Nassim Taleb: Mark, your book is the only place that understands crashes as natural equalizers. In the context of today’s raging debates on inequality, do you believe that the natural mechanism of bringing equality — or, at the least, the weakening of the privileged — is via crashes?

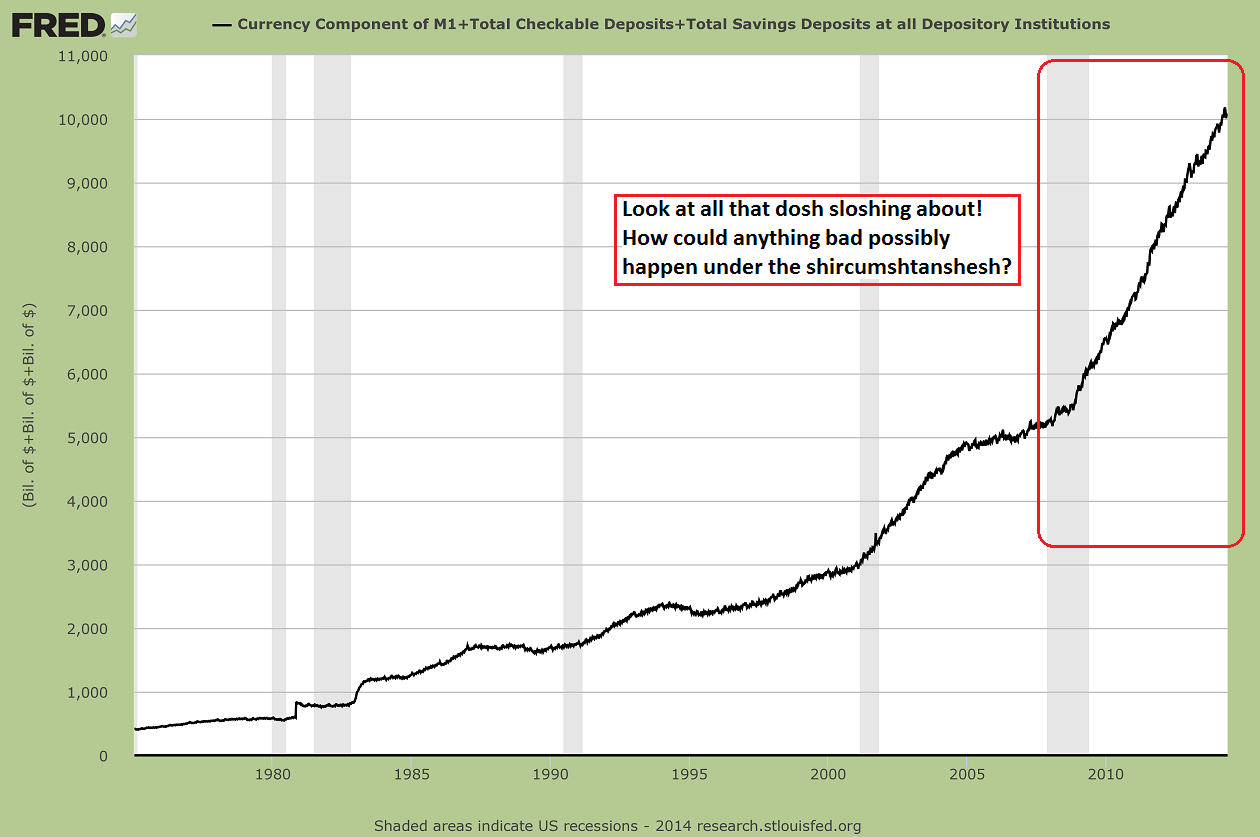

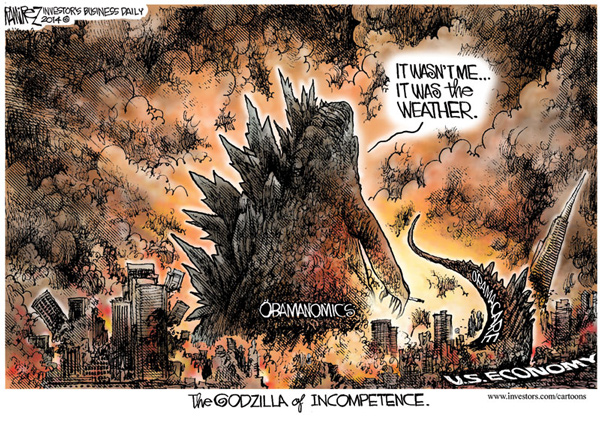

Mark Spitznagel: Well straight away let’s ask ourselves: Are we really seeking realized financial equality? How can we ever know what is the natural or acceptable level of inequality, and why is it even the rule of the majority to determine that? That aside, one can absolutely say logically and empirically that asset-market crashes diminish inequality. They are a natural mechanism for this, and a cathartic response to central banks’ manipulation of interest rates and resulting asset-market inflation, as well as other government bailouts, that so amplify inequality in the first place. So crashes are capitalism’s homeostatic mechanism at work to right a distorted system. We are in this ridiculous situation where utopian government policies meant to lessen inequality are a reaction to the consequences of other government policies — a round trip of market distortion. After we’ve been run over by a car, the assumed best treatment is to back the car over us again.

Taleb: I see you are distinguishing between equality of outcome and equality of process. Actually one can argue that the system should ensure downward mobility, something much more important than upward one. The statist French system has no downward mobility for the elite. In natural settings, the rich are more fragile than the middle class and we need the system to maintain it.

The reason I am discussing that here is linked to your book, The Dao of Capital, which mixes (rather, unifies) personal risk-taking with explanations of global phenomena. But as an author I hate people’s summaries of my work. Can you provide your own summary in a paragraph?

Spitznagel: To your first point, yes exactly, and in fact what’s hidden beneath all the aggregate income-inequality data is much cross-sectional downward mobility, in that most people in the right tail of income spend very little time there. The transience of success is assured by natural entrepreneurial capitalism, and is precisely what works about it: unseating the top, driving out the lucky and unworthy. Without this dynamic, capitalism doesn’t work. It isn’t even capitalism, but rather oligarchic central planning. Yet modern government chips away at this dynamic in so many ways, most significantly by providing floors and safety nets to crony bankers and other financial punters. What irony that the same people who today loudly endorse a global wealth tax to rein in inequality were also the very ones saying guys like us were nuts for opposing the bailouts back in 2008!

That we so casually ignore the implications of this goes to the main point of my book: In the words of Bastiat, we pursue a small present good which will be followed by a great evil to come, rather than a great good to come at the risk of a small present evil. The latter is what I call roundaboutness, which is central to strategic decision making, especially investing. It is about counter-intuitively heading right in order to better go left, or taking small losses now — and willingly looking like an idiot — to build a strategic advantage for later.

In Daoism it is wei wuwei or shi. In economics it is Robinson Crusoe, who starves himself by not spending all his time fishing by hand and instead spends time making a boat and net, in order to catch many more fish later. We have roundaboutness to thank for civilization itself. Yet it is so difficult because of our myopic brain, and in most modern instances downright impossible because of our myopic social structures — Washington and Wall Street being the best examples, where to disappoint in the present means there is no future, so why be concerned with the future? Of course exploiting this is what we do as investors. Looking at markets in this way, specifically how they scorn the roundabout — thanks in no small part to the Federal Reserve — is to understand them better, particularly the traps that they set.

Taleb: Did you consider simple remedies such as decentralization?

Spitznagel: When you understand the problem of centralized power in general, then the specific problem of central banking is just a particular example. What more centralized economic authority is there than the manipulation of money? And this feeds into greater and greater centralized authority. Bureaucrats and politicians, for the same reasons as Wall Street traders, are necessarily anti-roundabout. Decentralization dissipates their influence and limits their reach. Small localized majorities can do just as stupid and myopic things as broad majorities, but their coercion is escapable and weaker, and they can transparently fail and try again. (James Madison didn’t get this.) With public decentralization naturally comes private decentralization as, without public intervention, the bigger and broader the private bungle the more likely the disappearance of the bungler.

Taleb: I agree, but we need a “negative state” for law enforcement, something like the U.S. federal state or the traditional empire during Pax Romana or Pax Ottomana. In this idea the role of the state is protection, not to promote education or, say, corn fructose, which we know have worse adverse consequences when coming top-down from a powerful centralizer and, hence, implemented at a large scale. In my work the central mission of the state is to protect the environment, to shield me from irreversible harm done to my backyard by people who don’t have skin in the game and are protected by limited liability. There are things that can be done by the state, and only the central state. Do you agree?

Spitznagel: I definitely agree that the only conception of the state that makes any sense is the “night watchman” variety, which exists only to enforce the rules of the game rather than trying to pick the winners and losers (whether it’s financial institutions or monoculture crops). There is a deep tradition in classical liberalism and modern libertarianism that stresses the importance of limiting government action to the defense of life and limb — a defense of “negative liberty” — rather than the “positive” conception where it is the job of the government to promote literacy, full employment, equality, and so forth. Even protecting the environment falls under this “negative liberty” — pollution should really be seen as an aggression against property (as in one’s lungs, for instance). Even as recently as the 19th century pollution was a tort, suable for damages and to cease and desist. Then the law morphed to permit what was considered non-anomalous polluting. Ironically, it was paternalistic state oversight that trumped the decentralized and allegedly myopic common-law tradition — where an individual household could “halt progress” by bringing an injunction against the factory upstream that is dumping chemicals into the river. The rights of small property owners were set aside in the quest for industrial growth.

In any event, your approach of asking the state — the ultimate agency that lacks skin in the game (central banks being the greatest example) — to protect us from those lacking skin in the game is asking a lot of it.

How do you justify your generalized skin-in-the-game criterion with the observation that many of history’s greatest calamities — from military to financial — have basically been done at the hands of those whose skin was very much in the game? For example, we can’t blame the inadequacy of the Maginot Line and other French defenses on the lack of skin in the game; presumably the French officials responsible for these blunders suffered very great personal distress from the German invasion. And then there’s the crazy Nazi leaders, all of whom had an enormous stake in the outcome of their decisions. Certainly in finance, many a blow-up ruined those responsible.

Taleb: The skin-in-the-game idea, or what I now call the silver rule, i.e., the negative golden rule, is necessary but not sufficient. And it is not literal, as it can be gamed.

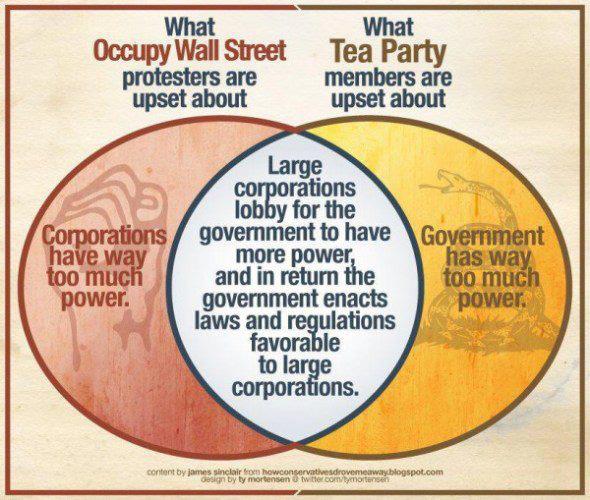

Talking about the silver rule, I feel that the clique of academic economists and people who spent too much time without contact with reality via risk-taking (that’s the main epistemological benefit of skin in the hogame), these people are now engaging in the politics of envy. The real class war we have isn’t what Marx thought it was, between the proletariat and the owners of capital. It is between the policy-makers-bureaucrats-with-no-skin-in-the-game who want to tax the rich to increase their power and the other classes. Historically, we have known since the Romans that the enemies of the people were the senatorial class, not the emperor. Bureaucracies are metastatic. Those economically in the bottom half are not interested in the rich getting poorer, they want a better life and hope to rise should they want to. And economists can come up with any economic theory that fits them. They can embrace any narrative-with-data that increases their role.

Having seen economists with data-mined theories blow up left and right, what do you think of Piketty’s book, Capital in the Twenty-First Century, and how do you compare it with yours?

Spitznagel: Well, while some have recently and rightfully criticized Piketty’s cherry-picked data and other empirical defects, to me his principal problems are conceptual — specifically his reliance on a very fast-and-loose model of what capital is and how it contributes to the economy. In his book, he switches back and forth between two distinct meanings for “capital”: Sometimes it’s an indiscriminate blob of concrete physical things — machinery, tools, acres of farmland — and other times it’s a sum of money. He then relies on a very crude model in which the stock of capital combines with the stock of labor to yield a blob of output, which is divided among the two classes according to a few parameters. With this confused structure and some historical trends, Piketty forecasts that the owners of “capital” will grow increasingly dominant, hence his call for a punitive tax on wealth for those with the most.

There are several problems with this approach. First and most basic, by constantly flipping back and forth between his concepts of capital, Piketty falls prey to crude, basic fallacies that have long ago been dismissed. The Austrian economist Böhm-Bawerk picked them apart in the late 1800s! In particular, Böhm-Bawerk showed that the physical productivity of a capital good can explain its rental price — how many dollars it earns per hour of hire — but has nothing directly to do with the rate of return the capitalist earns by investing in the physical-capital good. (This objection isn’t unique to the free-market Austrians, but is even embraced by post-Keynesians today.) Another major problem, of course, is the sheer envy underlying the whole enterprise. So what if capitalists enjoy a growing share of “total income”? The more tools and equipment that the workers have to augment their labor power, the higher real wages will be in absolute terms. Even if Piketty’s diagnosis were correct, his solution would hurt workers and capitalists alike.

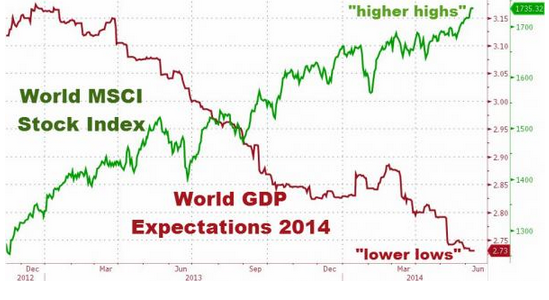

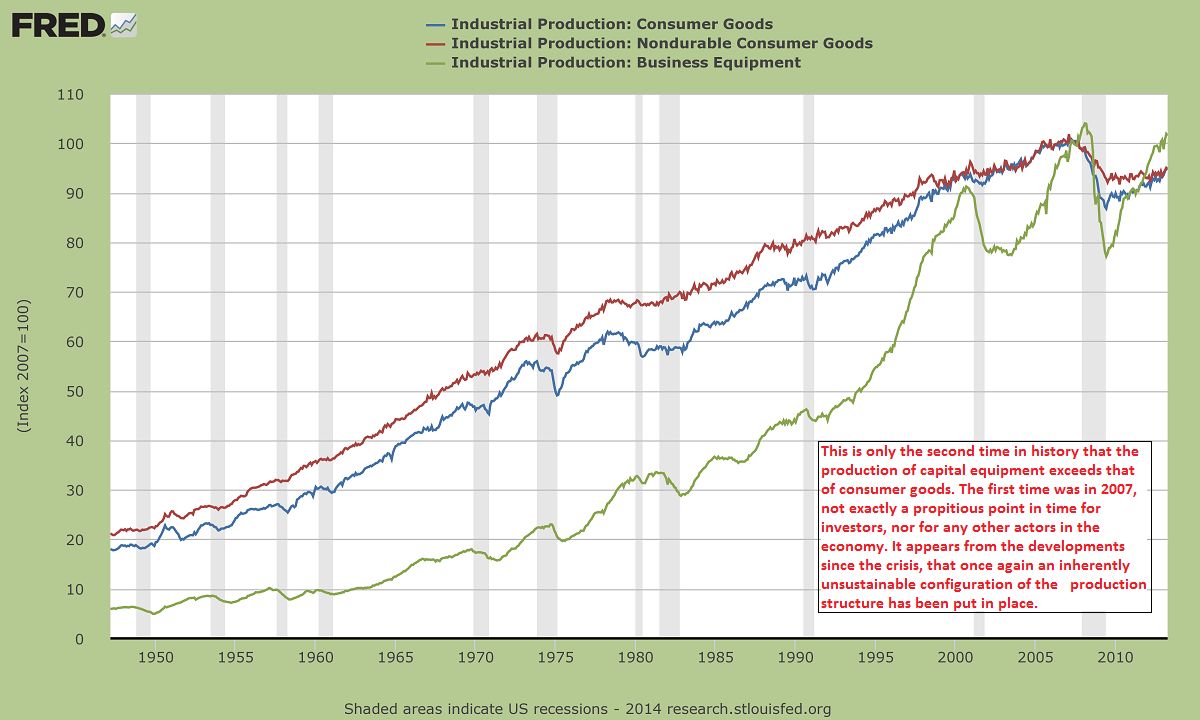

Most severe of all is that his very cartoonish and academic concept of capital just doesn’t allow for the monetary distortions and consequent booms and busts we’ve seen. It takes a richer framework than Piketty’s to show how this works. His theorizing blinds him to the most obvious empirical relationship in his own data: his historical high-inequality periods perfectly coincide with the two greatest monetary-induced-bubble and crony-capitalism periods — 1929 and now.

As for my book, I deal with the world largely shaped by Piketty’s same naïve concept of capital. By manipulating interest rates, central planners magically appear to manipulate capital’s profitability, and hence all the many moving parts and agents of the economy are but another tool to create the economy that they want. Of course, the world just isn’t that clean and simple. When we look back at Böhm-Bawerk’s notion of Produktionsumweg (or “roundabout production,” the essence of economic growth), we can recognize how far modern economics has now strayed from the multidimensional complexities of reality. Economics and investing have become games of cavalier manipulation and side bets on direct ends rather than what they should be: disciplines of understanding (what Mises called Verstehen) and building productive means. So I think it is very important to change our perception of these things. For me, this mostly happened in my youthful pit-trading days — a formative experience you and I share in common. As I address in my book, investors who understand the dynamics of economic distortions are far better at profiting from them.

Taleb: Let’s generalize from the Piketty into the “macro BS” problem. I started as a foreign-exchange option trader. Thirty years ago economists believed that “purchasing power parity” determined the “long term” currency rate between countries. And economists who became traders kept blowing up by selling the “expensive” currency and buying the “cheap” one. And, if anything, the opposite held: Currencies that were expensive kept getting more expensive. So it became known that the fastest road to bankruptcy in foreign exchange was an economics degree. More analytically, saying “the long term” without attaching a period to it (six months, six years, six hundred years, etc.) is meaningless. The duration is more relevant than the idea that currencies “converge.”

In the Piketty case, the argument that the rate of growth and that of the return on capital ought to be equal “in the long term” is very similar. Except that, in addition, Piketty forgot to make them stochastic, which would skew the return on capital by adding a small probability of ruin “Black Swan”-style that would annihilate capital in the long run.

Which bring me to silver rule (skin-in-the-game) problem. Every person who has skin in the game knows sort of what is bullsh** and what is not, since our capacities to rationalize — and those of bureaucrats and economists — are way too narrow for the complexity of the world we face, with its complex interactions. And survival is a stamp of statistical validity, not rationalization. This, in short, is why we are now talking about your book, because a book with “skin” is a different animal. So tell us about your idea of an impending “fixing” of the system, so to speak — how reality will resolve the current contradictions.

Spitznagel: I see the whole “r>g” [meaning return on capital is greater than the rate of growth] thing as taking bubble observations and rationalizing their extrapolation forever, thus simultaneously neglecting both the incidence of asset bubbles and what’s so bad about them. Such enormous shortsighted errors follow from the noisy duration of the “long term.” And exploiting these errors is the name of the game. In everyone’s scorn of the roundabout lies its greatest edge.

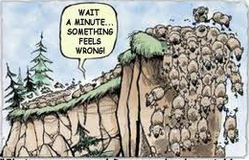

The main metaphor of my book is the “Yellowstone effect”: A massive fire in Yellowstone Park in 1988 opened the eyes of foresters to the fact that a century of wildfire-suppression, and with it competition- and turnover-suppression, had only delayed, concentrated, and by far worsened the destruction — not prevented it. This isn’t just about dead-wood accumulation creating a fragile tinderbox network. The real issue is how our tinkering artificially short-circuits the fundamental capacity of the system to allocate its limited resources, correct its errors, and find its own balance through the internal communication of information that no forestry manager could ever possibly possess. (The more this is mocked by technocratic naïfs like Geithner, the more valid it is.) But that capacity is still there, and homeostasis ultimately wins through a raging inferno. This is a cautionary tale for our economy. A crash, or the liquidation of assets that have grown unimpeded by economic reality (as if there were more nutrients in the ecosystem than there actually are), looks to academics and bureaucrats — and just about everyone else as well — like the system breaking down. It is actually the system fixing itself.

Taleb: Let us each conclude here. For my part, I would say three things.

First that intervention — in general, whether medical, governmental, or other — has side effects and needs to be treated exactly as we do with other complex systems: only when extremely necessary.

Second, counter to naïve conservatism, nature is not conservative, it destroys and creates species every day, but it does so in a certain pattern: Its destruction has the effect of isolating the system from large-scale harm. It does not try to preserve the past; it only tries to preserve the system.

Finally, liberty is not an economic good, but an existential one. The economic good is a mere bonus. The argument that liberty is good for economic activity or for growth of the system feels lowly and commercial (an argument used by consequentialists). If you were a wild animal, would you elect to be in a zoo because the economy is better over there than in the wild? Liberty is my raison d’être.

Spitznagel: Yes. The Daoist scholar Zhuangzi once said, upon being offered the prime ministership about 2,500 years ago, “Would the dead and adorned turtle in the king’s palace not prefer to be alive and free in the mud? So too would I.”

Here’s how I would reconcile my own position with yours: I agree that liberty is an end in itself, and is not to be valued merely as an instrumental means to something else. But precisely because of that, even if hypothetically you could convince me that a certain government intervention in the market were extremely necessary, as you say — for instance, would likely lead to greater economic growth or lower unemployment — I would still reject it on principle, because my support for property rights and a sphere of individual autonomy free from political meddling is not ultimately based on a utilitarian criterion. By all means, let’s brainstorm and see if there are ways to alleviate these problems and provide relief to the suffering. But any proposal that involves using coercion on unwilling citizens should be off the table. Anything else is a slippery slope to what we have today from these serial crises. To say this by no means demonstrates that I’m an ideologue or unscientific.

What we get from this is a self-organization that often seems chaotic to our myopic eye, yet when we take a step back we can see how the ecosystem ultimately and optimally steers itself. It was Zhuangzi, as I discuss in my book, who first articulated this idea of spontaneous order — whereby order naturally emerges from bottom-up individual interactions when things are left alone rather than from top-down control — a concept developed later by Menger and Hayek. We live in an economic age where we’ve simply lost our ability to look at the world in this way, though I suspect we’ll be reminded of it again sooner rather than later. Perhaps our takeaway from economic crises will finally be different the next time around.