If you are free Saturday then check this out:

http://vip.marketfy.com/valueinvestingseries/

From my friend, Toby Carlisle, of Deep Value Investing Fame.

HAPPY WEEKEND!

If you are free Saturday then check this out:

http://vip.marketfy.com/valueinvestingseries/

From my friend, Toby Carlisle, of Deep Value Investing Fame.

HAPPY WEEKEND!

Posted in Free Courses

JUN 24, 2010

Many of you enjoyed my previous transcript of a talk Li Lu gave at Columbia University. Thanks to Joe Koster, you can now view a more recent lecture he gave to Bruce Greenwald’s value investing class in April of 2010. Seen here: http://www7.gsb.columbia.edu/video/v/node/1365?page=26 Based on Berkshire’s investment in BYD, the fact that Lu manages Charlie Munger’s money, and that even Buffett would give money to Lu if he ever retired (according to Greenwald) makes me think Li Lu is an investor worth watching.

With that in mind, I believe it is insightful to study whatever you can find about him and his approach. I think this lecture from 2010 is great. The recording has some audio issues making it difficult to hear and I thought that some of you might enjoy reading notes from the talk. This is not a true transcript, but an approximation of what was said. I think it comes pretty close, having listened to the lecture a few times. I think you will find it helpful and Lu’s talk rewarding.

Bruce Greenwald: Warren Buffett says that when he retires, there are three people he would like to manage his money. First is Seth Klarman of the Baupost Group, who you will hear from later in the course. Next is Greg Alexander of the Sequoia Fund. Third is Li Lu. He happens to manage all of Charlie Munger’s money. I have a small investment with him and in four years it is up 400%.

http://streetcapitalist.com/2010/06/24/li-lus-2010-lecture-at-columbia/

http://www.bengrahaminvesting.ca/Resources/videos.htm#2006_Guest_Speakers

Letters to a young analyst (Great blog for books):

http://www.readingthemarkets.blogspot.com/2014/09/brakke-letters-to-young-analyst.html

Scottish Vote on Independence: https://www.youtube.com/watch?v=PD5Imb7vWSc

Posted in Free Courses, Investing Gurus

Tagged Graham Center, Ivey School, Li Liu, Reading the market

Welcome to Learning How to Learn: Powerful mental tools to help you master tough subjects

Learning How to Learn is for you—it’s meant to give you practical insight on how to learn more deeply and with less frustration. The lessons in this course can help you in learning many different subjects and skills. Whether you love language or math, music or physics, psychology or history, you’ll have a lot of fun, and learn a LOT about how to learn!

This is a 4-week course. Learning with others is more fun, so please feel free to share this course and these ideas with your friends and family. We’ve found that learners become so excited about these ideas that they can’t help sharing them with those in their circles—and with new friends made on the discussion forums through this course. Sharing helps build your own abilities! We’ve set up a Facebook page to let people know about the MOOC. Please feel free to go to the page and share if you like it and the course, (and give us a “like”)! We also have a Twitter hashtag on the course, #LH2L1 (for “Learning How to Learn, Session 1”).

SIGN UP: https://class.coursera.org/learning-001

CSInvesting: Wha? Learning how to learn? Wasn’t that what school was for? I know all that! This course will help you as an analyst and investor process new readings and material more efficiently. Whenever you learn a new industry or company, these skills will come in handy. I am taking the course. Even an old dog like me can learn. How about YOU?

An investing blog with humor: http://thefelderreport.com/ (Thanks to a reader!)

History

Bear-Markets-1871-to-date-Duration-and-Magnitude/ from Greenbackd.com

and

and now? ALL IN!

http://www.acting-man.com/?p=32263

R . I. P.

Lawrence H. White is Professor of Economics at George Mason University. He specializes in the theory and history of banking and money, and is best known for his work on free banking. He received his A.B. from Harvard and his M. A. and Ph.D. from the University of California, Los Angeles. He previously taught at New York University, the University of Georgia, and the University of Missouri – St. Louis.

Lawrence H. White is Professor of Economics at George Mason University. He specializes in the theory and history of banking and money, and is best known for his work on free banking. He received his A.B. from Harvard and his M. A. and Ph.D. from the University of California, Los Angeles. He previously taught at New York University, the University of Georgia, and the University of Missouri – St. Louis. Gonzalo Schwarz (moderator) manages the Awards and Grants program at the Atlas Network that include the prestigious Fisher Memorial Award and Templeton Freedom Awards. Additionally he manages the Latin American Program. He currently holds an MA in Economics from George Mason University and is looking to pursue other graduate studies. He is originally from Uruguay and has lived in four other countries throughout his life. In the past he worked in academics and other non profits. He enjoys participating in academic seminars and was also part of the Koch Foundation Fall internship in 2009. His main hobbies are sports, reading and spending time with his family.

Gonzalo Schwarz (moderator) manages the Awards and Grants program at the Atlas Network that include the prestigious Fisher Memorial Award and Templeton Freedom Awards. Additionally he manages the Latin American Program. He currently holds an MA in Economics from George Mason University and is looking to pursue other graduate studies. He is originally from Uruguay and has lived in four other countries throughout his life. In the past he worked in academics and other non profits. He enjoys participating in academic seminars and was also part of the Koch Foundation Fall internship in 2009. His main hobbies are sports, reading and spending time with his family.

Education is the ability to listen to almost anything without losing your temper or your self-confidence. –Robert Frost

My idea of education is to unsettle the minds of the young and inflame their intellects. –Robert M. Hitchins

My own education operated by a succession of eye-openers each invovling the repudiation of some previously held belief. –George Bernard Shaw

Every act of conscious learning requires the willingness to suffer an injury to one’s self-esteem. That is why young children, before they are aware of their own self-importance, learn so easily; and why older persons, especially if vain or important, cannot learn at all. –Thomas Szasz (www.gloomboomdoom.com)

A Young Reader’s Question

How do I become a great investor?

CSInvesting: Well, it might be too late for you. I started at age eight, and I struggle to keep the pace. 🙂 However, if you still wish to learn, read widely and experience life. Start a small business. Sell T-shirts or think of a fun business where you can sell products to your classmates.

My grandfather’s advice: “John, that’s your name right?” http://youtu.be/AloNERbBXcc

Buffett’s lecture to Indian business students (MUST SEE): http://youtu.be/4xinbuOPt7c (Value the business BEFORE you see the price.)

A Course in Charlie Munger’s Worldly Wisdom

The journey towards worldly wisdom travels through two equally important territories. Firstly, learning significant concepts from the different disciplines (“the big ideas”). Secondly, learning to recognize patterns of similarities among them.

Academic Economics_MungerUCSBspeech

Course Outline for Worldly Wisdom

Track down more lectures: http://www.safalniveshak.com/fundoo-professor-called-sanjay-bakshi/

HAVE A GREAT WEEKEND!

Posted in Free Courses, Humor & Entertainment, YOU

Tagged Learning, Munger, Worldly Wisdom

Free Book: Gold, the Monetary Polaris by Nathan Lewis

I highly recommend this book to understand our current mess and how we can go back to stable money and a prosperous world for all. Before dismissing the idea of a gold standard with thoughts of–there is not enough gold; we tried that before and why gold, we now have Bitcoin–learn first how a gold standard works and then financial and monetary history. Your study will pay huge dividends. Lewis debunks the myth that you need 100% gold-backing for paper money. (See Rothbard’s book, Case for a 100 Percent Gold Dollar)

For a great romp through financial history and the role that gold played: Gold as money Lewis Another great book.

Lewis writes on page 5, “A gold standard system has a specific purpose: to achieve, as closely as is possible in an imperfect world, the Classical ideal of a currency that is stable in value, neutral, free of government manipulation, precise in its definition, and which can serve as a universal standard of value, in much the manner in which kilograms or meters serve as standards of weights and measures.”

The author shows how and why the Classical principle of stable, gold-based money once made Americans wealthy. Why not now?

Stable money along with clear property rights/rule of law and low taxation/regulatory burdens have provided the means for the greatest human prosperity.

View Nathan Lewis’ articles here: www.newworldeconomics.com

Video Lecture published on Feb 18, 2014: Http://Www.Cato.Org/Events/Gold-Monet…

In this sequel to Gold: the Once and Future Money, Nathan Lewis describes the theoretical basis of gold-standard monetary systems. Lewis argues that the pre-1913 world gold standard system was perhaps the most successful monetary system the world has ever seen, enabling high levels of economic growth. Descriptions of both Britain’s economic rise under the gold standard and the United States’ rise to economic prominence under gold are also discussed.

Posted in Economics & Politics, Free Courses, History

Tagged Gold Standard, nathan Lewis, New World Economics

Mark Twain: “A mine is a hole in the ground with a liar standing next to it.”

Initial Steps

We first have to understand the product/market of our gold company. Gold companies produce gold and silver which is money. What is money? Precious metals have exchange value which makes up a large part of their value. You first have to understand the gold market. Note: why did gold go down LESS than other commodities such as oil in the 2008/2009 credit crisis?

You need to draw up an industry map. How? Find out who the participants are.

Start with history: http://www.fgmr.com/gold-mining-stocks-have-outperformed-the-djia.html

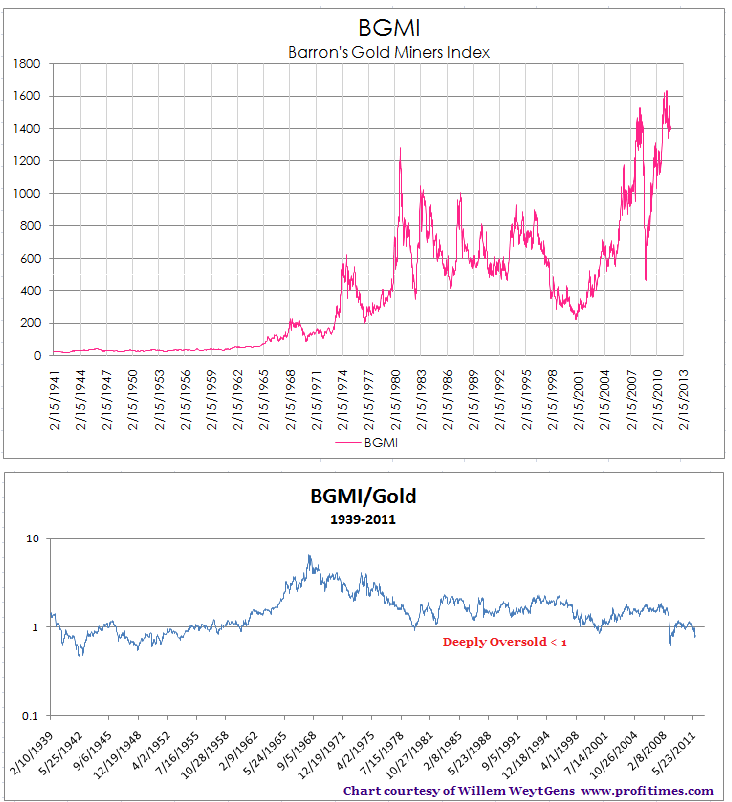

BGMI http://www.sharelynx.com/chartstemp/free/fchart-BGMI.php

QUIZ: What is the best environment to invest in Gold mining equities. Why?

We will circle back to an industry map after you have read about the industry.

What determines the price of gold: http://www.acting-man.com/?p=10251 Also, do a search for gold and/or mining stocks and then read his posts.

Study: www.monetary-metals.com

Gold as collateral: http://www.alhambrapartners.com/2014/02/26/gold-and-reverse-repos/ Also, do a search for gold.

Read free research on gold as money: http://www.myrmikan.com/port/

View all five videos on money: http://hiddensecretsofmoney.com/

Two excellent books: Gold, the Once and Future Money by Nathan Lewis. Also, Gold: The Monetary Polaris by Nathan Lewis.

Gold and inflation: http://www.garynorth.com/public/department32.cfm

The case for gold: http://www1.realclearmarkets.com/2011/11/18/my_thoughts_on_lewis_lehrman039s_gold_standard_120618.html

Understand royalty companies: http://seekingalpha.com/article/1341411-gold-and-silver-royalty-companies-part-1-the-pros-and-cons-of-royalty-companies (read all five parts)

Then read presentations of Royal Gold, Silver Wheaton, Franco-Nevada, Sandstrom from their websites for a good overview of the gold mining market(s).

These sites can get you started. Don’t believe the hype!

www.goldsilverdata.com Also, go to http://youtu.be/VjjLhPqO8bY to view video on valuing gold and silver stocks.

Go to www.youtube.com and search for Jim Grant AND gold, John Doody and mining stocks. Ditto for Brent Cook, Rick Rule. Search for their comments.

That will get you started and then next week, I will post an industry map. Ask questions. In two weeks we will crack a company.

Update March 17, 2014: Discussion of Junior Resource Sector

Posted in Competitive Analysis, Free Courses, Search Strategies, Valuation Techniques, YOU

Tagged gold mining, Industry Analysis

The free webinar, “SEC Filings Master Class,” took place Nov. 13-15, 2012.

Michelle Leder, who makes her living unearthing news in SEC filings, will help you feel more confident in your SEC-document sleuthing. In three one-hour sessions, you’ll enhance your ability to spot red flags in SEC filings.

WHAT YOU WILL LEARN

AGENDA

For each of the documents below, Leder will point out at least four key things to watch for that can produce good stories. She’ll offer examples of stories that have been done, point out where to find these types of stories in the fine print of the SEC document and offer attendees a chance to practice finding the news themselves.

YOUR INSTRUCTOR

Michelle Leder launched Footnoted.com (originally Footnoted.org) in 2003 to take “a closer look at the things that companies try to bury in their routine SEC filings,” according to the website. Its launch coincided with the release of her book, Financial Fine Print: Uncovering a Company’s True Value. Morningstar bought the site in 2010, but Leder bought it back in 2012.

What do you think?

SELF-GUIDED LESSON

Check out the resources below. At your own pace, you can walk through the self-guided lesson on tips for digging deeper into SEC filings.

http://businessjournalism.org/2012/11/12/sec-filings-master-class-self-guided-training/

“You can’t build lasting stock market gains or solid GDP growth on debt. Because debt cannot expand forever. Sooner or later it must stabilize and then it must contract. When that happens, all the positive features of debt become negative features. Instead of borrowing and spending more, people must spend less and pay off past debt. Instead of adding to corporate sales and profits, they subtract from them. Instead of driving up asset prices, they push them down.”

Borrowed money has an almost magical effect on the way up. It comes out of nowhere. So there is no labor cost to offset against it. It goes almost directly into corporate profits. http://www.rickackerman.com/2011/06/a-gloomy-richebacher-was-prescient-in-1999/

Links

If you have a few favorites, please let me know.

-work in progress-

My Other Blogs

Un Inversor Inteligente www.uninversorinteligente.com (spanish)

Ferrer Invest www.ferrerinvest.com/un-inversor-inteligente.html (spanish)

Seeking Wisdom www.seekingworldlywisdom.tumblr.com

Value Investing Research

Magic Formula Investing www.magicformulainvesting.com

Outstanding Investor Digest www.oid.com

The Manual of Ideas www.manualofideas.com

Value Investors Club www.valueinvestorsclub.com

Value Investor Insight www.valueinvestorinsight.com

Value Line www.valueline.com

Value Investing Blogs

All Value Investing www.allvalueinvesting.com Check out the videos!

Above Average Odds www.aboveaverageodds.com

The Brooklyn Investor: http://brooklyninvestor.blogspot.com/

Buffett FAQ www.buffettfaq.com

Fundoo Professor www.fundooprofessor.wordpress.com

Gannon and Hoang on Investing http://gannonandhoangoninvesting.com/

GrahamandDoddsville www.grahamanddoddsville.net

Greenbackd.com www.greenbackd.com

Greg Speicher www.gregspeicher.com

Margin of Safety www.amarginofsafety.com

Mungerisms www.mungerisms.blogspot.com

The Inoculated Investor www.inoculatedinvestor.com

Simoleon Sense www.simoleonsense.com

Street Capitalist www.streetcapitalist.com

Value Investing World www.valueinvestingworld.com

ValueWalk www.valuewalk.com

Warren Buffett Resource www.warrenbuffettresource.wordpress.com

Value Investing Sites

Alphaclone www.alphaclone.com

Dataroma www.dataroma.com

Gurufocus www.gurufocus.com

Seeking Alpha www.seekingalpha.com

Value Investing Firms

Ariel Investments www.arielinvestments.com

Aquamarine www.aquamarinefund.com

Baron Funds www.baronfunds.com

Baupost www.baupost.com

Bestinver www.bestinver.es

Century Management www.centman.com

Clipper Fund www.clipperfund.com

Davis Funds www.davisfunds.com

Dreman Value Management www.dreman.com

Fairholme www.fairholmefunds.com

First Eagle Funds www.firsteaglefunds.com

First Pacific Advisors www.fpafunds.com

Formula Investing Funds www.formulainvestingfunds.com

GMO www.gmo.com

Greenlight Capital www.greenlightcapital.com

Himalaya Capital Management www.himalayacapital.com

Hummingbird Value Fund www.hummingbirdvalue.com

Longleaf Partners www.longleafpartners.com

Mackenzie Investments www.mackenziefinancial.com

Muhlenkamp & Co. www.muhlenkamp.com

Oakmark Funds www.oakmark.com

Oaktree Capital Management www.oaktreecapital.com

Olstein Funds www.olsteinfunds.com

Pabrai Investment Funds www.pabraifunds.com

Pzena Investment Management http://www.pzena.com

Redfield, Blonsky & Co. www.rbcpa.com

Sarbit www.sarbit.com

Sequoia www.sequoiafund.com

T2 Partners www.t2partnersllc.com

Third Avenue www.thirdavenuefunds.com

Third Point www.thirdpoint.com

Tweedy, Browne www.tweedy.com

Weitz Funds www.weitzfunds.com

Wintergreen Funds www.wintergreenfund.com

Value Investing Schools and Courses

Centro Enseñanza Online Manuel Ayau www.umayau.com (spanish)

Columbia Business School www7.gsb.columbia.edu/valueinvesting

Gabelli School of Business www.fordham.edu/cba

Kellogg School Of Management www.bit.ly/zU5n3b

Management Development Institute www.sanjaybakshi.net

Richard Ivey School of Business www.bengrahaminvesting.ca

UC Davis Graduate School of Management www.bit.ly/xkUZ4v

Value Oriented Companies

Berkshire Hathaway www.berkshirehathaway.com

Fairfax Financial Holdings www.fairfax.ca

Notable Economists

Carlos Rodriguez Braun www.carlosrodriguezbraun.com (spanish)

Jesús Huerta de Soto www.jesushuertadesoto.com (spanish)

Juan Ramón Rallo www.juanramonrallo.com (spanish)

Philipp Bagus www.philippbagus.com

Xavier Sala-i-Martín www.salaimartin.com

Amateur Portfolio Managers

Covestor www.covestor.com

Marketocrazy www.marketocracy.com

Unience www.unience.com (spanish)

Media and other resources

Farnam Street www.farnamstreetblog.com

Barking up the wrong tree www.bakadesuyo.com

Futile Finance www.futile.free.fr

Inteligencia y Libertad www.intelib.com (spanish)

Libre Mercado www.libremercado.com (spanish)

Grupo Retiro www.gruporetiro.com (Family Business, spanish)

Michael Mauboussin www.michaelmauboussin.com

Santa Fe Institute www.santafe.edu

Libertarian Think Tanks

CATO Institute www.cato.org

Instituto Juan de Mariana www.juandemariana.org (spanish)

Ludwig von Mises Institute www.mises.org

A reader suggests: