First, I get my stock tips from experts.

Second, I wait until the recommended stock goes up after the broadcast tip to make sure the trend is your friend. Who needs to understand accounting anyway or the present value of free cash flow. I mean understanding the magnitude and sustainablility of free cash flow or how the business makes money is old news. Compare expectations versus funamentals? I go with price because price is all.

I don’t need to think probabilistically because there are sure things like following Jim Cramer’s recommendations.

I am often wrong but never in doubt.

What behavioral biases? I am right, always right. I don’t need losers like you second guessing me.

Now why would I blindly follow Jim Cramer? The most important part of investing is having someone to blame when you lose money. I typically lose 9 out of ten times and my losses are triple my wins. Consistency wins!

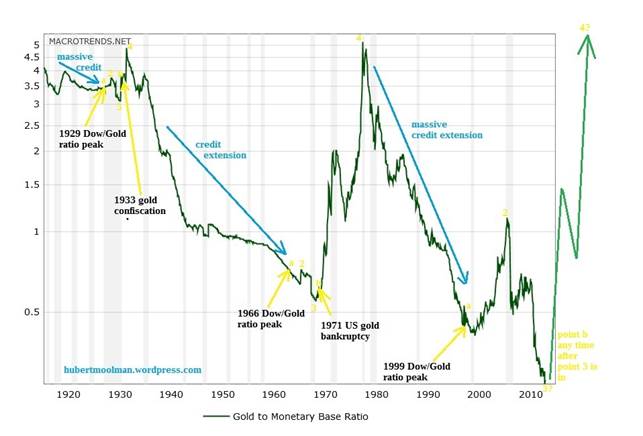

This article hits home because I have also felt the pain of being a contrarian as anyone who types in “gold stocks” in the search box can see.

I bought AG in mid-2014 at $8, then $4.50, then $3. Over two years, I was down over 45% based on my average price. Clients screamed. One said that if my IQ was higher, he could call me stupid. One client took out an insurance policy on me and told me that I might have an accident. Now all is forgiven. Yes, I have sold some AG but still retain a position because conditions haven’t changed, but the price has begun to discount the good news. Risk is higher now than in 2015. Yet, there doesn’t seem to be a mania into these stocks–so far. But mining stocks are burning matches where their assets deplete and deplete. You have to jump off the train when people are clamouring for these companies.

Did your parents ever tell you not to worry about what other people think? I remember my mother telling me this when I was in eighth grade. I’m not sure if she was simply giving good advice or trying to talk me out of buying parachute pants. In the early 80’s parachute pants were a must have for the in crowd. I wanted to fit in, but my mom convinced me it wasn’t necessary to act and dress like everyone else. In hindsight, good call mom. Now if only she would have talked me into cutting off my glorious “Kentucky waterfall” mullet! The pressures of conforming and fitting in don’t go away after eighth grade – it sticks around many years thereafter. Investing is no different.

In the past I’ve discussed and written about the psychology of investing and the role of group-think. The pressure to conform in the investment management industry is tremendous, especially for relative return investors. As their name implies, these investors are measured relative to the crowd. One wrong step and they may look different. Looking different in the investment management business can be the kiss of death, even if it’s on the upside. If a manager outperforms too much, he or she must have done something too risky or too unconventional. For some relative return investors being different (tracking error) is considered a greater risk than losing money. Losing client capital is fine as long as it’s slightly less than your peers and benchmarks. From what I’ve gathered over the years, to raise a lot of assets under management (AUM) in the investment management industry, the key is looking a little better, but not too much better, and definitely not a whole lot worse.

How did we get here? Since my start in the industry, relative return investing has gradually taken share from common sense investing strategies such as absolute return investing. How well one plays the relative return game is a major factor in determining how capital is allocated to asset managers. I believe this is partially due to the growing role of the institutional consultant and their desire to put managers in a box (don’t misbehave or surprise us) and turn the subjective process of investing into an objective science. Institutional consultants allocate trillions of dollars and are hired by large clients, such as pension funds, to decide which managers to use for their plans. The consultants’ assets under management and their allocations are huge and have gotten larger over time, increasing the desire by asset managers to be selected. This has increased the influence consultants have on managers and how trillions of dollars are invested.

During my career I’ve presented hundreds of times to institutional consultants. While I have a very high stock selection batting average (winners vs. losers), my batting average as it relates to being hired by institutional consultants is probably the lowest in the industry. It isn’t that they don’t understand or like the strategy. In fact after my presentations I’ve had several consultants tell me they either owned the strategy personally or were considering it for purchase. Although they appreciated the process and discipline, they couldn’t hire me because I invested too differently and had too much flexibility and control (for example, no sector weight and cash constraints). In other words, they liked the strategy, but they were concerned that the portfolio’s unique positioning could cause large swings in relative performance and surprise their clients. In conclusion, in the relative return asset allocation world, conformity is preferred over different, as investing differently can carry too much business risk (risk to AUM).

Over the past 18 years the absolute return strategy I manage has generated attractive absolute returns with significantly less risk than the small cap market. Isn’t that what consultants say they want – higher returns with lower risks? Yes, this is what they want, but they want it without looking significantly different than their benchmark. This has never made sense to me. How can managers provide higher returns with less risk (alpha) by doing the same thing as everyone else? Maybe others can, but I cannot. For me, the only way to generate attractive absolute returns over a market cycle is to invest differently.

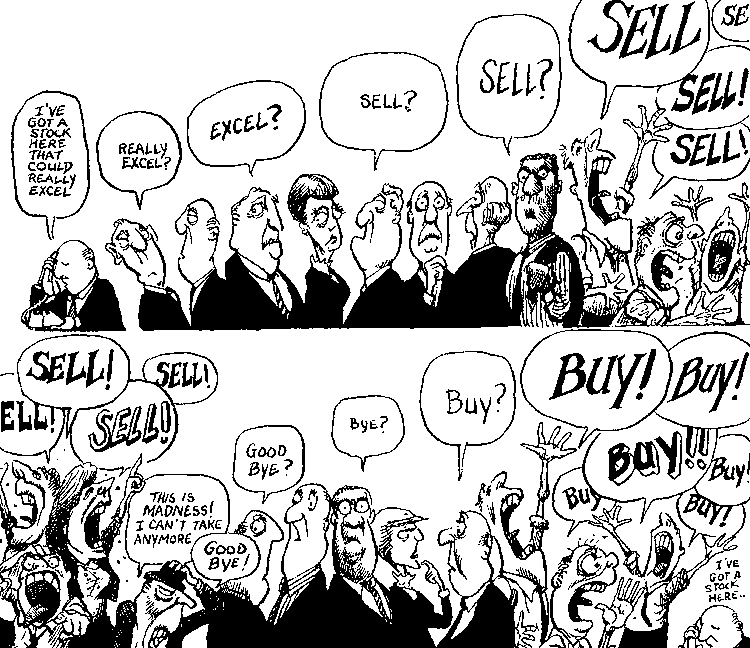

Investing differently and being a contrarian is easy in theory. When the herd is overpaying for popular stocks avoid them (technology 1999-2000). Conversely, when investors are aggressively selling undervalued stocks buy them (miners 2014-2015). It’s not that complicated, but in the investment management industry, common sense investment philosophies like buy low sell high have been losing share to investment philosophies and processes that increase the chances of getting hired. Instead of asking if an investment will provide adequate absolute returns, a relative return manager may ask, “What would the consultant think or want me to do?” I believe the desire to appease consultants and win their large allocations has been an underappreciated reason for the growth in closet indexing, conformity, and group-think.

In my opinion, the business risk associated with looking different has reduced the number of absolute return managers and contrarians. And some of the remaining contrarians don’t look so contrarian. For example, look at the four-star Fidelity Contra Fund. According to Fidelity this “contra” fund invests in securities of companies whose value FMR believes is not fully recognized by the public. Three of its top five holdings are Facebook, Amazon, and Google. I suggest the fund be renamed to the “What’s Working Fund”. With $105 billion in assets under management, one thing that is working is the sales department! Wow, that’s impressive. What would AUM be if the fund actually invested in a contrarian manner? My guess is it would be a lot lower, especially at this stage of the market cycle when owning the most popular stocks is very rewarding for performance and AUM.

I’m not just picking on Fidelity. The relative return gang is in this together. After the last cycle we learned most active funds underperformed on the downside. Given the valuations of some of the buy-side favorites currently, I suspect they’ll have difficulty protecting capital again this cycle once it undoubtedly concludes. This could be the nail in the coffin for active management. If the industry is unwilling to invest differently and they don’t protect capital on the downside, why not invest passively and pay a lower fee?

In my opinion, given the broadness of this cycle’s overvaluation, the most obvious and most difficult contrarian position today is not taking a position, or holding cash. In an environment with consistently rising stock prices and the business risk associated with holding cash, I don’t believe many managers are willing to be patient. That’s unfortunate because I’ve found the asset that is often the most difficult to own is often the right one to own. The most recent example of this is the precious metal miners.

After the precious metal miners crashed in 2013, I became interested in the sector and began building a position. Besides a couple positions I purchased during the crash of 2008-2009, I had never owned precious metal miners before. They were usually too expensive as they sold well above replacement value (how I value commodity companies). Miners are a good example of how quickly overvalued can turn into undervalued. In addition to selling at discounts to replacement cost, I focused on miners with better balance sheets to ensure they’d survive the trough of the cycle.

After the miners crashed in 2013, they eventually crashed again in 2014 and became even more attractively priced. I held firm and in some cases bought more in attempt to maintain the position sizes. After adding to the positions in 2014, they crashed again in 2015 and early 2016. I again bought to maintain position sizes. I’ve never seen a group of stocks so hated. Many were down 90% from their highs – similar to declines seen in stocks during the Great Depression. The media hated the miners with article after article bashing them and calling their end product “barbaric”. I haven’t seen many of those articles recently. The bear market in the miners ended in January. Today they’re the best performing sector in 2016, as many have doubled and tripled off their lows.

Owning the miners is a good example of how difficult it can be to be a contrarian. While clearly undervalued based on the replacement cost of their assets, there didn’t appear to be many value managers taking advantage of these opportunities. I thought, “Isn’t investing in the miners now the definition of value investing? Where did everyone go?” It was extremely lonely. Some investors argued they weren’t good businesses as they were capital intensive and never generated free cash flow. Obviously they’re volatile businesses, but after doing the analysis I discovered that good mines can generate considerable free cash flow over a cycle. Pan American Silver (PAAS) did just that during the cycle before the bust. As a result of past free cash flow generation, Pan American entered the mining recession with an outstanding balance sheet. New Gold (NGD) is another miner with a tremendous asset in its low-cost New Afton mine, which also generates considerable free cash flow. I also owned Alamos Gold (AGI). Alamos had a new billion dollar mine, Young Davidson, which was paid for free and clear net of cash and was expected to generate free cash flow. Alamos was an extraordinary value near its lows and was the strategy’s largest position in 2016.

Assuming a mining company had developed mines in production, generated cash, and had a strong balance sheet, I believed while the trough would be painful, these companies would survive and prosper once the cycle turned. They weren’t all bad businesses when viewed over a cycle, as all cyclical businesses should be viewed. Furthermore, many had very attractive assets that would take years if not decades to replicate. In the end, survive and thrive is exactly what happened for many of the miners this year. I sold several of the miners as they appreciated and eventually traded above my calculated valuations. The remainder were liquidated when capital was returned to clients. It was a heck of a ride and was one of the most grueling and difficult positions I’ve ever taken. But it was worth it.

The reason I bring up the miners is not to boast, but to illustrate how difficult it is to buy and maintain a contrarian position in today’s relative return world. I believe it helps in understanding why so few practice contrarian investing, or for that matter, disciplined value and absolute return investing. During the two and a half years of pain (late 2013-early 2016), equity performance in the strategy I manage suffered. I initially incurred losses and was getting a lot of questions — I had to defend the position. Relative performance between 2012-2014 was poor (high cash levels also contributed to this). During this time, the strategy lost considerable assets under management. People were beginning to believe I lost my marbles. Whether or not I was going crazy is still up for debate, but one thing was certain, holding a large position in out-of-favor miners wasn’t encouraging flows into the strategy. While the miners were eventually good investments, in my opinion, they were not good for business.

As value investors we often talk about being fearful when others are greedy and greedy when others are fearful. However, in practice it’s extraordinarily difficult. In addition to the pain one must endure personally from investing differently, a portfolio manager also takes considerable career and business risk. Given how the investment and consultant industry picks and rewards managers, it can be easier and more profitable to label yourself as a contrarian or value investor, but avoid investing like a contrarian or value investor. Instead simply own stocks that are working and are large weights in benchmarks – the feel good stocks. I’ve always said I know exactly what stocks to buy to immediately improve near-term performance. Playing along is easy. Investing differently is not.

Investing to fit in with the crowd may feel good and it may be good for business in the near-term, but fads are cyclical and often end in embarrassment (google parachute pants and click on images). Participants in fads and manias often walk away asking “What was I thinking?”. But for now owning what’s working is working, so let the good times roll. I’ll stick with a more difficult position. Just like I did with the miners, until it pays off, I plan to stay committed to my new most painful contrarian position – 100% patience. —

Boy does the above post ring true.