The secret to investing is to figure out what something is worth and then pay a whole lot less for it.–Joel Greenblatt

Thanks to a reader for the suggestion and link:

UPDATE on LXK

I sold out today: http://wp.me/p2OaYY-18i

The secret to investing is to figure out what something is worth and then pay a whole lot less for it.–Joel Greenblatt

Thanks to a reader for the suggestion and link:

UPDATE on LXK

I sold out today: http://wp.me/p2OaYY-18i

Posted in Humor & Entertainment, Investor Psychology, Risk Management

Tagged pari-mutual gambling

A Reader’s Question:

Dear John: I have a friend who wants to know what to do with his money. I know Charlie Munger suggests investing in cheap index funds for a “no-nothing” investor. But aren’t there problems with indexes? What do you think?

Well, especially now when most bonds (especially government bonds) seem high risk for no-or-low return, the first question would be what should that person allocate towards equities.

I am working on my answer, but thought YOU have advice for this reader.

The links here:

all provide a case for equity investing. However, when you hear that historically the stock market has returned 8.6% or 9% for the past 200 years, it is a little like saying the average height of the person in this room is five foot five inches tall. The room has a pro basketball player standing tall at 7.5 feet and a dwarf in the corner at 3.5 feet–the average is 5.5 feet. People are still seared by this experience in 2007-2009.

I will post my response tomorrow.

Posted in Investor Psychology, Risk Management

Tagged Advice, New Investor, Reader's Question

But why should we learn about the world and its history, why bother trying to live in harmony with others? What is the point of all this effort? And does it have to make sense? These questions, and some others of a similar nature, bring us to the third dimension of philosophy, which touches upon the ultimate question of salvation or wisdom. If philosophy is the ‘love’ (philo) of ‘wisdom’ (sophia), it is at this point that it must make way for wisdom, which surpasses all philosophical understanding. To be a sage, by definition, is neither to aspire to wisdom or seek the condition of being a sage, but simply to live wisely, contentedly and as freely as possible, having finally overcome the fears sparked in use by our own finiteness. –Luc Ferry in A Brief History of Thought

Mental Models: http://www.farnamstreetblog.com/mental-models/

Why Legos Are So Expensive — And So Popular? Hint—it is a FRANCHISE! (I hope readers who have children that play with Legos can add their input–Why did you shell out those big bucks for plastic blocks?)

January 16, 2013

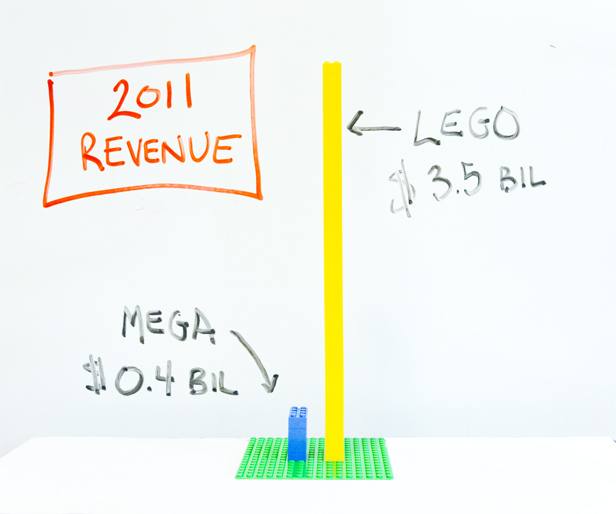

A lot of people wonder how Lego, selling a now un-patented product, can command both massive market share and sell at twice the price of the nearest competitor: Megablocks.

Mega blocks are much cheaper than Legos yet Legos dominates in sales.

Mega blocks are much cheaper than Legos yet Legos dominates in sales.

Rhett Allain, in his WIRED article addressing why lego sets are so expensive, unsatisfyingly concludes “Honestly, I don’t know much about plastic manufacturing – but the LEGO blocks appear to be created from harder plastic. Maybe this would lead them to maintain their size over a long period of time.”

While lego offers a superior product, that doesn’t wholly account for why they sell so well.

Chana Joffe-Walt offers a much better explanation in her NPR Planet Money article: (click on link to hear the radio show on Legos)

Lego did find a successful way to do something Mega Bloks could not copy: It bought the exclusive rights to Star Wars. If you want to build a Death Star out of plastic blocks, Lego is now your only option.

The Star Wars blocks were wildly successful. So Lego kept going — it licensed Indiana Jones, Winnie the Pooh, Toy Story and Harry Potter.

Sales of these products have been huge for Lego. More important, the experience has taught the company that what kids wanted to do with the blocks was tell stories. Lego makes or licenses the stories they want to tell.

Lego isn’t just selling a product, they are selling a story. Still, I doubt that alone fully explains the difference.

I think Warren Buffett offers the best explanation. Talking about the brand power of See’s Candies, he comments:

What we did know was that they had share of mind in California. There was something special. Every person in Ca. has something in mind about See’s Candy and overwhelmingly it was favorable. They had taken a box on Valentine’s Day to some girl and she had kissed him. If she slapped him, we would have no business. As long as she kisses him, that is what we want in their minds. See’s Candy means getting kissed. If we can get that in the minds of people, we can raise prices. I bought it in 1972, and every year I have raised prices on Dec. 26th, the day after Christmas, because we sell a lot on Christmas. In fact, we will make $60 million this year. We will make $2 per pound on 30 million pounds. Same business, same formulas, same everything–$60 million bucks and it still doesn’t take any capital.

… It is a good business. Think about it a little. Most people do not buy boxed chocolate to consume themselves, they buy them as gifts—somebody’s birthday or more likely it is a holiday. Valentine’s Day is the single biggest day of the year. Christmas is the biggest season by far. Women buy for Christmas and they plan ahead and buy over a two or three-week period. Men buy on Valentine’s Day. They are driving home; we run ads on the Radio. Guilt, guilt, guilt—guys are veering off the highway right and left. They won’t dare go home without a box of Chocolates by the time we get through with them on our radio ads. So that Valentine’s Day is the biggest day.

Can you imagine going home on Valentine’s Day—our See’s Candy is now $11 a pound thanks to my brilliance. And let’s say there is candy available at $6 a pound. Do you really want to walk in on Valentine’s Day and hand—she has all these positive images of See’s Candy over the years—and say, “Honey, this year I took the low bid.” And hand her a box of candy. It just isn’t going to work. So in a sense, there is untapped pricing power—it is not price dependent.

The reason Lego is awesome and Megablocks is not has as much to do with what’s in the consumers’ mind as the product on the shelf. It’s the experience you have with Lego that makes it so amazing.

Remember the first time you played with Lego? You want to pass that experience off to someone else. No one wants to show up to a kid’s birthday party and announce to everyone they took the ‘low bid’ on a relatively cheap children’s toy.

Lego is a safe bet and we want to reduce uncertainty.

Read more posts on Farnam Street on:

Association bias • Lego • Warren Buffett

—

I went to Toys R Us recently to buy my son a Lego set for Hanukkah. Did you know a small box of Legos costs $60? Sixty bucks for 102 plastic blocks!

In fact, I learned, Lego sets can sell for thousands of dollars. And despite these prices, Lego has about 70 percent of the construction-toy market. Why? Why doesn’t some competitor sell plastic blocks for less? Lego’s patents expired a while ago. How hard could it be to make a cheap knockoff?

Luke, a 9-year-old Lego expert, set me straight.

“They pay attention to so much detail,” he said. “I never saw a Lego piece … that couldn’t go together with another one.”

Lego goes to great lengths to make its pieces really, really well, says David Robertson, who is working on a book about Lego.

Inside every Lego brick, there are three numbers, which identify exactly which mold the brick came from and what position it was in in that mold. That way, if there’s a bad brick somewhere, the company can go back and fix the mold.

For decades this is what kept Lego ahead. It’s actually pretty hard to make millions of plastic blocks that all fit together.

But over the past several years, a competitor has emerged: Mega Bloks. Plastic blocks that look just like Legos, snap onto Legos and are often half the price.

So Lego has tried other ways to stay ahead.

The company tried to argue in court that no other company had the legal right to make stacking blocks that look like Legos.

“That didn’t fly,” Robertson says. “Every single country that Lego tried to make that argument in decided against Lego.”

But Lego did find a successful way to do something Mega Bloks could not copy: It bought the exclusive rights to Star Wars. If you want to build a Death Star out of plastic blocks, Lego is now your only option.

The Star Wars blocks were wildly successful. So Lego kept going — it licensed Indiana Jones, Winnie the Pooh, Toy Story and Harry Potter.

Sales of these products have been huge for Lego. More important, the experience has taught the company that what kids wanted to do with the blocks was tell stories. Lego makes or licenses the stories they want to tell.

And kids know the difference.

“If you were talking to a friend you wouldn’t say, ‘Oh my God, I just got a big set of Mega Bloks,’ ” Luke says. “When you say Legos they would probably be like, ‘Awesome can we go to your house and play?’ ”

Lego made almost $3.5 billion in revenue last year. Mega made a tenth of that.

But Mega Bloks may yet gain on Lego.

Mega now owns the rights to Thomas the Tank Engine, Hello Kitty, and the video game Halo. And, on shelves for the first time ever this week: Mega Bloks Barbies.

PS: I will post shortly on a Reader’s Question: What besides an Index would you recommend for a person who seeks safety and return on his/her capital?

Posted in Competitive Analysis, Economics & Politics

Tagged Farnam, Franchises, Legos, Mental Models, NPR PLANET MONEY

www.cafehayek.com… is from David Hume’s 1742 essay “Of Public Credit,” (here from page 350 of the 1985 Liberty Fund collection of Hume’s essays, edited by the late Eugene Miller, Essays: Moral, Political, and Literary) (original emphasis):

[O]ur modern expedient, which has become very general, is to mortgage the public revenues, and to trust that posterity will pay off the incumbrances contracted by their ancestors: And they, having before their eyes, so good an example of their wise fathers, have the same prudent reliance on their posterity; who, at last, from necessity more than choice, are obliged to place the same confidence in a new posterity.

Moods and Markets (Socionomics)

Of course, mood and emotion have an influence on people’s actions. I view socionomics/psychology as a supplement to but not a substitute for understanding Austrian Business Cycle Theory. In the interests of openness and inquiry I am posting on socionomics. Some may view it as star-gazing. YOU decide.

Socinomics is the study of how changes in social mood motivate and affect social actions and our behavior, not just in the financial markets but also in politics and popular culture. Socioeconomics, on the other hand, looks at how changing economic conditions and social conditions relate. The two fields have different views of cause and effect.

Mood is defined as our underlying confidence which is all about the future and how certain we are, not only about what we believe is ahead but whether our own immediate choice of action—our decisions–will be successful.

The reality, however, is that the future is in no way correlated to our level of confidence. The future is going to be what it is going to be whether we are confient about it or not.

For example, in June 2011, Wells Fargo exited the reverse mortgage business (www.wellsfargo.com/press/2011/20110616_Mortgage) by stating that “The decision was made based on today’s unpredictable home values.” The press release implies that when Wells Fargo entered the reverse mortgage business in 1990, the company thought that home values were predictable. The reality is that home values were just as predictable or unpredictable in 2011 as they were in 1990. When we are confident (good mood) we tend to believe that we can predict accurately and when we are not confident, we view the world as more unpredictable. Read more below:

Socionomics in a nutshell and Social Behavioral Dynamics_Robert Prechter

Online Resources: www.socionomics.net and www.horizonpreference.com

Books: One of the greatest investors of all times was John Templeton who said to buy at the point of “maximum pessimism.” I have been looking for books that explain how to do this, or at least make an attempt.

We continue our study of Herbalife’s saga with a recent post from www.brontecapital.com. There are lessons here on conducting research and on hubris.

What this story is really about

Herbalife is a company which combines a lot of good (think the life-saved diabetic above) with some pretty ugly features.

But this is not really a story about Herbalife – Herbalife will survive globally. Like all multi-level marketing schemes it will have its ups and downs. There will be all sorts of problems (such as tax compliance throughout the scheme, cash handling, perhaps even using Herbalife accounts to launder money).

What this has (deservedly) become is the story about how Bill Ackman can be so wrong. He spent (by his own admission) a year and a half analysing this company and his thesis can be falsified by visiting a few clubs in his home city. Bill Ackman’s thesis is the most easily falsified bear-thesis I have seen from a major hedge fund ever.

You have to wonder how this happened. So I am going to tell you:

Bill Ackman a Harvard educated (magna cum laude) billionaire New York hedge fund manager bet over a billion dollars on a short position (imperilling his fund and his reputation) without checking the facts.

And he did not check the facts because he was so rigid with a misplaced silver spoon that he could not stoop to sit on a subway for thirty minutes and talk with poor people for ninety minutes.

Read the entire article–an important read

http://brontecapital.blogspot.com/2013/01/notes-on-visiting-herbalife-nutrition.html

Also…..http://seekingalpha.com/article/1111331-implications-of-herbalife-s-soaring-short-interest-ratio

Expectations of Low Future Growth?

Market Review LMCM See Future Value (See page 5). Perhaps the market is discounting real growth vs. nominal growth? Don’t take that chart at face value.

Where is the Inflation (CPI) ? Another lesson in why price aggregates are so misleading.

Critics of the Austrian School of economics have been throwing barbs at Austrians like Robert Murphy because there is very little inflation in the economy. Of course, these critics are speaking about the mainstream concept of the price level as measured by the Consumer Price Index (i.e., CPI).

….

High prices seem to be the norm. The US stock and bond markets are at, or near, all-time highs. Agricultural land in the US is at all time highs. The Contemporary Art market in New York is booming with record sales and high prices. The real estate markets in Manhattan and Washington, DC, are both at all-time highs as the Austrians would predict. That is, after all, where the money is being created, and the place where much of it is injected into the economy.

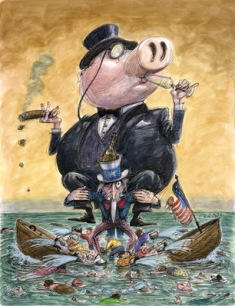

This doesn’t even consider what prices would be like if the Fed and world central banks had not acted as they did. Housing prices would be lower, commodity prices would be lower, CPI and PPI would be running negative. Low-income families would have seen a surge in their standard of living. Savers would get a decent return on their savings.

Of course, the stock market and the bond market would also see significantly lower prices. Bank stocks would collapse and the bad banks would close. Finance, hedge funds, and investment banks would have collapsed. Manhattan real estate would be in the tank. The market for fund managers, hedge fund operators, and bankers would evaporate.

In other words, what the Fed chose to do ended up making the rich, richer and the poor, poorer. If they had not embarked on the most extreme and unorthodox monetary policy in memory, the poor would have experienced a relative rise in their standard of living and the rich would have experienced a collective decrease in their standard of living.

http://mises.org/daily/6340/Where-Is-the-Inflation

Posted in Risk Management, Valuation Techniques, YOU

Tagged Ackman, Bronte Capital, CPI, herbalife, inflation, Low Future Growth, research

| There are several articles in this Value Vault

for analyzing and understanding moats. Let me know what you learn. |

|||||

| Readings on Moats | |||||

| MOAT READINGS |

|

||||

Posted in Search Strategies, Valuation Techniques

If you’re not focusing on becoming so good they can’t ignore you, you’re going to be left behind. This clarity is refreshing. It tells you to stop worrying about what your job offers you, and instead worry about what you’re offering the world. This mindset — which I call the craftsman mindset — allows you to sidestep the anxious questions generated by the passion hypothesis — “Who am I?”, “What do I truly love?” — and instead put your head down and focus on becoming valuable.

Becoming a Craftsman

In a 2007 episode of the Charlie Rose show, Rose was interviewing the actor and comedian Steve Martin about his memoir Born Standing Up. They talked about the realities of Martin’s rise. In the last five minutes of the interview, Rose asks Martin his advice for aspiring performers.

“Nobody ever takes note of [my advice], because it’s not the answer they wanted to hear,” Martin said. “What they want to hear is ‘Here’s how you get an agent, here’s how you write a script,’ . . . but I always say, ‘Be so good they can’t ignore you.’ “

In response to Rose’s trademark ambiguous grunt, Martin defended his advice: “If somebody’s thinking, ‘How can I be really good?’ people are going to come to you.”

This is exactly the philosophy that catapulted Martin into stardom. He was only twenty years old when he decided to innovate his act into something too good to be ignored. “Comedy at the time was all setup and punch line . . . the clichéd nightclub comedian, rat-a-tat-tat,” Martin explained to Rose. He thought it could be something more sophisticated. It took Martin, by his own estimation, ten years for his new act to cohere, but when it did, he became a monster success. It’s clear in his telling that there was no real shortcut to his eventual fame, and the compelling life it generated. “[Eventually] you are so experienced [that] there’s a confidence that comes out,” Martin explained. “I think it’s something the audience smells.”

If you’re not focusing on becoming so good they can’t ignore you, you’re going to be left behind. This clarity is refreshing. It tells you to stop worrying about what your job offers you, and instead worry about what you’re offering the world. This mindset–which I call the craftsman mindset-allows you to sidestep the anxious questions generated by the passion hypothesis—”Who am I?”, “What do I truly love?”—and instead put your head down and focus on becoming valuable.

Martin’s advice, however, offers more than just a strategy for avoiding job uncertainty. The more I studied it, the more convinced I became that it’s a powerful tactic for building a working life that you eventually grow to love. As I’ll explain below, regardless of how you feel about your job right now, adopting the craftsman mindset can be the foundation on which you build a compelling career.

—

This is a great article on improving “YOU” follow the links and hear Martin rip on the banjo:

Learn from Steve Martin: http://www.mises.org/daily/6247/What-Austrians-Can-Learn-from-Steve-Martin

Job Crafting: Job_Crafting-Theory_to_Practice-Aug_08 and Crafting a job

Become a Study Hack (Study Success) http://calnewport.com/blog/

Fed Regional Bank President Calls Out the Fed By Joseph Salerno ·

Sunday, January 13th, 2013

In a speech in New Jersey last week, Philadelphia Federal Reserve Bank President Charles Plosser sounded an Austrian note in reportedly calling for the Fed to slow or halt its bond purchases in the near future because their benefits are “pretty meager” and they involve “lots of risks” including distorting the economy. Plosser also criticized the Fed’s zero interest-rate policy as counterproductive, stating:

Efforts to drive real rates more negative or promises to keep rates low for a long time may have frustrated households’ efforts to rebuild their balance sheets without stimulating aggregate demand or consumption . . . Monetary policy accommodation that lowers interest rates is unlikely to stimulate firms to hire and invest until a significant amount of the uncertainty has been resolved. Firms have the resources to invest and hire, but they are uncertain as to how to put those resources to their highest valued use.

President Plosser is to be applauded for his Austrian insight that rational entrepreneurial skittishness in the face of regime uncertainty–and not a shortage of money or Krugman’s mythical “liquidity trap”– is responsible for the U.S economy’s stagnant recovery.

Black Swans

These articles reconcile Tobin’s Q with Austrian Business Cycle Theory:

Austrians and the Black Swan and Q Ratios and Stock Market Crashes

Let me know if you grasp those two articles.

PS: Now there is a way to place PERMANENT links to the investing videos and book vaults. I will post those later this week. If someone does NOT think that is a good idea let me know. Anytime someone wants to view a video lecture, they can go to the links page.

To Get Big Think Small

I am having difficulty finding value, so now I gotta go small. More on micro-cap investing…..Liquidity as an Investing Style and Microcap_Investing and then More_on_Microcap_Investing. If you can accurately value a business while the company’s stock price is volatile, then you have a gold mine. Smaller companies tend to be more OVER and UNDER-VALUED than larger, well-known names.

Secrets and Lies of the Bailout

Secrets and Lies of the BailoutSo what exactly did the bailout accomplish? It built a banking system that discriminates against community banks, makes Too Big to Fail banks even Too Bigger to Failier, increases risk, discourages sound business lending and punishes savings by making it even easier and more profitable to chase high-yield investments than to compete for small depositors. The bailout has also made lying on behalf of our biggest and most corrupt banks the official policy of the United States government. And if any one of those banks fails, it will cause another financial crisis, meaning we’re essentially wedded to that policy for the rest of eternity – or at least until the markets call our bluff, which could happen any minute now.

An excellent article that shows what has happened to our centrally-controlled, socialist, Ponzi financial system. Of course, the author does not point out the causes or remedies, but he does show the results of the bailout.

My favorite line:

We thought we were just letting a friend crash at the house for a few days; we ended up with a family of hillbillies who moved in forever, sleeping nine to a bed and building a meth lab on the front lawn.

http://www.rollingstone.com/politics/news/secret-and-lies-of-the-bailout-20130104?print=trueor Crony_Finance_Rolling_Stone.

View these films: http://thebubblefilm.com/cast/jim-rogers/

Conventional Wisdom on Booms and Busts from a Value Guru

Ask yourself what have you learned from reading this article. What can you apply from his thoughts? Read here: Ditto.

PS:I didn’t learn much. 50 seconds to the trash bin.

HAVE A GREAT WEEKEND.

Posted in Economics & Politics, Investing Gurus, Search Strategies, Special Situations, YOU

Tagged Bailout, Microcap Investing, Ponzi, Rollingstone, The Fed