, regulatory filings show. In 2016’s third quarter, Alaska unloaded half its stake. What’s left of Alaska’s holdings in Magazine Luiza is now worth about 111 million reais ($33 million).

Asked how he knew Magazine Luiza would do as well as it did, he says he didn’t. “I just knew it was cheap.” The fact that the retailer of appliances and electronics had a market value of 180 million reais even though a bank had offered to pay 300 million reais for the right to offer extended guarantees on Magazine Luiza products made that clear.

“Either the bank was crazy or there was value there,” Barros says.

Alaska’s Black Master fund has returned 143 percent in 2016, compared with a 33 percent gain for Brazil’s benchmark Ibovespa stock index. The gains were also driven by a stake in Cia. de Saneamento do Parana, the water utility known as Sanepar that’s almost tripled this year.

Alaska is still a relatively small player in Brazil’s 2.38 trillion-real stock market. The asset manager employs 11 people (“That includes the lady who serves the coffee,” Barros says). While Alaska oversees about 1.6 billion reais, three-quarters of that is Barros’s own cash. But the fund is actively seeking new clients.

Why now, after 50 years of going it alone?

“Because I’m positive that the market is going to rise,” he says.