HAVE A GOOD WEEKEND!

Posted in Uncategorized

$2 a course and free lecture on Energy Economics

I don’t agree with everything the Austrians believe. For example, I don’t think real bills are inflationary. But there are excellent courses on logic and history here for the hard-core among us.

Hedge Fund Quiz

Please explain to your hedge fund boss why you did not recommend these companies: DPZ and PZZA.? Lessons here? What can we learn from companies we do not invest in?

Posted in Free Courses

Greetings from Finland,

Point 1: In valuing a business you have either an asset or a franchise (or franchise 2% to 5% of businesses or non-franchise) to value. The terms are not important, but the concepts are. If you pay over asset value for a business then growth will not bail you out. Time is not on your side. Therefore, step one in improving your results is do not mistake a non-franchise business for a franchise business. You are in the death-zone where you risk a PERMANENT loss of capital. See below, dead Russian soldier during WWII invasion of Finland.

Examples would be swks vl. There is almost no way in a competitive world that SWKS’ returns on capital will remain at those levels (20%+) over the next ten years–and that is what speculators (NOT investors) are betting on.

Buying net/nets and working capital bargains (buying at a discount to liquid working capital and paying nothing for fixed assets) is probably the safest type of investment IF done as a group. For example, Energold, Inc. (EGDFF) is a working capital bargain with a decent balance sheet but if frontier drilling does not increase over the next five to ten years then it could go out of business. If you invest 10% in ten of those net/nets and working capital bargains, then the ODDS are with you. This is NOT a recommendation for Energold, inc. because it is just a fair business in a hugely cyclical industry, but it is cheap based on its balance sheet.

The bottom-line is that you need to practice and DO valuation all the time. Value a company every day or every week. Go through a Moody’s manual or value-line (or the equivalent in Finland) and look at a lot of companies. Reading about sex, or sky-diving or war is not the same as participating. Yes, go ahead and read, but request annual reports from all the companies in Finland and start valuing them. If you have trouble, then set aside and come back later when you have more knowledge. Don’t be afraid to call up the companies. If you find a company that is really cheap, ask the CFO why doesn’t he sell his home to buy more stock? The point is to be ACTIVELY valuing companies ALL THE TIME. Practice, practice.

Take KO VL Last I looked Coke was trading at about 16 times EV-to-EBITDA while HNRG trades at 4 times EV-to-EBIDA (deduct $1 per share for subs.). Cheap!? Well, hold on, for every dollar of sales Coke makes about 80 to 85 cents in free cash flow while for Hallador Energy (Coal Producer) every dollar of sales generates about 15 cents of free cash-flow right now. I expect that to rise to 20 cents but you can see that Mr. Market handicaps each business properly–usually (but not always). Hallador has unused capacity and can grow profitably but to a certain limit. I would characterize Hallador as a non-franchise but with quality assets compared to its competitors in the coal industry (second on cost curve behind Foresight Energy (FELP).

When you buy a franchise then you must expect that barriers to entry will hold-off regression to the mean. The strategy is almost opposite to buying assets where you expect regression to the mean to occur.

Point 2: How to think about prices. This comes down to knowing yourself? How do you think, how do you react under stress? Only YOU (not me or other “experts”). Here is an example of a true value investor:

You have to keep a log of your investments and decisions. What patterns do you see. Are you patient? How will you develop patience. If you have $1,000 US dollars, then if you make 5 investments of $200 each, write-up each investment–its value, why you made the investment, what would cause you to sell and/or abandon the investment. Then keep meticulous journal entries. You buy at $10 then the price rises to $15 then declines to $8. Will you buy more? Why or why not? The famous Seth Klraman, sells some at $15 because he knows he will be too upset to buy at $10 or $8 if he hasn’t sold some of his stock. The point is that Mr. Klarman has found a method that fits HIS personality.

Spend more time in introspection and practicing investing. Let me know your progress and GOOD LUCK.

Best,

John Chew

More readings

Strategies used by Munger Buffett and Davis to outperform

Has Buffett Lost the Midas Touch

the-manual-of-ideas_josh-shores_2015-07

So that is the thinking behind my style of deep value investing: swimming against the earnings obsessives to pluck out liquid-asset-rich companies with nimble service-focused business models. Then buying them when no one else will, and selling them when everyone else wants them. –Jeroen Bos

Deep Value Investing – Jeroen Bos A great series of case studies of balance-sheet investing

Deep_Value_Investing_Appendix The financials to supplement the book of cases above.

valuewalk-article1_1 His deep value approach has severely LAGGED the small-cap index AS YOU WOULD EXPECT in the latter stages of a bull market.

t1763-deep-value-fund-at-a-glance-v21

ch-deep-value-investments-factsheet

At a minimum you will learn more about how to analyze balance sheets.

Posted in Uncategorized

When you read about weakness in emerging market and commodities AFTER 50% price drops, there might be a chance of the news ALREADY in the the pricing structure.

There is a joke that illustrates the value of optionality

An investment banker and carpenter are sitting next to each other on a long flight. The investment banker asks the carpenter if she would like to play a fun game. The carpenter is tired and just wants to have a nap, so she politely declines and tries to sleep. The investment banker loudly insists that the game is a lot of fun and says, “I will ask you a question, and if you don’t know the answer you must pay me only $5. Then you ask me one question, and if I don’t know the answer, I will pay you $500.” To keep him quiet, she agrees to play the game.

The investment banker asks the first question: “What’s the distance from the earth to the Saturn?” The carpenter doesn’t say a word, pulls out $5, and hands it to the investment banker.

The carpenter then asks the investment banker, “What goes up a hill with three legs and comes down with four?” She then closes her eyes again to rest.

The investment banker immediately opens his laptop computer, connects to the in-flight Wi-Fi, and searches the Internet for an answer without success. He then sends emails to all of his smart friends, who also have no answer. After two hours of searching, he finally gives up. The investment banker wakes up the carpenter and hands her $500. The carpenter takes the $500 and goes back to sleep. The investment banker is going crazy from not knowing the answer. So he wakes her up and asks, “What does go up a hill with three legs and comes down with four?”

The carpenter hands the investment banker $5 and goes back to sleep.

Go find bets like that!

A Trading Parable

Once upon a time, a man and his assistant arrived in a very small town and spread the word to the townspeople that the man was willing to buy monkeys for $100 each. The people knew there were many monkeys in the nearby forest and immediately started catching them. Thousands of monkeys were bought at a price of $100 and placed in a large cage. Unfortunately for the townspeople, the supply of monkeys quickly diminished to a point where it took many hours to catch even one.

When the new man announced he would now buy monkeys at a price of $200 per monkey, the town’s resident’s redoubled their efforts to catch monkeys. But after a few days the monkeys were so hard to find that the townspeople stopped trying to catch any more. The man responded by announcing that he would buy monkeys at $500 after he returned with additional cash from a trip to the big city.

While the man was gone, his assistant told the villagers one by one: “I will secretly sell you my boss’ monkeys for $350, and when he returns from the city, you can sell them to him for $500 each.”

The villagers bought every single monkey, and they never saw the man or his assistant ever again.

more: Leveraged Bubbles

Question: Inevitable Currency Collapse?

Premise 1: All dollars are borrowed into existence. The Fed, for example, creates dollars to purchase government bonds, which, in turn, are paid in dollars, but those dollars are backed by debt. Around and round we go.

Premise 2. The debt can’t be extinguished, so debt grows while the marginal utility of debt declines. You borrow $100 from the bank, then repay your bank with $100 then your cash declines by $100 and the bank’s loan balance declines by $100. But what happens to the $100 used to buy a tool for your business. Now the tool maker has the $100.

Can the debt be paid back out of current income? When the marginal utility of debt reaches zero or a negative number, then the dollar has to collapse since the value of the debt will have to decline until collapse. Ernest Hemingway, said, “We go broke in two ways. First slowly and then suddenly.”

How does the dollar die? It drowns in debt. The money supply may even be decreasing as debt defaults, but the value of other debt collapses and thus the dollar. Remember that all dollars are backed by the balance sheet of the Federal Reserve.

I am not saying that the dollar will collapse tomorrow but what will stop the inevitable? Since all other currencies are a derivative of the reserve currency, the US Dollar, you will see greater stress in foreign currencies before the dollar shows the same level of decline.

Question 2: legal tender laws were eliminated and people could choose their own money, would interest rates remain LOW and S T A B L E? How would rates fluctuate?

Hint: note how relatively stable interest rates were between 1880 and 1913. What set the rate of interest?

Question 3: Does a long-term decline in interest rates hurt businesses? How? What adjustments would you make as an analyst in such an environment?

Prizes to be determined.

The end game?

I will send out the Value Vault keys as promised to the folks who have made requests over the past week.

HAVE A GREAT WEEKEND!

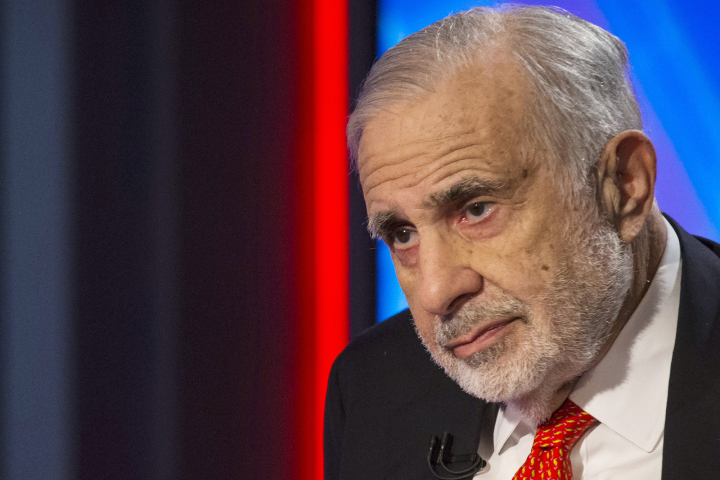

Billionaire activist-investor Carl Icahn gives an interview on FOX Business Network’s Neil Cavuto show in New York in this February 11, 2014 file photo. Icahn said October 9, 2014, Apple Inc’s shares could double in value and urged the company’s board to buy back more shares using its $133 billion cash pile. REUTERS/Brendan McDermid/Files (UNITED STATES)

Carl Icahn is becoming a DC activist just in time to help stimulate congressional talks on corporations being able to repatriate money to America at a lower tax rate, he told The Post.

Icahn — a day after GOP presidential front-runner Donald Trump unveiled his economic plan, which included corporate tax relief for repatriated funds — released a 15-minute video Tuesday titled “Danger Ahead,” giving his views on the US economy. Icahn also endorsed Trump for president.

The billionaire investor dedicated much of the video and a corresponding interview with The Post to the taxation rate of repatriated profits.

“We want to make sure companies have the ability to bring their funds [$2.2 trillion in overseas profits] back,” he told The Post.

“Repatriation [tax rate] should be 7 or 8 percent.” Presently, companies pay taxes in countries where they make the goods, and then a 35 percent rate when bringing the money back to the US.

Icahn said he had been in touch with Sens. Charles Schumer (D-NY) and Orrin Hatch (R-Utah) and Rep. Paul Ryan (R-Wis.), “and everyone wants to see a [reduced rate] bill” by December.

“I think Schumer, Hatch and Ryan want to see this happen,” Icahn said.

If they don’t succeed, Icahn said, the repatriation effort will stall in the 2016 presidential election year and the US will see more balance-sheet cash remaining overseas, out of Uncle Sam’s reach.

Icahn’s biggest stock position, meanwhile, is his stake in Apple, from which he would benefit greatly if the company can repatriate some of its $200 billion at a lower tax rate.

“Repatriation would be viewed as massively positive for Apple,” Friedman Billings Ramsey Capital analyst Dan Ives said.

Icahn Enterprises, the investor’s publicly traded vehicle that is a proxy for his investments, is down 28 percent this year and 37 percent over the past 12 months. The company took a $373 million loss last year, largely on energy stock declines.

Another top 10 Icahn holding is Herbalife, which, as of June 30, had 48 percent of its $750 million in cash overseas.

The foreign cash repatriation talks in Washington could use some help, a well-placed Senate source told The Post. “I think it’s a long shot it gets passed this year.”

The main problem is key Democrats want to spend the new proceeds collected from repatriation on a long-term highway funding bill.

But key Republicans are uncomfortable with that idea because they are concerned that once repatriated money slows, Congress may have to raise taxes to pay for continued highway funding.

Not all business interests, especially big tech companies, are for repatriation at lower tax rates as they now have an excuse to not bring back foreign profits. So Icahn calling senators and being vocal on the subject makes a difference, the source said.

Icahn in the video explains why he is for repatriation.

“If that money came back, it would [be used] for jobs.”

“That money is given to somebody who will invest in this country. As opposed to taking the money in Europe and investing in Ireland or somewhere like that.”

www.nypost.com

Friday, September 25, 2015

No Mas, No Mas! The Vale Chronicles (Continued)!

Some of my Brazilian readers seem to be upset that I used “No Mas”, Spanish words, rather than Portuguese ones, in the title. To be honest I was not thinking about language, but instead about a boxing match from decades ago, where Roberto Duran used these words to give up in his bout with Sugar Ray Leonard.

I have used Vale as an illustrative example in my applied corporate finance book, and as a global mining company, with Brazilian roots, it allows me to talk about how financial decisions (on where to invest, how much to borrow and how dividend payout) are affected by the ups and downs of the commodity business and the government’s presence as the governance table. In November 2014, I used it as one of two companies (Lukoil was the other one) that were trapped in a risk trifecta, with commodity, currency and country risk all spiraling out of control. In that post, I made a judgment that Vale looked significantly under valued and followed through on that judgment by buying its shares at $8.53/share. I revisited the company in April 2015, with the stock down to $6.15, revalued it, and concluded that while the value had dropped, it looked under valued at its prevailing price. The months since that post have not been good ones for the investment, either, and with the stock down to about $5.05, I think it is time to reassess the company again.

John Chew: At least the author has a process to reassess his investment. I believe the critical flaw in his analysis (easy to say in hindsight) was not noting the massive mal-investment due to distorted credit markets caused by central bank policies. To normalize iron ore prices you would need pre-distortion prices going back twenty-five years.

Read more: No Mas!

Posted in Investor Psychology, Risk Management, Valuation Techniques, YOU

Tagged Brazil, Cyclicals, Damadoran, Emerging Markets, Vale, valuation