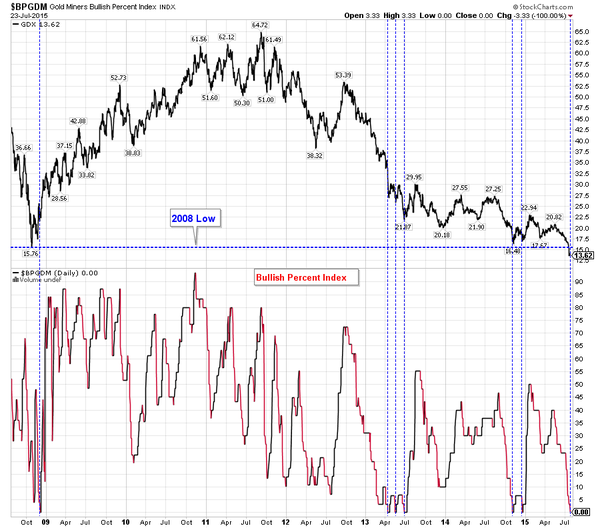

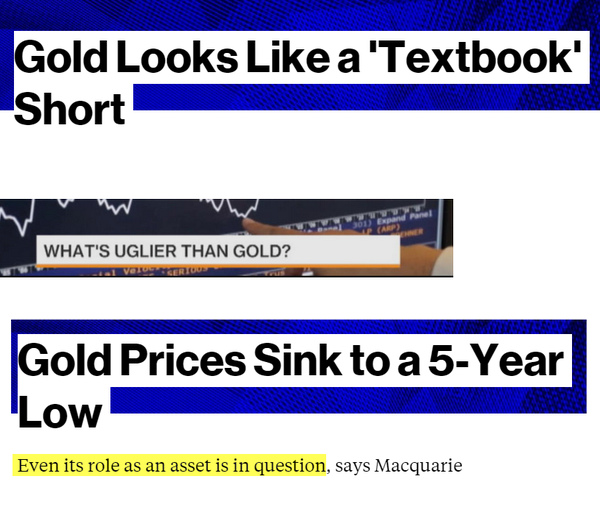

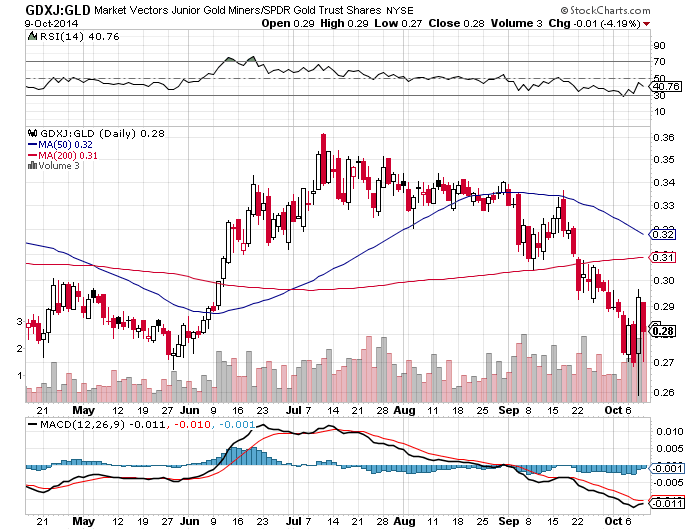

Bloomberg hating on gold. “Looks like a short”, “Nothing uglier”, “Not even an asset”…AFTER miners drop 90%.

“The Direxion Daily Gold Miners Bear 3X Shares, or DUST, is up a whopping 99 percent in July.” http://www.bloomberg.com/news/articles/2015-07-24/these-leveraged-etfs-show-just-how-bad-the-commodities-crash-has-been … via @EricBalchunas

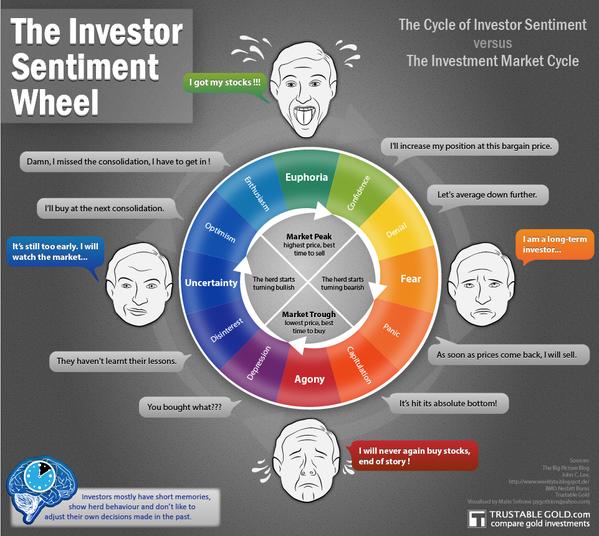

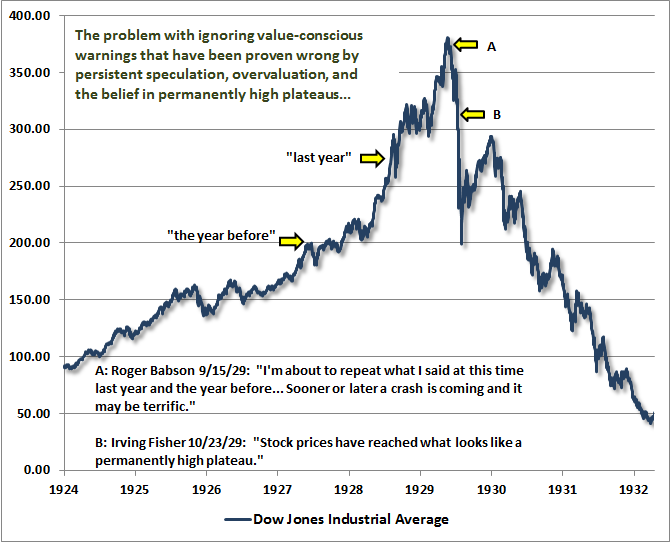

Grant on gold July 22 2015 Zweig The same analyst who suggested buying miners within 1% of the all-time top in Sept. 17, 2011 now says gold is a “doorstop” in July 17, 2015. NOW, he tells me! Journalists chase price and sentiment.

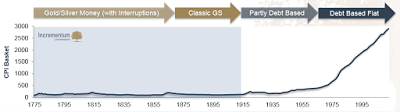

Goldman sees gold to $1,000 (July 2015) and Goldman sees gold at 1840 by end 2012 Note a pattern?

Media piles on late in trend:

Perhaps today the absurdity has reached the apex of its crescendo with this utterly ridiculous “letter to gold bug” published by Marketwatch: It’s time to surrender and let the yellow metal fall to its bear market low

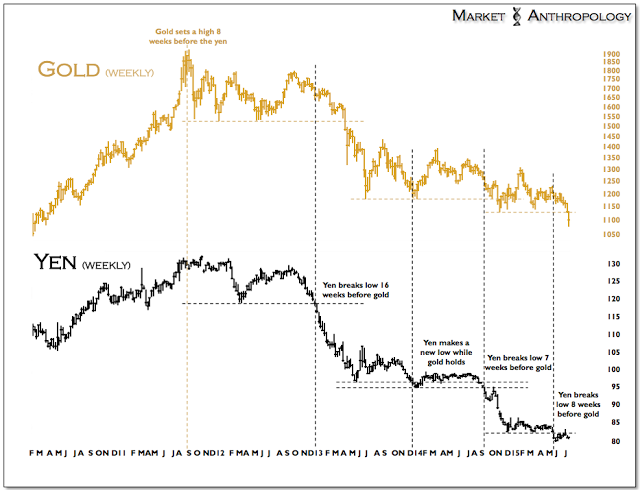

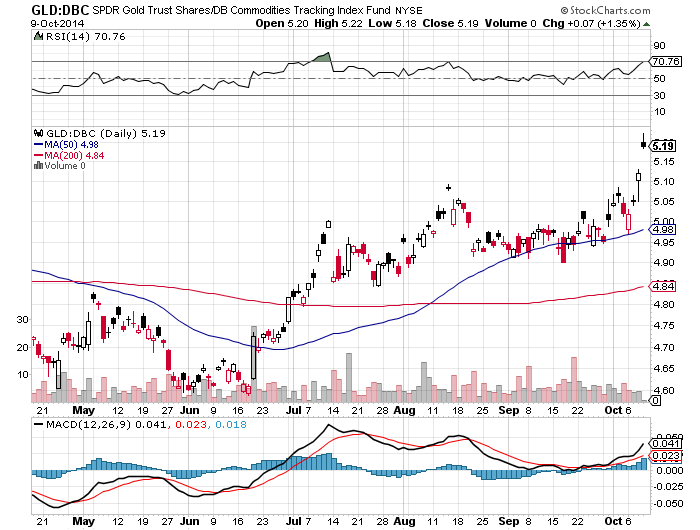

Better analysis: Gold Warns Again and Heavy wears the crown

Amazon Beats

How analysts react after Amazon reports–follow the herd recommendations regardless of price. Analysis?

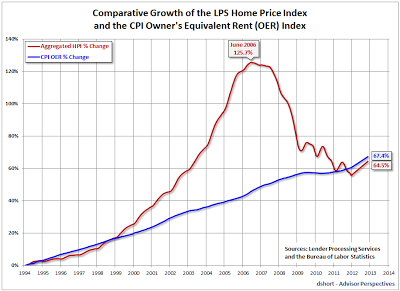

The headlines reported that AMZN’s sales were up 20% year over year for Q2 and that net income had swung from a loss of $123mm to a profit of $92 million yr/yr for Q2. While those numbers are what they are, sales growth from Q1 to Q2 was a mere 2.9% – pretty much in-line with the rate of inflation.

The media propagandists attributed AMZN’s highly “surprising” quarter to big gains in its AWS business segment, which is its cloud-computing business. However, if we drill down into the numbers made available in its 8-K, we find that the AWS segment represents just 7.7% of AMZN’s revenue stream vs. 6.6% of revenues in Q1. Sure seems like a lot of manic hype over well less than 10% of AMZN’s business model.

As it turns out, AMZN’s AWS business model, like everything else it does, is seeded in low quality sources of revenue that will ultimately prove to be unsustainable. Why? See this comment sent to me by someone who read my Amazon research report and who used to specialize in high tech accounting for Silicon Valley start-ups:

I audited many of the high fliers that crashed and burned, took companies public & was at the printers the day the bubble really burst which ultimately tabled that IPO…Amazon Web Services is growing by leaps and bounds and a significant amount of those $’s are coming from venture backed start-ups. Almost the entire Silicon Valley and other startups outside the Valley use AWS. Venture backed startups have exploded just as AWS revenues have exploded…That segment of their business will get walloped which right now seems to be a main source of their operating income.

Read more: Dot con

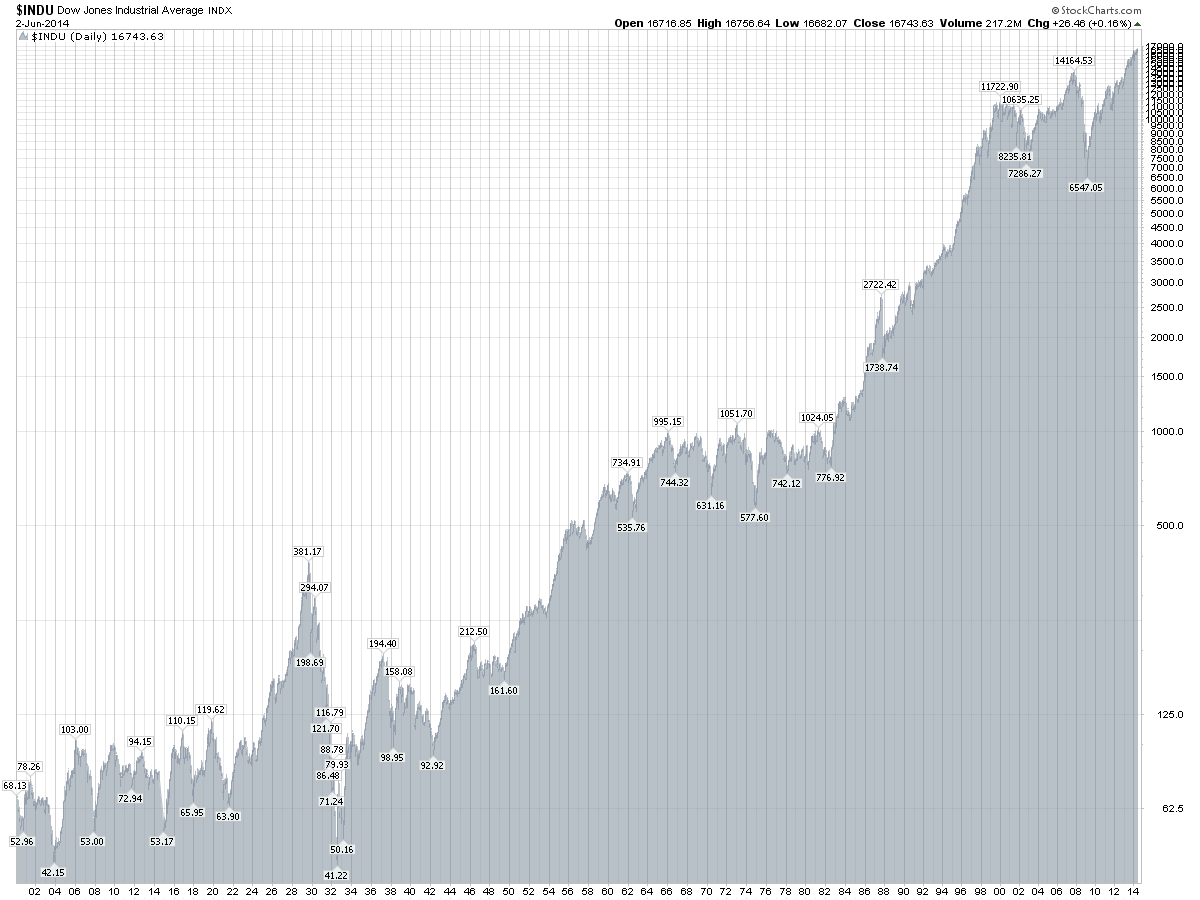

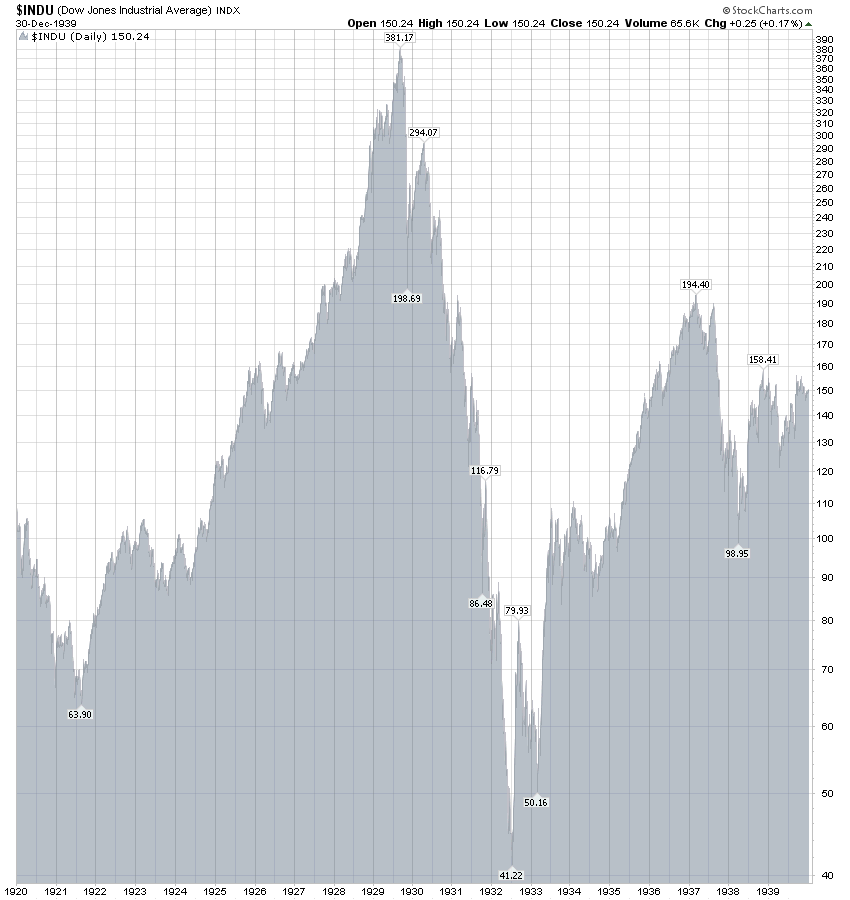

Notice the difference between mining stocks and Amazon–Deja-Vu of the late 1999’s/2000. Remember the music Sugar Ray