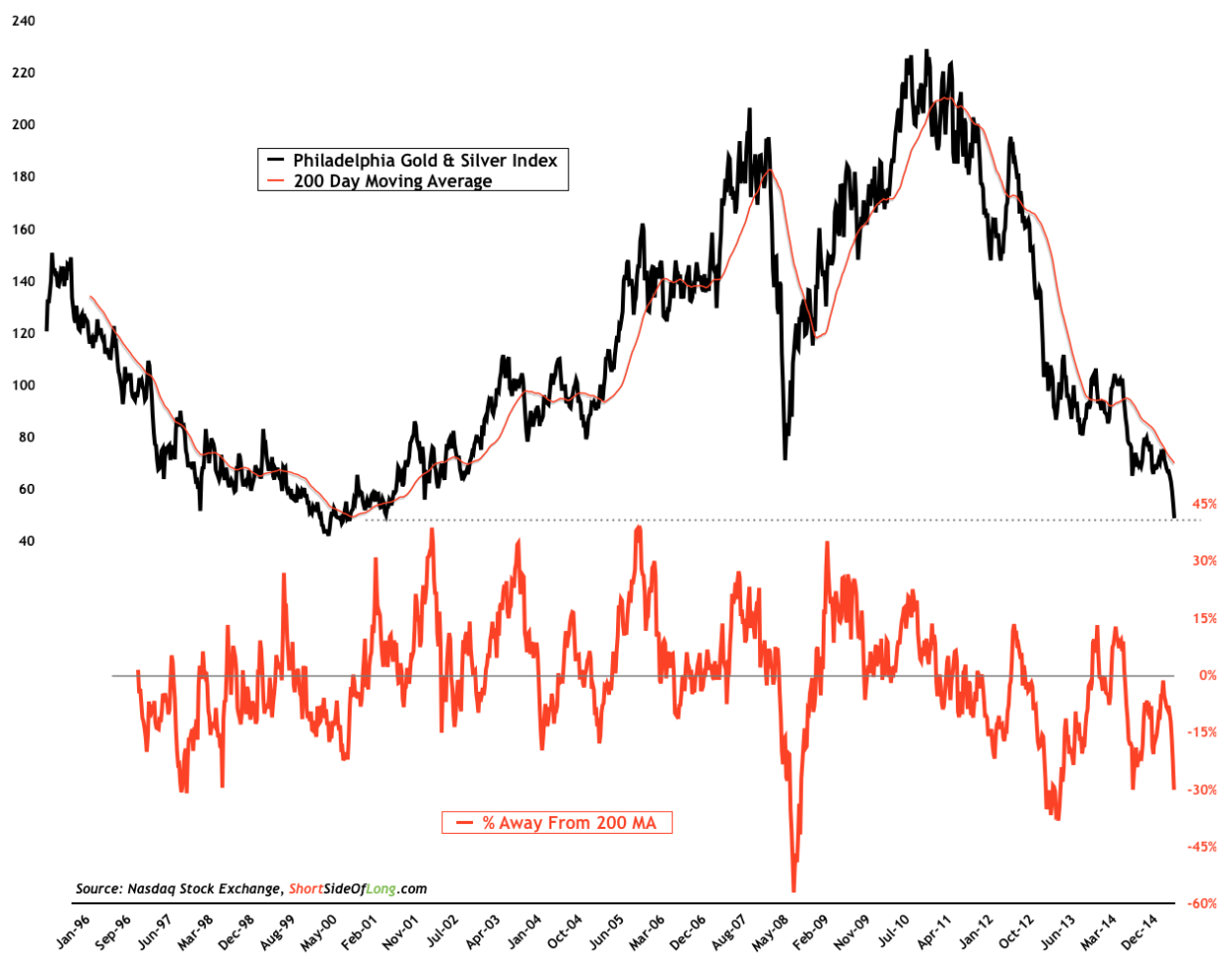

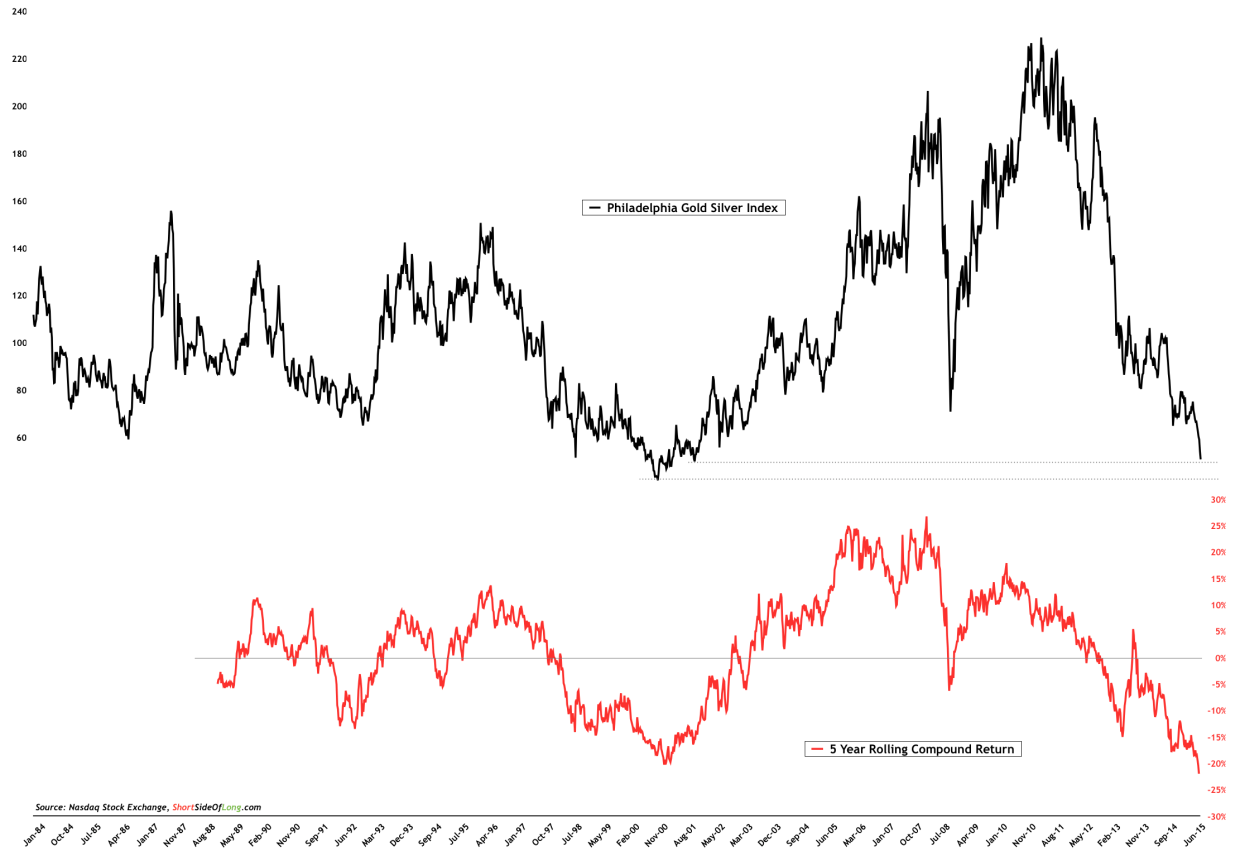

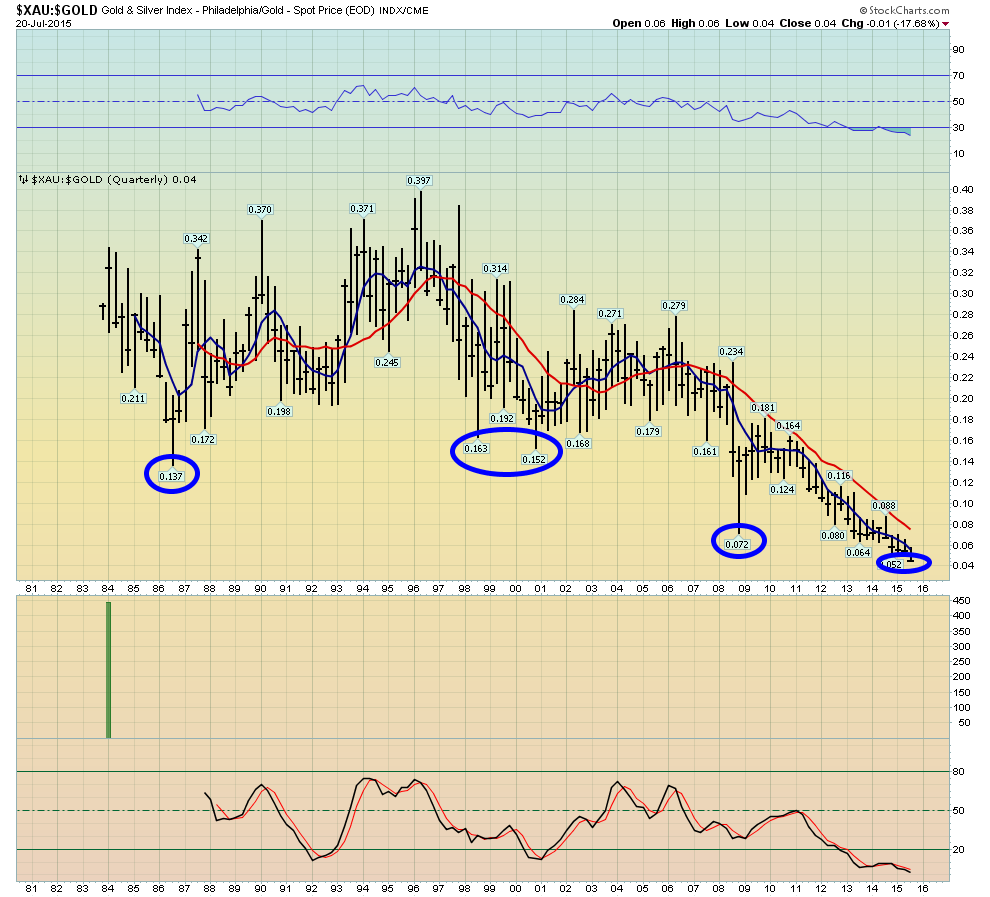

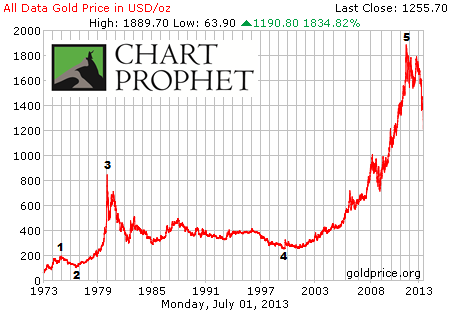

An Epic Bear Market in miners

Mining securities are not the thing for widows and orphans or country clergymen, or unworldly people of any kind to own. But for a businessman, who must take risks in order to make money; who will buy nothing without careful, thorough investigation; and who will not risk more than he is able to lose, there is no other investment in the market today as tempting as mining stock.” – Charles H. Dow (1879)

There is NO REASON to own gold! (NOW, they tell us!)

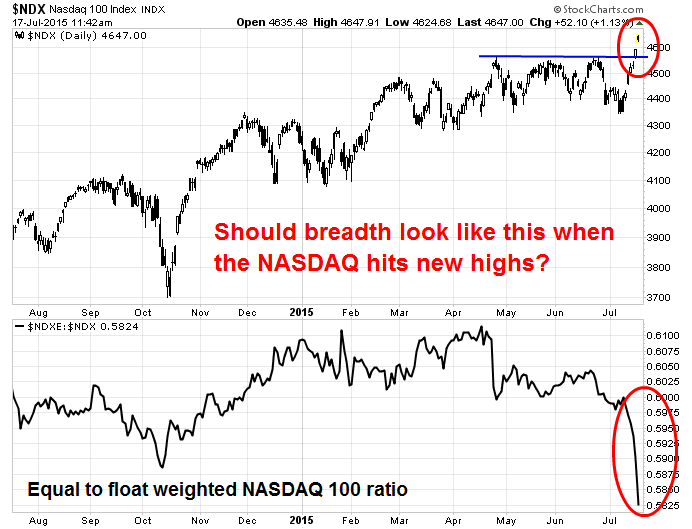

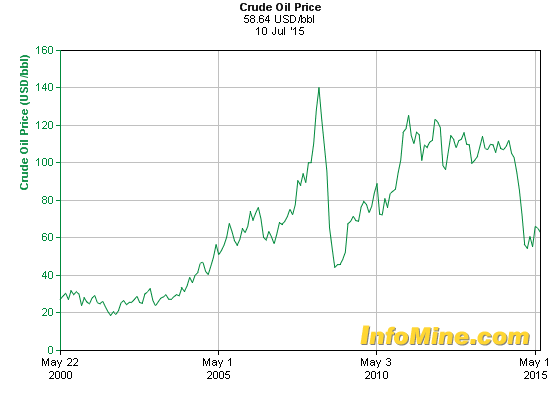

Global dollar stress might be causes gold price crashes.

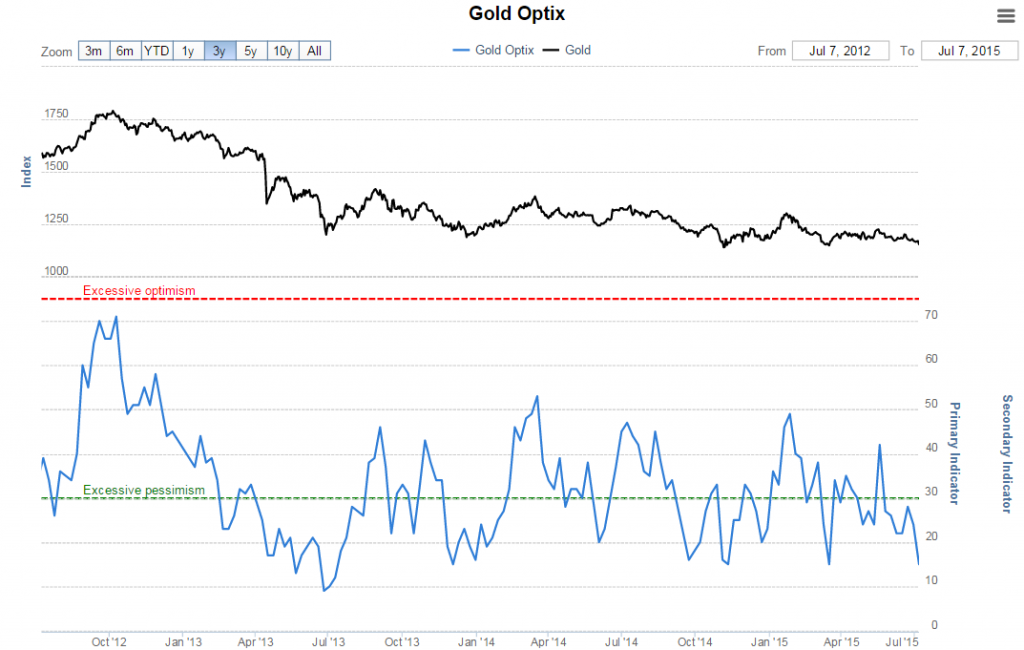

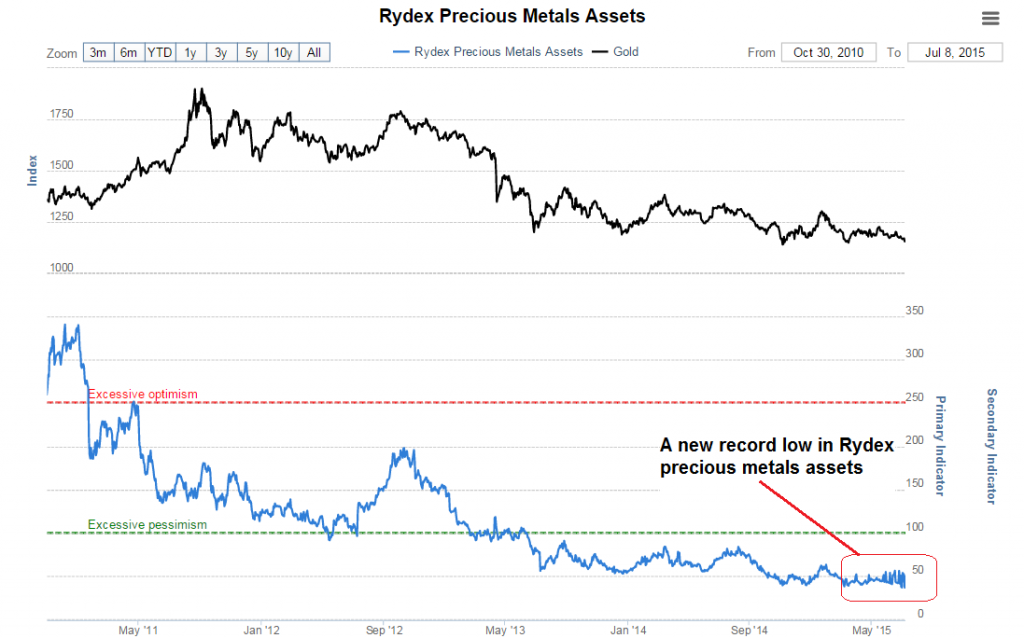

The “price action” for gold is bad! The price of gold went down.

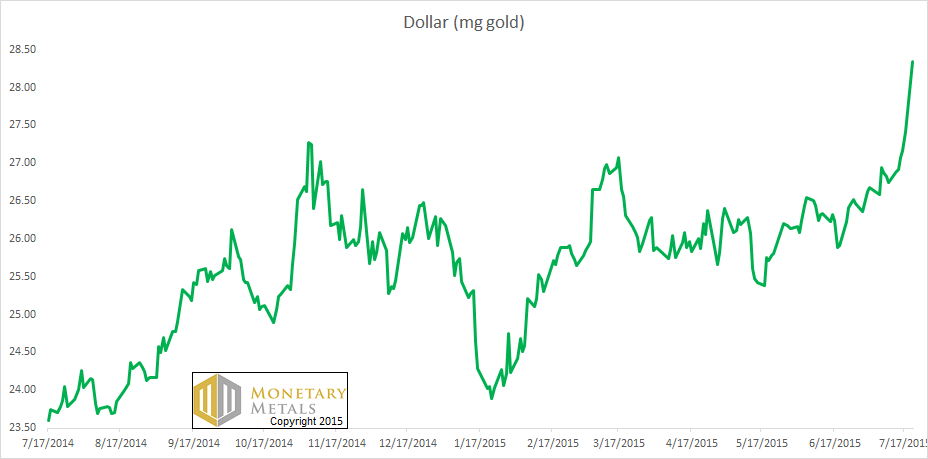

Why not be happy and say that the dollar buys you more gold because of this:

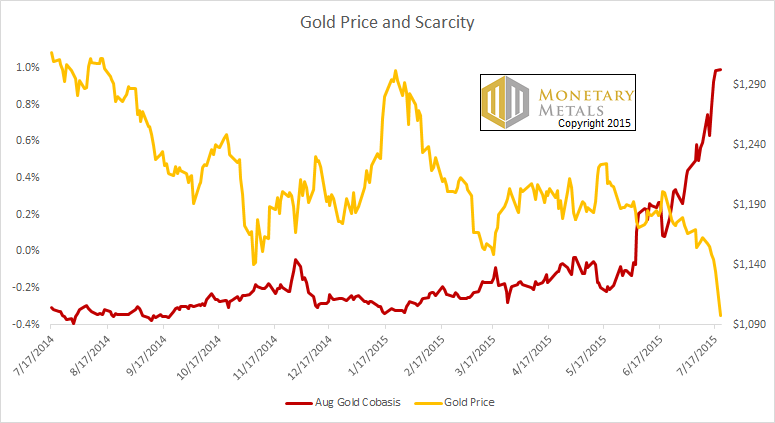

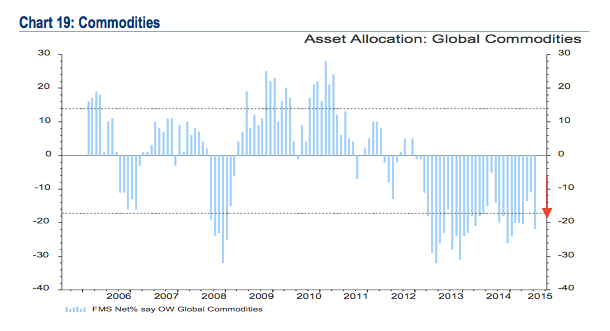

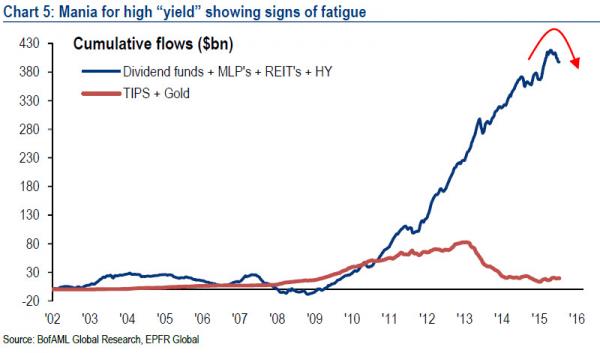

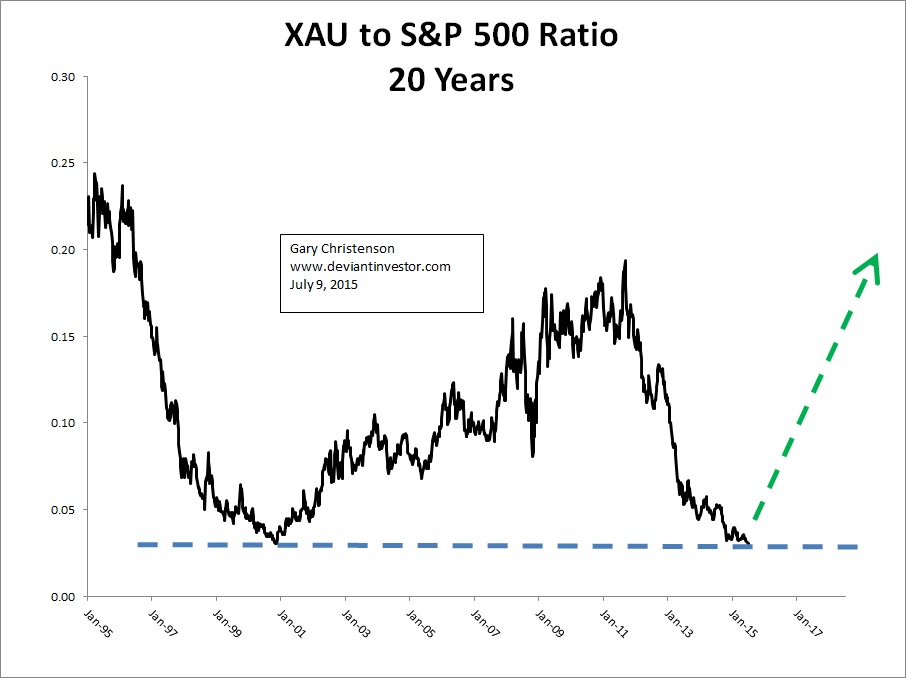

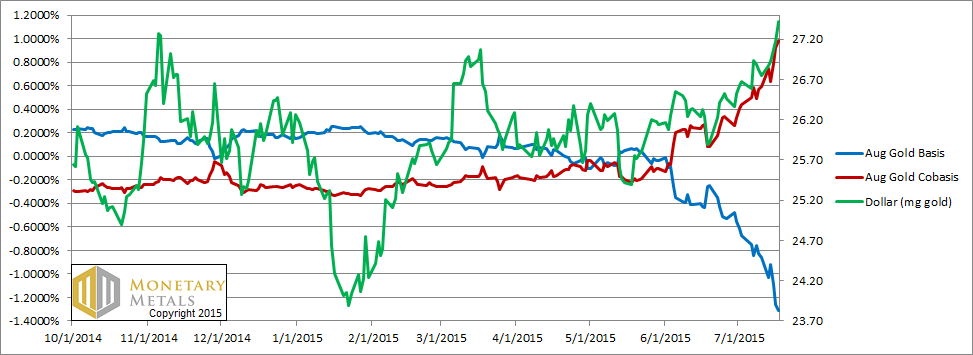

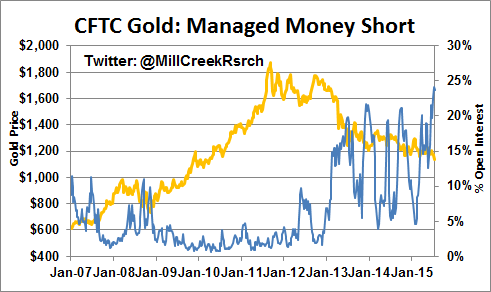

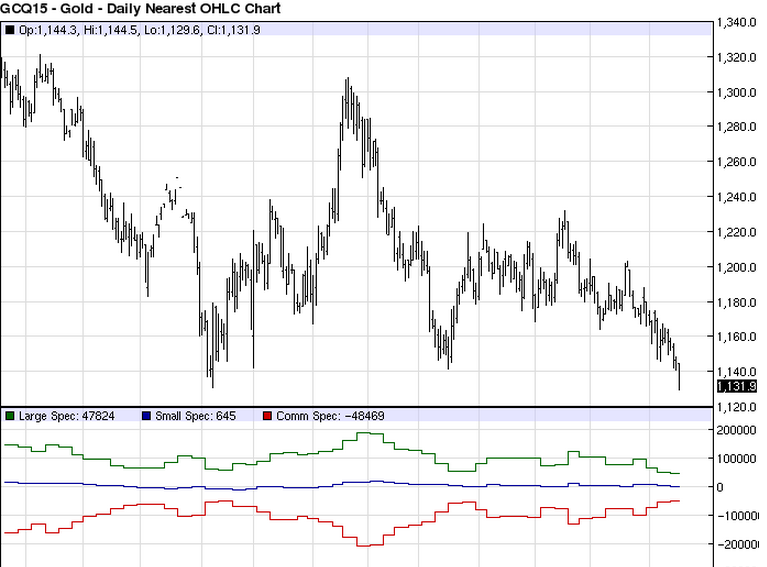

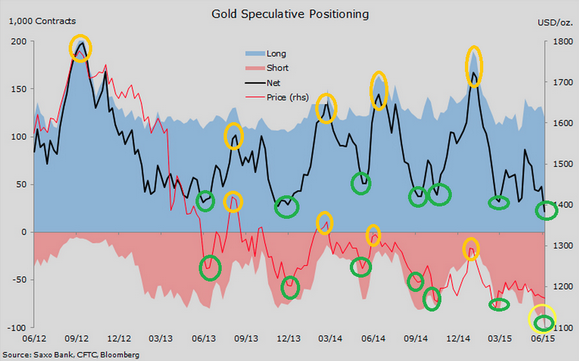

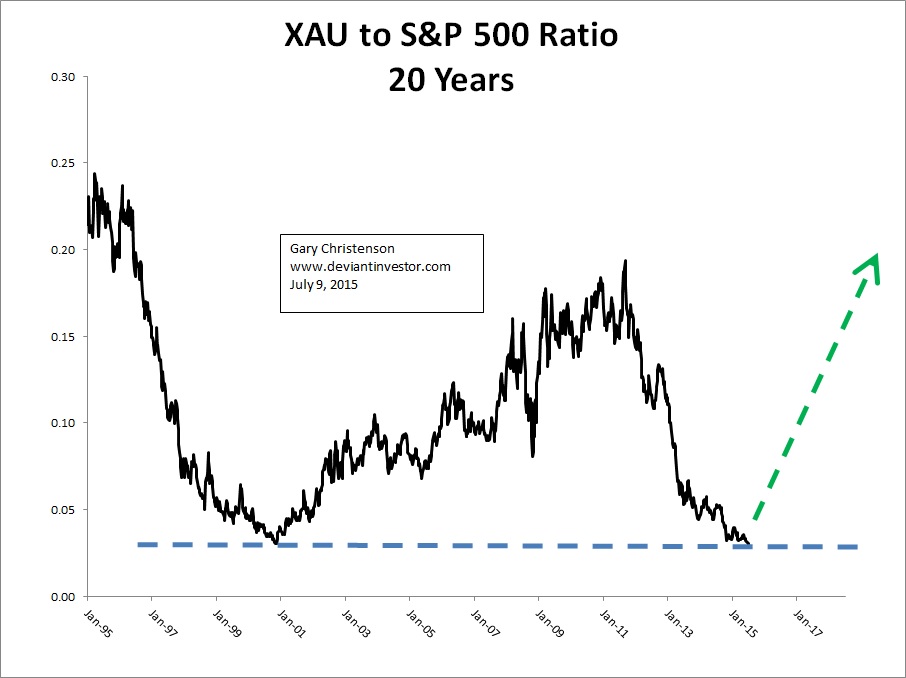

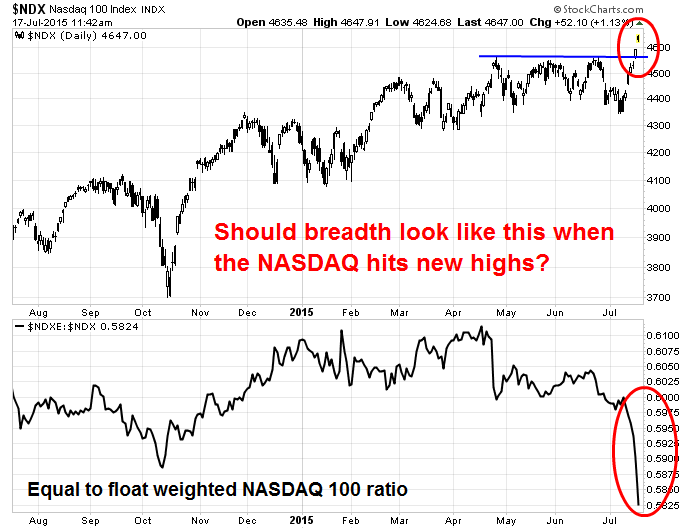

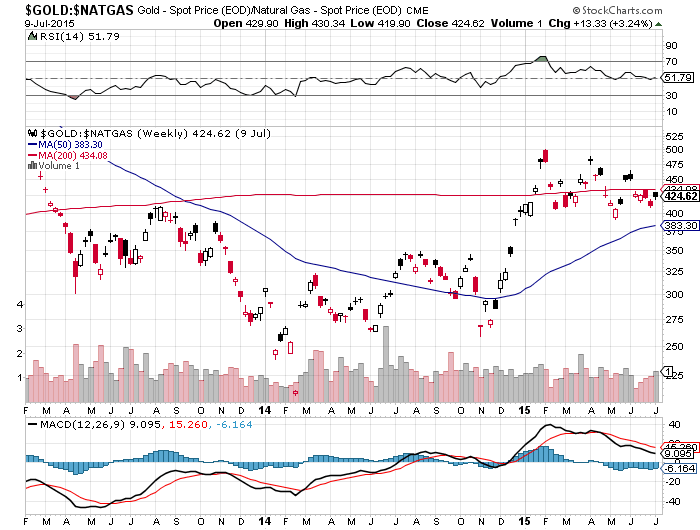

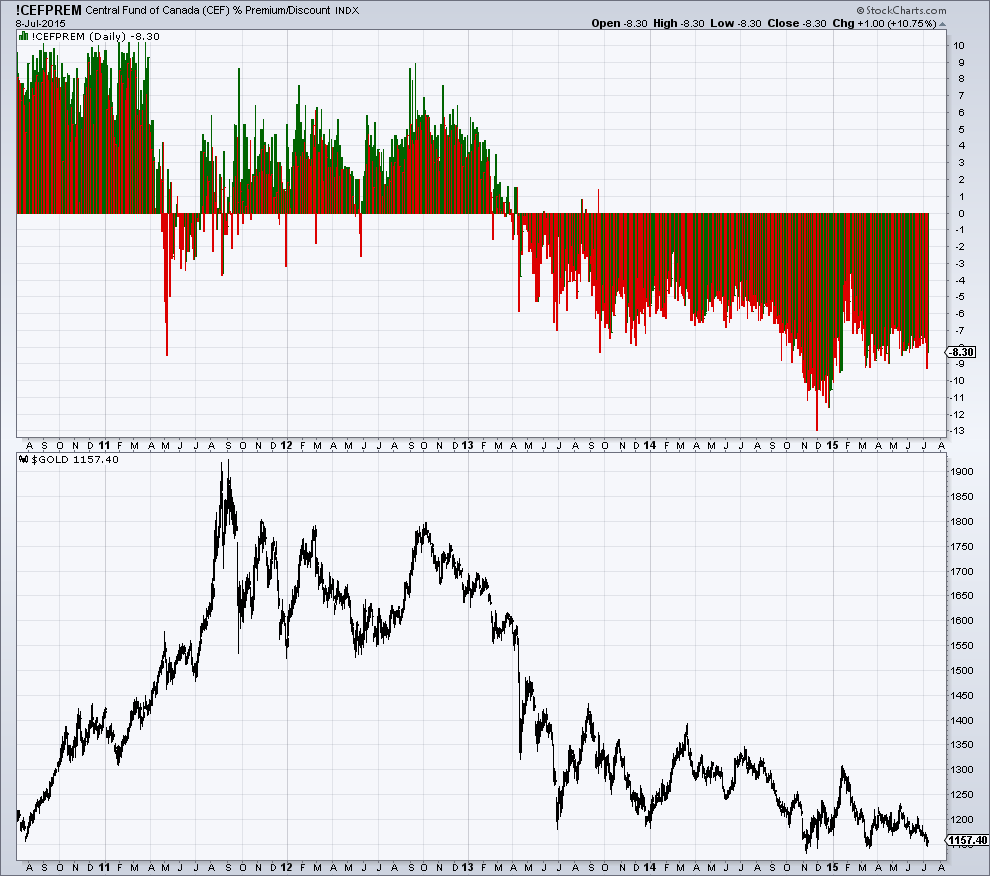

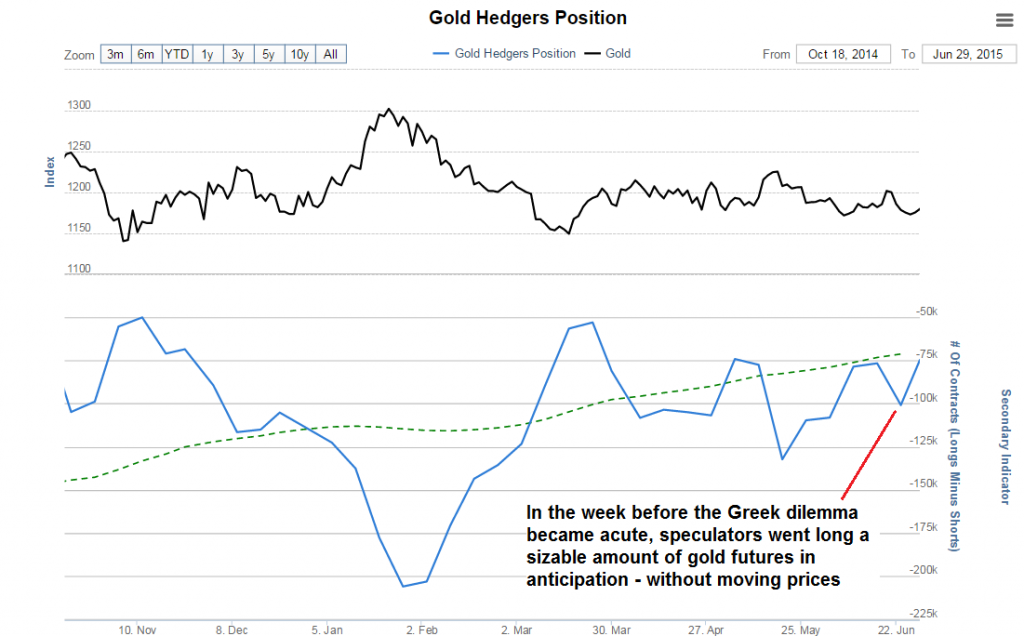

The holders of physical bullion are not selling, but futures traders are–see the red line rising which is the co-basis. If I hold gold in stock, but sell futures to lock in the price, then co-basis represents the difference between the bid price for spot and the offer price for futures. Leveraged futures traders are selling futures but bullion holders are not de-stocking (selling). The selling in gold futures has brought epic extremes in prices of miners relative to gold/silver. EPIC quantitative easing may be a factor.

Video: Sellers in action:SELL ‘EM!

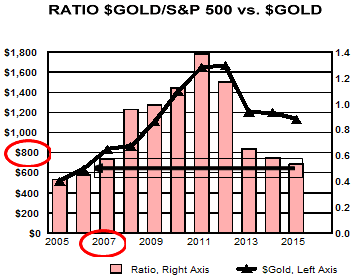

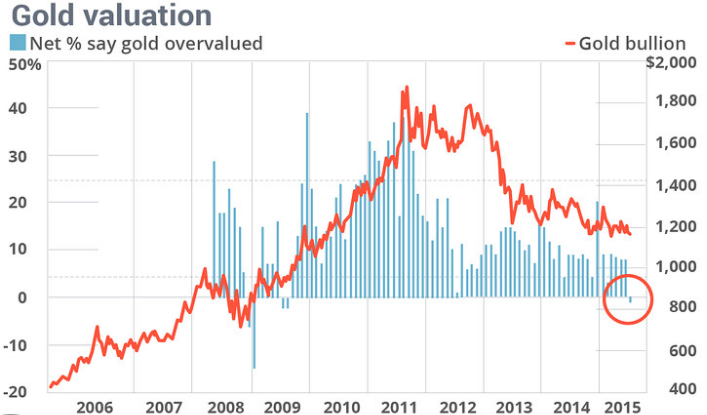

Does Gold represent good “value?”

Only you can answer that question. Don’t confuse gold (money) as an investment. If you couldn’t find a margin of safety in the current stock market, you might own gold because you believe gold relative to dollars is safer, holds purchasing power better, more stable, etc.

For those technical wizards out there, note that silver did not “confirm” the price decline in gold yesterday.

Just remember (thanks www.monetray-metals.com)