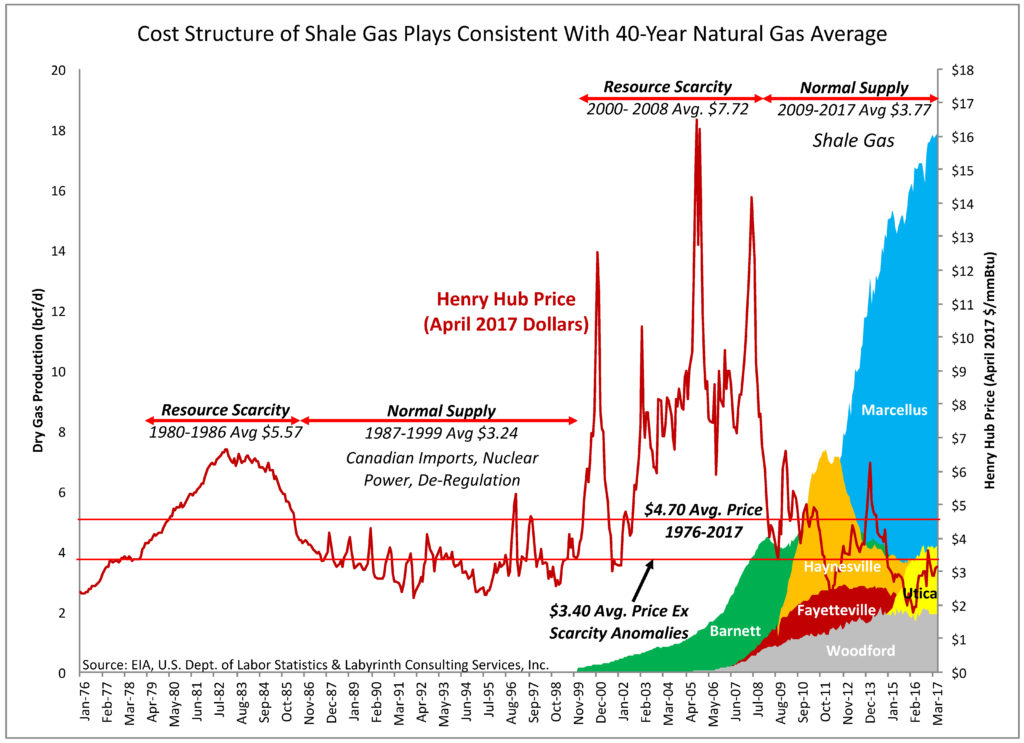

Shale gas is not a revolution. It’s just another play with a somewhat higher cost structure but larger resource base than conventional gas.

The marginal cost of shale gas production is $4/mmBtu despite popular but incorrect narratives that it is lower. The average spot price of gas has been $3.77 since shale gas became the sustaining factor in U.S. supply (2009-2017). Medium-term prices should logically average about $4/mmBtu.

A crucial consideration going forward, however, will be the availability of capital. Credit markets have been willing to support unprofitable shale gas drilling since the 2008 Financial Collapse. If that support continues, medium-term prices for gas may be lower, perhaps in the $3.25/mmBtu range. The average spot price for the last 7 months has been $3.13.

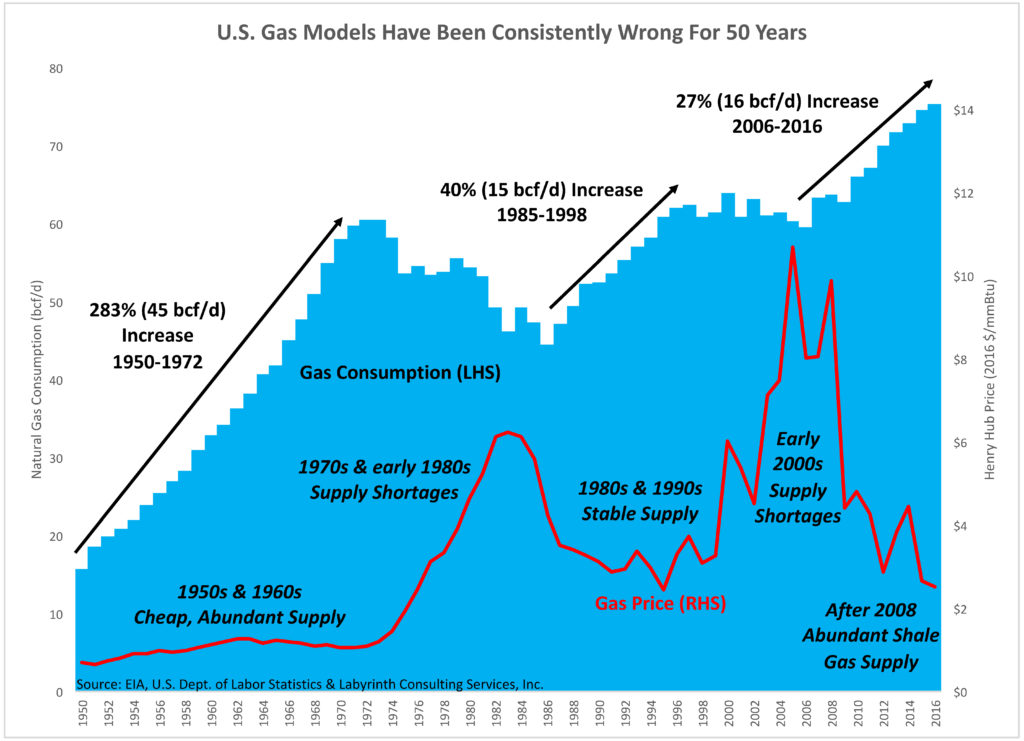

Gas supply models over the last 50 years have been consistently wrong. Over that period, experts all agreed that existing conditions of abundance or scarcity would define the foreseeable future. That led to billions of dollars of wasted investment on LNG import facilities.

Today, most experts assume that gas abundance and low price will define the next several decades because of shale gas. This had led to massive investment in LNG export facilities.

(CSInvesting: You should read Mr. Berman’s full report at the link below. He uses history to debunk long-term prediction models and shows the common sense of looking at markets through the long lens of history. The assumption of abundant natural gas could be wrong–many “experts” are not even thinking of vastly different outcomes to their models.)

http://www.artberman.com/shale-gas-not-revolution/

Excellent interview: https://www.youtube.com/watch?v=RY4kM1kWaGM

warren-buffett-favorite-books-2015-10/

Excellent investment letters from Moran Creek

- MCCM-2Q2016_Market-Outlook or Seth Klarman and MoS

- MCCM1Q2015MarketOutlook Julien Robertson

- MCCM_1Q2017_MarketOutlook Not So Intelligent Investors

Are these sustainable competitive advantages ?http://www.collaborativefund.com/blog/sustainable-sources-of-competitive-advantage/

A great read on investing:http://www.collaborativefund.com/blog/what-i-believe-most/

F

F