“Repetitio est mater studiorum,” says the Latin proverb – repetition is the mother of all learning.

Lessons for this post:

- Know what you are doing.

- Avoid paying massive premiums over net asset values.

Below is CUBA, a closed-end fund investing in companies that invest in Cuba or will benefit by an increase in business with Cuba. Note the spike upward on the announcement that Obama would allow a prisoner exchange and take Cuba off the US’s terror list opening up the possibility of the end of the US embargo.

Now go: CUBA NAV Summary (Click on the button, since exception on the right side of the page, to see the history of price vs. Net Asset Value (“NAV”). Note the results last time “investors”/speculators or the confused paid in excess of 50% to the underlying stocks. We can argue about the intrinsic values of the underlying stocks but not the prices–because price is what it is. Mr. Market has spoken.

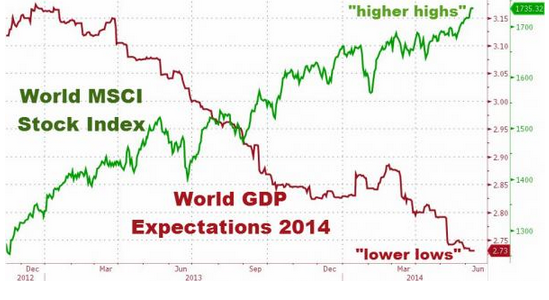

Here we are today

Go back and click on CUBA NAV Summary and view the one year summary. Note that the price reached a 70% premium to the NAV AFTER the news event of “improving” US/Cuba relations. Upon hearing the news:

My first post on CUBA (CEF) SELL! Can I predict? No, just common-sense.

Where is the efficient market? Perhaps the unavailability of shares to borrow hindered arbitrageurs who could buy the underlying stocks and short the closed-end fund (“CEF”), CUBA. But to pay such a premium is almost a guaranteed loss unless sold to a greater fool who will pay an even more absurd premium. That is speculating not investing. What is business-like about paying a 70% premium after a news event?

A closed-end fund sells a fixed number of shares to investors. For example, let’s pretend we start a closed-end fund to buy stocks, called the BS Fund. We sell 10 shares at $10 each for $100 in capital, then we buy 1 share of Company X at $50 and 2 shares of Company Y for $25 (ignoring commissions and fees). The net asset value (NAV) is ($50 times 1 share) + ($25 times 2 shares) = $100. The net asset value per share is also $10. So the price per share of the CEF ($10) trades at no premium (0) to the NAV per share $100/10 shares. Now an investor wants to sell 3 of his BS (CEF shares) to an investor who bids for them at $9.00 per share. Unless, the underlying share prices of Company X and Y change, then the discount is now 10%. We, as the management, must institute a decision to buy back shares of the BS fund to close the discount or investors increase their demand for the shares.

Carl Icahn got his start as a closed end fund arbitrageur, who would force the managements of the closed-ends funds that traded at large discounts to NAV, to buy-back their shares.

Setting aside the emotional impact of the news announcement, the prisoner exchange and Obama’s reducing of sanctions doesn’t change much. By the way, if sanctions and embargos don’t work (I agree) as Obama claims then why the sanctions on Russia? If the Russians didn’t surrender during Stalingrad, what are the odds now? Color me cynical.

The US is ALREADY one of the top ten trading partners with Cuba. Of course, the embargo is a farce, kept in place for political purposes. Congress still has to vote to remove the embargo, but even without the embargo Cuba lacks the production of goods and services to trade. Why? Cubans lack the capital to produce because they lack the security of property rights and the rule of law to acquire capital. No Habeas Corpus, no freedom of speech, and no rights. No tyranny generates LONG-TERM economic growth.

What returns will foreign investors require to invest in Cuba? Say you whip out your spread-sheet and suggest 25% annual returns to build a new hotel in Cuba based on your projection of American tourists hitting the shores of Cuba like locusts. Two years after the hotel is built, Raul Castro and his military cronies tears up your contract. Investment lost. Without the rule of law and sanctity of contract, the rest means little. The first lesson is to know what you are doing.

Life in Cuba:

- Tengo Hambre A Cuban Says I AM HUNGRY!

- Life for Cuban Youth (Cuba with highest suicide rates in the Western Hemisphere.

—

The investor who buys CUBA would have to understand what the current changes mean for the companies in the fund. Anyone who spends time understanding the current economic conditions there would grasp how little the current announcement means for investment there. Ask the Canadian investor rotting in a Cuban jail today Canadian investor rots in Cuban jail.

Speculators were willing to pay at 70% premium AFTER the price of the underlying companies had moved higher by 10% to 15% on the news. A premium on top of a premium–a lesson of what NOT to do. Questions?

If anyone in this class does that, then this awaits: No Excuse