Thank you once again sharing the links, access to the value vault, and your blog posts. My experience over the last couple of years has been primarily in private growth investing, and the insights you have shared have helped me significantly reconsider my investment approach.

My Reply: There are plenty of case studies and examples on this site to learn about valuation. You can visit:http://pages.stern.nyu.edu/~adamodar/ https://www.coursera.org/course/accountingand…Value Investing for Grown ups by Damodaran to learn about valuation and accounting. But the secret to investing and improvement lies within you. That sounds either profound or hokey, but true. I don’t believe MBA courses or apprenticeship (if you can find one) will really help. You don’t want to learn about another person’s style, you want to develop your own. Google and youtube.com Michael Burry for why this is true.

As an example, you can read 5 Keys to Value Investing. The author worked as an analyst for Micheal F. Price. He would submit ideas and get grilled by Price. I didn’t see a whole lot of mentoring going on. Of course, you want to study other investors and the psychology of investment:

- Charlie_Munger_The_Art_of_Stock_Picking

- Buffett Klarman and Graham on Mr Market

- Great Investor Behavior

- Investing and Personality Type

But there are no shortcuts to studying yourself. You have to consistently and persistently keep a notebook, log, diary or tape recorder of your trades/investments/decisions. Review them that day and a week, month and year later. Study your proclivities. Can you step outside and see yourself objectively? Impossible? Hire a high school kid on Summer Vacation to film your day at work and see if you notice tendencies. You won’t believe the tape!

Do you have a business plan for your investing career? Goals? Map out the steps.

I highly suggest you see how your countrymen developed their own styles in: http://www.amazon.com/Free-Capital-private-investors-millions/ by Guy Thomas

Review: Conclusion “Free Capital” treads original ground in profiling anonymous, “everyman” successful investors that no one has heard of yet who have interesting stories, experiences and lessons to share all their own. We can all learn from more than just Warren Buffett, after all.

—-

As an example, I know that I am an emotional basket-case. I cry during the cartoons if Tweedy Bird gets hurt (http://youtu.be/89FDAYsTgfs). If I buy a stock at $7.05 and the next print is 7.04, I am on the floor wailing. If Jim Cramer on CNBC said buy Tweedle Dumb stock, I would wait for the stock to rally, then buy after the news is priced in only to sell at a loss seconds later.

Also, I have an aversion to paying full price. I went “Dutch” on my honeymoon; my wedding had a cash bar. My guests had to take the subway to the reception; some had to hitch-hike. I am a cheapie.

Ok, I have to deal with serious psychological issues, but how does that help YOU?

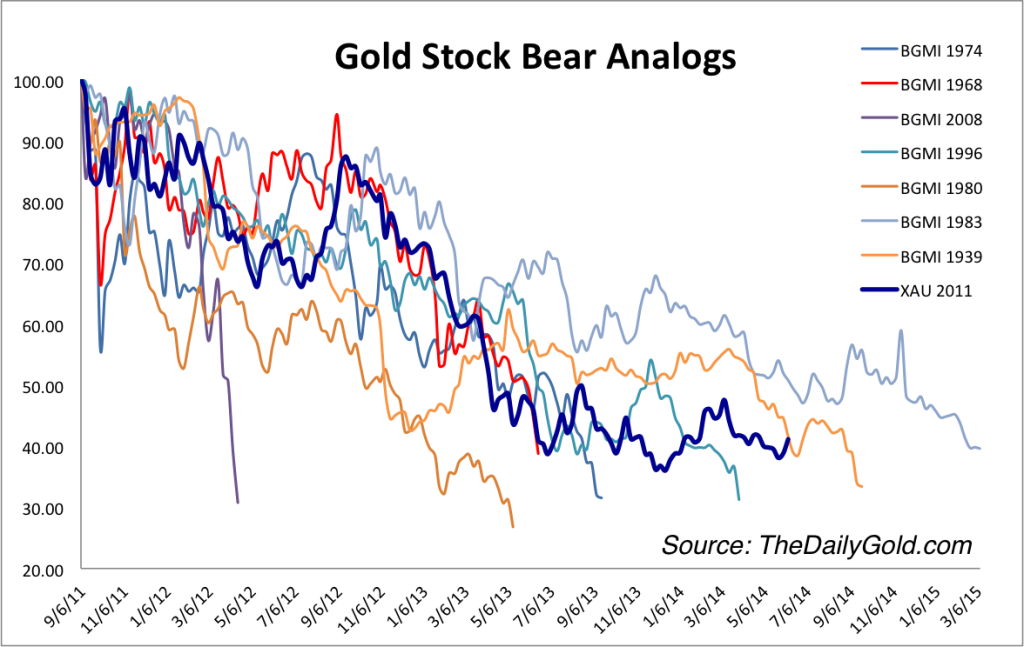

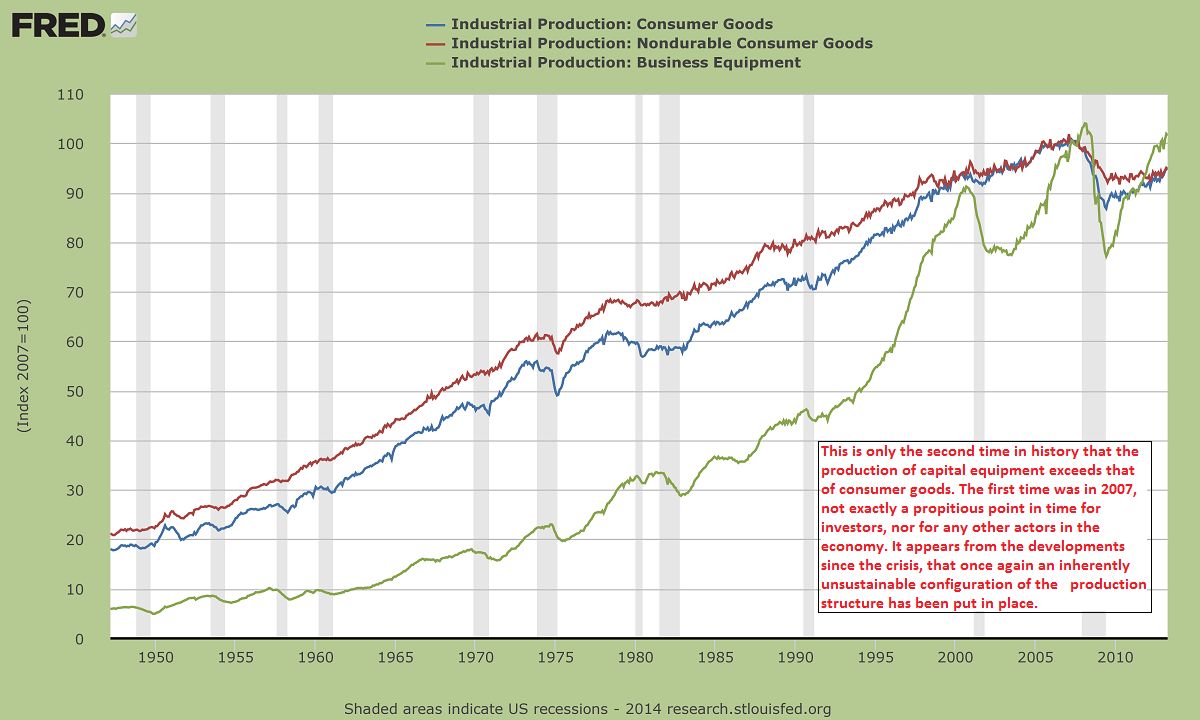

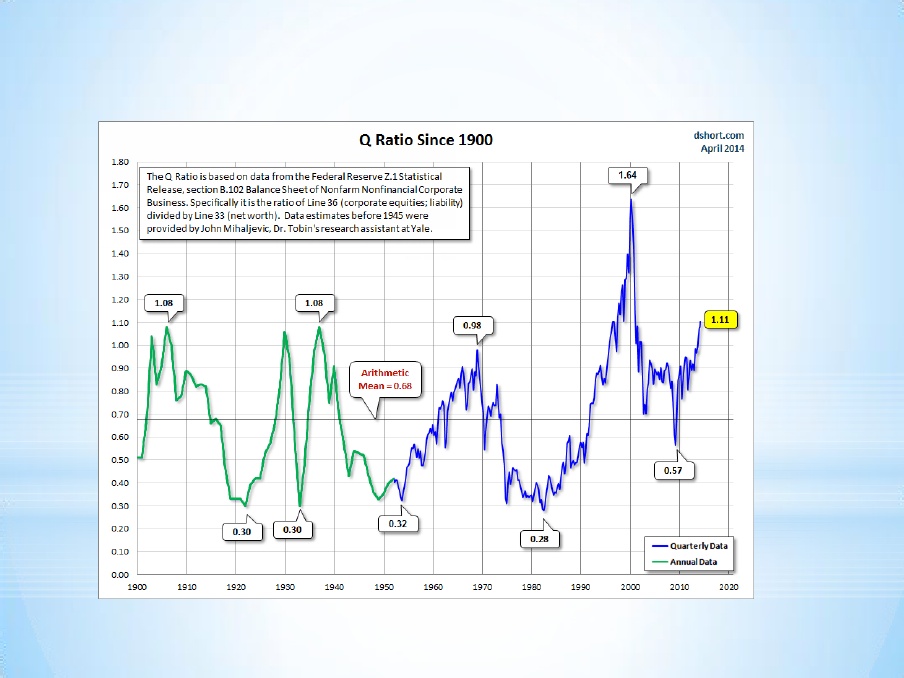

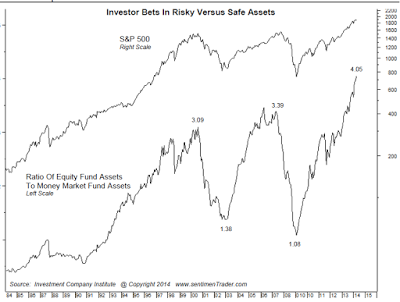

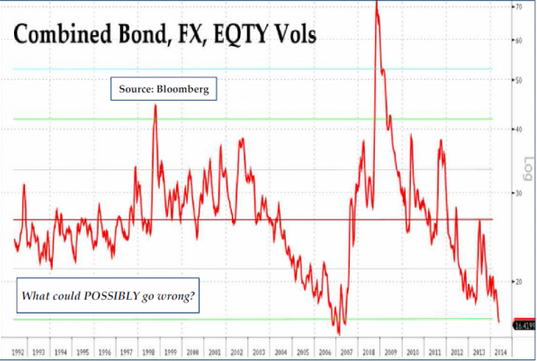

Well, even I can develop methods to work around my quirks. See the chart at the top of the page. I have been buying certain gold/silver stocks over the past year because of two reasons: historic/generational low cheapness and lack of the same in other markets, in general. But prices can swing 10% in a day! How would I survive?

My time frame is the next three-to-five years. I study the companies without input from others, I turn off CNBC, and I place my buy and sell orders BEFORE the market and then check at the end of the day. I may go months without doing anything in terms of buying or selling, but I will keep following the companies and their industries closely. I have also held stocks like Enstar (ESGR) for a decade.

My time-frame is longer than most participants. I work around my psychological hurdles because I have faced them. And only YOU can face yours.