Pitch the Perfect Investment

The Essential Guide to Winning on Wall Street

Pitching an investment idea is the life-blood of Wall Street analysts —whether at money management firms and investment banks or with CEOs to potential investors. Those who do it well win, and win big. Sonkin and Johnson teach professional analysts, sophisticated private investors and ambitious young analysts how to uncover the perfect investment and pitch it to critical decision makers, to advance their careers and increase their wealth.

No other book like this one exists. There are plenty of books that focus on investment strategy, company analysis and critical thinking. Yet, there is no book that combines investment analysis with persuasion and sales – in Wall Street vernacular—pitching. In our increasingly competitive world, being able to pitch your idea is becoming as critical as being able to find and analyze great investment opportunities. It is imperative to get clients or superiors to take action on your ideas. The teaching of this skill is sorely lacking on Wall Street. Pitching the Perfect Investment will present a two-step process: 1) finding the perfect investment; and 2) crafting the perfect pitch. The book will show that to be successful the reader will require two very different skill sets: the first is investment analysis and decision making; and, the second is persuasion and sales.

Pitching the Perfect Investment presents world-class insights into search strategy, data collection and research, securities analysis, risk assessment and management, combined with the use of critical thinking, to uncover the perfect opportunity for professional analysts, sophisticated private investors and ambitious young analysts as well as mergers and acquisition specialists advising clients, financial consultants and corporate financial analysis teams. Pitching draws from the disciplines of psychology, argumentation and informal logic. It instructs the investor analysts of all types how to craft this perfect investment into the perfect pitch. Pitching an investment is an essential skill to securing and then excelling at your job on Wall Street.

This is an essential skill for the ambitious young investment analyst looking to begin a career on Wall Street as well as the seasoned veteran discussing an idea on CNBC, and every investor in-between.

Aspiring analysts should be aware of this book, but I am not recommending since I have not read it. Common-sense writing helps. Clearly state your thesis then provide supporting facts and risks. Done. But if you can’t state your case to a child in less than a paragraph, then go back to your desk.

For example, Navigator Holdsings (NVGS) has a dominant position in handy-size petrochemical transportation and it trades at 55% of net asset value, its balance sheet and flexible fleet allows it to be profitable despite a perfect storm in the LPG shipping market. One of the most famous value investors, Wilbur Ross bought into NVGS at an average price of $8.73 over three years ago for a 50% stake. NVGS is now 20% below that price. The current lows in freight rates due to A, B, C are unsustainable due to 1, 2, 3, therefore normalized rates will mean much higher values. Timing is, of course, uncertain, but there are considerations for building more US ethylene plants for export. NVGS has the dominant position for transporting that product which requires special handling (super low temperatures and pressure). Price is about 50% below asset value and earnings power value.

Probably too long-winded, but you get the point.

—

Beware the echo chamber http://graphics.wsj.com/blue-feed-red-feed/ A serious concern for your research. Scary.

More on psychology for contrarians.

| Latest NewsJune 10, 2016 – We’re pleased to announce a new website launching in the coming week. Please let us know any questions or comments about the transition.

June 08, 2016 – Check out our latest 1-hour free webinar “Trading on Sentiment Strategies to Profit from Media Analytics in Global Equities.” Recent PressMay 14, 2016 – How To Time The Stock Market Using Media Sentiment — Ky Trang Ho Forbes |

||

| The World&39;s Greatest Stock Picker

Manny introduced himself to me as “the world’s greatest stock picker.” He explained that one key to his success was that he only needed two hours of sleep a night. He pored over details in every significant financial publication and in those quiet morning hours when all others slept, he let information percolate. By the morning he had brilliant new insights into the industries and companies that were poised to outperform over the following months. Some of the world’s top fund managers subscribed to his research, he told me. I asked if his clients knew he was housed in prison, in solitary confinement. He explained that of course they didn’t, and he asked that I kindly keep his secret. He distributed his stock research through his secretary, who kept his office open. In the intervening days I checked out Manny’s story. Much was true – he was in fact publishing highly-regarded financial research to large AUM clients from prison. On the surface his research analysis sounded brilliant – the creative ramblings of an out-of-the-box Wall Street-obsessed thinker. But as we talked in depth it became clear that his thought process was laced with irrational and circumstantial connections. He was often confusing wishful thinking with objective analysis. He was hypomanic, with grandiose claims and excessively optimistic projections. As a psychiatrist I’ve worked with many people with grandiose delusions. In each case the client has fixed beliefs that are contrary to reality – beliefs that guide much of their waking actions – beliefs that are entirely untrue. Delusions aren’t limited to manic prisoners, in fact we spend most of our days navigating the world based on assumptions, many of which are entirely unfounded. Because the financial markets are imbued with uncertainty, assumptions are more dangerous in that environment. Regardless of the fragility in our collective understanding of markets, there are enormous payoffs for those who can discern reality more accurately. In fact, academic research on trading models finds that most are delusional. “Most of the empirical research in finance, whether published in academic journals or put into production as an active trading strategy by an investment manager, is likely false.” ~ Campbell Harvey and Yan Liu, “Evaluating Trading Strategies,” 2014 This quote is particularly relevant to us at MarketPsych because we are restarting our trading business. We’re currently trading a unique media-based machine learning strategy and re-registering as an investment adviser. It has been a long road to find a strategy worth deploying capital into, and based on our prior experience, trading delusions can easily become enshrined in predictive models. Today’s newsletter examines the nature of false beliefs among investors, how beliefs shift (with an Amazon case study), honest investment strategy development, and examines what, if anything, we can do to find the truth about what moves markets. |

|||

When Delusions Crack – Brick and Mortar Retailers

(The following was written by our own Tate Hayes and a longer version will appear in Investopedia this weekend.) Nordstrom’s and Macy’s have both seen a 50% drop in stock price over the last year on the back of deceasing revenues. Wal-Mart and Best Buy shares have taken just under a 10% hit over the last 12 months. In contrast, Amazon’s stock price is up almost 70% in the last year and 135% in the past two years. Investors’ beliefs about the retail sector have changed dramatically in the past 2 years. In examining media optimism data since July 2014, a clear decline is evident. Over the last 24 months, investors became more optimistic about Amazon, but increasingly pessimistic about a number of the top brick-and-mortar retailers (Wal-Mart, Nordstrom, Macy’s, and Best Buy are charted below). The media sentiment of these individual companies are compiled in the Thomas Reuters MarketPsych Indices (TRMI). The TRMI Optimism index represents the frequency of positive, future-tense references about a company verses those that are negative in millions of articles daily from thousands of news and social media sources. The 200 day-averages of media optimism about each retailer are plotted in the chart below.

What is remarkable is both how long the delusion of bricks-and-mortar retailer safety stayed afloat, and also how quickly it is unraveling as optimism about the individual retailers plummets. First optimism about Amazon rose, and then, on cue, optimism about bricks-and-mortar retailers declined. Our new book, Trading on Sentiment: The Power of Minds Over Markets (Wiley, 2016), explains in detail how media sentiment is quantified and used to time markets and select investments. |

|||

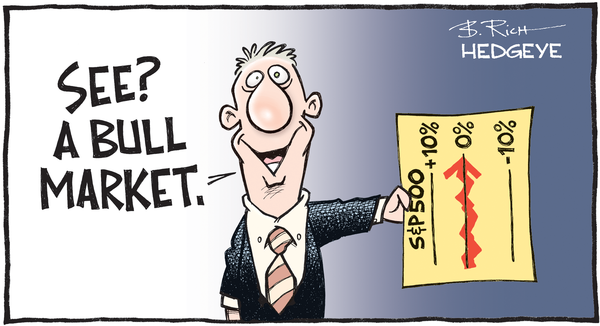

| How We Know What Isn&39;t So

Throughout the twentieth century, a variety of stock market leading indicators achieved notoriety. The Super Bowl indicator was oft-cited in media. It was so-called because the U.S. stock market was said to rise in years that an NFL team won the American football Super Bowl. This indicator was 90 percent accurate in predicting the annual stock market direction from 1967 to 1997. However, the Super Bowl indicator is a random coincidence, the result of overfitting to a limited data set. Such spurious correlations are often repeated in the media and by the statistically illiterate. As we are seeing in the U.S. election cycle, in politics there is an advantage to sincere assertions of half-truths and lies. But in scientific disciplines like healthcare and (aspirationally) finance, objective truth is the bedrock of all subsequent activity. In 2005, Dr. John Ioannidis wrote an academic article that has become the most widely read paper on PLoS One (Public Library of Science) and the first to surpass one million views. The paper contains a proof that the majority of published medical research results are false positives (i.e., untrue).(1) Dr. Ioannidis’s statistical insights have been extended to finance by Marcos Lopez Del Prado, Campbell Harvey, Yan Liu, and others.(2,3,4,5). If a test result is considered true at a 95 percent confidence interval (two sigma), then that confidence interval must be expanded as additional tests are performed on the dataset to achieve a simile level of confidence that the result is not a random coincidence. Yet with massive data sets available, statistical overfitting is inevitable. It is tempting to believe in strategies that do not meet solid statistical thresholds because (1) it is difficult to find novel and outperforming investment strategies, and (2) the thrill of thinking one might have found such a strategy is more compelling than the repeated frustration of intellectual honesty. The incentive to find a good result often leads to short-cuts in testing hygiene and spurious correlations. Essential to identifying useful predictive relationships in data is to adopt techniques to achieve statistical confidence in positive findings. Also important is to understand the probable rationale – the underlying assumptions – for the findings. Amidst so much hype, how can we know what is real? |

|||

Our Own Trading

While trading MarketPsych’s hedge fund, we adopted numerous datamining hygiene techniques, including: rigorous data exploration of the training set only; using multiple out of sample sets and k-fold cross-validation; utilizing universal concepts and language in our ontologies; visual inspection of output; and using a human filter to exclude strategies that are not empirically supported or based on “common sense.” We are confident in the validity of our statistical hygiene and testing techniques because of these efforts to debias. However, without real-time performance and common-sense explanations, it is difficult to establish the robustness of quantitative investing strategies. To address these concerns, we have (1) an independently audited track record from our hedge fund, (2) live forward tested strategies launched online in 2013, and (3) empirical support for the validity of our strategies from psychological research. Each of those factors increases confidence, but nonetheless, modeling is very difficult to get right. Our equity curve is below.

As markets recovered from the financial crisis, our fear-based trading strategy was no longer suited to the positive momentum of prices. Yet we did not successfully pivot on the strategy, and we shut down the fund. We have a new strategy being traded currently, and it is adaptive – as media delusions shift, it compensates. This strategy appears less vulnerable to regime changes, but it’s not open for outside investors yet. Among traders the most common techniques for establishing the statistical validity of a finding include data division into training/test/out-of-sample sets and k-fold cross-validation. When data is divided into sets, typically 60% of the data is used for feature selection (identifying the best indicators), while 20% is used for testing to verify that the findings in the training set hold true in data that was “blinded”. Then once the model has been tweaked and risk management set on the training and testing sets, the model is run on the out-of-sample set to verify that it still holds true. K-fold cross-validation is another technique for verifying the predictive value of a trading system. After studying the performance of indicators on an external training set (maybe 30% of the study data), and selecting the best, then the testing set (60%) and training set (90% of alll data) are utilized for cross-validation. If k = 10%, then the data set is divided into deciles. The overall model is learned on 90% of the data and tested on 10%. The 90% and 10% data sets are randomized each pass and dozens of passes are performed. The range of performance on each 10% set gives an approximation of the model’s stability. If the model is declared useful, then a final 10% study is performed on the final out-of-sample set to verify the model’s value. In all cases of developing trading models, it also helps to watch real-time trading on paper first and then to forward-test with a small amount of real money before going live. |

|||

| Housekeeping and Closing

I met Manny well before the financial crisis while I was working part-time in a prison (to fund the launch of MarketPsych). His optimistic research tone reflected the mood of the times. Many of the popular Wall Street delusions are simply beliefs that fit the current social mood. Eventually I asked Manny, “Do your clients know you’re manic?” He replied “Of course not!” He was trying to milk his manic energy for all he could by producing as much research as possible to pay for his legal bills. I haven’t kept track of Manny, so I don’t know if he saw the financial crisis coming or how his life turned out. Nonetheless I wish him well. We love to chat with our readers about their experience with psychology in the markets. Please send us feedback on what you’d like to hear more about in this area. Learn more about improving your investment returns with insights from sentiment analysis of the herd in our new book, “Trading on Sentiment: The Power of Minds Over Markets.” If you represent an institution, please contact us if you’d like to see into the mind of the market using our Thomson Reuters MarketPsych Indices to monitor real-time market psychology and macroeconomic trends for 30 currencies, 50 commodities, 130 countries, 50 equity sectors and indexes, and 8,000 global equities extracted in real-time from millions of social and news media articles daily. Keep It Real, |

|||

| References

1. J. P. Ioannidis, “Why Most Published Research Findings Are False,” PLoS Medicine 2, e124 (2005), pp. 694–701. |

||

more here: https://www.marketpsychinsights.com/blog/