Mr. Ned Goodman of Dundee Corporation has over 50 years of investment and business experience. His “Buffett-like” 2012 Annual Report is a great read: Contrarian Business Man Dundee Annual-Report-2012 (Beware of confirmation bias! His views mirror mine, but he is too optimistic).

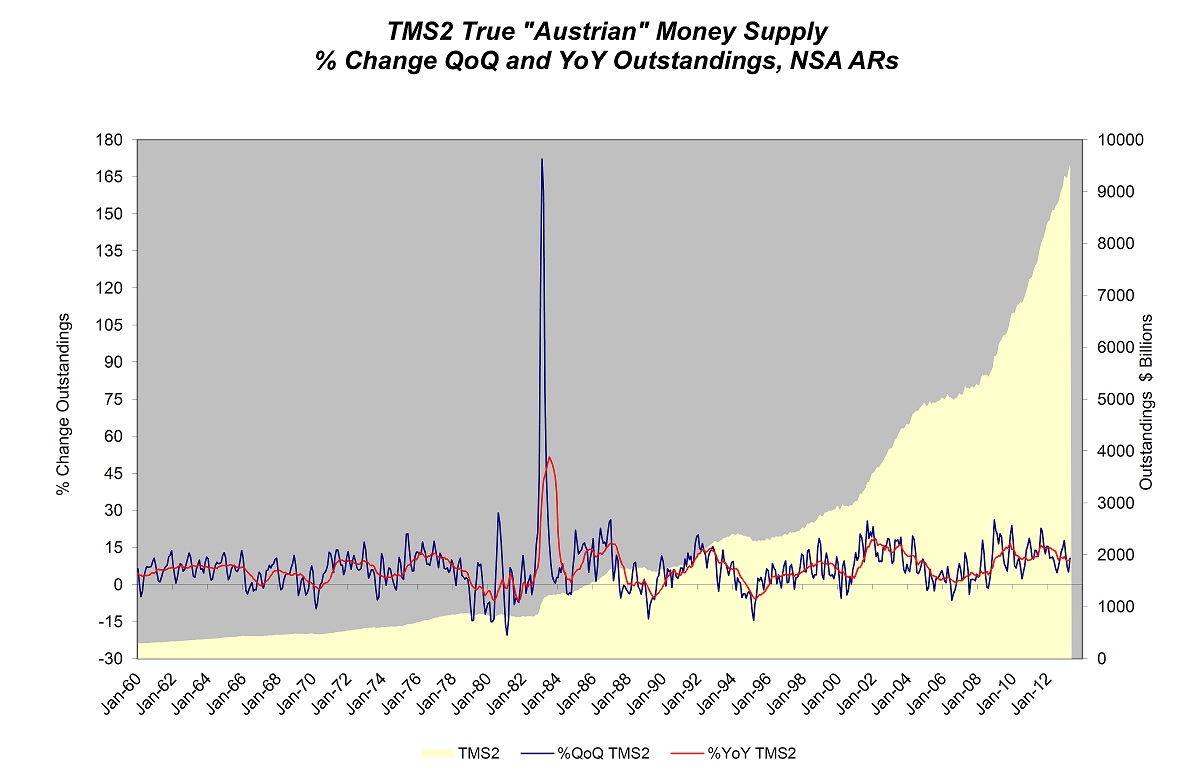

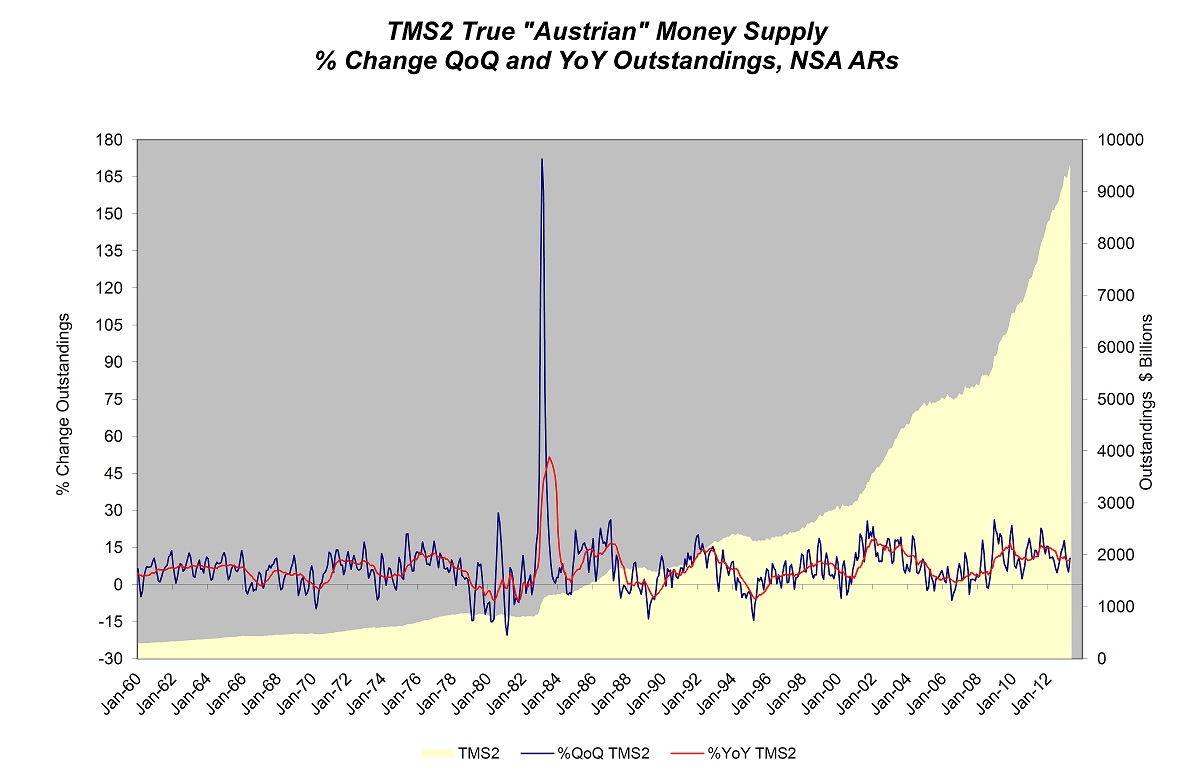

The following statement came from the CFA Institute not the regular “gold nut” – “Swap paper for Gold”. In 1971 the US broke the final link between national currencies and gold, which had been around for millennia. The many years since have provided continuous inflation and a series of larger and larger financial bubbles. The current situation is best described as a “debt binge.”

Why gold? “The price of gold is the reciprocal of the world’s faith in the deeds and words of the likes of Ben Bernanke”. As the global Central bankers increase their supply of paper currency, we should all be losing faith in their promises and move to the historical form of money that just cannot be created out of thin air or by the push of an electronic button.

Why gold? According to James Rickard there will soon be a re-linking of gold to money at a significantly higher price; i.e. an across-the-board devaluation of the world’s major currencies which will create the inflation that the central banking policymakers really want. It then allows nations to repay debt at par with currency that is worth considerably less because it was recently printed. Mr. Bernanke does this every day when he prints new currency to buy old bonds. He is reducing the debt load of the country with devalued currency.

It is important to remember that, “In a currency war nobody wins”; we see a lot of wealth destruction unless we own hard assets that systematically increase as inflation takes place. Gold is the historical favourite.

Mountains of debt will be an insurmountable obstacle to any country’s previously loved higher standards of living. The growing gap between what the government attests to and what it spends will always threaten its financial solvency. And this, today, is a global problem – not only one for the United States. The pending economic situation is all about debt, deficits, and inflation. Rising and unsustainable debts or deficits will potentially sooner or later lead to potentially catastrophic consequences. At the top of the list has usually been severe inflation in the future.

The whole situation mirrors the late 1960s, during a period that led up to the “Nixon Shock.” Back then, the world was on the Bretton Woods System – an attempt on the part of Western central bankers to pin the dollar to gold at a fixed rate, while still allowing the metal to trade privately as a commodity. This led to a gap between the market price of gold as a commodity and the official price available from the Treasury.

As the true value of gold separated further and further from its official rate, the world began to realize the system was unsustainable, and many suspected the US was not serious about maintaining a strong dollar. West Germany moved first on these fears by redeeming its dollar reserves for gold, followed by France, Switzerland, and others. This eventually culminated in President Nixon “closing the gold window” in 1971 by ending any link between the dollar and gold. This “Nixon Shock” spurred chronic inflation throughout the ’70s and a concurrent rally in gold.

Perhaps the entire international community is thinking back to the ’60s, because Germany isn’t the only country maneuvering away from the dollar today. The Netherlands and Azerbaijan are also discussing repatriating their foreign gold holdings. And every month, we hear about central banks increasing gold reserves. The latest are Russia and Kazakhstan, but in the last year, countries from Brazil to Turkey have been adding to their gold holdings in order to diversify away from fiat currency reserves.

And don’t forget China. Once the biggest purchaser of US bonds, it is now a net seller of Treasuries, while simultaneously gobbling up gold. Some sources even claim that China has unofficially surpassed Germany as the second largest holder of gold in the world.

Unlike the ’60s, today there is no official gold window to close. There will be no reported “shock” indicator of a dollar flight. This demand by Germany may be the closest indicator we’re going to get. Placing blame where it’s due, let’s call it the “Bernanke Shock.”

…..Let me warn my readers if you decide to read through the full length of this report you will continue to

read that I am more bullish on the price of gold than ever and that I am expecting a future global inflationary scene. The warning is that you should know that I am well aware that the price of gold currently is down by more than 15%, the biggest drop since 1980, and according to most “street” players does not look so good for the future. The last six months has been the worst stretch for the gold price since the early 1980s but also from which time the price of gold is still up by over 500%, after twelve years of rising prices.

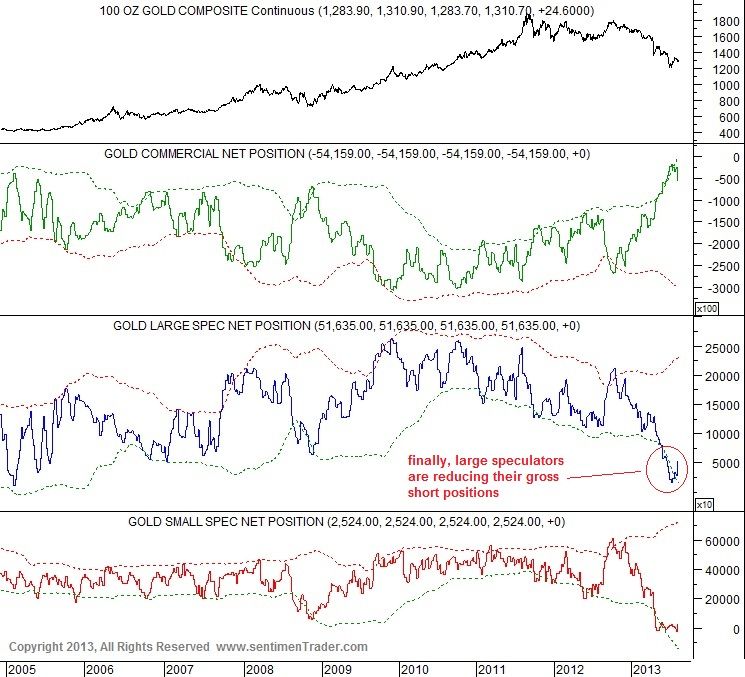

Clearly the number of obvious fundamentals working for a higher gold price is in decline other than several of my personal favourites. The mania of fear about global money printing and the continuous purchase of gold by central bankers, especially from China, is very much still intact. The herd of every day investors who got on the band wagon in the bear market of 2007 is probably lightening up as the fear of shorter term gold price is worse than the Armageddon than has been in place. The real gold players are still intact as can be seen in that in this same recent fourth quarter of 2012 central bankers bought 145 tons of gold bullion.

The first quarter of 2013 is not published as yet, but expect to see more buying of gold by central bankers. The purchase of 145 tons in Q4 was only eclipsed by central bank buying in the second quarter of 2012, when they bought 161 tons, the largest sized purchase by central bankers in any previous quarter of a year. The recent fourth quarter purchase of 145 tons is the second largest purchase of central bankers, ever. I ask you to consider that in my view the central bankers of the world are the only people who have full access to inside information and whose job description demands that they use it for their quest to keep the economy, as seen by others, to look very stable.

And today the world does not look very stable.

We have trouble in the Eurozone and of course, today, Cyprus; the US GDP in the fourth quarter of 2012 “grew” at an annualized rate of 0.4% which was deemed positive as most thought that there would be a 0.1% negative figure. This “show” of better numbers than expected of course has a negative effect for the US gold odd lotters who use the GLD ETF. In addition, the Federal Reserve in the US managed to somehow, since the end of 2012, move the value of the US dollar up by 4%. Obviously because gold is priced in those reserve currency dollars that automatically causes the price to go down. However, a 4% increase in the dollar is a move that looks very anomalous as compared to previous dollar valuation.

Fortunately, for Mr. Bernanke his job is made easier by the “currency war” that actually is in place, notwithstanding the many denials. As a result, while some central bankers are major buyers of gold, there is at least one in Washington who needs the gold price to remain quiet, or down, to achieve his country’s needs for stability. However, there is a bigger picture and the two largest buyer nations, Russia and China, have recently had a very friendly tête-à-tête meeting of the Presidents. Newly elected President Xi Jinping of China used the term “international strategic partners” to describe the new Russian-Chinese relationship.

Stay tuned on the gold price, the true buyers of gold would rather see a lower price. The central bankers outside of the United States may have a different vision than the US central bankers who are entrapped by the Keynesian view as they try to dismiss gold as having any value from a self serving logic to keep the reserve currency of the world stable. And besides, once Goldman Sachs covers their short position they will probably falsely seduce as much gold buying as they did on the announcement of their short sale on April 10.

……………..While most of the obvious outlook for the year 2013 carries total uncertainty, there are three things of certainty for this writer:

1. Inflation will go higher

2. Yield of any kind will be the attraction and will be at higher and higher rates

3. The commodity super-cycle is not over

Gold Stocks:

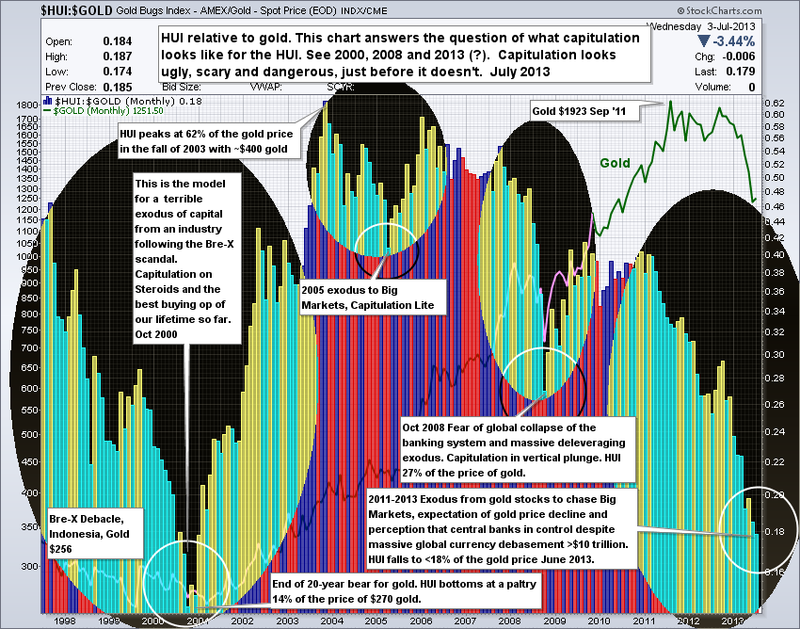

John Templeton always told us, “Do not tell me where the news is best – tell me where it is the worst”. Guess what? Today it is the worst in the mineral industry, especially in gold. I continue to consider that gold and gold stocks are still in a long term secular bull market that began in late 1999 and early 2000, and today gold and gold stocks are recovering from their recent lows created by the Goldman Sachs “go-short warning” of April 10 th, 2013. At current prices (April 11th, 2013), gold as a commodity looks historically inexpensive when compared to historical prices.

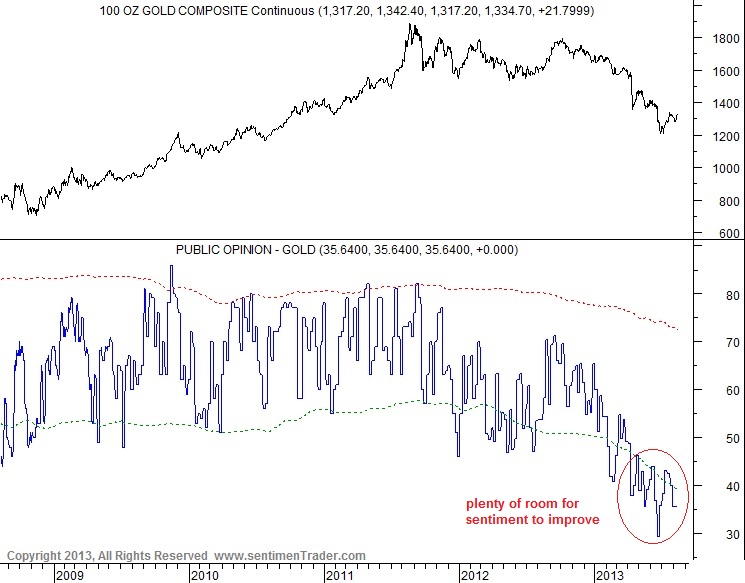

Gold as an ETF is under siege today and maximum pessimism is being delivered in the midst of a very Long-term secular bull market for gold in bullion format. This is a very unique set of timing, not unlike the early days of the 1970s when gold at $100 an ounce was a pure giveaway. Prices have been created by false and manufactured pessimism. Within a more secular bull market we can expect unbelievable opportunity for significant gains. The overall market for gold is still in a bull market but the current situation is acting like a bear market. As John Templeton said, “Buy at maximum pessimism”.

There can NEVER be a taper

The US Federal Reserve led by Ben Bernanke is talking out of both sides of his mouth. In late February he said that due to signs of improvement in the economy (that only he saw) he might stop buying debt and printing money. Nonetheless, the $85 billion of debt he buys each month continues like clockwork, even today, in May.

The Future of Asset Management

I have been a professional asset manager for over fifty years. Many years which included portfolios of publicly traded stocks and bonds for wealthy families, banking institutions, pension funds of major companies, mutual funds of diverse holdings as well as the creator and provider of “tax flow through” investment dollars to a hybrid of junior and senior Canadian resource companies.

I have come to realize that a lot has changed since 1962. In fact, a lot more has changed since 2002. According to the CFA Institute whom I quote herein: “In 2002 asset managers were still smarting from the fact that ‘Yahoo’ did not take over the world.” “Institutional investors were firing balanced managers and replacing them with “specialized ones” (whatever that is). ETFs were just coming out as a niche product which really did not look any different than an index fund or most similarly specialized mutual funds. Spreading risk through structured derivatized vehicles like collateral debt obligation was incorrectly thought to lower risk not to increase it. And so, said the CFA Institute, it was generally unrelievedly agreed that Alan Greenspan “was the wisest man in the world”. Of course, says the CFA Institute today, things look different now. It is safe to say that very few people projected those ten years from 2002 to 2012 as they turned out.

So how do they think it is now going to be for asset managers in the next ten years?

• revenues are not going to grow as fast

• margins will be compressed

• there is a shift out of high margin to lower margin products

• profitability will be down

• competition will be increased

• the ETF market will continue to grow

• enhanced indexation or engineered beta (whatever that is) will take on market share

• along with a host of other negatives as related to asset management participants

IS IT AN UPSIDE DOWN WORLD?

The world is awash with contradiction with stocks rising to new highs as interest rates reflect a slowing economy. The stock market rally is not believable and is unloved by those of us who are deemed to be pro. In 2009 when I was being bullish and stating that the US Fed and Monetary policy could return the US to growth as well as inflation there was much skepticism. The reverse is now true. Other than me, equity investors seem to have a very high degree of faith that the central bankers can pull all off those variables which they thought were not possible in 2009. My view – the faith in the US Fed is totally misplaced. After four years of extreme monetary policy the Fed (Bernanke) has failed to create real economic growth.

Today, even China has too much debt. They are likewise addicted to debt to achieve growth, but they at least are smart enough to be ridding themselves of US Treasury Bills. Nothing is normal. Not the economy. Not the financial system. Not the financial markets. And not the political system.

…Clearly, it would appear that Dr. Bernanke has no real exit strategy, other than his personal exit. If the

Fed actually raised rates as a result of one of its movable goal posts being hit, the result could be a much

greater financial crisis than the one we lived through in 2008. The bond bubble would burst, interest rates and unemployment would soar, housing prices would collapse, banks would fail, borrowers would default, budget deficits would swell, and there would be no way to finance another round of bailouts for anyone, including the Federal Government itself. It’s not really safe out there.

In order to generate phony economic growth and to “pay” the US debts in the most dishonest manner possible, it appears that the Federal Reserve is leading the world to the destruction of the dollar.

Anyone with wealth in the U.S. dollar should be concerned that the economic leadership is firmly in the hands of bureaucrats who are committed to an ivory tower version of reality that bears no resemblance to the world as it really is. And the Chinese and the Russians are aware and do have that very concern.

There is no exit strategy for the monetization of debt. Any increase in interest rates would blow away the monetary policy of the United States and will likely undo the reserve currency privilege of the dollar.

…

The US household debt today is at all-time highs as compared to household income, and most credit cards and home equity lines are maxed out. To increase consumption, earnings must rise and unemployment has to be reduced. Further, the lack of domestic savings and an aging population with more and more retirees would actually mean less consumption and growth over the near term and at current debt levels, as well as deleveraging on a global basis. There is likely insufficient even global savings to fund the American’s Squanderville even though the Federal Reserve in the US continues to issue Squanderbonds and creating pieces of paper, causing many foreigners of Thriftville to grow uneasy about the long-term value of the American Squanderbonds that are continuing to be created.

Gold

Let me bring back gold and tell you why I am a totally convinced gold nut. The story of gold has no ending but I was impressed by a fellow Canadian by the name of Robert Mundell who – in December 1999 – won the Nobel Economics prize and said as he accepted the prize, “The main thing we miss today is universal money, a standard of value. The link between the past and the future and the current linking remote parts of the human race to one another”. He went on to remind his audience that gold had filled that role from the time of Augustus until 1914 and that the absence of gold as an intrinsic part of our monetary system today “makes our twentieth century unique in several thousand years”. It now seems that in 44 BC all roads led to Rome, In 1944 all paths led to the USA and today and 2014 all roads lead to gold.

Goldman Sachs’ Jeffrey Currie created gold’s biggest collapse since 1980 after the recent April 10 Th because he recognized two very essential technical points. Firstly, presumably, without his assistance the price chart of gold had just gone through the technical point called “The Death Cross”. Secondly, he had the power of Goldman Sachs behind his negative thrust,. As such, the price of gold as measured by the ETF traded down as GLD broke down after twelve straight years of a rising price. However, while the public at large was selling their ETF as a follow up to Goldman, the central bankers of the world used the price drop to bulk up their purchases of gold bullion and China for one was a significant buyer of the metal as well.

When it comes to gold, the central bankers have more power than Goldman and we are treating the drop in price as a Goldman Sachs’ profit ploy and expect that it will take some time to overcome the technical damage with the likelihood of more bottom testing to come. We are more impressed by the response of the physical buyers of gold bullion in Asia and the US where there was a rush to buy physical gold at the Goldman-created lower price. There are indications that some Indiangold retailers were actually paying a premium of $8 to $10 per ounce over the derivative ETF price in order to meet immediate customer demand. They have paid premiums before but these numbers are four or five times the previous premiums to satisfy Indian retail demand. And to top it off, the China Gold Association has reported that Chinese retail purchases of bullion tripled across China on the 15 Th and 16 th of April following the Goldman inspired price collapse.

Further, according to CLSA, it was reported that trading of gold on the Shanghai Gold Exchange, a proxy for gold demand in China surged to a record 43.3 tonnes on April 22 and is averaging 36 tonnes per day of buying as compared to a daily average of less than 10 tonnes per day for the first quarter of 2013 and according to CLSA again, “Hong Kong jewellers have said that they have effectively run out of gold holdings”. And in the US, the mint said that they have suspended sales of its smallest one-tenth ounce gold bullion coins as “surging demand ran down government inventories”.

To quote CLSA once again, “It is interesting to note how the technical breakdown in bullion seems to have been triggered by massive selling of pap er gold, in what increasingly looks like a classic “bear raid”. This is all part of a process where ownership of gold is passing from weak hands to strong hands. That is long term bullish”.

We agree with the CLSA comments and congratulate Goldman Sachs for ach We agree with the CLSA comments and congratulate Goldman Sachs for achieving a profitable “bear raid”; not their first and highly likely, not their last.

My personal gut feeling is that we are heading towards a seismic move for the price of gold – a seismic move upwards – just to make it clear. It will happen because governments and central bankers are more likely to step-up fiscal and monetary actions as the economic growth outlook continues to deteriorate. We are on the threshold of a new gold standard being formed. The world is moving step by step towards a de facto gold standard or a new facto gold standard take over by the International Monetary Fund.

Background on the Gold Market

What’s done is done. Inflation is ongoing. Deflationist Error

Ganging up on gold http://www.acting-man.com/?p=24310