CNBC Interview of John Hempton (Bronte Capital in Australia) on going long on Herbalife DESPITE agreeing with Ackman.

http://video.cnbc.com/gallery/?video=3000139284&play=1

Hempton: Short-seller Went Long Herbalife Fri 04 Jan 13. The following transcript has not been checked for accuracy.

Hempton: Short-seller Went Long Herbalife Fri 04 Jan 13. The following transcript has not been checked for accuracy.

CNBC: Activist Robert Chatman battling Bill Ackman on Herbalife (see next article in this post). Herbalife’s Chairman says Ackman will lose his fight against Herbalife. But he have not the only one who thinks they will lose. Watching this battle, in his own words, says it is like watching hedge fund porn. Herb, thanks for joining us today.

Herb Greenberg: What makes him so interesting in this case is that he is mostly known as a short seller and he is buying the stock even though he agrees with Ackman. He joins us now live in our studios. John Hempton of www.bronte.com, “How are you.”

Hempton: I’m pretty well.

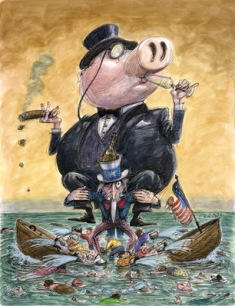

Greenberg: I got to ask a quick question here. yeah. You’re a short seller and you are — you are long this stock. How does that work? Why would you do that? I’m pretty familiar with scum bags. Multilevel marketing schemes are scum bags. There are a million people in their chain and Bill Ackman says Herbalife is ripping them off. Tobacco companies kill twice as many people a year as Herbalife has in its network. Those companies kill 400,000 people in America. Hugely profitable. They are scum bags but return cash to shareholders for decades. If you have shorted them, you’ve been run over.

Herbalife, five years ago, had about 140 million shares, it now has 108 million shares. It buys back stock regularly; pays a fairly hefty dividend. They are a scum bags, but they are a stock market scum bag.

Greenberg: You have to be careful with what you say here. The question is, will the Federal Trade Commission (“FTC”) go after the company? One reason you don’t believe that Ackman will be right is because you don’t believe the FTC will do that.

Hempton: You say something obviously is wrong and you think the government will rescue you. all Herbalife needs to do is find somebody who was fat and is less fat because of Herbalife and somewhere in the 2.5 million distributors there will be a few of those. Wheel them out in front of them (FTC regulators), and you are know, what Bill Ackman’s case now is that the government’s going to go and help the billionaire hedge fund manager.

Greenberg: I know another hedge fund manager here john, and he is very politically connected, very short the stock, and he believes that the heat will get turned up on this industry very quickly here. And he believes that one of the things they will be looking at is the industry itself targeting lower-income people. So what is to say that even though the FTC didn’t do this before, they don’t come back and do it now?

Hempton: I believe the same thing about the tobacco companies 20 years ago. the FTC has known about multilevel marketing schemes for decades. If this (Herbalife’s scam/cash flows) lasts three years, Ackman is wrong. If it lasts a decade, Ackman is so wrong, it’s just silly. Now this thing really has cash flow. A thesis that says, I got to wait for government is a bad thesis. I don’t know how many really dodgy companies I’ve reported to the FTC and what do they do? Sometimes they fine them. The vast bulk of the time they don’t.

CNBC: “Herb (Greenberg), I’m wondering where we go from here. I know we are looking forward to Herbalife’s rebuttal and Ackman is preparing his rebuttal to that rebuttal. What is the next chapter in the story?

Greenberg: Does this does become the equivalent of the for profit education industry where they go after it and where the industry, people said, they will never go after that industry. The government went after that and in this case you end up with a very hard reset of the business models of these companies.

Hempton: And for profit education industry case the victim is at least in part the government. the government giving stupid loans. a relatively easy way of the government reducing their fiscal drain.

Greenberg: John (Hempton), if in it case the victim is lower-income population, a lot of lower-income population and the Obama Administration could be very interested in that, wouldn’t that potentially have an impact?

Hempton: When did the government care about lower-income people in that way? Lower-income people are largely the victims of tobacco companies too. You look at tobacco, it is completely inversely correlated to wealth and income. Rich people don’t smoke. Poor people smoke. People in most jurisdictions just raise taxes from that.

Greenberg: Okay, we will see who is correct on this one. John, thank you very much for coming along.

And more discussion here…..http://brontecapital.blogspot.com/2013/01/bill-ackman-either-lacks-imagination-or.html?utm_source=feedburner&utm_medium=email&utm_campaign=Feed%3A+BronteCapital+%28Bronte+Capital%29

Herbalife: Why I Made It a 35% Position after the Bill Ackman Bear Raid

This is a guest post prepared by Robert Chapman. Chapman is the founder of Chapman Capital LLC, which is a Los Angeles based investment company specializing in takeovers and turnarounds. In 2000, Chapman Capital was an activist versus Herbalife following the death of Herbalife’s founder Mark Hughes. This is an amazing article. It’s well-researched and easy to understand. If you’re remotely curious about the future of Herbalife after Ackman’s attack, the mechanics of short selling and the potential value of Herbalife’s stock, this is a MUST read. If you find this article informative, hit the +1 or Like buttons above. Sincerely, +Kevin Thompson

…REGUATORY SUMMARY: FTC has been there, done that.

The Ackman Tell. Many poker games are won and lost upon that infamous turning point when a player properly reads his opponent’s “tell.” To wit, I am confident that during an interview with CNBC’s Andrew Ross Sorkin on “D-Day” (12/20/2012), Bill Ackman slipped his “tell”, confirming my suspicion that he already realized the FTC wasn’t going to make his day by shutting down HLF. I strongly recommend all HLF traders/investors read the transcript of this interview, as Sorkin does a masterful job of fighting the media urge to genuflect before Ackman’s drawn down zipper, otherwise known as “The Whitney Tilson”.

http://thompsonburton.com/mlmattorney/2013/01/01/herbalife-why-i-made-it-a-35-position-after-the-bill-ackman-bear-raid/

Interview with Michael Mauboussin: Untangling Skill and Luck in Business, Sports, and Investing (From www.simoleonsense.com)

Interview with Michael Mauboussin: Untangling Skill and Luck in Business, Sports, and Investing (From www.simoleonsense.com)

Today we’re going to talk about the role of skill and luck in generating success.

Michael Mauboussin’s Background

Michael Mauboussin, is the Chief Investment Strategist at Legg Mason Capital Management. Michael is also an adjunct at Columbia Business School and Chairman of the Board of Trustees at The Santa Fe Institute.

Book Synopsis

What role, exactly, do skill and luck play in our successes and failures? Some games, like roulette and the lottery, are pure luck. Others, like chess, exist at the other end of the spectrum, relying almost wholly on players’ skill. In his provocative new book, Michael Mauboussin untangles the intricate strands of skill and luck, defines them, and provides useful frameworks for analyzing their relative contributions. He offers concrete suggestions for how to put these insights to work to your advantage in business and other dimensions of life.

Click Here To Watch The Interview

Click Here To Access The Transcript

CSinvesting Editor: Just remember that those that know, don’t tell; and those that don’t know, have the floor to themselves. Some might call Mr. Mauboussin, “an entertainer.”